[CBSE] Q 25 Adjustments in Preparation of Financial Statement Solution TS Grewal Class 11 (2025-26)

Solution of Question number 25 of the Adjustments in Preparation of Financial Statements of TS Grewal Book class 11, 2025-26?

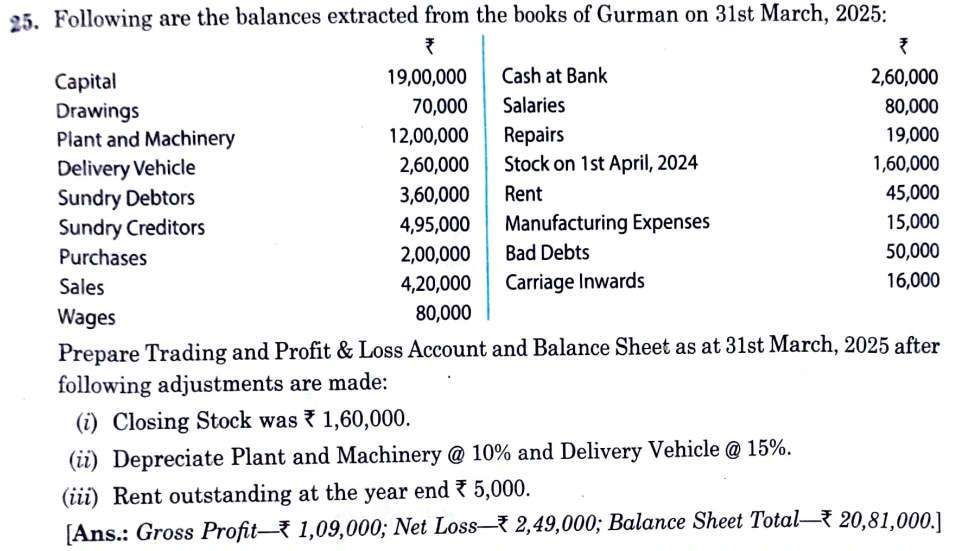

Following are the balances extracted from the books of Gurman on 31st March, 2025:

| ₹ | ₹ | ||

| Capital | 19,00,000 | Cash at Bank | 2,60,000 |

| Drawings | 70,000 | Salaries | 80,000 |

| Plant and Machinery | 12,00,000 | Repairs | 19,000 |

| Delivery Vehicle | 2,60,000 | Stock on 1st April 2024 | 1,60,000 |

| Sundry Debtors | 3,60,000 | Rent | 45,000 |

| Sundry Creditors | 4,95,000 | Manufacturing Expenses | 15,000 |

| Purchases | 2,00,000 | Bad Debts | 50,000 |

| Sales | 4,20,000 | Carriage Inwards | 16,000 |

| Wages | 80,000 |

Prepare Trading and Profit & Loss Account and Balance Sheet as at 31st March, 2025 after following adjustments are made:

(i) Closing stock was ₹ 1,60,000.

(ii) Depreciate Plant and Machinery @ 10% and Delivery Vehicle @ 15%.

(iii) Rent outstanding at the year end ₹ 5,000.

[Ans.: Gross Profit – ₹ 1,09,000; Net Loss – ₹ 2,49,000; Balance Sheet Total – ₹ 20,81,000.]

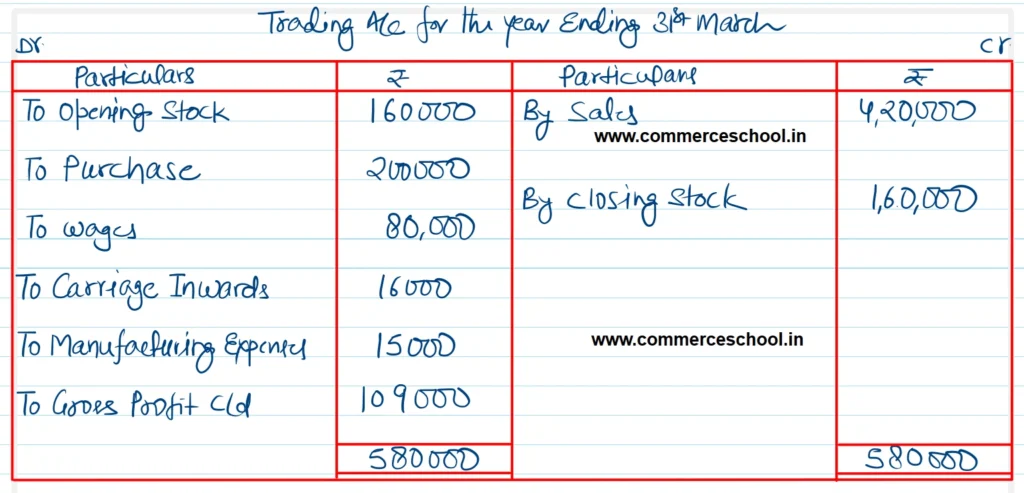

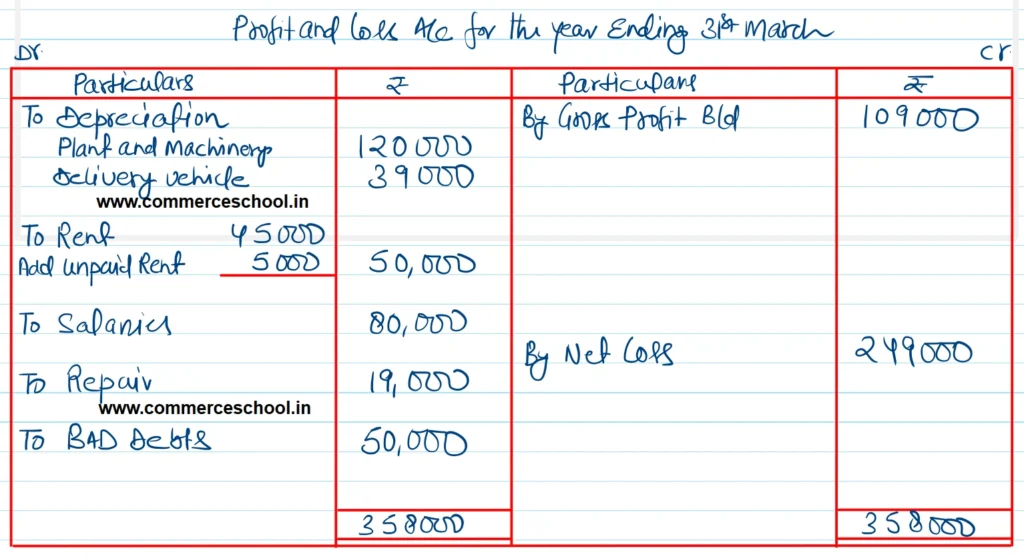

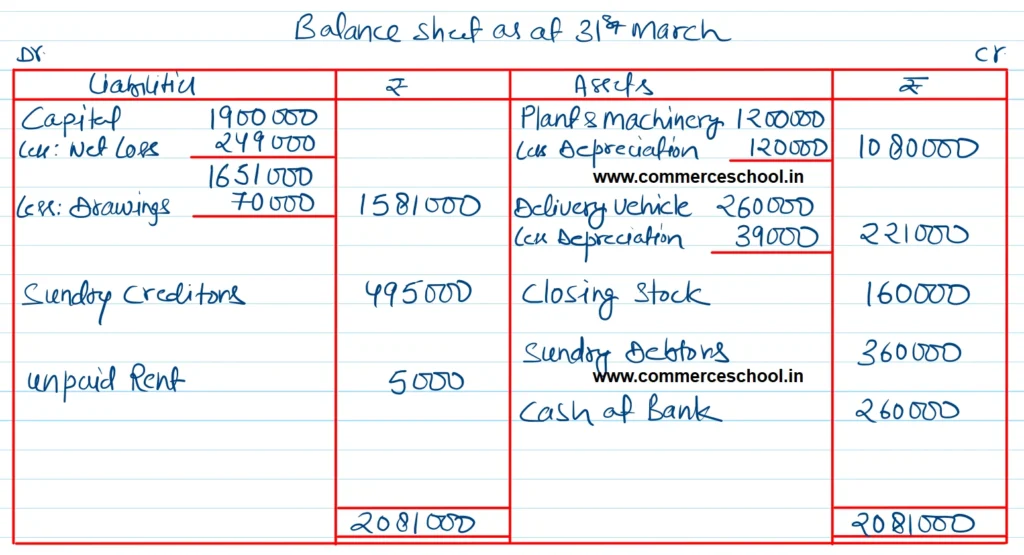

Solution:-

Here is the list of all Solutions.

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |