[CBSE] Q 25, Q 26 Bank Reconciliation Statement Solutions TS Grewal class 11 (2025-26)

Solution of Question number 25 and 26 Bank Reconciliation statement TS Grewal Class 11 CBSE Board 2025-26 Session

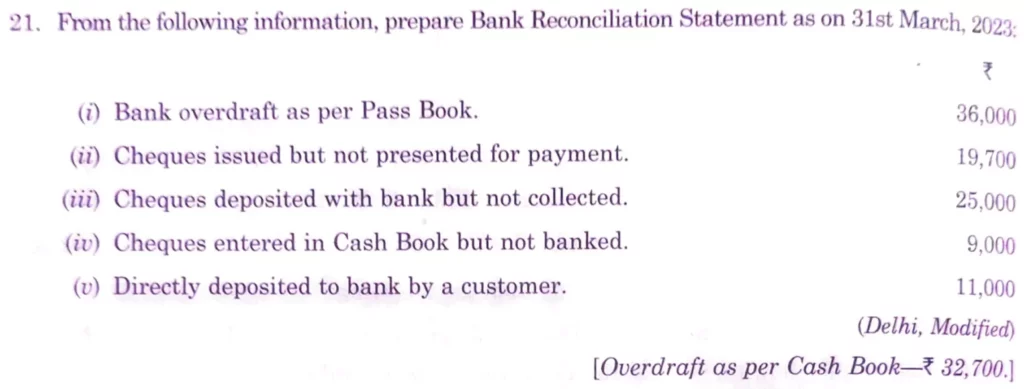

Q. 25. From the following information, prepare Bank Reconciliation Statement as on 31st March, 2025:

| (i) Bank Overdraft as per Pass Book. | 36,000 |

| (ii) Cheques issued but not presented for payment. | 19,700 |

| (iii) Cheques deposited with bank but not collected. | 25,000 |

| (iv) Cheques entered in Cash Book but not banked. | 9,000 |

| (v) Directly deposited to bank by a customer | 11,000 |

[Overdraft as per Cash Book – ₹ 32,700.]

Solution:-

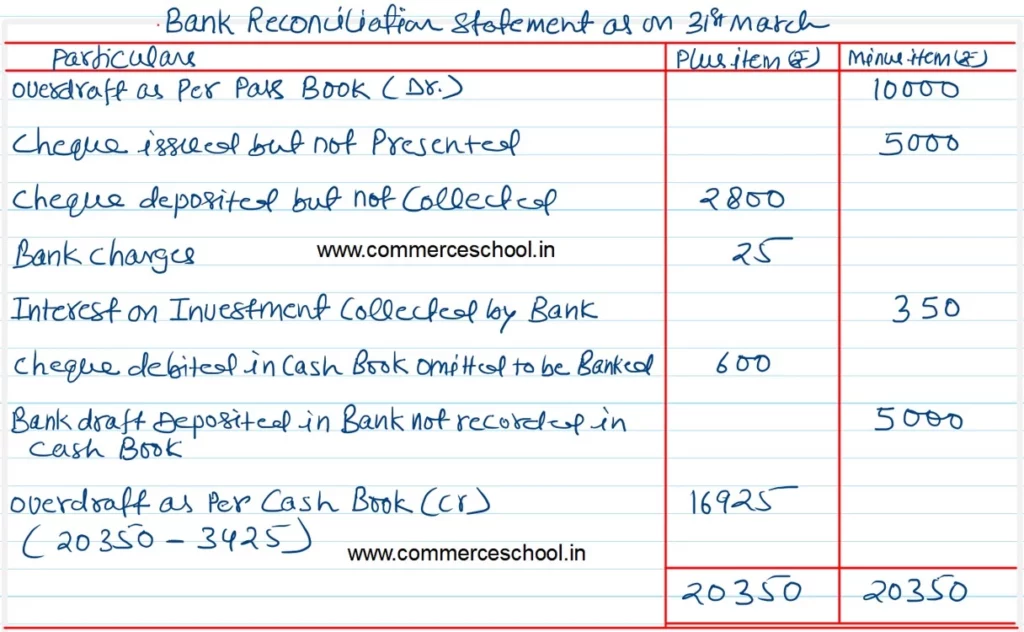

Q. 26. On 31st March, 2023, Pass Book of Sapna shows debit balance of ₹ 10,000.

From the following particulars, prepare Bank Reconciliation Statement:

(i) Cheques amounting to ₹ 8,000 drawn on 25th March of which cheques of ₹ 5,000 cashed in April, 2023.

(ii) Cheques paid into bank for collection of ₹ 5,000 but cheques of ₹ 2,200 could only be collected in March, 2023.

(iii) Bank Charges ₹ 25 and dividend of ₹ 350 on investment collected by bank could not be shown in the Cash Book.

(iv) A cheque of ₹ 600 debited in the Cash Book omitted to be banked.

(v) Bank draft of ₹ 5,000 received from a customer was deposited but not recorded in the Cash Book.

[Overdraft as per Cash Book – ₹ 16,925.]

Solution:-

Below is the list of all solutions of the Bank Reconciliation statement TS Grewal CBSE Board

thanks sir this solution really help me to solving question and also to complete my accounts notebook very quickly 😀

thanku very much sir