[CBSE] Q 25, Q 26 Depreciation Solutions TS Grewal Class 11 (2025-26)

Solution of Question number 25 and 26 of the Depreciation chapter TS Grewal Class 11 CBSE Board for 2025-26 Session.

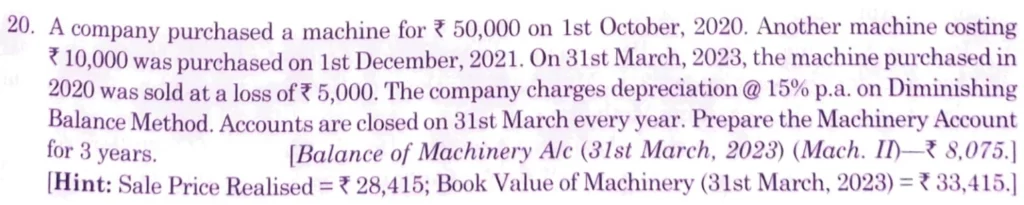

Q. 25. A company purchased a machine for ₹ 50,000 on 1st October, 2020. Another machine costing ₹ 10,000 was purchased on 1st December, 2021.

On 31st March, 2023, the machine purchased in 2019 was sold at a loss of ₹ 5,000. The company charged depreciation @ 15% p.a. on Diminishing Balance Method. Accounts are closed on 31st March every year. Prepare the Machinery Account for 3 years.

[Balance of Machinery A/c (31st March, 2023 (Mach. II) – ₹ 8,075.]

[Hint: Sale Price Realised – ₹ 28,415; Book Value of Machinery (31st March, 2023) = ₹ 33,415.]

Solution:-

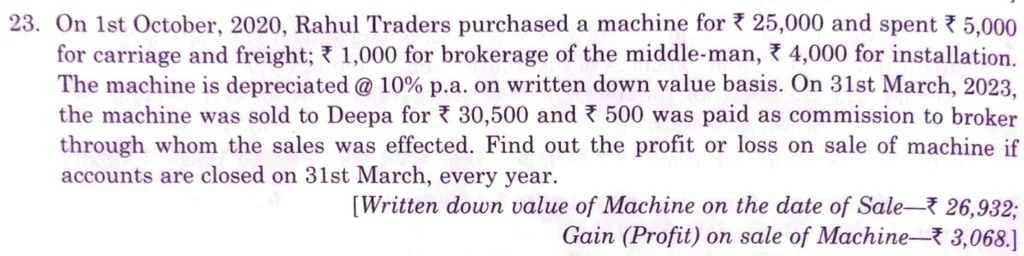

Q. 26. On 1st October, 2020, Rahul Traders purchased a machine for ₹ 25,000 on which he spent ₹ 5,000 for carriage and freight; ₹ 1,000 for brogerage of the middle-man, ₹ 4,000 for installation.

The machine is depreciated @ 10% p.a. on written down value basis. On 31st March, 2023 the machine was sold to Deepa for ₹ 30,500 and ₹ 500 was paid as commission to broker through whom the sales was affected. Find out the profit or loss on sale of machine if accounts are closed on 31st March, every year.

[Written down value of Machine on the date of Sale – ₹ 26,9332; Gain (Profit) on sale of Machine – ₹ 3,068.]

Solution:-

Following is the list of all solutions of the depreciation chapter of ts Grewal CBSE for the (2025-26) session.