[CBSE] Q. 26 Change in profit sharing ratio Solution TS Grewal Class 12 (2024-25)

Solution to Question number 30 of the Change in Profit sharing ratio chapter 4 of TS Grewal Book class 12 CBSE 2024-25 Edition.

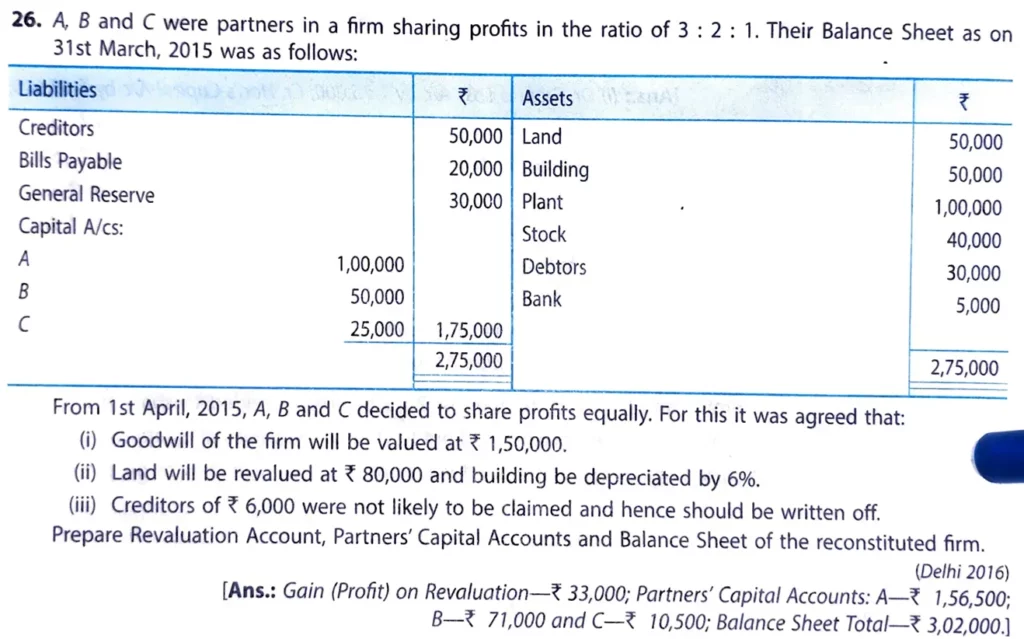

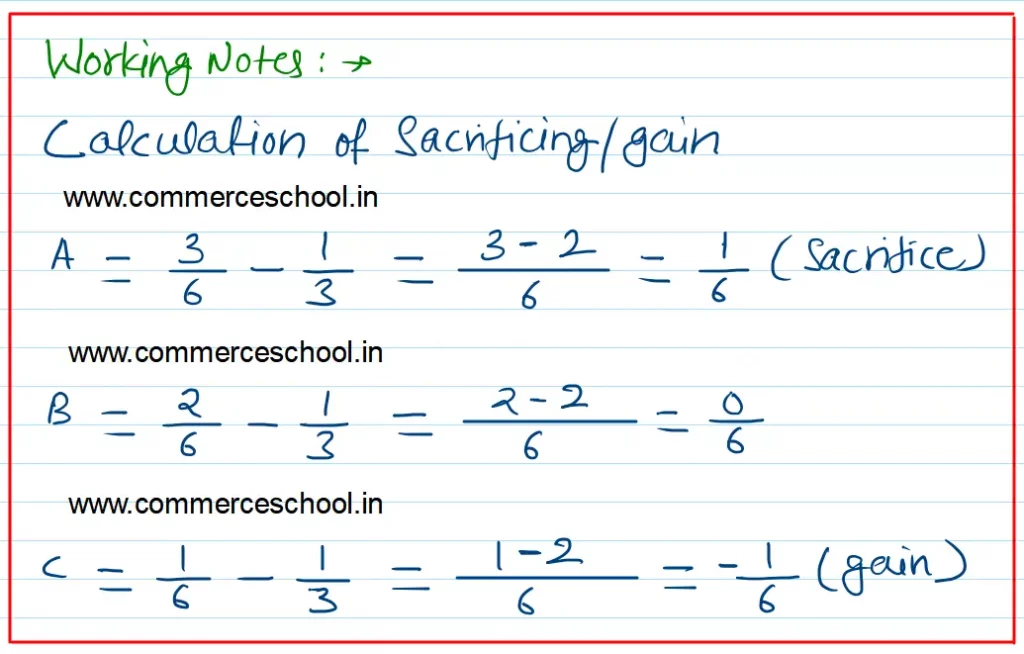

A, B and C were partners in a firm sharing profits in the ratio of 3 : 2 : 1. Their Balance Sheet as on 31st March, 2015 was as follows:

| Liabilities | ₹ | Assets | ₹ |

| Creditors Bills Payable General Reserve Capital A/cs: A B C | 50,000 20,000 30,000 1,00,000 50,000 25,000 | Land Building Plant Stock Debtors Bank | 50,000 50,000 1,00,000 40,000 30,000 5,000 |

| 2,75,000 | 2,75,000 |

From 1st April, 2015, A, B and C decided to share profits equally. For this it was agreed that:

i) Goodwill of the firm will be valued at ₹ 1,50,000.

ii) Land will be revalued at ₹ 80,000 and building be decpreciated by 6%

iii) Creditors of ₹ 6,000 were not likely to be claimed and hence should be written off.

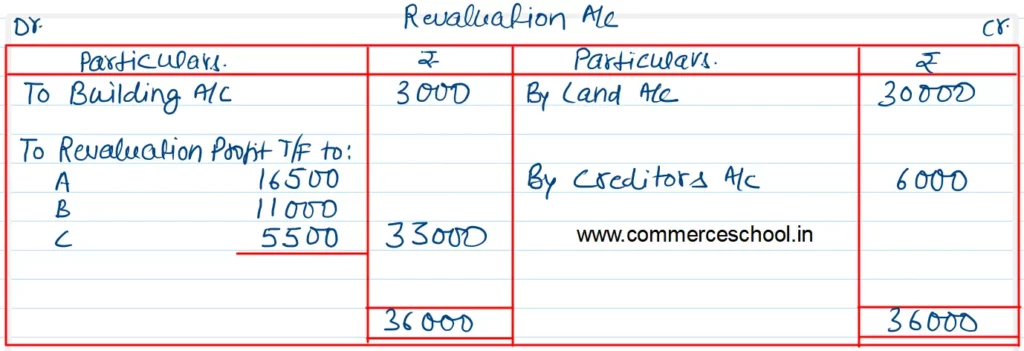

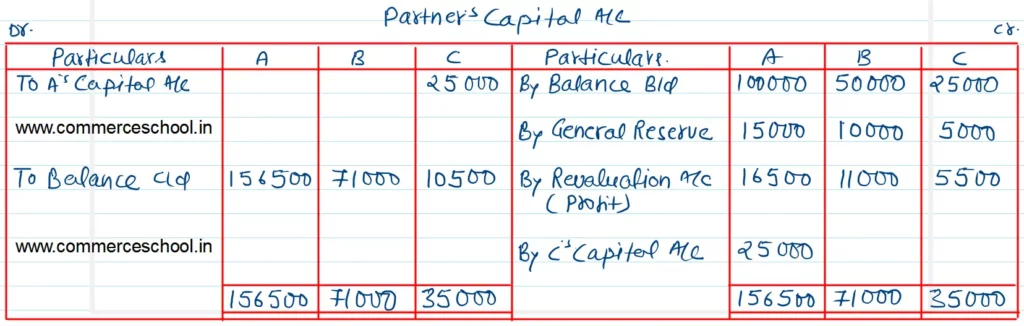

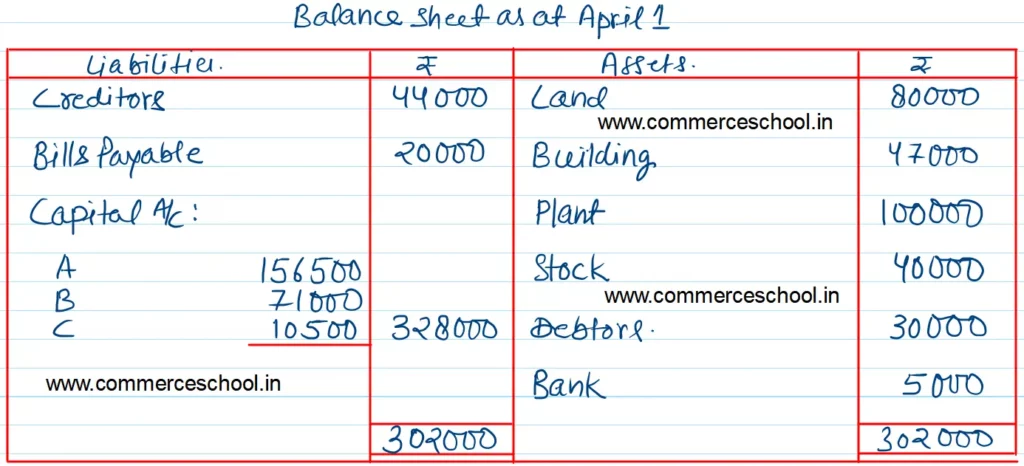

Prepare Revaluation Account, Partner’s Capital Accounts and Balance Sheet of the reconstituted firm.

[Ans.: Gain (Profit) on Revaluation – ₹ 33,000; Partner’s Capital Accoufnts: A – ₹ 1,56,000; B – ₹ 71,000 and C – ₹ 10,500; Balance Sheet Total – ₹ 3,02,000.]

Solution:-

Here is the list of all Solutions

| S.N | Questions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Questions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Questions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |