[CBSE] Q 27, Q 28 Bank Reconciliation Statement Solutions TS Grewal class 11 (2025-26)

Solution of Question number 27 and 28 Bank Reconciliation statement TS Grewal Class 11 CBSE Board 2025-26 Session

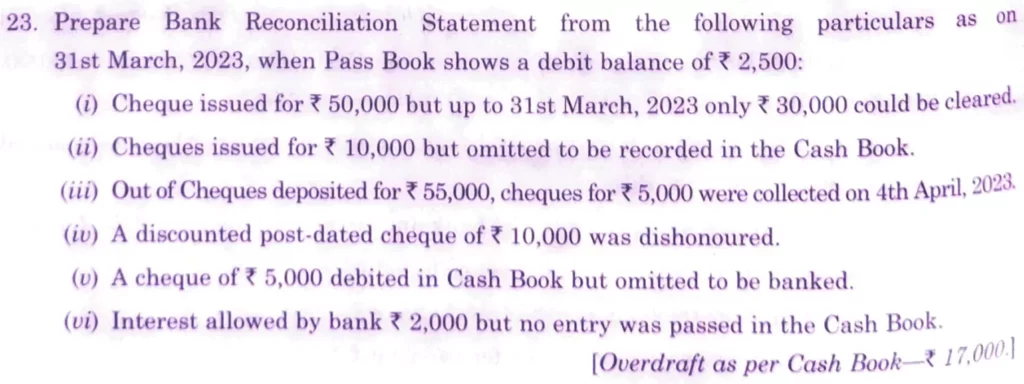

Q. 27. Prepare Bank Reconciliation Statement from the following particulars as on 31st March, 2023, when Pass Book shows a debit balance of ₹ 2,500:

(i) Cheque issued for ₹ 50,000 but up to 31st March, 2023 only ₹ 30,000 could be cleared.

(ii) Cheques issued for ₹ 10,000 but omitted to be recorded in the Cash Book.

(iii) Out of Cheques deposited for ₹ 55,000, cheques for ₹ 5,000 were collected on 4th April, 2023.

(iv) A discounted post-dated cheque of ₹ 10,000 was dishonoured.

(v) A cheque of ₹ 5,000 debited in Cash Book but omitted to be banked.

(vi) Interest allowed by bank ₹ 2,000 but no entry was passed in the Cash Book.

[Overdraft as per Cash Book – ₹ 17,000.]

Solution:-

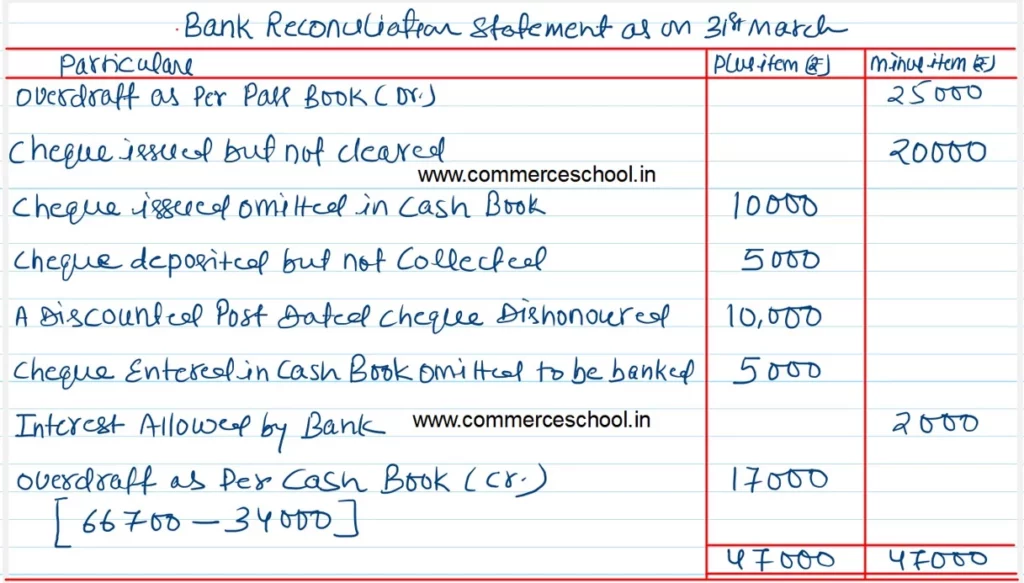

Q. 28. Komal needs help in preparing the Bank Reconciliation Statement as on 31st May, 2025, based on the following information reported by his cashier:

(i) Bank balance as per the Bank Statement received is ₹ 15640 (Dr.)

(ii) Of the total cheques deposited for ₹ 60,000 and issued for ₹ 40,000, 10% of each were cleared and encashed in the month of June, 2025, respectively.

(iii) Bank interest ₹ 350 allowed and ₹ 840 charged, as reflected in the Pass Book, were both credited in the Cash Book, in the last week of May.

(iv) A Cheque for ₹ 500 was debited twice in the Cash Book.

(v) A direct deposit into bank of ₹ 2,000 by client lalita, was not recorded in the Cash Book.

[Ans. Overdraft as per Cash Book – ₹ 15,840.]

Solution:-

Below is the list of all solutions of the Bank Reconciliation statement TS Grewal CBSE Board