[CBSE] Q. 28 Death of Partner Solution TS Grewal Class 12 (2023-24)

Solution of Question number 28 of the Death of Partner Chapter of TS Grewal Book 2023-24 Edition CBSE Board.

X and Y are partners. The Partnership Deed provides inter alia:

(a) That the Accounts be balanced on 31st March every year.

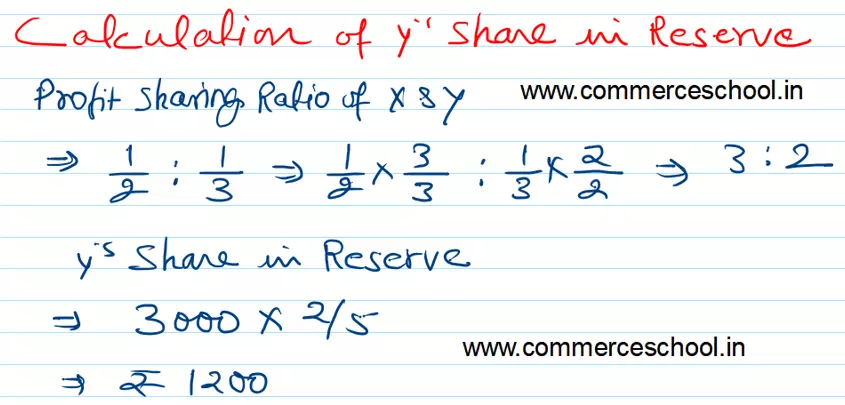

(b) That the profits be divided as: X one-half, Y one-third and carried to a Reserve one-sixth.

(c) That in the event of the death of a partner, his Executors be entitled to be paid:

(i) The capital to his credit till the date of death.

(ii) His proportions of profits till the date of death based on the average profits of the last three completed years.

(iii) By way of Goodwill, his proportion of the total profits for the three preceding years.

| Liabilities | ₹ | Assets | ₹ |

| Capital A/cs: X Y Reserve Creditors | 9,000 6,000 3,000 3,000 | Sundry Assets | 21,000 |

| 21,000 | 21,000 |

8, 17

Profits for three years ended 31st March, were: 2021 – ₹ 4,200; 2022 – ₹ 3,900; 2023 – ₹ 4,500. Y died on 1st August, 2023. Prepare necessary accounts.

[Ans.: Amount due to Y’s Executors – ₹ 12,800.]

Solution:-

Solutions of Death of Partner chapter 7 of TS Grewal Book class 12 Accountancy 2023-24 CBSE Board

| S.N | Questions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Questions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Questions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Questions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |