[CBSE] Q 29, Q 30 Bank Reconciliation Statement Solutions TS Grewal class 11 (2025-26)

Solution of Question number 29 and 30 Bank Reconciliation statement TS Grewal Class 11 CBSE Board 2025-26 Session

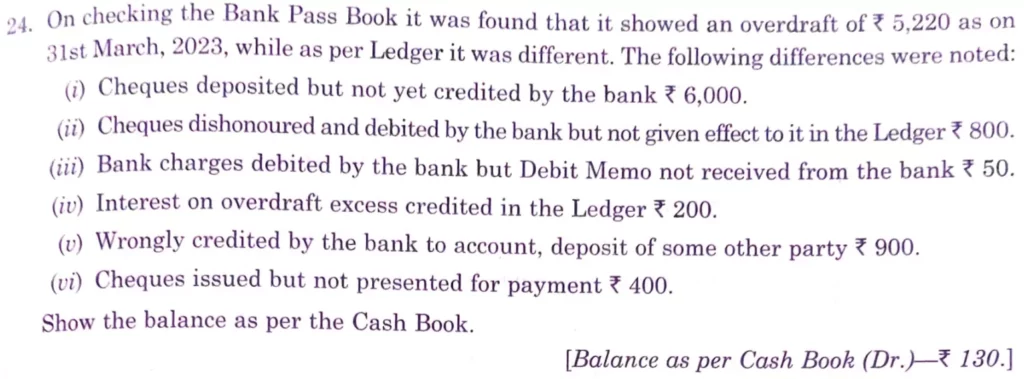

Q. 29. On checking the Bank Pass Book it was found that it showed as overdraft of ₹ 5,220 as on 31st March, 2023, while as per Ledger it was different. The following differences were noted:

(i) Cheques deposited but not yet credited by the bank ₹ 6,000.

(ii) Cheques dishonoured and debited by the bank but not given effect to it in the Ledger ₹ 800.

(iii) Bank charges debited by the bank but Debit Memo not received from the bank ₹ 50.

(iv) Interest on overdraft excess credited in the Ledger ₹ 200.

(v) Wrongly credited by the bank to account, deposit of some other party ₹ 900.

(vi) Cheques issued but not presented for payment ₹ 400.

[Balance as per Cash Book (Dr.) – ₹ 130.]

Solution:-

Q. 30. From the following particulars, you are required to ascertain the bank balance as would appear in the Cash Book of Ramesh as on 31st October, 2022:

(i) Bank Pass Book showed an overdraft of ₹ 16,500 on 31st October.

(ii) Interest of ₹ 1,250 on overdraft up to 31st October, 2022 has been debited in the Bank Pass Book but it has not been entered in the Cash Book.

(iii) Bank charges debited in the Bank Pass Book amounted to ₹ 35.

(iv) Cheques issued prior to 31st October, 2022 but not presented till that date, amounted to ₹ 11,500.

(v) Cheques paid into bank before 31st October, but not collected and credited up to that date, were for ₹ 2,500.

(vi) Interest on investment collected by the bankers and credited in the Bank Pass Book amounted to ₹ 1,800.

[Overdraft as per Cash Book – ₹ 26,015.]

Solution:-

Below is the list of all solutions of the Bank Reconciliation statement TS Grewal CBSE Board