[CBSE] Q. 3 solution of Fundamentals of Partnership Firms TS Grewal Book 2023-24 Edition

Are you looking for the solution of Question number 3 of the Fundamentals of partnership firm chapter TS Grewal Book CBSE 2023-24 Edition?

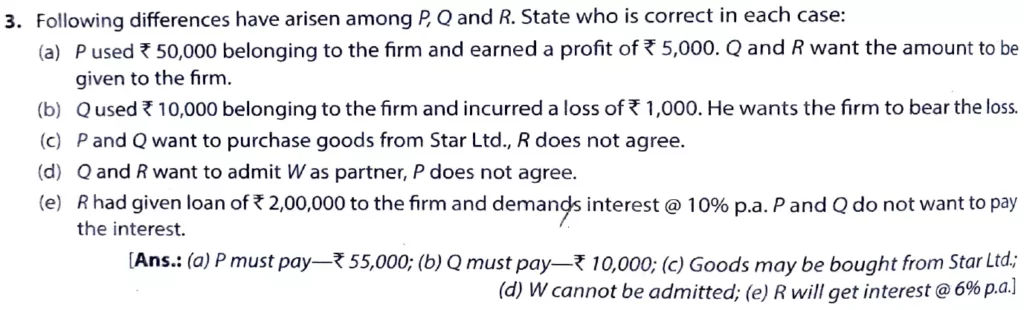

The following difference has arisen among P, Q, and R. State who is correct in each case:

a) P used ₹ 50,000 belonging to the firm and earned a profit of ₹ 5000. Q and R want the amount to be given to the firm.

b) Q used ₹ 10,000 belonging to the firm and incurred a loss of ₹ 1,000. He wants the firm to bear the loss.

c) P and Q want to purchase goods from Star Ltd. R does not agree.

d) Q and R want to admit W as a partner, but P does not agree.

e) R had given a loan of ₹ 2,00,000 to the firm and demanded interest @ 10%. P and Q do not want to pay the interest.

Solution:-

Here is the solution of it.

| Video Solution | Link |

| Watch Video Solution of this Question | Click Here |

a) If any partner uses the money of the firm and earned a profit. He has to pay back the used money with profit. hence, p has to back ₹ 55,000 to the firm.

b) If any partner uses the firm money and incurred a loss. He has to bear the loss and the full amount of money taken by the partner has to return back the firm. hence Q has to pay ₹ 10,000 to the firm.

c) any business decision is decided by the majority. Hence P and Q want to purchase goods from star Ltd is accepted as there are only 3 partners and the majority win.

d) W as a partner can not be admitted as to admit a new partner, all partners must agree.

e) In the absence of a partnership deed. Provisions of the Indian Partnership Act 1932 would apply. Only a 6% p.a rate of interest on the loan of partners to the firm would be charged. Hence. In the place of 10% p.a, only a 6% p.a rate of interest would be charged.

| Video Solution | Link |

| Watch Video Solution of this Question | Click Here |

Here is the list of all Solutions.

| S.N | Questions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Questions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Questions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Questions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |

| 40 | Question – 40 |

| S.N | Questions |

| 41 | Question – 41 |

| 42 | Question – 42 |

| 43 | Question – 43 |

| 44 | Question – 44 |

| 45 | Question – 45 |

| 46 | Question – 46 |

| 47 | Question – 47 |

| 48 | Question – 48 |

| 49 | Question – 49 |

| 50 | Question – 50 |

| S.N | Questions |

| 51 | Question – 51 |

| 52 | Question – 52 |

| 53 | Question – 53 |

| 54 | Question – 54 |

| 55 | Question – 55 |

| 56 | Question – 56 |

| 57 | Question – 57 |

| 58 | Question – 58 |

| 59 | Question – 59 |

| 60 | Question – 60 |

| S.N | Questions |

| 61 | Question – 61 |

| 62 | Question – 62 |

| 63 | Question – 63 |

| 64 | Question – 64 |

| 65 | Question – 65 |

| 66 | Question – 66 |

| 67 | Question – 67 |

| 68 | Question – 68 |

| 69 | Question – 69 |

| 70 | Question – 70 |

| S.N | Questions |

| 71 | Question – 71 |

| 72 | Question – 72 |

| 73 | Question – 73 |

| 74 | Question – 74 |

| 75 | Question – 75 |

| 76 | Question – 76 |

| 77 | Question – 77 |

| 78 | Question – 78 |

| 79 | Question – 79 |

| 80 | Question – 80 |

| S.N | Questions |

| 81 | Question – 81 |

| 82 | Question – 82 |

| 83 | Question – 83 |

| 84 | Question – 84 |

| 85 | Question – 85 |

| 86 | Question – 86 |

| 87 | Question – 87 |

| 88 | Question – 88 |

| 89 | Question – 89 |

| 90 | Question – 90 |

| S.N | Questions |

| 91 | Question – 91 |

| 92 | Question – 92 |

| 93 | Question – 93 |

| 94 | Question – 94 |

| 95 | Question – 95 |