[CBSE] Q 31, Q 32 Bank Reconciliation Statement Solutions TS Grewal class 11 (2025-26)

Solution of Question number 31 and 32 Bank Reconciliation statement TS Grewal Class 11 CBSE Board 2025-26 Session

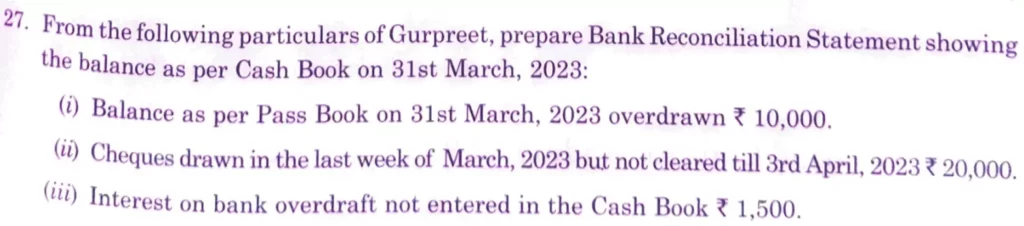

Q. 31. From the following particulars of Gurpreet, prepare Bank Reconciliation Statement showing the balance as per Cash Book on 31st March, 2023:

(i) Balance as per Pass Book on 31st March, 2023 overdrawn ₹ 10,000.

(ii) Cheques drawn in the last week of March, 2023 but not cleared till 3rd April, 2023 ₹ 20,000.

(iii) Interest on bank overdraft not entered in the Cash Book ₹ 1,500.

(iv) Cheques of ₹ 20,000 deposited in the bank in March, 2023 but not collected and credited till 3rd April, 2023.

(v) ₹ 100 Insurance Premium paid by the bank under a standing order has not been entered in the Cash Book.

(vi) A draft of ₹ 10,000 favouring Atul & Co. was issued by the bank charging commission of ₹ 200. However, in the Cash Book entry was passed by ₹ 10,000.

[Overdraft as per Cash Book – ₹ 8,200.]

Solution:-

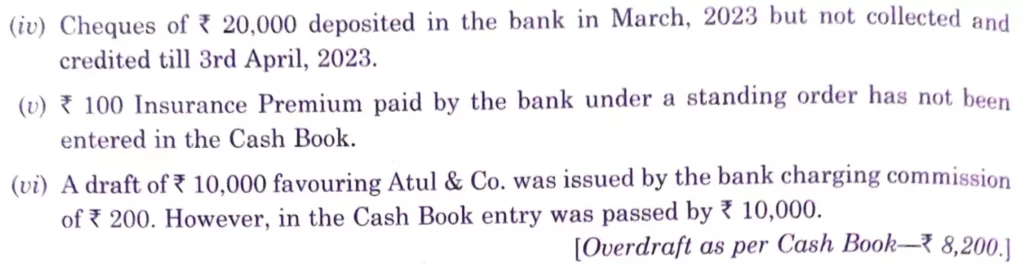

Q. 32. From the following information supplied by Sanjay, prepare his Bank Reconciliation Statement as on 31st March, 2025:

| Bank Overdraft as per Pass Book. | 16,500 |

| Cheques issued but not presented for payment | 8,750 |

| Cheques deposited with the Bank but not collected | 10,500 |

| Cheques recorded in the Cash Book but not sent to the bank for collection. | 2,000 |

| Payments received from customers directly by the bank. | 3,500 |

| Bank charges debited in the Pass Book. | 200 |

| Premium of life policy of Sanjay paid by the bank on standing advice. | 1,980 |

| Bank had debited ₹ 3,100 for payment of electricity bill. It was not recorded in Cash Book. | 100 |

[Overdraft Balance as per Cash Book – ₹ 10,970.]

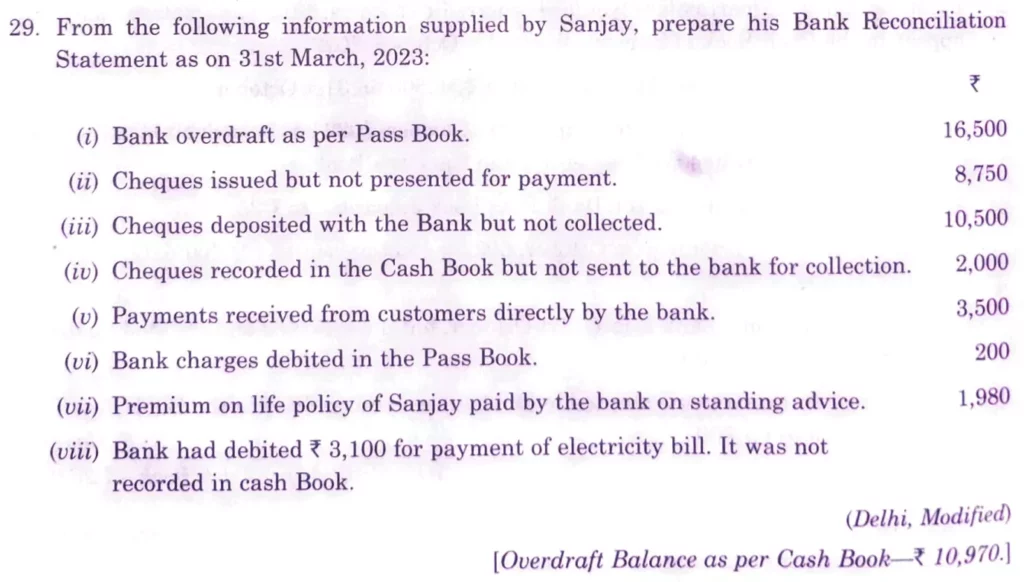

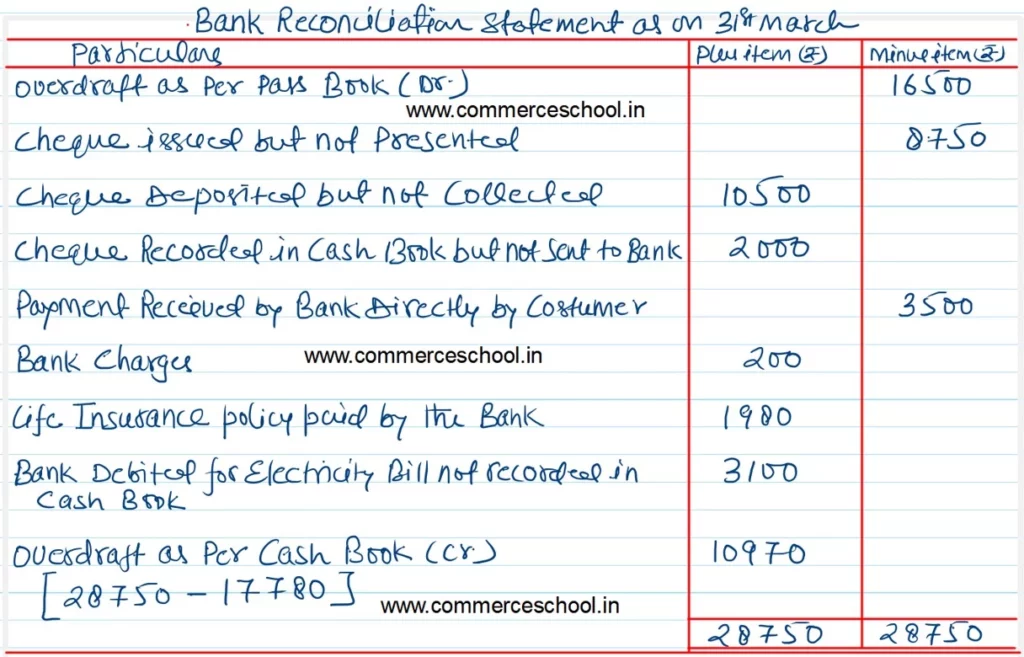

Solution:-

Below is the list of all solutions of the Bank Reconciliation statement TS Grewal CBSE Board