[CBSE] Q 31, Q 32 Depreciation Solutions TS Grewal Class 11 (2025-26)

Solution of Question number 31 and 32 of the Depreciation chapter TS Grewal Class 11 CBSE Board for 2025-26 Session.

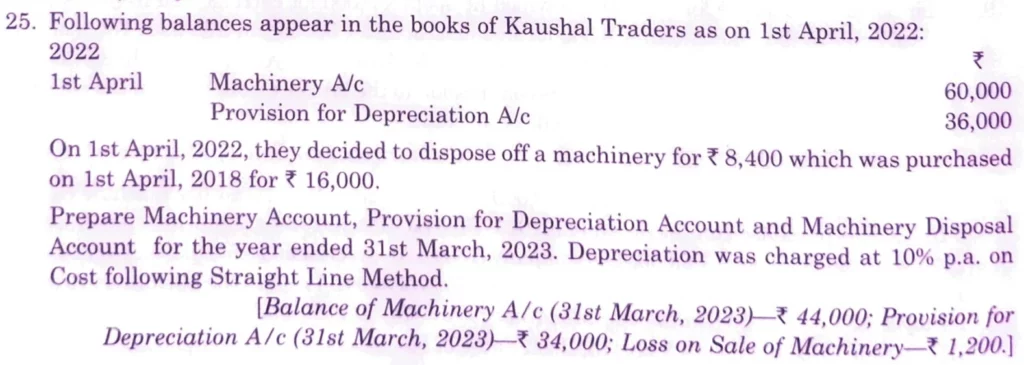

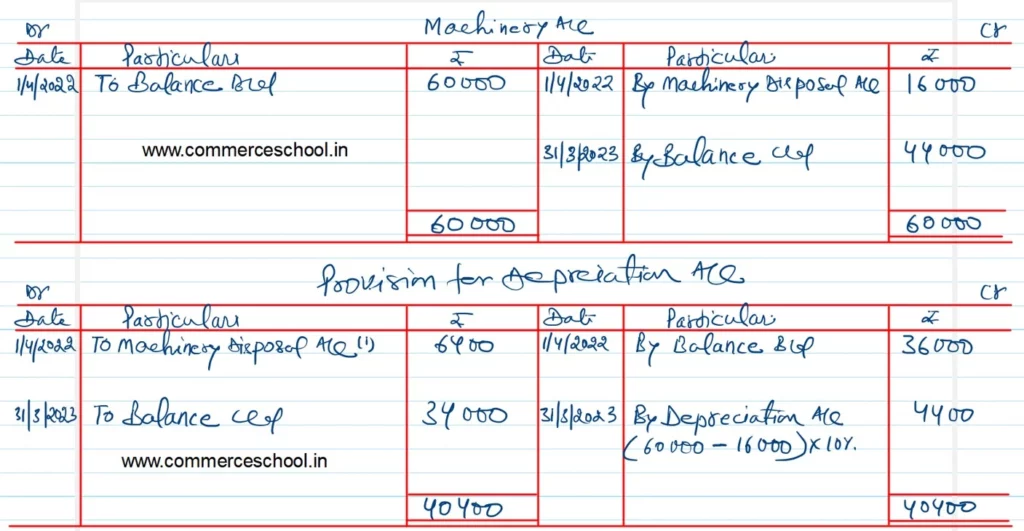

Q. 31. Following balances appear in the books of Kaushal Traders as on 1st April, 2022:

| 2022 1st April | Machinery A/c Provision for Depreciation A/c | 60,000 36,000 |

On 1st April, 2022, they decided to dispose off a machinery for ₹ 8,400 which was purchased on 1st April, 2018 for ₹ 16,000.

You are required to prepare the Machinery Account, Provision for Depreciation Account and Machinery Disposal Account for the year ended 31st March, 2023. Depreciation was charged at 10% p.a. on Cost following Straight Line Method.

[Balance of Machinery A/c (31st March, 2023) – ₹ 44,000; Provision for Depreciation A/c (31st March, 2023) – ₹ 34,000; Loss on Sale of Machinery – ₹ 1,200.]

Solution:-

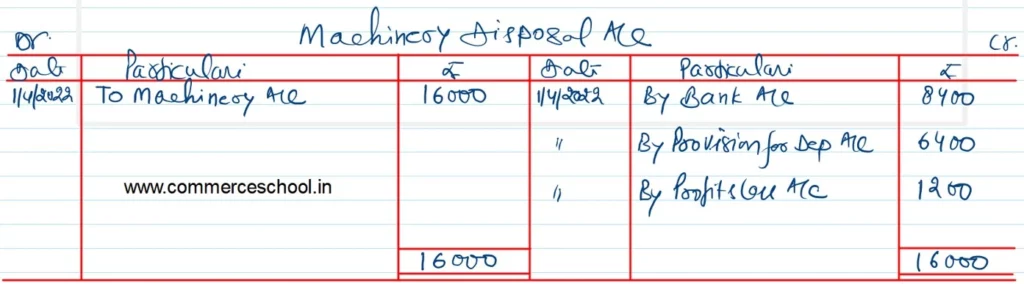

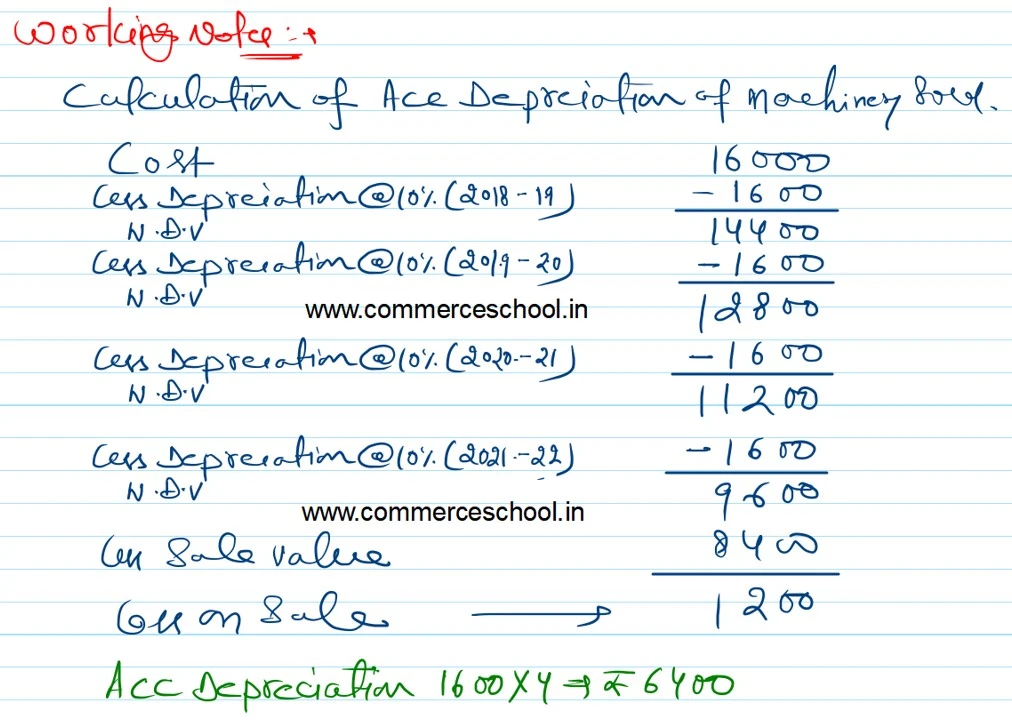

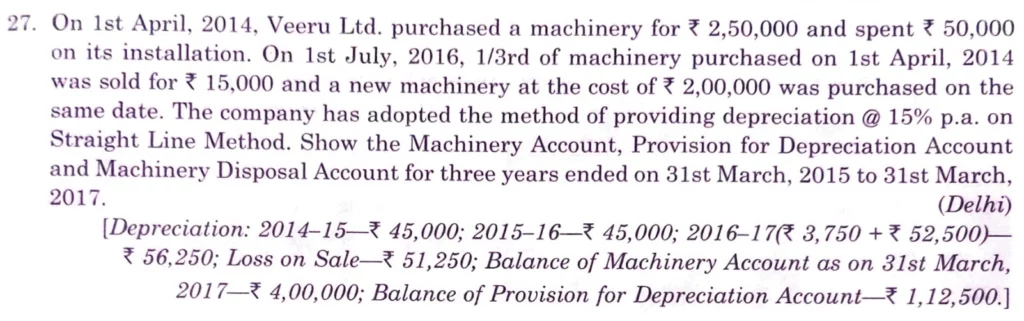

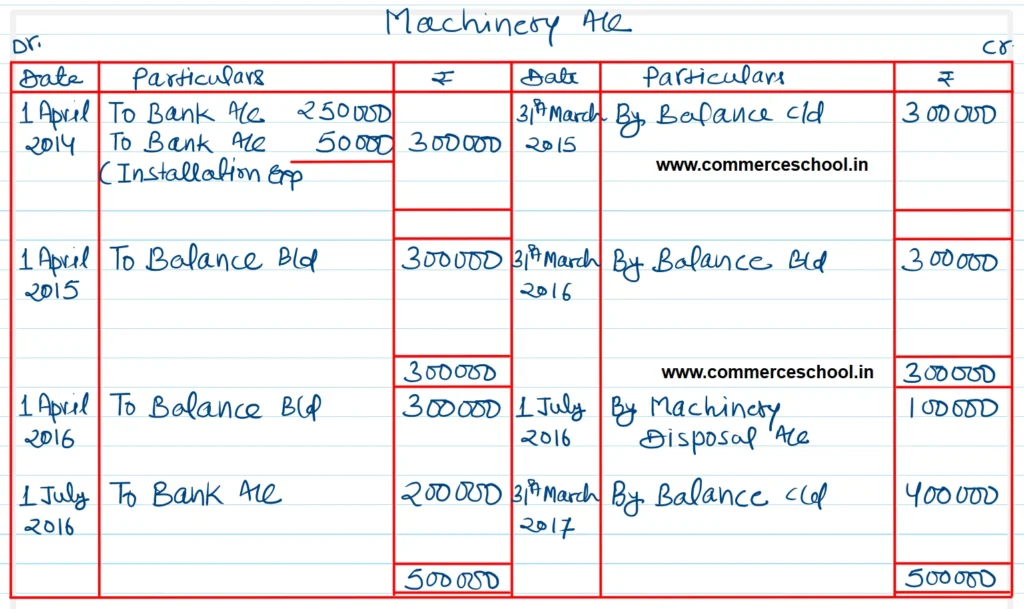

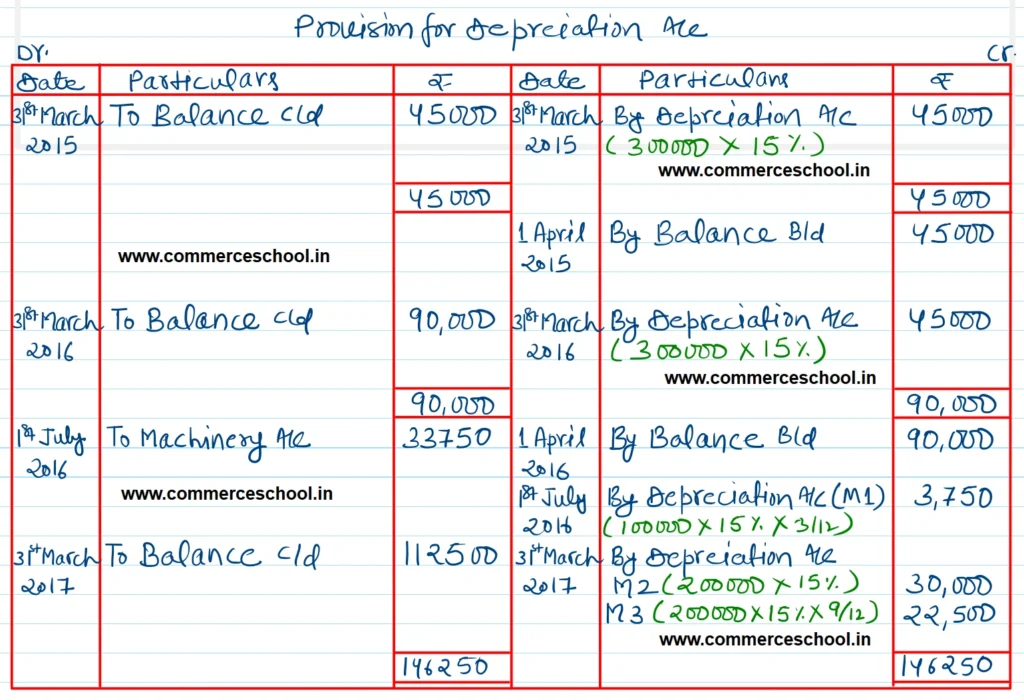

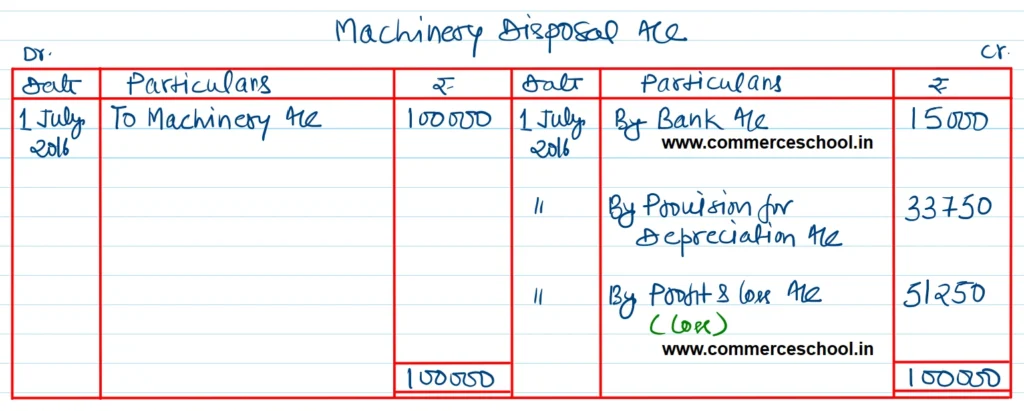

Q. 32. On 1st Apirl, 2014, Veeru Ltd. purchased a machinery for ₹ 2,50,000 and spent ₹ 50,000 on its installation.

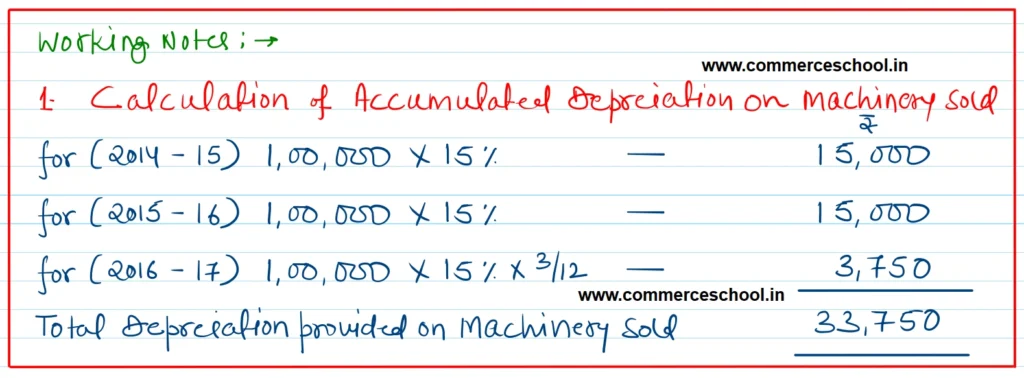

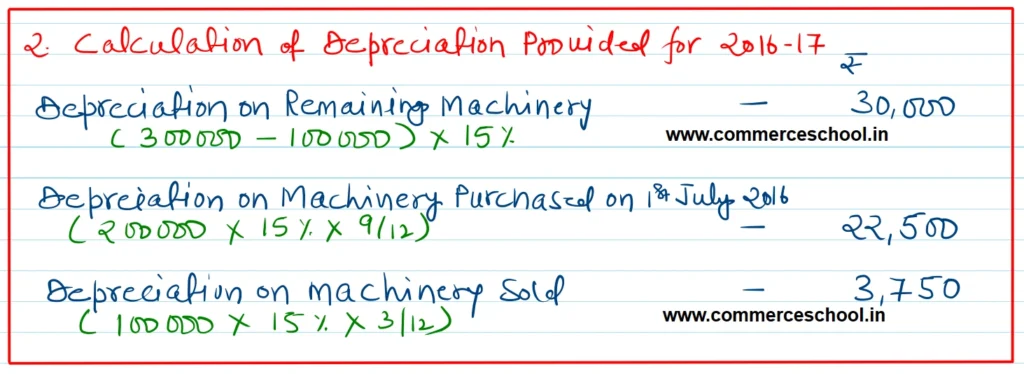

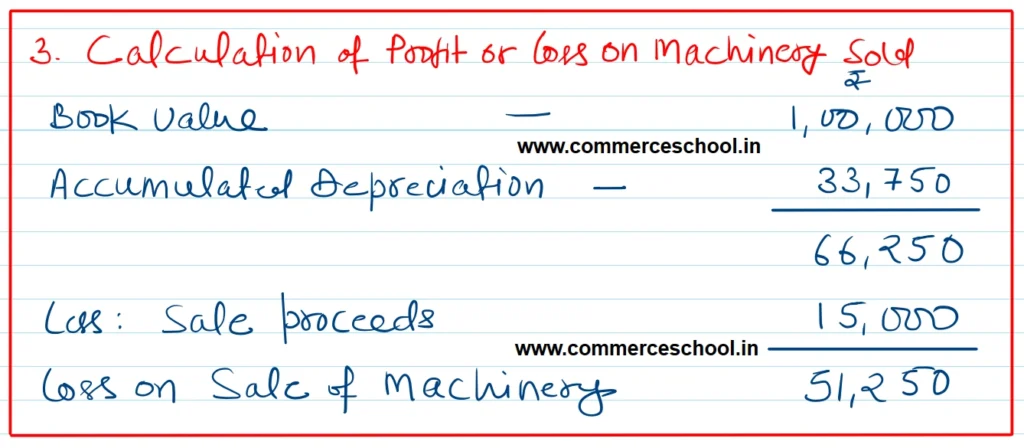

On 1st July, 2016, 1/3rd of machinery purchased on 1st April, 2014 was sold for ₹ 15,000 and a new machinery at the cost of ₹ 2,00,000 was purchased on the same date. The company has adopted the method of providing depreciation @ 15% p.a. on Straight Line Method. Show the Machinery Account, Provision for Depreciation Account and Machinery Disposal Account for three years ended on 31st March, 2015 to 31st March, 2017.

[Depreciation: 2014 – 15 – ₹ 45,000; 2015 – 16 – ₹ 45,000; 2016 – 17 (₹ 3,750 + ₹ 52,500) – ₹ 65,250; Loss on sale – ₹ 51,250; Balance of Machinery Account as on 31st March, 2017 – ₹ 4,00,000; Balance of Provision for Depreciation Account – ₹ 1,12,500.]

Solution:-

Following is the list of all solutions of the depreciation chapter of ts Grewal CBSE for the (2025-26) session.