[CBSE] Q. 31 Solution of Retirement of Partner TS Grewal Class 12 (2024-25)

Solution to Question number 31 of the Retirement of Partner chapter 5 of TS Grewal Book 2024-25 Edition CBSE Board.

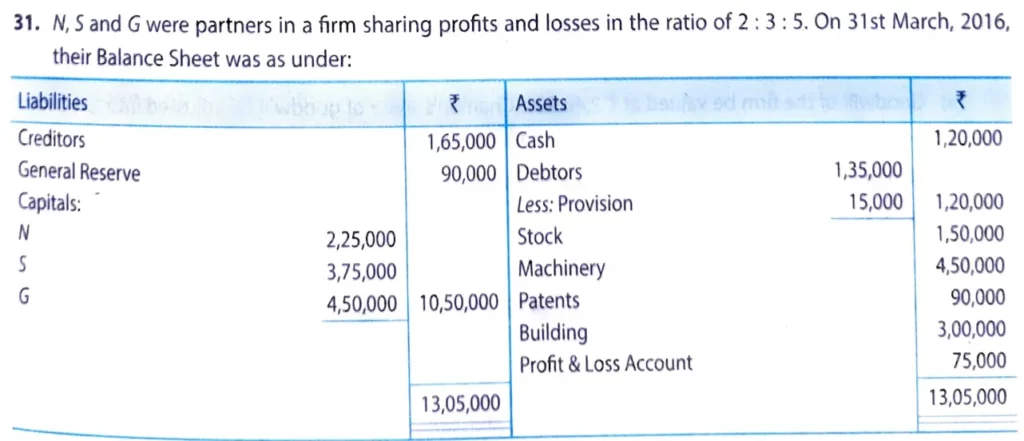

N, G and G were partners in a firm sharing profits and losses in the ratio of 2 : 3 : 5. On 31st March, 2016 their Balance Sheet was as under:

| Liabilities | ₹ | Assets | ₹ | |

| Creditors General Reserve Capitals: N S G | 1,65,000 90,000 2,25,000 3,75,000 4,50,000 | Cash Debtors Less: Provision Stock Machinery Patents Building Profit & Loss Account | 1,35,000 15,000 | 1,20,000 1,20,000 1,50,000 4,50,000 90,000 3,00,000 75,000 |

| 13,05,000 | 13,05,000 |

G retired on the above date and it was agreed that:

(a) Debtors of ₹ 6,000 will be written off as bad debts and a provision of 5% on debtors for bad and doubtful debts will be maintained.

(b) Patents will be completely written off and stock, machinery and building will be depreciated by 5%.

(c) An unrecorded creditor of ₹ 30,000 will be taken into account.

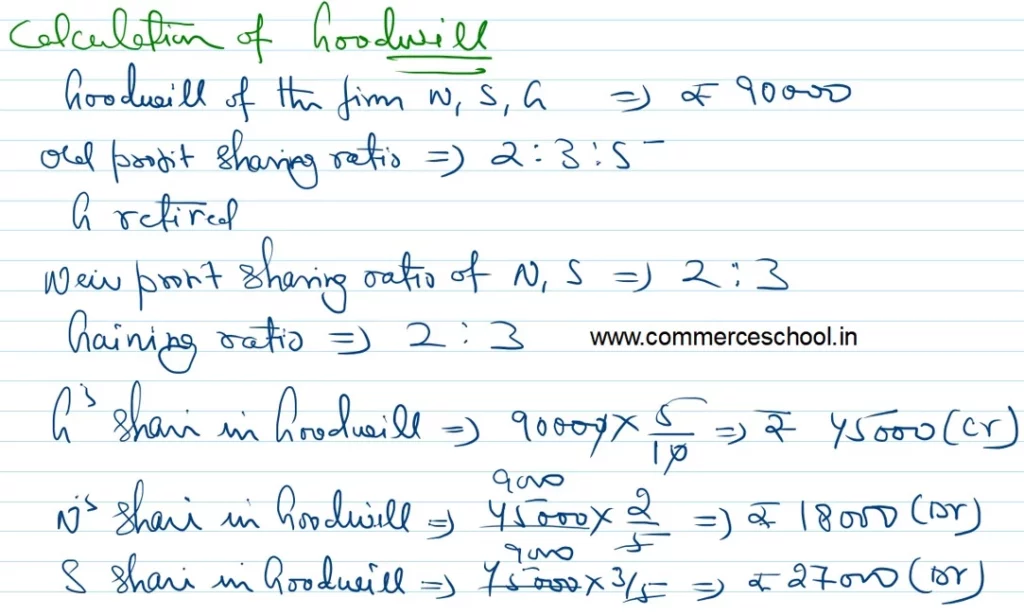

(d) N and S will share the future profits in 2 : 3 ratio.

(e) Goodwill of the firm on G’s retirement was valued at ₹ 90,000.

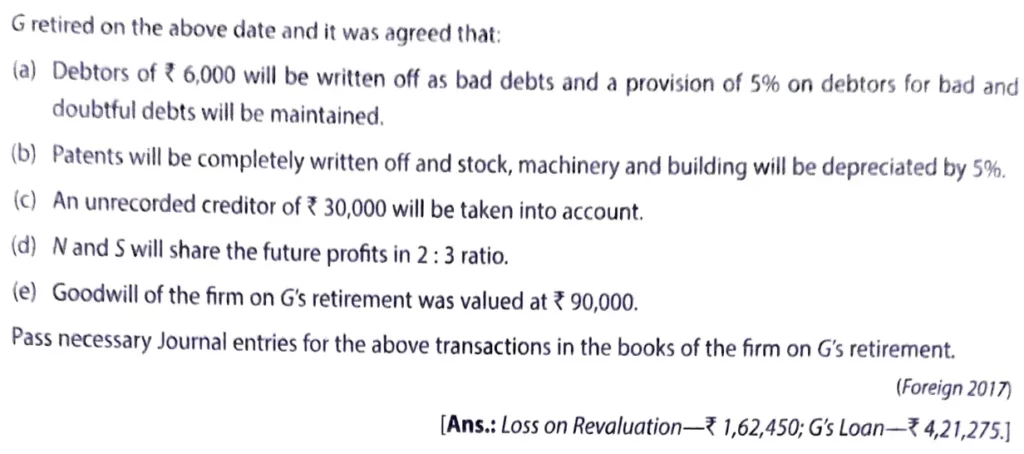

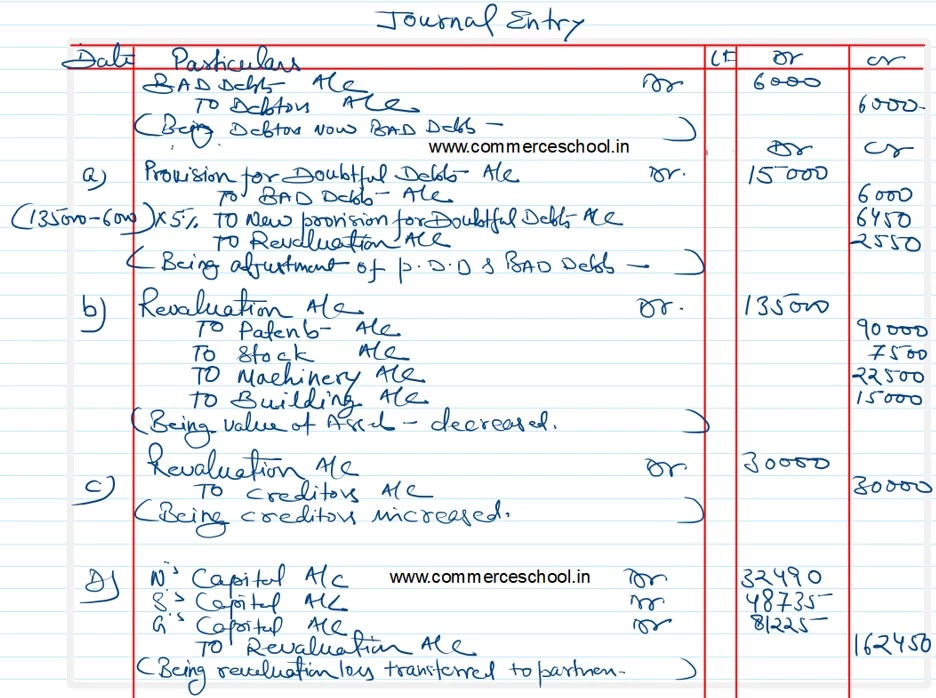

Pass necessary Journal entries for the above transactions in the books of the firm on G’s retirement.

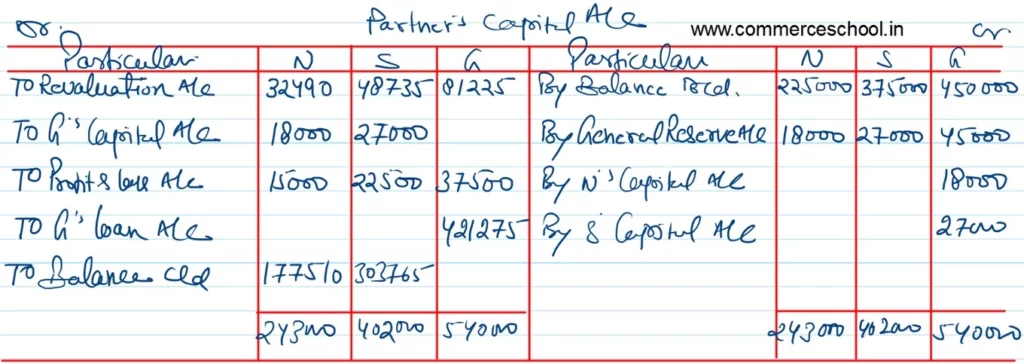

[Ans.: Loss on Revaluation – ₹ 1,62,450; G’s Loan – ₹ 4,21,275.]

Solution:-

Here is the list of all Solutions of Retirement of Partners of TS Grewal class 12 CBSE 2024-25.

| S.N | Questions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Questions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Questions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Questions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |

| 40 | Question – 40 |

| S.N | Questions |

| 41 | Question – 41 |

| 42 | Question – 42 |

| 43 | Question – 43 |

| 44 | Question – 44 |

| 45 | Question – 45 |

| 46 | Question – 46 |

| 47 | Question – 47 |

| 48 | Question – 48 |

| 49 | Question – 49 |

| 50 | Question – 50 |

| S.N | Questions |

| 51 | Question – 51 |

| 52 | Question – 52 |

| 53 | Question – 53 |

| 54 | Question – 54 |

| 55 | Question – 55 |

| 56 | Question – 56 |

| 57 | Question – 57 |