[CBSE] Q 33, Q 34 Depreciation Solutions TS Grewal Class 11 (2025-26)

Solution of Question number 33 and 34 of the Depreciation chapter TS Grewal Class 11 CBSE Board for 2025-26 Session.

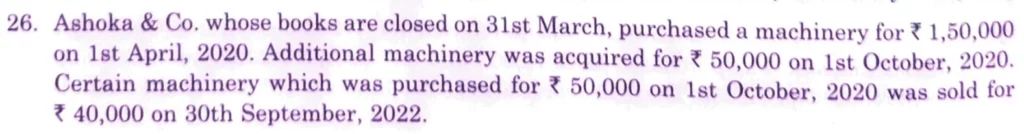

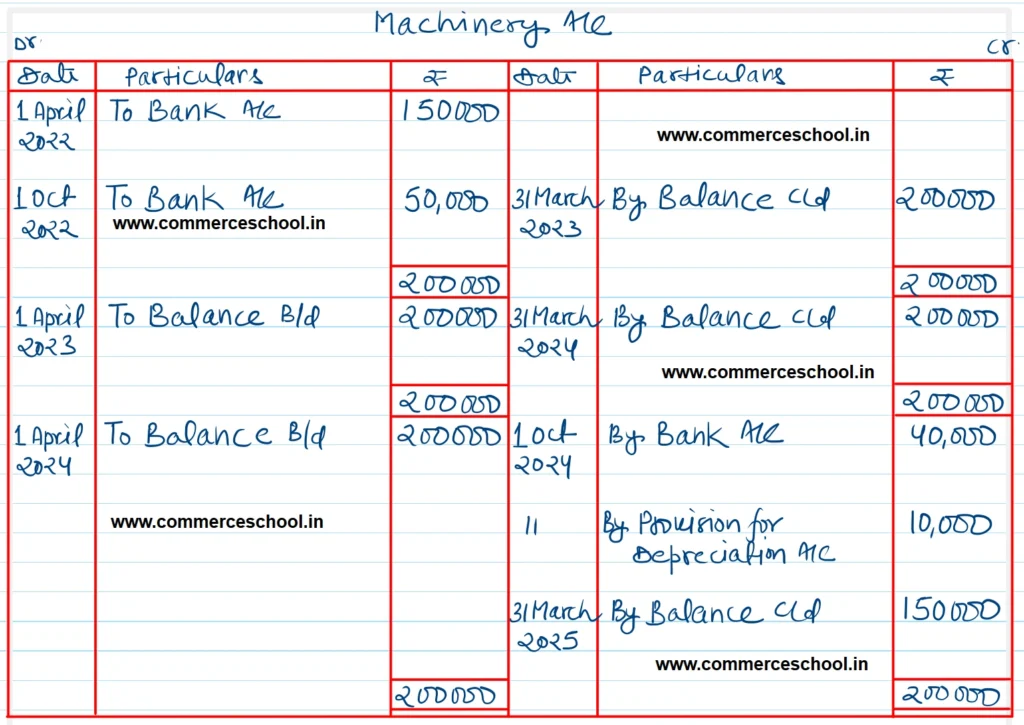

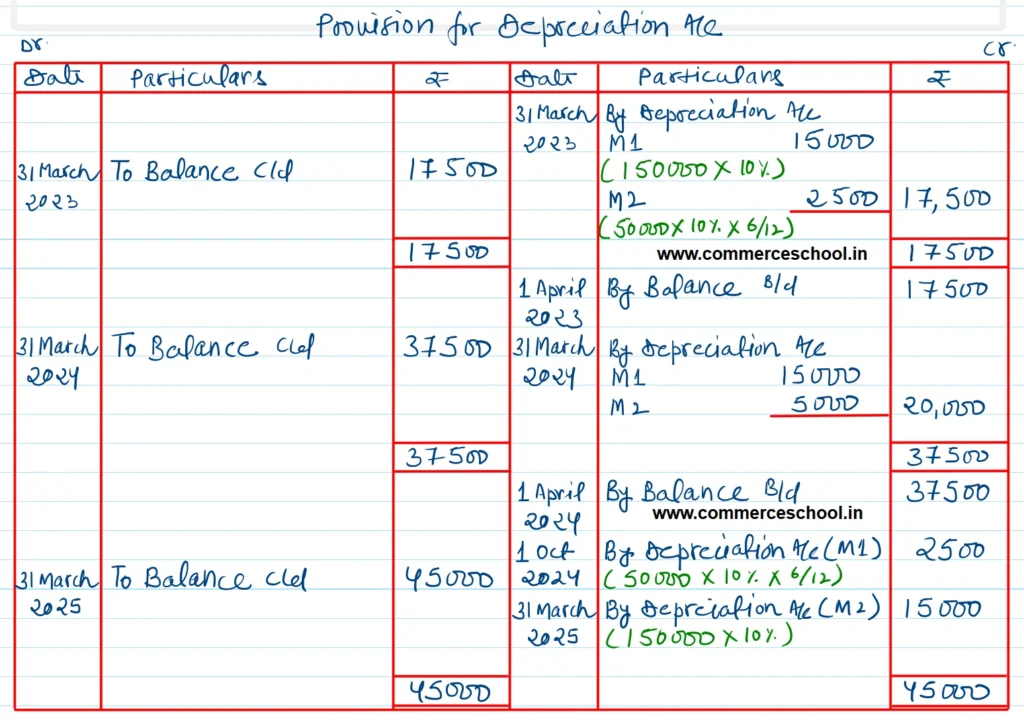

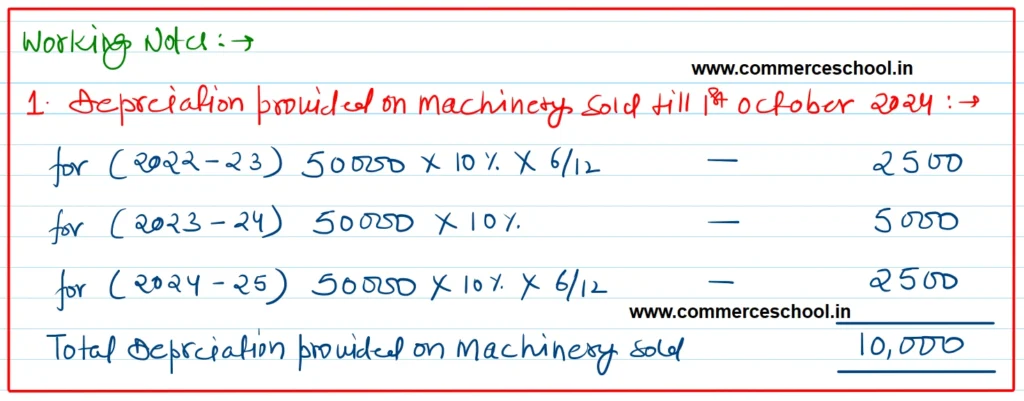

Q. 33. Ashoka & Co. whose books are closed on 31st March, purchased a machinery for ₹ 1,50,000 on 1st April, 2020.

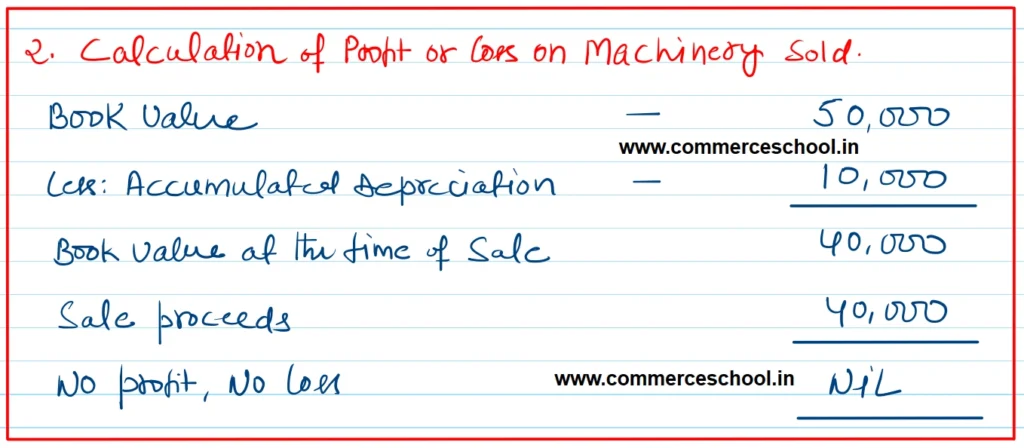

Additional machinery was acquired for ₹ 50,000 on 1st October, 2020. Certain machinery which was purchased for ₹ 50,000 on 1st October, 2020 was sold for ₹ 40,000 on 30th Septemeber, 2022.

Prepare the Machinery Account and Accumulated Depreciation Account for all the years up to the year ended 31st March, 2023. Depreciation is charged @ 10% p.a. on Straight Line Method. Also, show the Machinery Disposla Account.

[Neither Gain (Profit) nor loss on Sale of Machine; Balance of Machinery a/c (31set March, 2023) – ₹ 1,50,000; Balance of Accumulated Depreciation A/c (31st March, 2023) ₹ 45,000.]

Solution:-

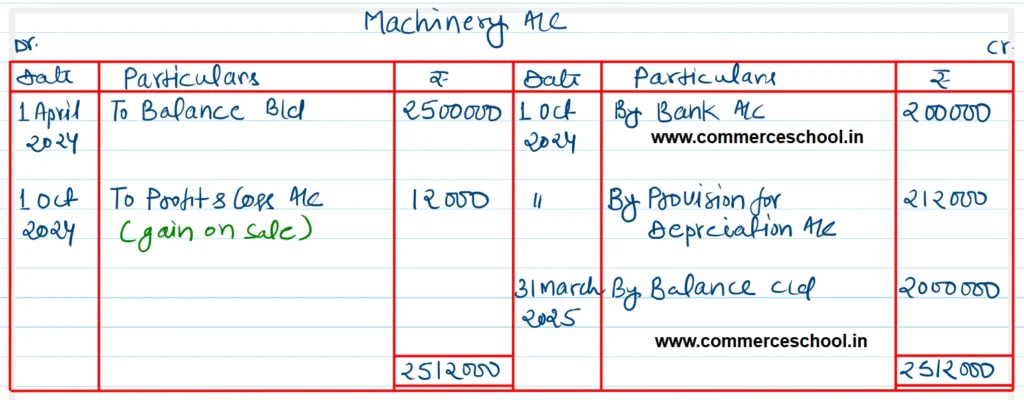

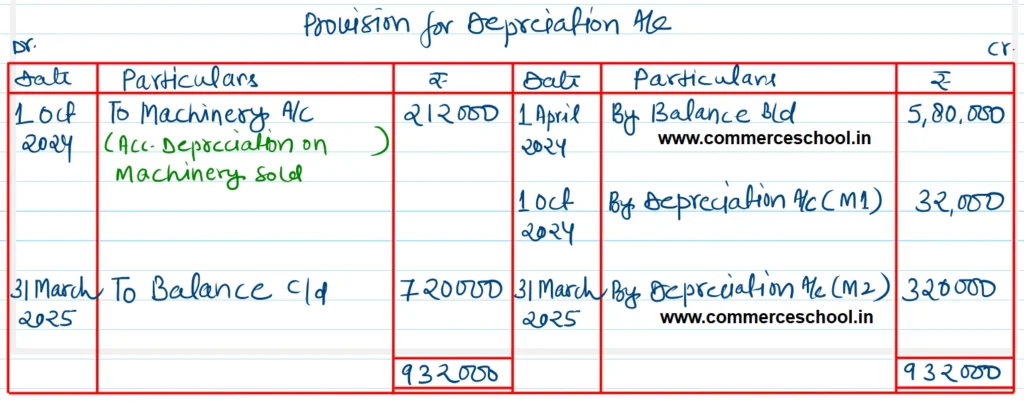

Q. 34. From the books of Harish Traders following information as on 1st April, 2024, is extracted:

| Plant and Machinery Account | ₹ 25,00,000 |

| Provision for Depreciation Account | ₹ 5,80,000 |

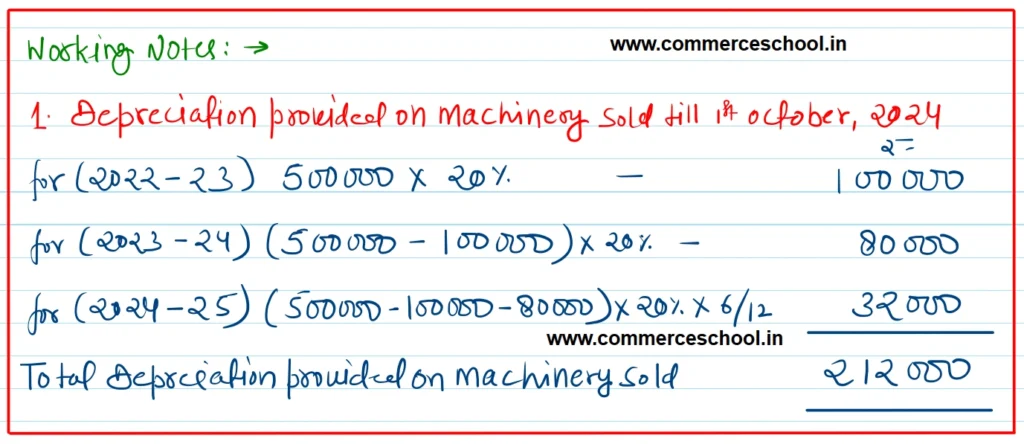

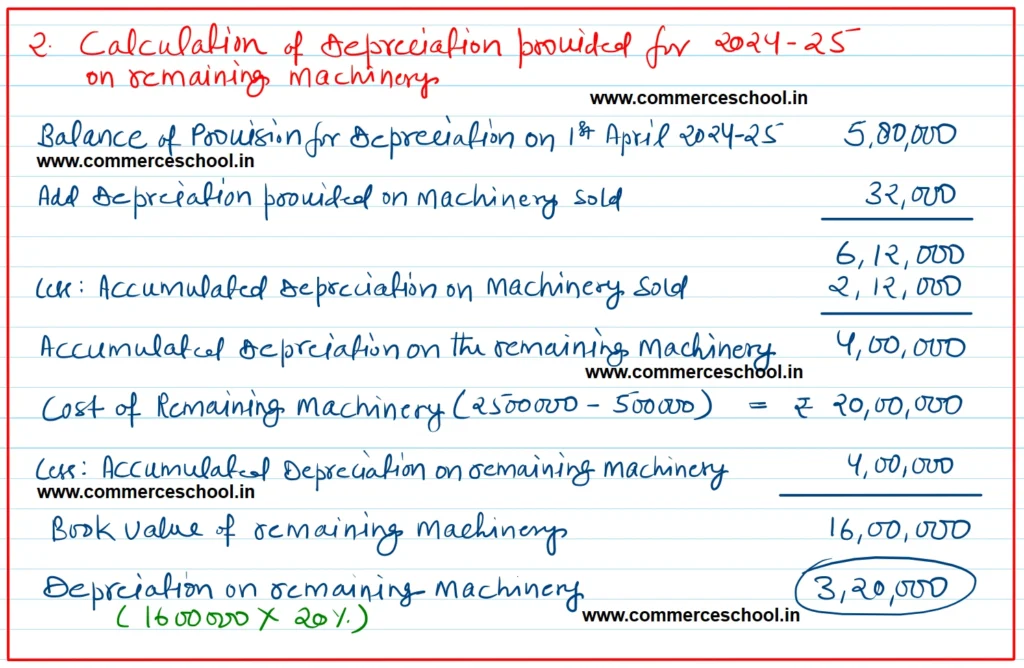

Depreciation is charged on the plant at 20% p.a. by the Diminishing Balance Method. A piece of machinery purchased on 1st April, 2022 for ₹ 5,00,000 was sold on 1st October, 2024 for ₹ 3,00,000. Prepare the Plant and Machinery Account and Provision for Depreciation Account for the year ended 31st March, 2025. Also, prepare Machinery Disposal Account.

[Ans. Depreciation: 2024-25 – ₹ 3,20,000; Balance of Machinery Account as on 31st March, 2025 – ₹ 20,00,000; Provision for Depreciation Account – ₹ 7,20,000; Gain on Sale of Machinery – ₹ 12,000.]

Solution:-

Following is the list of all solutions of the depreciation chapter of ts Grewal CBSE for the (2025-26) session.

This was good whenever I wanted to clarify doubts inhad class 11 accountancy. But suddenly I don’t know the reason the solution are not showing up and therefore I can’t verify my answers so please fix this bug/glitch