[CBSE] Q 34 DK Goel Admission of a Partner Solutions Class 12 (2024-25)

The solution of Question number 34 of Admission of a Partner chapter 3 of DK Goel Class 12 CBSE (2024-25)

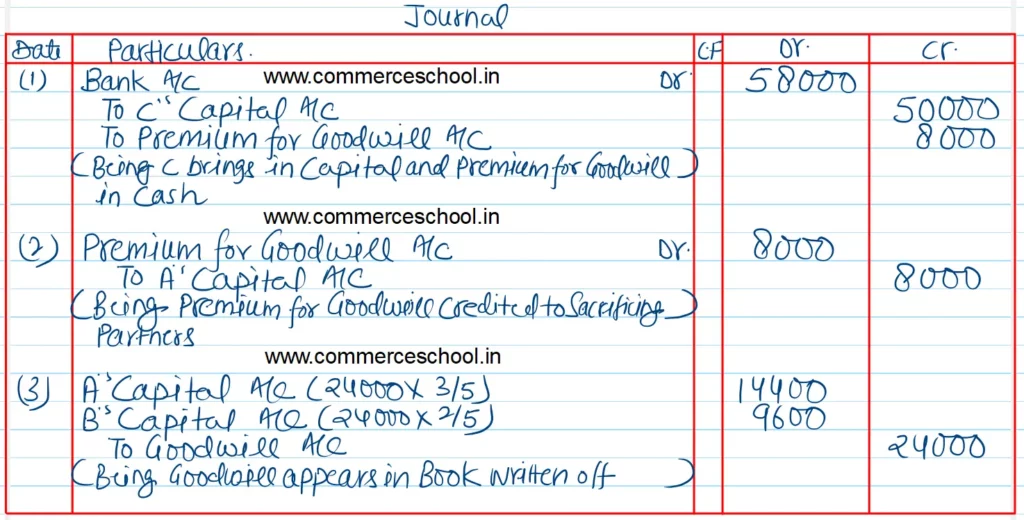

Q. 34 (A). A and B are partners, sharing profit and losses in the ratio of 3 : 2. Goodwill appears in their Balance Sheet at ₹ 24,000, When C is admitted into partnership for 1/5th share in profit. He pays ₹ 50,000 for capital and ₹ 8,000 as goodwill. The ratio of the partners A, B and C in the new firm would be 2 : 2 : 1.

Pass journal entries in the books of the new firm to record above adjustments.

[Ans. Premium for goodwill ₹ 8,000 is transferred to A’s Capital. Old goodwill ₹ 24,000 will be written off in A and B in the ratio of 3 : 2.]

Solution:-

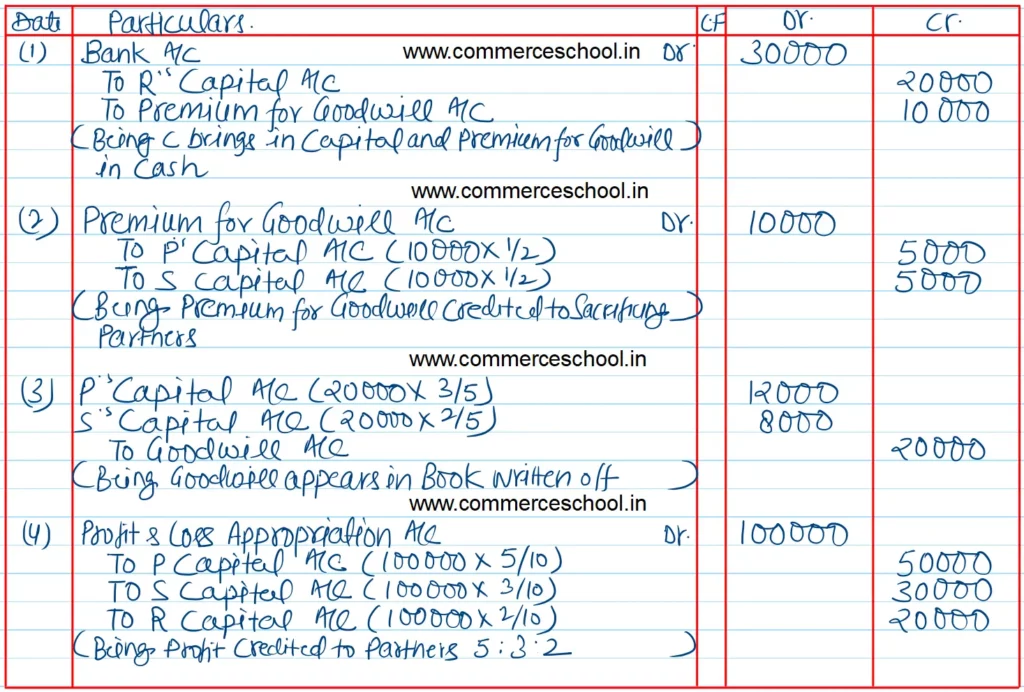

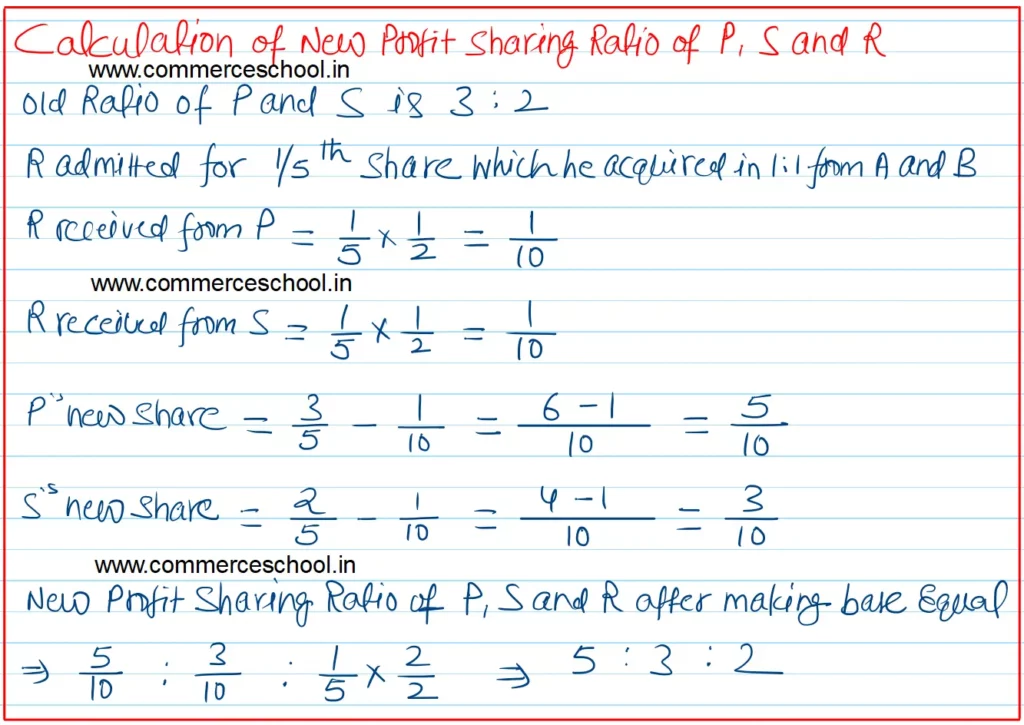

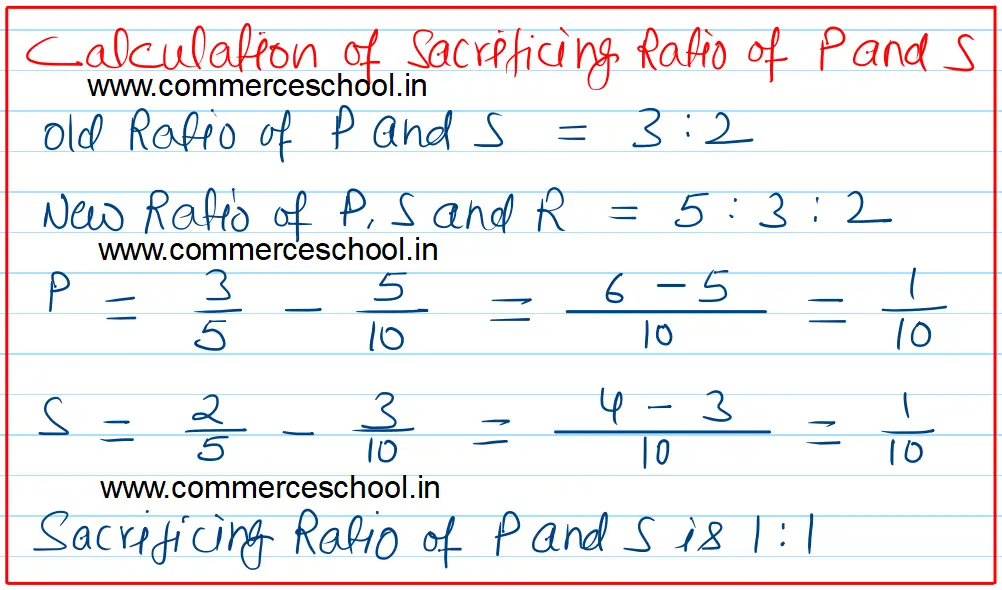

Q. 34 (B). P and S are partners sharing profits in the ratio of 3 : 2. Their books showed goodwill at ₹ 20,000, R is admitted with 1/5th share which he acquires equally from P and S. R brings ₹ 20,000 as his capital and ₹ 10,000 as his share of goodwill. Profits at the end of the year were of the amount of ₹ 1,00,000. You are required to give journal entries to carry out the above arrangement.

[Ans. New Ratio 5 : 3 : 2.]

Solution:-

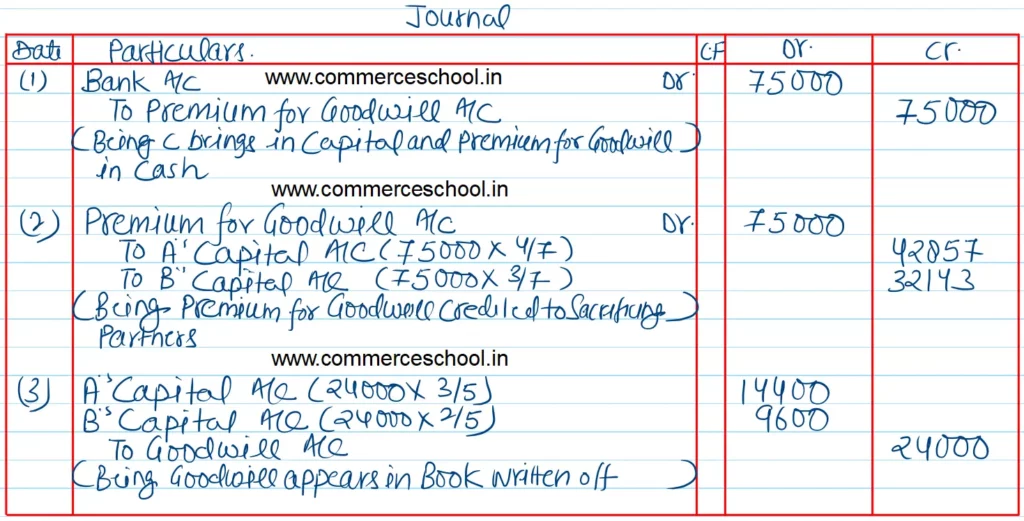

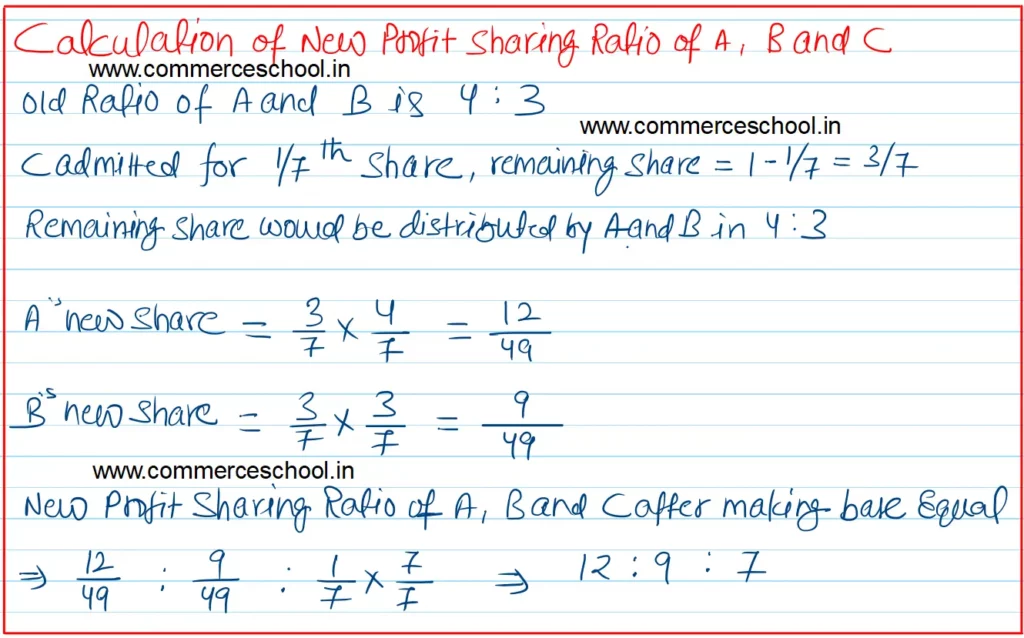

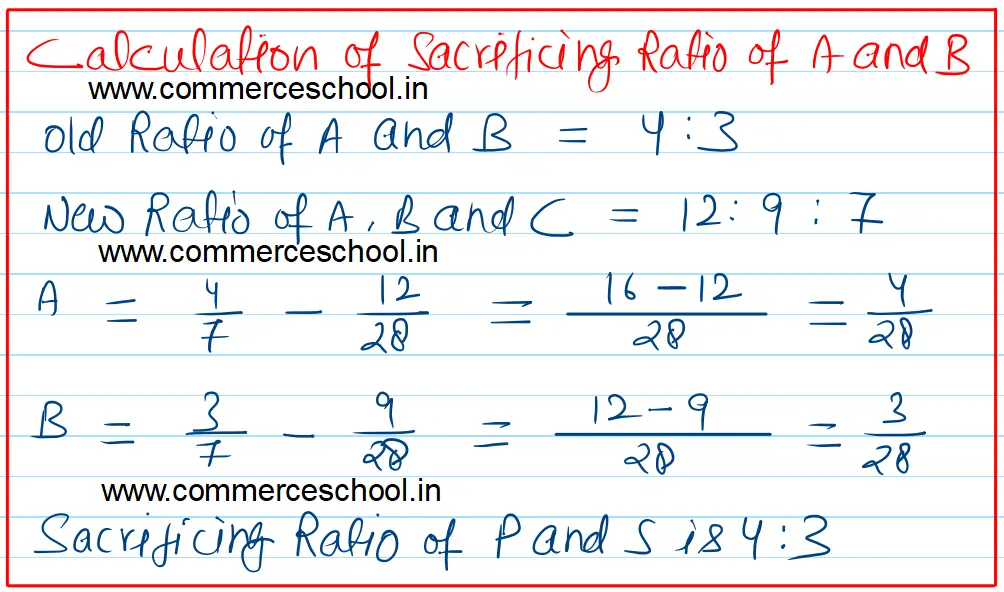

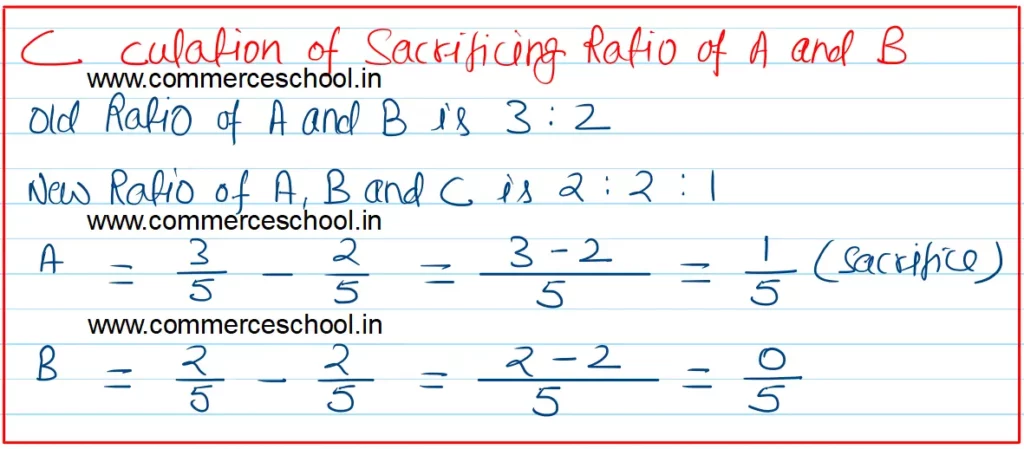

Q. 34 (C). A and B carrying on business as partners used to share profits and losses thus; A 4/7ths and B 3/7ths, and goodwill appeared in the books of the firm at ₹ 2,80,000 when C was admitted as a partner having 1/7th share in profits and losses. C was asked to pay a premium of ₹ 75,000 for goodwill, and the profit-sharing ratio as between A and B remained unchanged. Show entries in the journal of the firm.

[Ans. Goodwill of ₹ 2,80,000 written off by A and B in their old ratio, i.e., 4 : 3.]

Solution:-