[CBSE] Q 37 Adjustments in Preparation of Financial Statement Solution TS Grewal Class 11 (2025-26)

Solution of Question number 37 of the Adjustments in Preparation of Financial Statements of TS Grewal Book class 11, 2025-26?

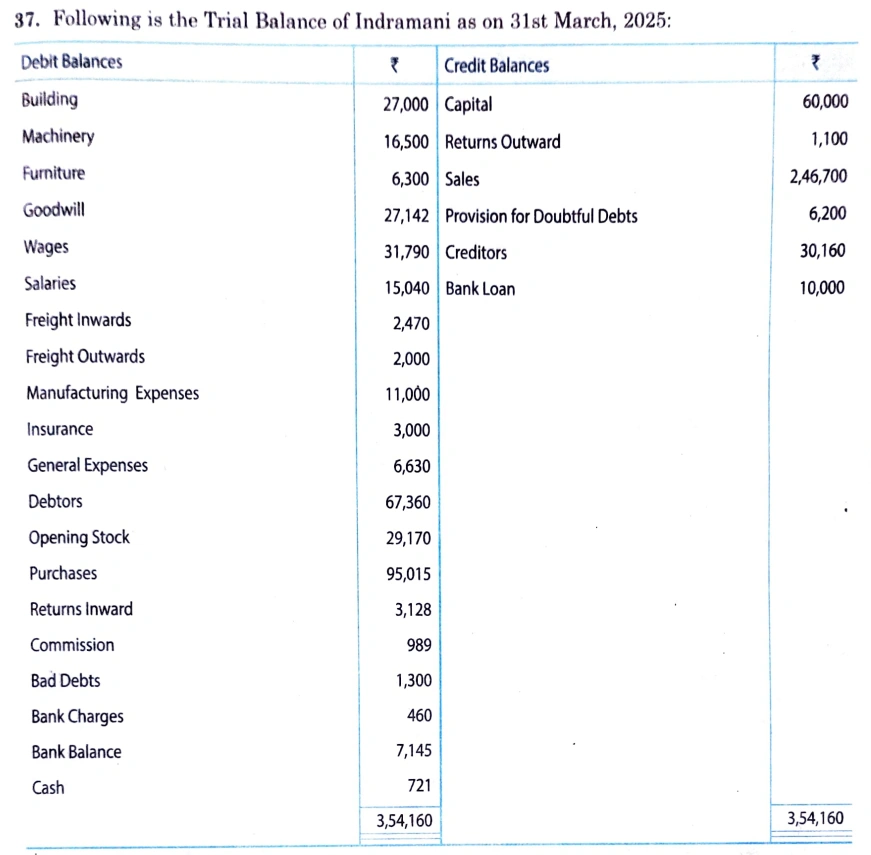

Following is the Trial Balance of Indramani as on 31st March, 2023:

| Debit Balances | ₹ | Credit Balances | ₹ |

| Building Machinery Furniture Goodwill Productive Wages Salaries Freight Inwards Freight Outwards Manufacturing Expenses Insurance General Expenses Debtors Opening Stock Purchases Returns Inward Commission Bad Debts Bank Charges Bank Balance Cash | 27,000 16,500 6,300 27,142 31,790 15,040 2,470 2,000 11,000 3,000 6,630 67,360 29,170 95,015 3,128 989 1,300 460 7,145 721 | Capital Returns Outward Sales Provision for Doubtful Debts Creditors Bank Loan | 60,000 1,100 2,46,700 6,200 30160 10,000 |

| 3,54,160 | 3,54,160 |

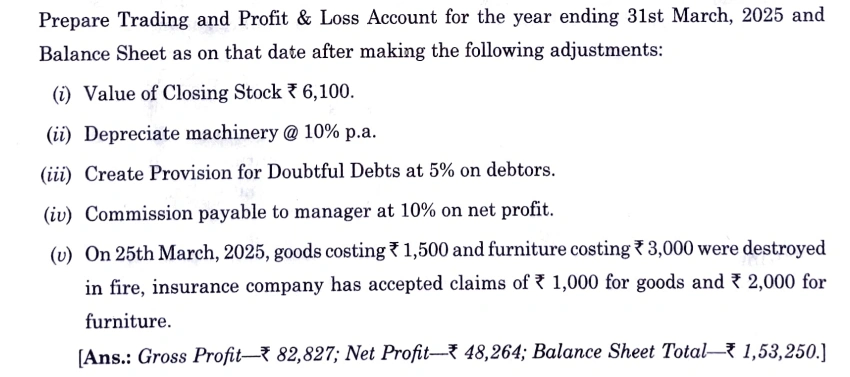

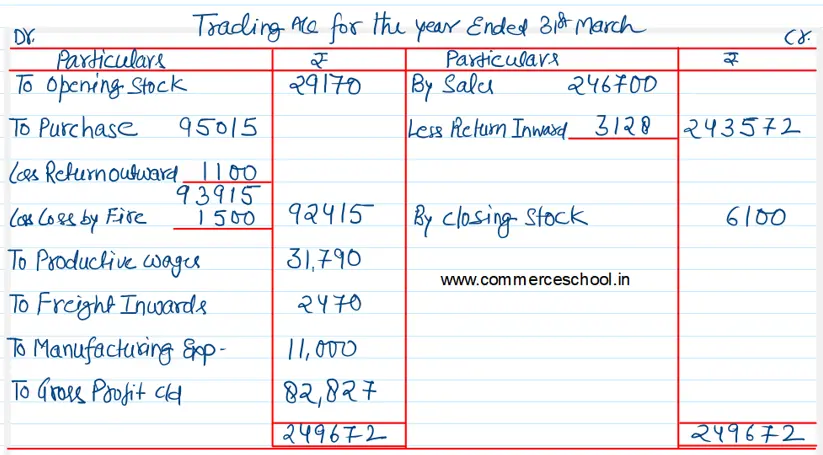

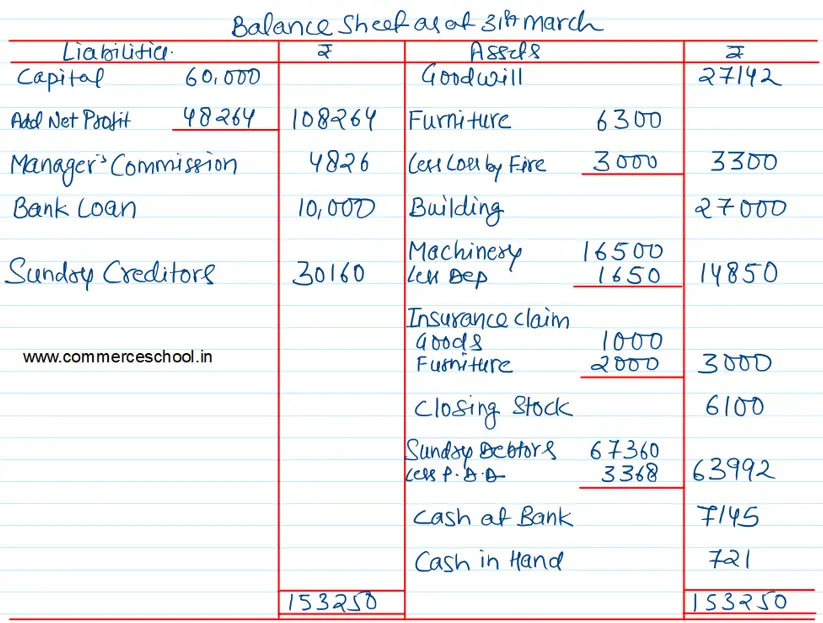

Prepare Trading and Profit & Loss Account for the year ending 31st March, 2023 and Balance Sheet as on that date after making the following adjustments:

(i) Value of Closing Stock ₹ 6,100.

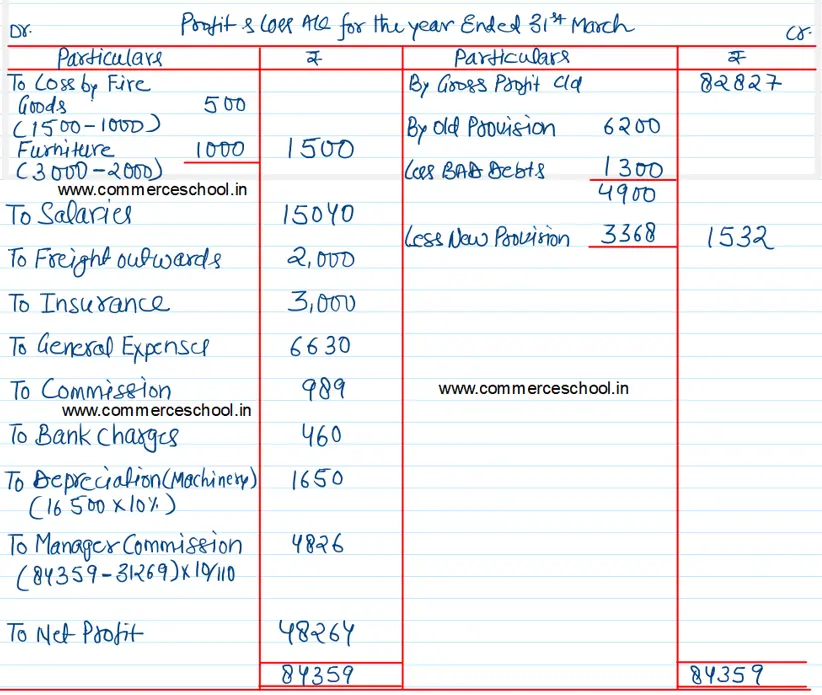

(ii) Depreciate Machinery @ 10% p.a.

(iii) Create Provision for Doubtful Debts at 5% on debtors.

(iv) Commission payable to manager at 10% on net profit.

(v) On 25th March, 2023, goods costing ₹ 1,500 and furniture costing ₹ 3,000 were destroyed by fire, insurance company has accepted claims of ₹ 1,000 for goods and ₹ 2,000 for furniture.

[Gross Profit – ₹ 82,827; Net Profit – ₹ 48,264; Balance Sheet Total – ₹ 1,53,250.]

Solution:-

Here is the list of all Solutions.

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |