[CBSE] Q 37 DK Goel Dissolution of a Partnership Firm Solutions Class 12 (2024-25)

Solution of Question number 37 of Dissolution of a Partnership Firm chapter 5 of DK Goel Class 12 CBSE (2024-25)

Q. 37. Michael, Jackson and John were partners in a firm sharing profits in the ratio of 3 : 1 : 1. On 31st March, 2017, they decided to dissolve their firm. On that date their Balance Sheet was as follows:

Balance Sheet of Michael, Jackson and Johan

as at 31.3.2017

| Liabilities | ₹ | Assets | ₹ |

| Creditors | 11,500 | Bank | 6,000 |

| Loan | 3,500 | Debtors 48,400 Less: Provision for Doubtful Debts 2,400 | 46,000 |

| Capitals: Michael Jackson Johan | 50,000 25,000 14,000 | Stock in Trade | 16,000 |

| Furniture | 2,000 | ||

| Sundry Assets | 34,000 | ||

| 1,04,000 | 1,04,000 |

It was agreed that:

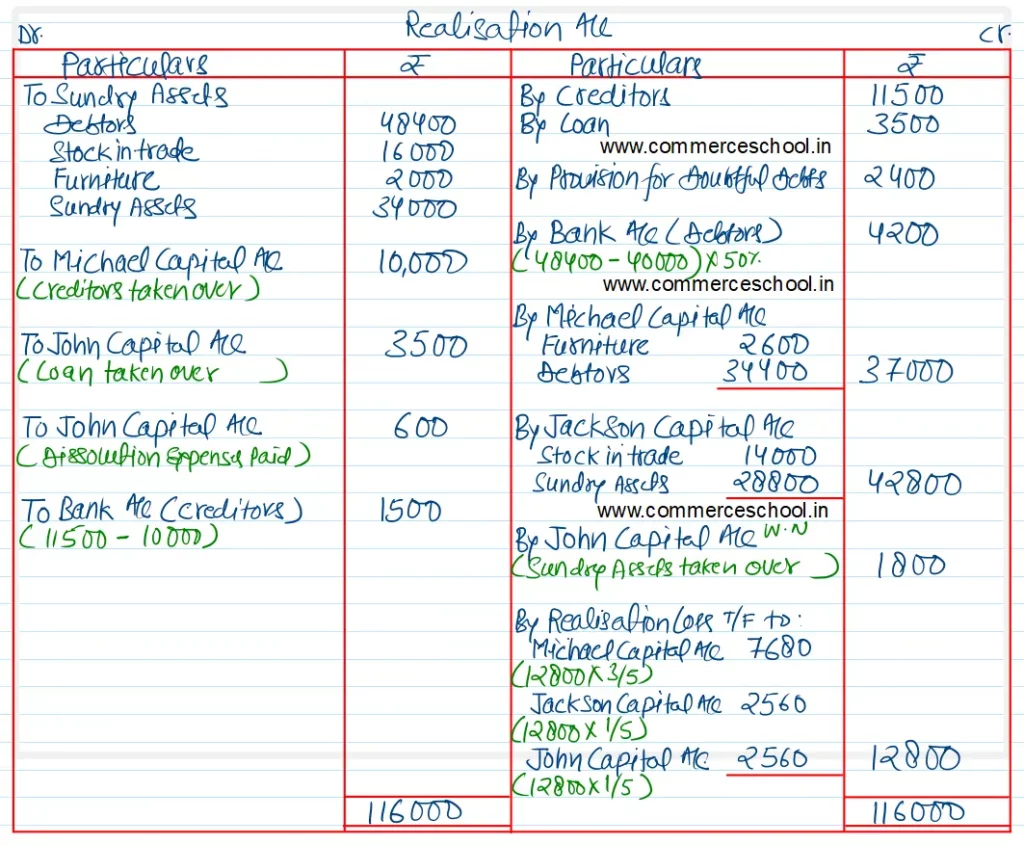

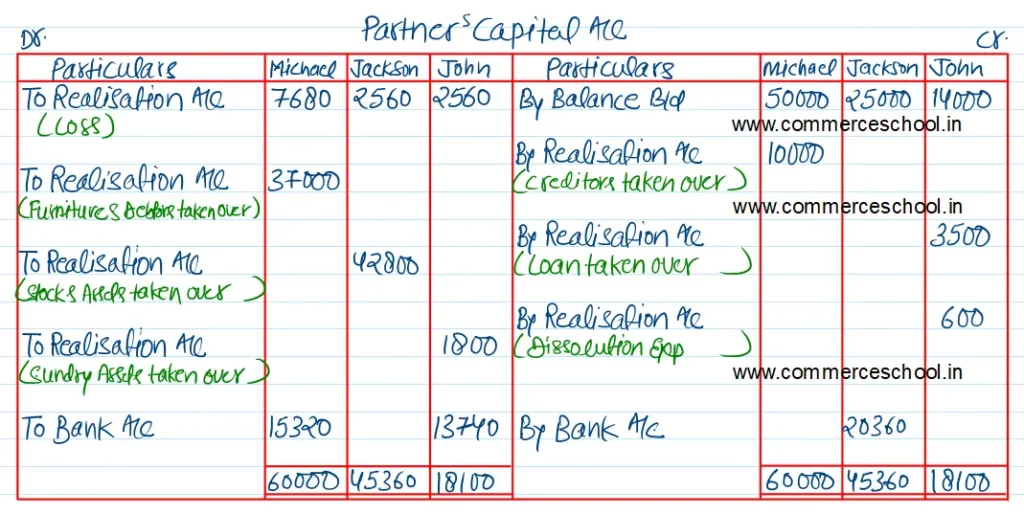

(I) Michael was to take over Furniture at ₹ 2,600 and Debtors amounting to ₹ 40,000 at ₹ 34,000 and the Creditors of ₹ 10,000 were to be paid by him at this figure.

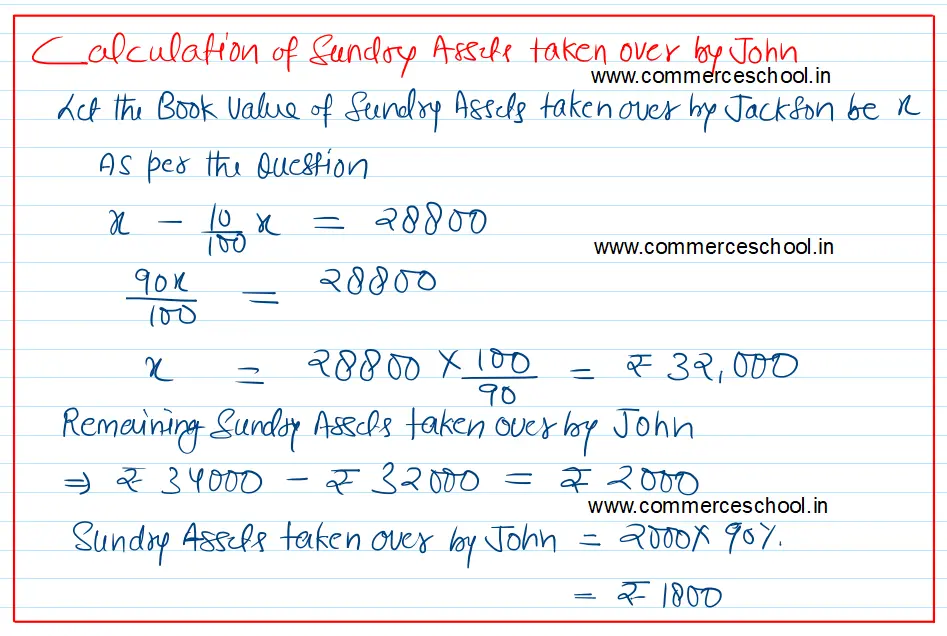

(ii) Jackson was to take over all the stock in trade at ₹ 14,000 and some of the other Sundry Assets at ₹ 28,800 (being 10% less than book value).

(iii) John was to take over the remaining Sundry Assets at 90% of the book value and assumed the responsibility for the discharge of the loan.

(iv) The remaining debtors were sold to a debt collecting agency for 50% of the book value. The expenses of dissolution ₹ 600 were paid by John.

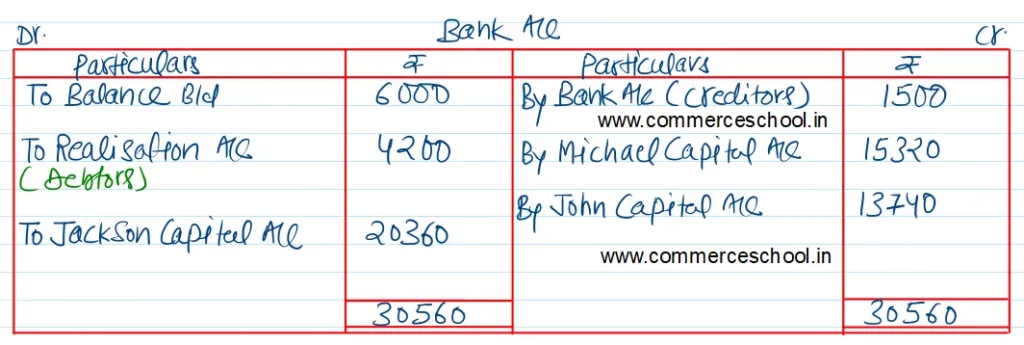

Prepare Realisation Account, Bank Account and Partner’s Capital Accounts.

[Ans. Loss on Realisation ₹ 12,800; Final payment to Michael ₹ 15,320 and to John ₹ 13,740; Amount brought in by Jackson ₹ 20,360; Total of Bank A/c ₹ 30,560.]

Solution:-

Here are the solutions of Dissolution of a Partnership Firm chapter 5 of DK Goel Class 12 CBSE (2024-25)

| S.N | Questions | |

| 1 | Question – 1 | |

| 2 | Question – 2 | |

| 3 | Question – 3 | |

| 4 | Question – 4 | |

| 5 | Question – 5 | |

| 6 | Question – 6 | |

| 7 | Question – 7 | |

| 8 | Question – 8 | |

| 9 | Question – 9 | |

| 10 | Question – 10 |

| S.N | Questions | |

| 11 | Question – 11 | |

| 12 | Question – 12 | |

| 13 | Question – 13 | |

| 14 | Question – 14 | |

| 15 | Question – 15 | |

| 16 | Question – 16 | |

| 17 | Question – 17 | |

| 18 | Question – 18 | |

| 19 | Question – 19 | |

| 20 | Question – 20 |

| S.N | Questions | |

| 21 | Question – 21 | |

| 22 | Question – 22 | |

| 23 | Question – 23 | |

| 24 | Question – 24 | |

| 25 | Question – 25 | |

| 26 | Question – 26 | |

| 27 | Question – 27 | |

| 28 | Question – 28 | |

| 29 | Question – 29 | |

| 30 | Question – 30 |

| S.N | Questions | |

| 31 | Question – 31 | |

| 32 | Question – 32 | |

| 33 | Question – 33 | |

| 34 | Question – 34 | |

| 35 | Question – 35 | |

| 36 | Question – 36 | |

| 37 | Question – 37 | |

| 38 | Question – 38 | |

| 39 | Question – 39 | |

| 40 | Question – 40 |