[CBSE] Q. 39 Solution of Retirement of Partner TS Grewal Class 12 (2024-25)

Solution to Question number 39 of the Retirement of Partner chapter 5 of TS Grewal Book 2024-25 Edition CBSE Board.

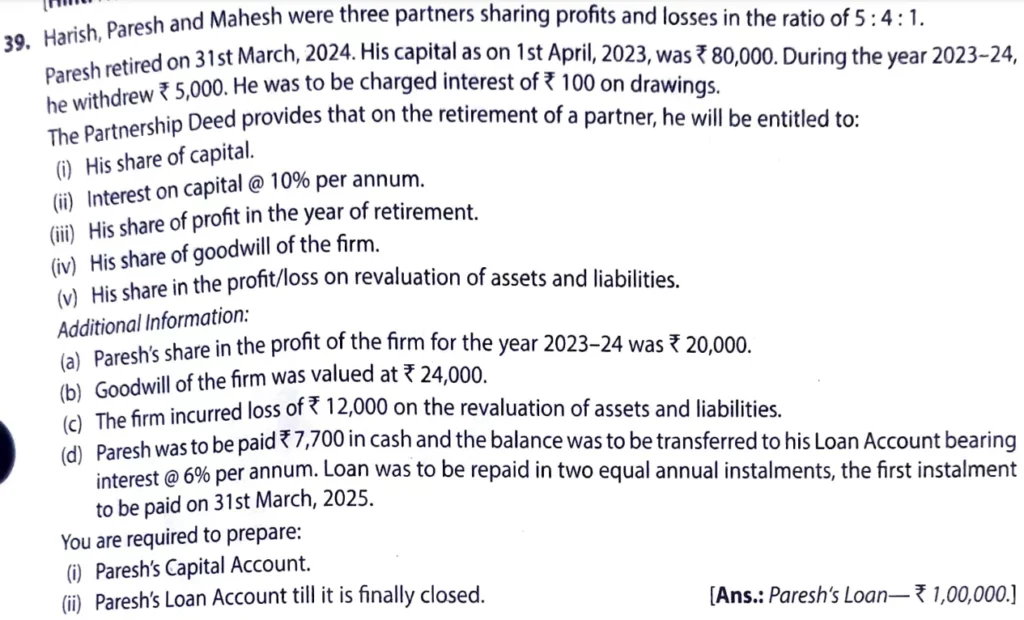

Harish, Paresh and Mahesh were three partners sharing profits and losses in the ratio of 5 : 4 : 1.

Paresh retired on 31st March, 2022. His capital as on 1st April, 2021, was ₹ 80,000. During the year 2021-22, he withdrew ₹ 5,000. He was to be charged interest of ₹ 100 on drawings.

The Partnership Deed provides that on the retirement of a partner, he will be entitled to:

i) His share of capital.

ii) Interest on capital @ 10% per annum.

iii) His share of profit in the year of retirement.

iv) His share of goodwill of the firm.

v) His share in the profit/loss on revaluation of assets and liabilities.

Additional Information:

a) Paresh’s share in the profit of the firm for the year 2021-22 was ₹ 20,000.

b) Goodwill of the firm was valued at ₹ 24,000.

c) The firm incurred loss of ₹ 12,000 on the revaluation of assets and liabilities.

d) Paresh was to be paid ₹ 7,700 in cash and the balance was to be transferred to his loan account bearing interest @ 6% p.a. Loan was to be repaid in two equal annual installments, the first installment to be paid on 31st March 2023.

You are required to prepare:

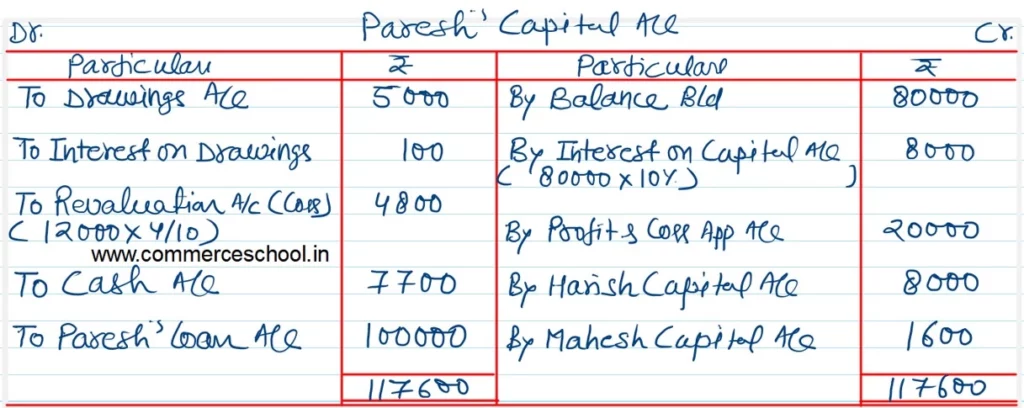

(i) Paresh’s Capital Account.

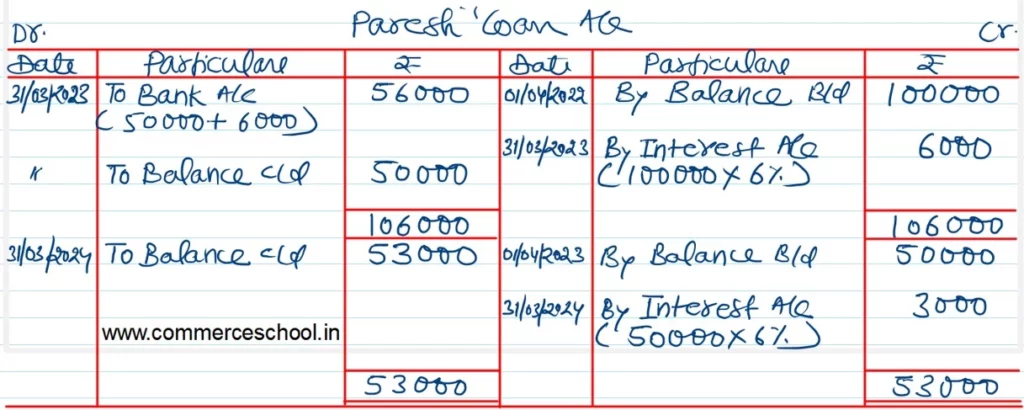

(ii) Paresh’s Loan Account till it is finally closed.

[Ans.: Paresh’s Loan – ₹ 1,00,000]

Solution:-

Here is the list of all Solutions of Retirement of Partners of TS Grewal class 12 CBSE 2024-25.

| S.N | Questions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Questions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Questions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Questions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |

| 40 | Question – 40 |

| S.N | Questions |

| 41 | Question – 41 |

| 42 | Question – 42 |

| 43 | Question – 43 |

| 44 | Question – 44 |

| 45 | Question – 45 |

| 46 | Question – 46 |

| 47 | Question – 47 |

| 48 | Question – 48 |

| 49 | Question – 49 |

| 50 | Question – 50 |

| S.N | Questions |

| 51 | Question – 51 |

| 52 | Question – 52 |

| 53 | Question – 53 |

| 54 | Question – 54 |

| 55 | Question – 55 |

| 56 | Question – 56 |

| 57 | Question – 57 |