[CBSE] Q 4 Accounting for Goods and Services Tax (GST) TS Grewal class 11 (2023-24)

Are you looking for solutions of Question number 4 of Accounting for Goods and Services Tax (GST) of TS Grewal class 11 CBSE Board 2023-24

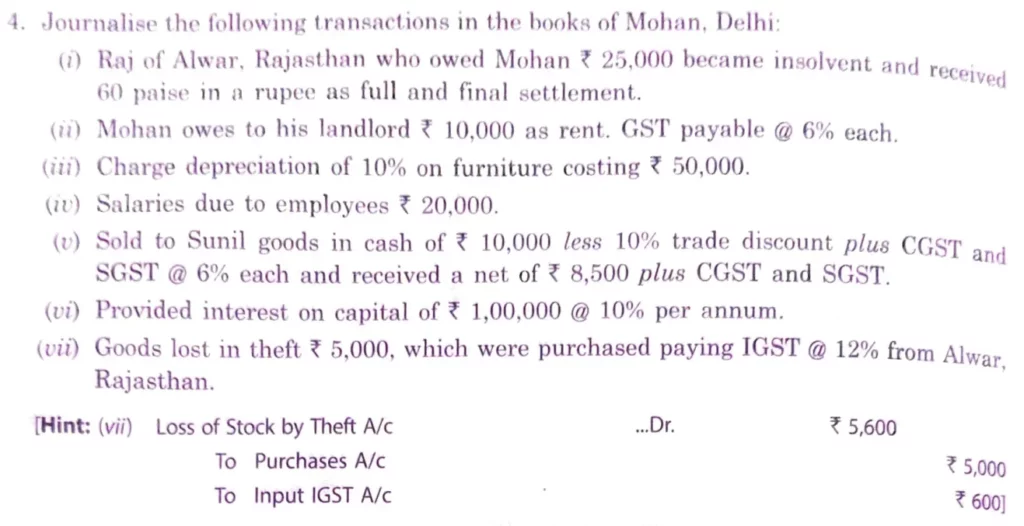

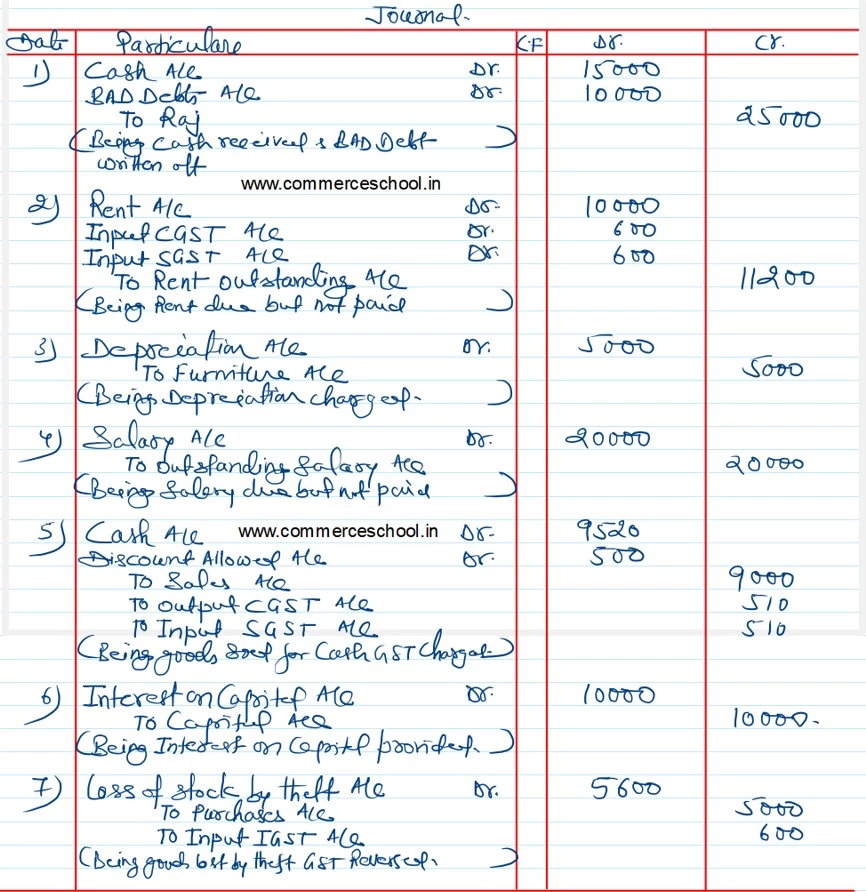

Journalise the following transactions in the books of Mohan, Delhi:

(i) Raj of Alwar, Rajasthan who owed Mohan ₹ 25,000 became insolvent and received 60 paise in a rupee as full and final settlement.

(ii) Mohan owes to his landlord ₹ 10,000 as rent. GST payable @ 6% each.

(iii) Charge depreciation of 10% on furniture costing ₹ 50,000.

(iv) Salaries due to employees ₹ 20,000.

(v) Sold to Sunil goods in cash of ₹ 10,000 less 10% trade discount plus CGST and SGST @ 6% each and received a net of ₹ 8,500 plus CGST and SGST.

(vi) Provided interest on capital of ₹ 1,00,000 @ 10% per annum.

(vii) Goods lost in theft ₹ 5,000, which were purchased paying IGST @ 12% from Alwar, Rajasthan.

Solution:-

Below is the list of all solutions of chapter 12 Goods and Services Tax (GST) TS Grewal class 11 CBSE 2023-24