[CBSE] Q 4 DK Goel Dissolution of a Partnership Firm Solutions Class 12 (2024-25)

Solution of Question number 4 of Dissolution of a Partnership Firm chapter 5 of DK Goel Class 12 CBSE (2024-25)

The following is the Balance Sheet of A and B as at 31st March, 2023. The profit sharing ratios of the partners are 3 : 2.

| Liabilities | ₹ | Assets | ₹ |

| Creditors | 97,500 | Land & Buildings | 30,000 |

| Capital Accounts: A B | 85,000 63,000 | Motor Vehicles | 18,300 |

| Stock | 72,800 | ||

| Debtors 1,13,200 Less: Provision for Bad Debts 2,450 | 1,10,750 | ||

| Cash at Bank | 13,650 | ||

| 2,45,500 | 2,45,500 |

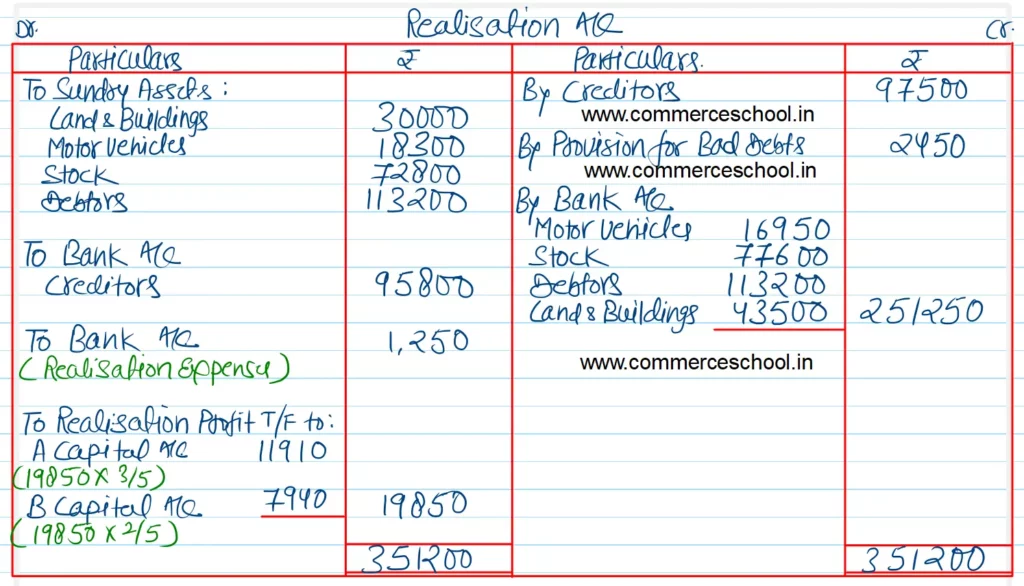

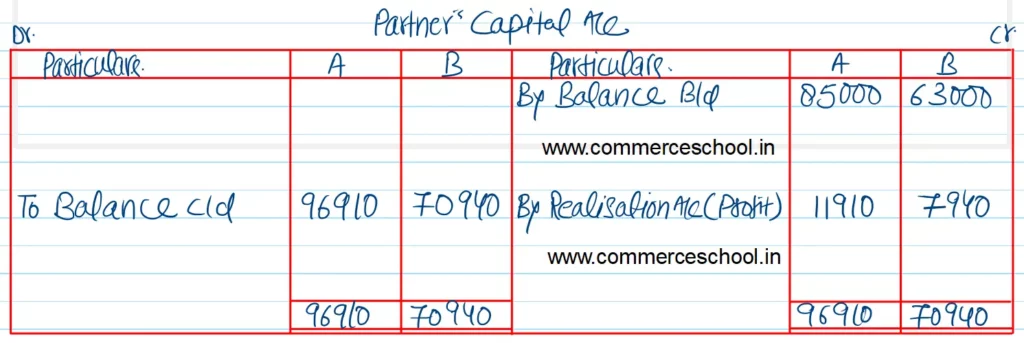

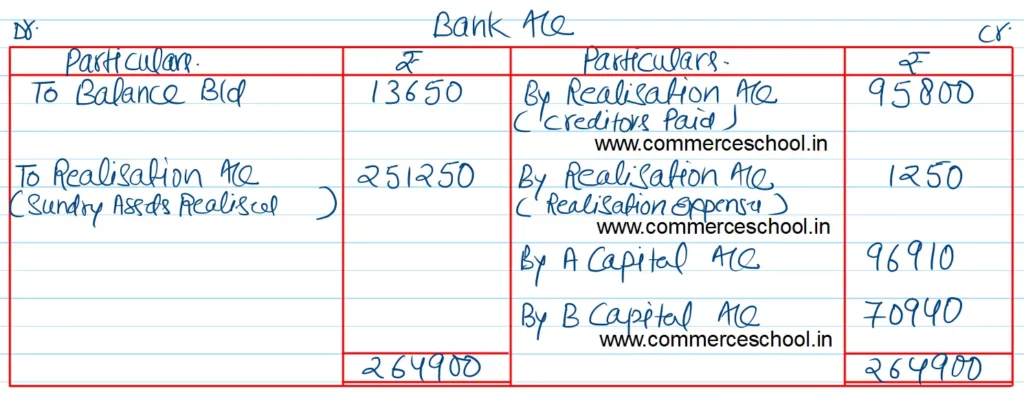

The partners decided to dissolve the firm on and from the date of the Balance Sheet. Motor Vehicles and Stock were sold for cash at ₹ 16,950 and ₹ 77,600 respectively and all Debtors were realised in full. Land & Buildings were sold at ₹ 43,500. Creditors were paid off subject to discount of ₹ 1,700. Expenses of realisation were ₹ 1,250.

Prepare Realisation Account, Bank Account and Partner’s Capital Accounts to close the books of the firm as a result of its dissolution.

[Ans. Gain on Realisation ₹ 19,850; Amount paid to A ₹ 96,910 and B ₹ 70,940; Total of Bank A/c ₹ 2,64,900.]

Here are the solutions of Dissolution of a Partnership Firm chapter 5 of DK Goel Class 12 CBSE (2024-25)

| S.N | Questions | |

| 1 | Question – 1 | |

| 2 | Question – 2 | |

| 3 | Question – 3 | |

| 4 | Question – 4 | |

| 5 | Question – 5 | |

| 6 | Question – 6 | |

| 7 | Question – 7 | |

| 8 | Question – 8 | |

| 9 | Question – 9 | |

| 10 | Question – 10 |

| S.N | Questions | |

| 11 | Question – 11 | |

| 12 | Question – 12 | |

| 13 | Question – 13 | |

| 14 | Question – 14 | |

| 15 | Question – 15 | |

| 16 | Question – 16 | |

| 17 | Question – 17 | |

| 18 | Question – 18 | |

| 19 | Question – 19 | |

| 20 | Question – 20 |

| S.N | Questions | |

| 21 | Question – 21 | |

| 22 | Question – 22 | |

| 23 | Question – 23 | |

| 24 | Question – 24 | |

| 25 | Question – 25 | |

| 26 | Question – 26 | |

| 27 | Question – 27 | |

| 28 | Question – 28 | |

| 29 | Question – 29 | |

| 30 | Question – 30 |

| S.N | Questions | |

| 31 | Question – 31 | |

| 32 | Question – 32 | |

| 33 | Question – 33 | |

| 34 | Question – 34 | |

| 35 | Question – 35 | |

| 36 | Question – 36 | |

| 37 | Question – 37 | |

| 38 | Question – 38 | |

| 39 | Question – 39 | |

| 40 | Question – 40 |