[CBSE] Q 40 Adjustments in Preparation of Financial Statement Solution TS Grewal Class 11 (2025-26)

Solution of Question number 40 of the Adjustments in Preparation of Financial Statements of TS Grewal Book class 11, 2025-26?

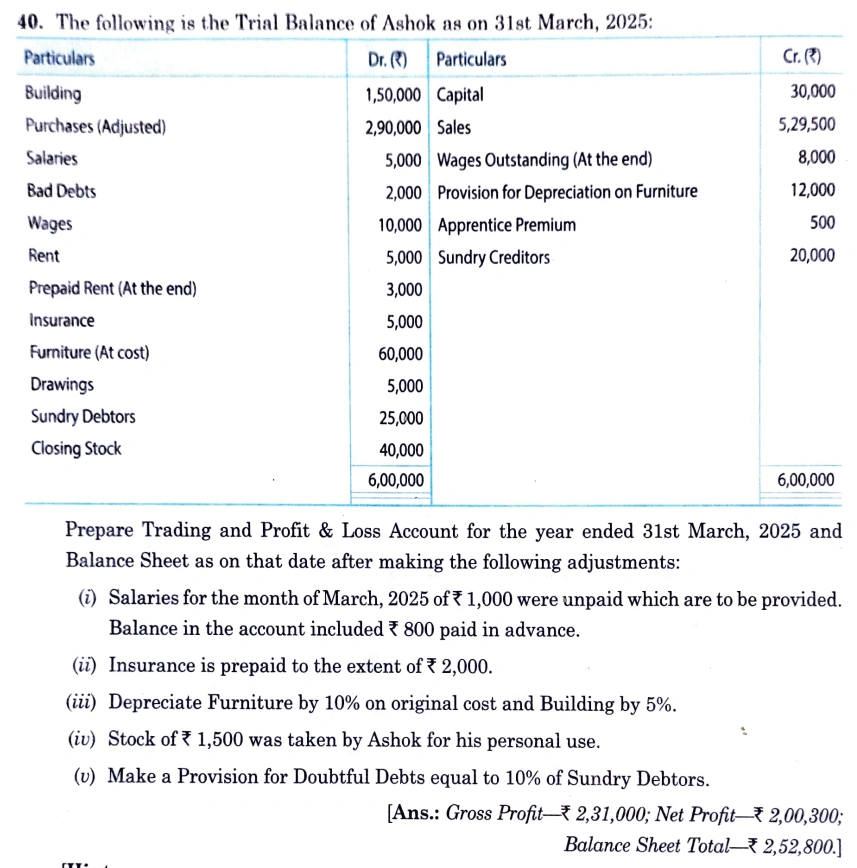

The following is the Trial Balance of Ashok as on 31st March, 2023:

| Particulars | Dr. (₹) | Particulars | Cr. (₹) |

| Building Purchases (Adjusted) Salaries Bad Debts Wages Rent Prepaid Rent (At the end) Insurance Furniture (At cost) Drawings Sundry Debtors Closing Stock | 1,50,000 2,90,000 5,000 2,000 10,000 5,000 3,000 5,000 60,000 5,000 25,000 40,000 | Capital Sales Wages Outstanding (At the end) Provision for Depreciation on Furniture Apprentice Premium Sundry Creditors | 30,000 5,29,500 8,000 12,000 500 20,000 |

| 6,00,000 | 6,00,000 |

Prepare Trading and Profit & Loss Account for the year ended 31st March, 2023 and Balance Sheet as on that date after making the following adjustments:

(i) Salaries for the month of March, 2023 of ₹ 1,000 were unpaid which are to be provided. Balance in the account included ₹ 800 paid in advance.

(ii) Insurance is prepaid to the extent of ₹ 2,000.

(iii) Depreciate Furniture by 10% on original cost and Building by 5%.

(iv) Stock of ₹ 1,500 was taken by Ashok for his personal use.

(v) Make a Provision for Doubtful Debts equal to 10% of Sundry Debtors.

[Gross Profit – ₹ 2,31,000; Net Profit – ₹ 2,00,300; Balance Sheet Total – ₹ 2,52,800.]

Solution:-

Here is the list of all Solutions.

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |