[CBSE] Q 40 DK Goel Dissolution of a Partnership Firm Solutions Class 12 (2024-25)

Solution of Question number 40 of Dissolution of a Partnership Firm chapter 5 of DK Goel Class 12 CBSE (2024-25)

Q. 40. The following is the Balance Sheet of X and Y as at 30th June, 2022.

| Liabilities | ₹ | Assets | ₹ |

| Sundry Creditors | 20,000 | Goodwill | 10,000 |

| Bills Payable | 20,000 | Buildings | 25,000 |

| Bank Overdraft | 8,000 | Plant | 25,000 |

| Outstanding Expenses | 2,000 | Investments | 15,300 |

| X’s brother’s Loan | 20,000 | Stock | 8,700 |

| Y’s Loan | 10,000 | Debtors 17,000 Less: Provision 2,000 | 15,000 |

| Investment Fluctuation Fund | 2,800 | Bills Receivable | 10,000 |

| Employee’s Provident Fund | 1,200 | Cash at Bank | 13,000 |

| General Reserve | 2,000 | Profit and Loss A/c (Dr. Balance) | 4,000 |

| X’s Capital Y’s Capital | 20,000 20,000 | ||

| 1,26,000 | 1,26,000 |

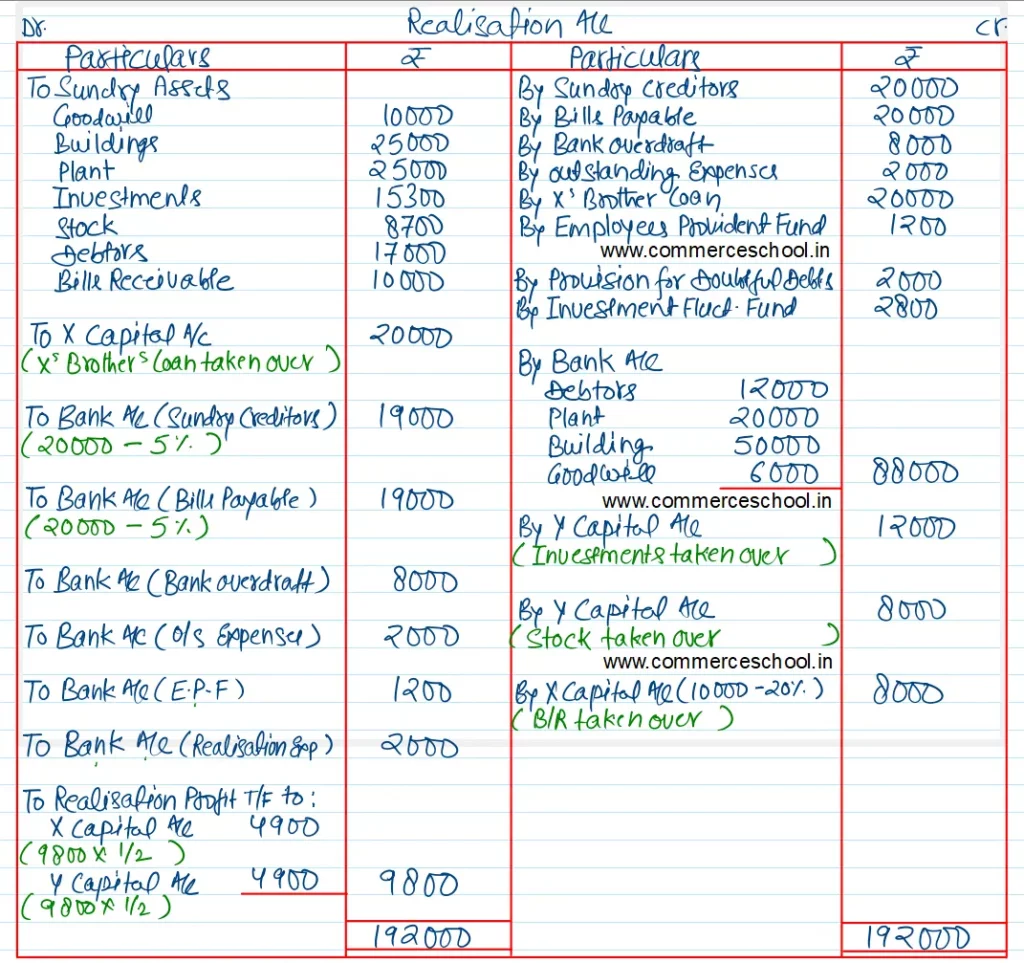

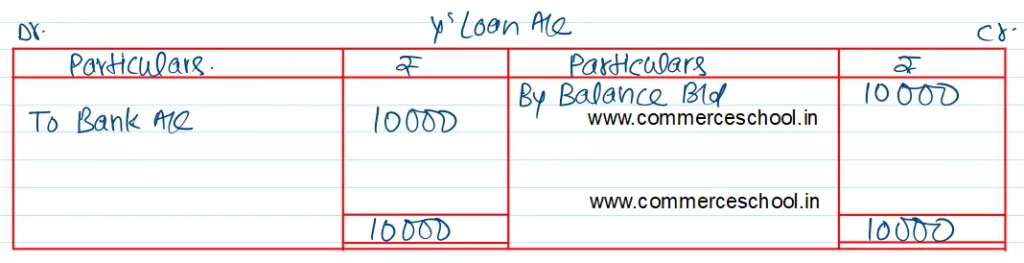

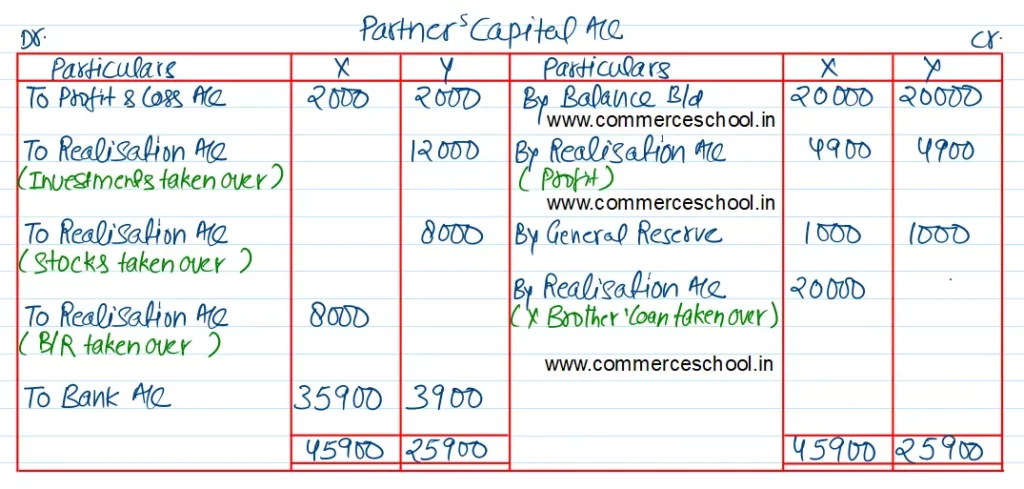

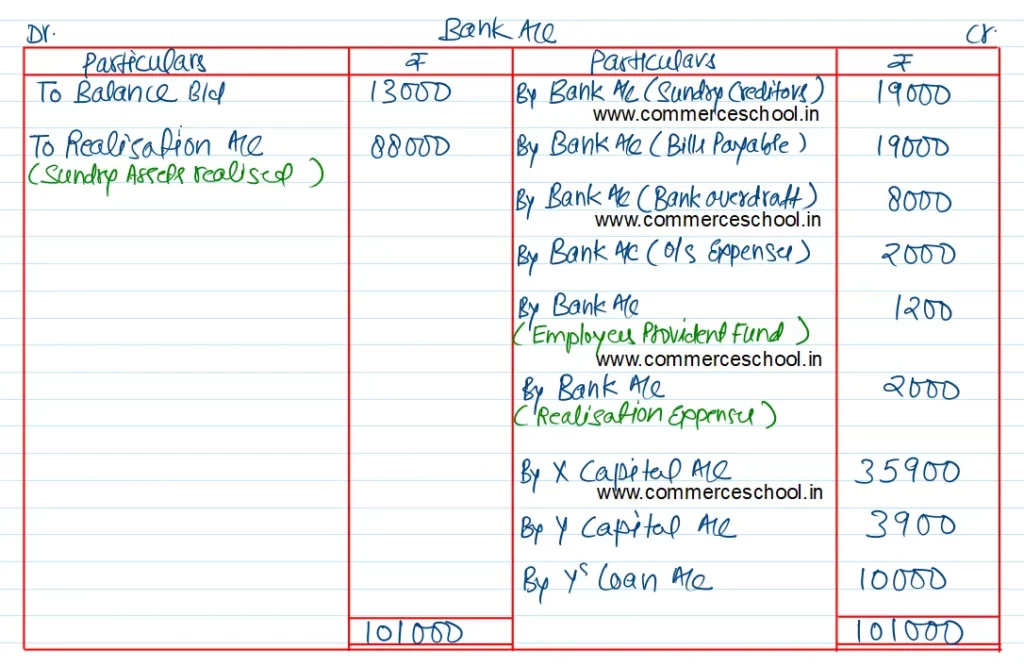

The firm was dissolved on 30th June, 2022 and the following arrangements were decided upon:

(a) X agreed to pay off his brother’s loan;

(b) Debtors realised ₹ 12,000;

(c) Y took over all the investments at ₹ 12,000.

(d) Other assets realised as follows:

Plant – ₹ 20,000, Building – ₹ 50,000, Goodwill – ₹ 6,000

(e) Sundry Creditors and Bills payable were settled at 5% discount, Y accepted stock at ₹ 8,000 and X took over Bills Receivable at 20% discount.

(f) Realisation Expenses amounted to ₹ 2,000.

You are required to pass Journal Entries.

[Ans. Gain on Realisation ₹ 9,800; Final Payment to X ₹ 35,900 and Y ₹ 3,900; Total of Bank A/c ₹ 1,01,000.]

Solution:-

Here are the solutions of Dissolution of a Partnership Firm chapter 5 of DK Goel Class 12 CBSE (2024-25)

| S.N | Questions | |

| 1 | Question – 1 | |

| 2 | Question – 2 | |

| 3 | Question – 3 | |

| 4 | Question – 4 | |

| 5 | Question – 5 | |

| 6 | Question – 6 | |

| 7 | Question – 7 | |

| 8 | Question – 8 | |

| 9 | Question – 9 | |

| 10 | Question – 10 |

| S.N | Questions | |

| 11 | Question – 11 | |

| 12 | Question – 12 | |

| 13 | Question – 13 | |

| 14 | Question – 14 | |

| 15 | Question – 15 | |

| 16 | Question – 16 | |

| 17 | Question – 17 | |

| 18 | Question – 18 | |

| 19 | Question – 19 | |

| 20 | Question – 20 |

| S.N | Questions | |

| 21 | Question – 21 | |

| 22 | Question – 22 | |

| 23 | Question – 23 | |

| 24 | Question – 24 | |

| 25 | Question – 25 | |

| 26 | Question – 26 | |

| 27 | Question – 27 | |

| 28 | Question – 28 | |

| 29 | Question – 29 | |

| 30 | Question – 30 |

| S.N | Questions | |

| 31 | Question – 31 | |

| 32 | Question – 32 | |

| 33 | Question – 33 | |

| 34 | Question – 34 | |

| 35 | Question – 35 | |

| 36 | Question – 36 | |

| 37 | Question – 37 | |

| 38 | Question – 38 | |

| 39 | Question – 39 | |

| 40 | Question – 40 |