[CBSE] Q. 40 Solution of Accounting for Share Capital TS Grewal Class 12 (2022-23)

Are you looking for the solution to Question number 40 of the Accounting for Share Capital chapter of TS Grewal Book 2022-23 Edition CBSE Board?

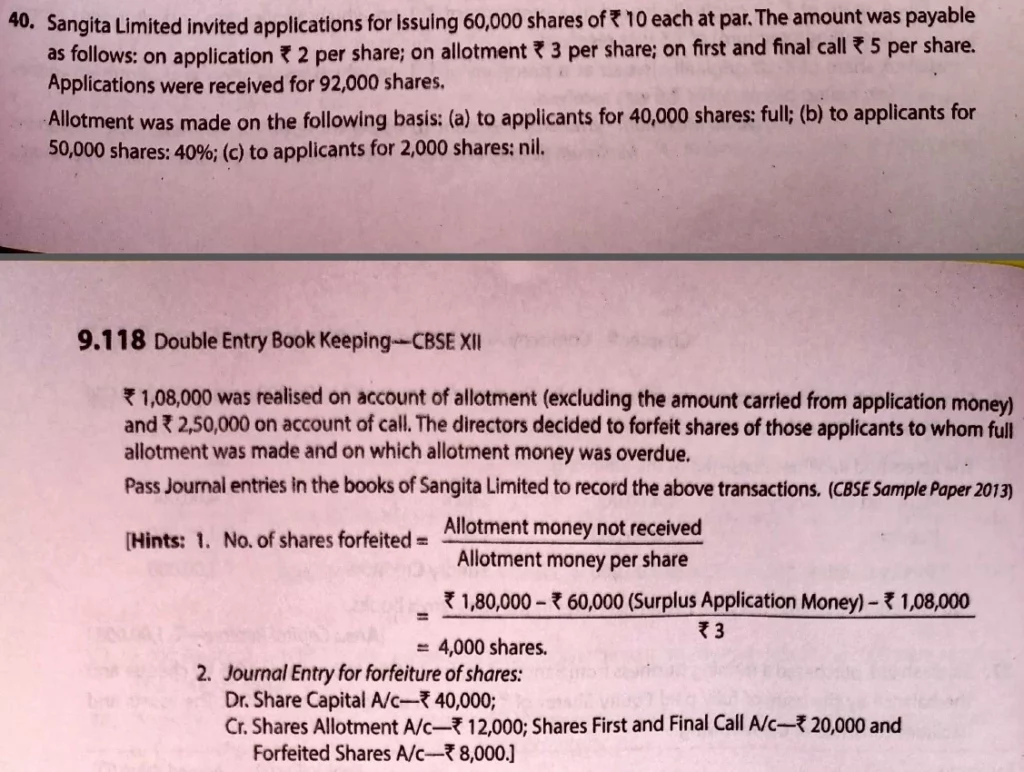

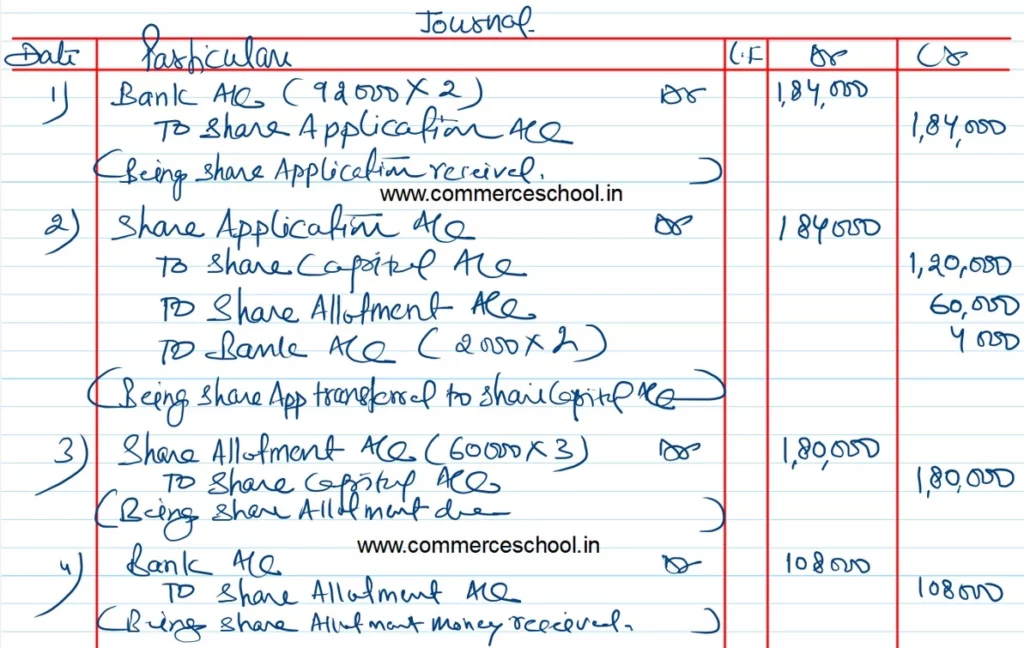

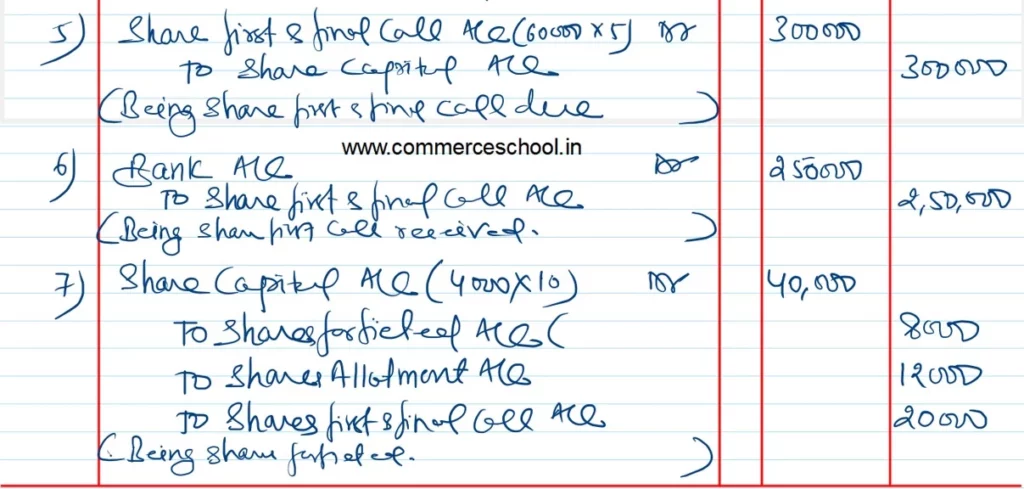

Sangita Limited invited applications for issuing 60,000 shares of ₹ 100 each at par. The amount was payable as follows: on application ₹ 2 per share; on allotment ₹ 3 per share; on first and final call ₹ 5 per share. Applications were received for 92,000 shares.

Allotment was made on the following basis: (a) to applicants for 40,000 shares; full; (b) to applicants for 50,000 shares: 40% (c) to applicants for 2,000 shares; nil.

₹ 1,08,000 was realised on account of allotment (excluding the amount carried from application money) and ₹ 2,50,000 on account of call. The directors decided to forfeit shares of those applicants to whom full allotment was made and on which allotment money was overdue.

Pass Journal entries in the books of Sangita Limited to record the above transactions.

Solution:-

Issue of Share chapter Solutions of TS Grewal Class 12 Accountancy CBSE 2022-23

Let’s Practice

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Solutions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Solutions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |

| 40 | Question – 40 |

| S.N | Solutions |

| 41 | Question – 41 |

| 42 | Question – 42 |

| 43 | Question – 43 |

| 44 | Question – 44 |

| 45 | Question – 45 |

| 46 | Question – 46 |

| 47 | Question – 47 |

| 48 | Question – 48 |

| 49 | Question – 49 |

| 50 | Question – 50 |

| S.N | Solutions |

| 51 | Question – 51 |

| 52 | Question – 52 |

| 53 | Question – 53 |

| 54 | Question – 54 |

| 55 | Question – 55 |

| 56 | Question – 56 |

| 57 | Question – 57 |

| 58 | Question – 58 |

| 59 | Question – 59 |

| 60 | Question – 60 |

| S.N | Solutions |

| 61 | Question – 61 |

| 62 | Question – 62 |

| 63 | Question – 63 |

| 64 | Question – 64 |

| 65 | Question – 65 |

| 66 | Question – 66 |

| 67 | Question – 67 |

| 68 | Question – 68 |

| 69 | Question – 69 |

| 70 | Question – 70 |