[CBSE] Q. 43 Cash Flow Statement TS Grewal Class 12 (2025-26)

the solution of Question number 43 of the Cash Flow Statement of TS Grewal Book 2025-26 session?

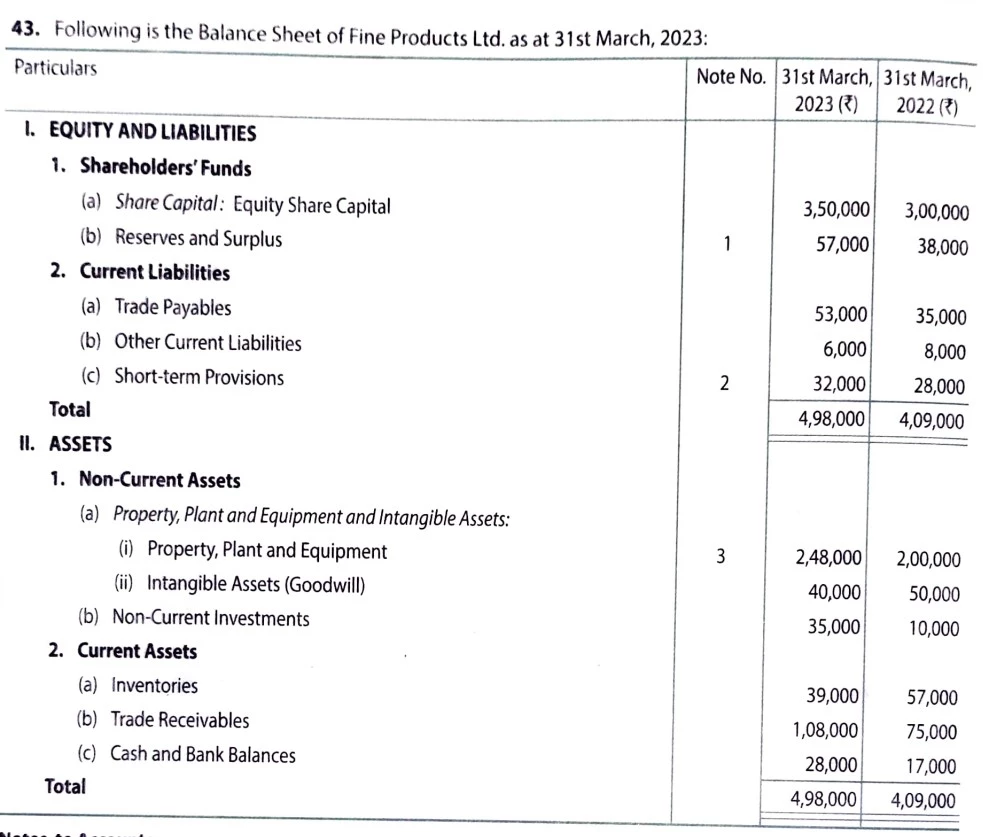

Following is the Balance Sheet of Fine Products Ltd. as at 31st March, 2023:

| Particulars | 31st March, 2023 (₹) | 31st March, 2022 (₹) |

| I. EQUITY AND LIABILITIES | ||

| 1. Shareholder’s Funds (a) Share Capital: Equity Share Capital (b) Reserves and Surplus | 3,50,000 57,000 | 3,00,000 38,000 |

| 2. Current Liabilities (a) Trade Payables (b) Other Current Liabilities (c) Short-term Provisions | 53,000 6,000 32,000 | 35,000 8,000 28,000 |

| Total | 4,98,000 | 4,09,000 |

| II. Assets | ||

| 1. Non-Current Assets (a) Property, Plant and Equipment, and Intangible Assets: (i) Property, Plant and Equipment (ii) Intangible Assets (Goodwill) (b) Non-Current Investments | 2,48,000 40,000 35,000 | 2,00,000 50,000 10,000 |

| 2. Current Assets (a) Inventories (b) Trade Receivables (c) Cash and Bank Balances | 39,000 1,08,000 28,000 | 57,000 75,000 17,000 |

| Total | 4,98,000 | 4,09,000 |

| Particulars | 31st March, 2023 (₹) | 31st March, 2022 (₹) |

| Reserves and Surplus General Reserve Surplus, i.e., Balance in Statement of Profit & Loss | 30,000 27,000 | 20,000 18,000 |

| 57,000 | 38,000 | |

| Short-term Provisions Provision for Tax | 32,000 | 28,000 |

| Property, Plant and Equipment Land and Building Plant and Machinery | 57,000 1,91,000 | 1,10,000 90,000 |

| 2,48,000 | 2,00,000 |

Note: Proposed dividend on equity for the years ended 31st March, 2022 and 2023 are ₹ 39,000 and ₹ 45,000 respectively.

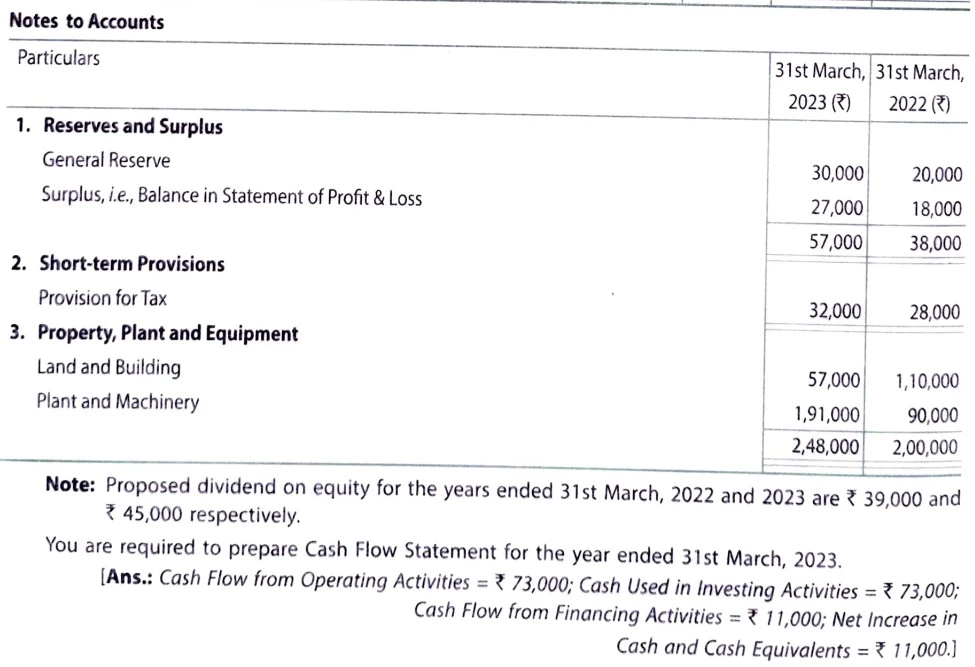

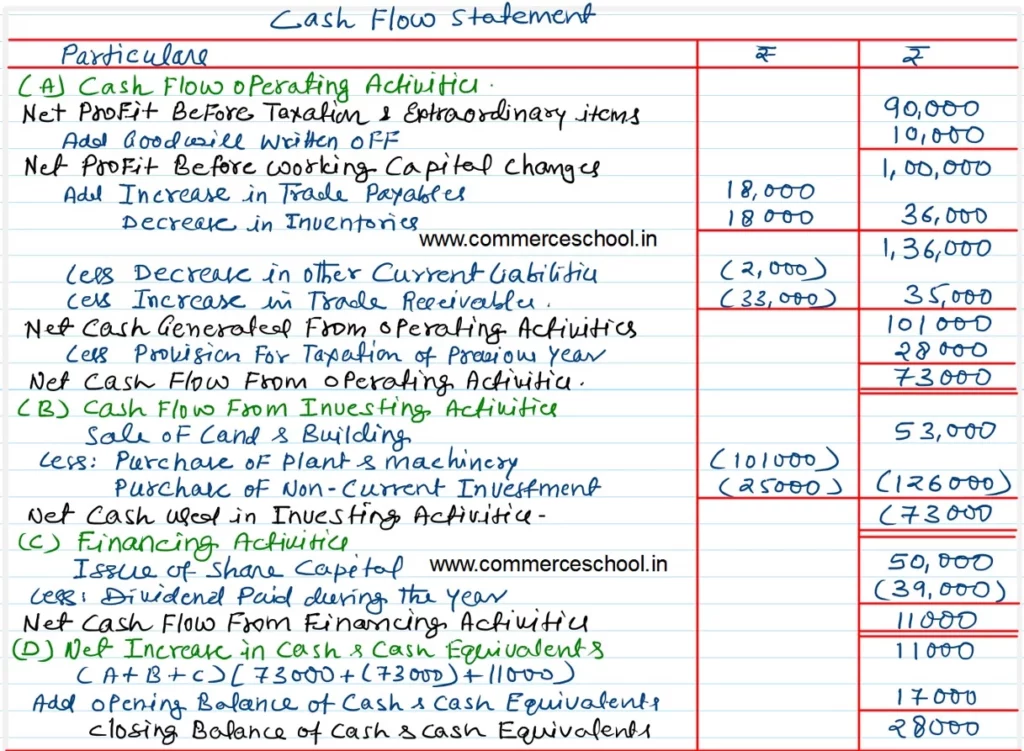

You are required to prepare Cash Flow Statement for the year ended 31st March, 2023.

[Ans.: Cash Flow from Operating Activities = ₹ 73,000; Cash used in Investing Activities = ₹ 73,000; Cash Flow from Financing Activities = ₹ 11,000; Net Increase in Cash and Cash Equivalents = ₹ 11,000.]

Solution:-

Here is the list of all Solutions (2025-26).

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Solutions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Solutions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |

| 40 | Question – 40 |

| S.N | Solutions |

| 41 | Question – 41 |

| 42 | Question – 42 |

| 43 | Question – 43 |

| 44 | Question – 44 |

| 45 | Question – 45 |

| 46 | Question – 46 |

| 47 | Question – 47 |

| 48 | Question – 48 |

| 49 | Question – 49 |

| 50 | Question – 50 |

| S.N | Solutions |

| 51 | Question – 51 |

| 52 | Question – 52 |

| 53 | Question – 53 |

| 54 | Question – 54 |

| 55 | Question – 55 |