[CBSE] Q 43 DK Goel Dissolution of a Partnership Firm Solutions Class 12 (2024-25)

Solution of Question number 43 of Dissolution of a Partnership Firm chapter 5 of DK Goel Class 12 CBSE (2024-25)

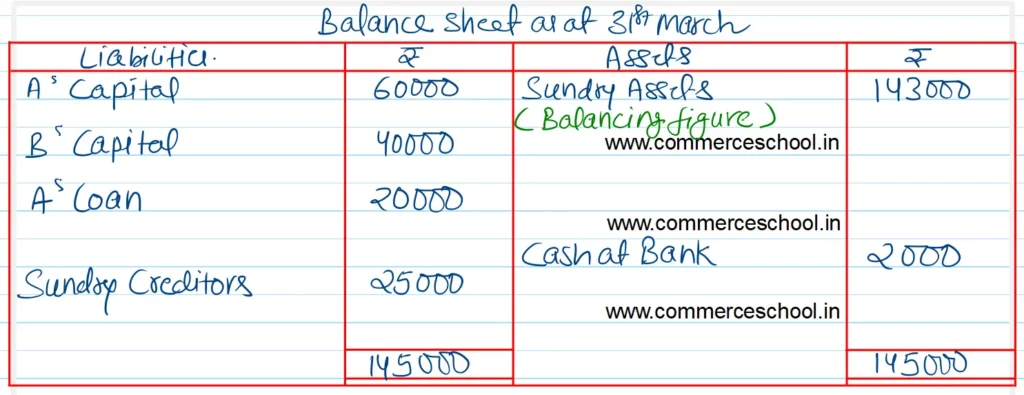

Q. 43. A and B dissolve their partnership. Their position as at 31st March, 2024 was as follows:

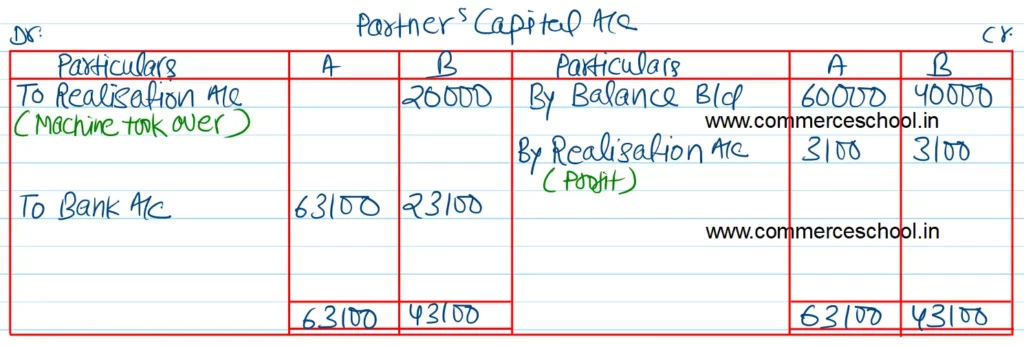

A’s Capital – ₹ 60,000

B’s Capital – ₹ 40,000

Sundry Creditors – ₹ 25,000

Cash at Bank – ₹ 2,000

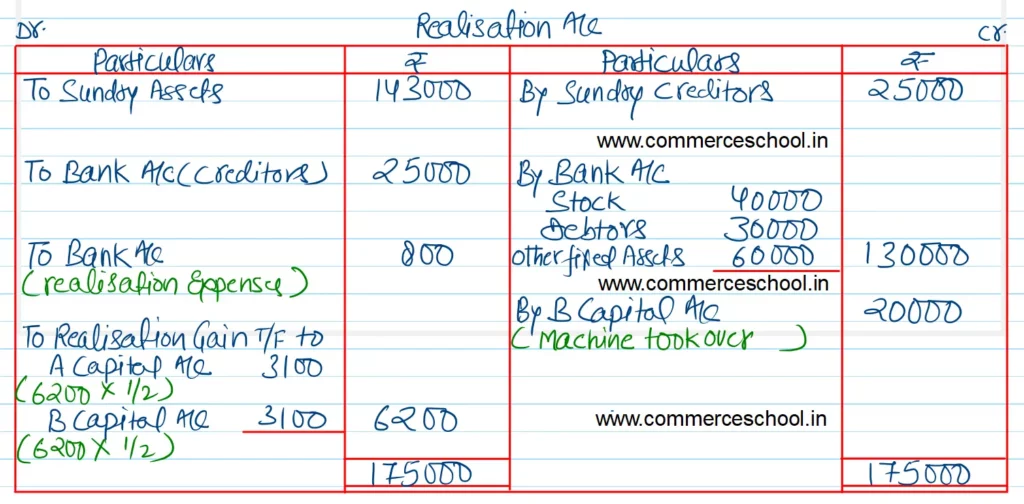

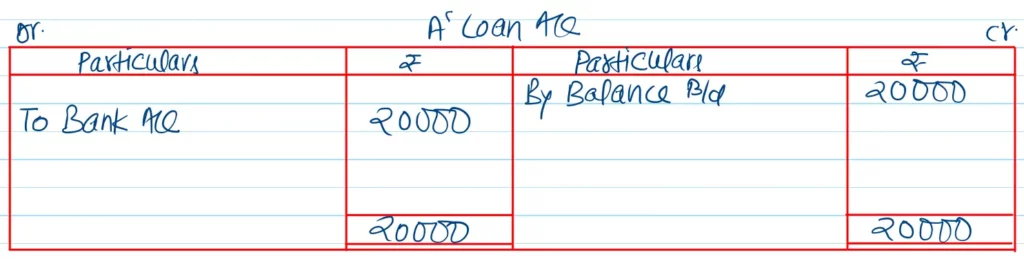

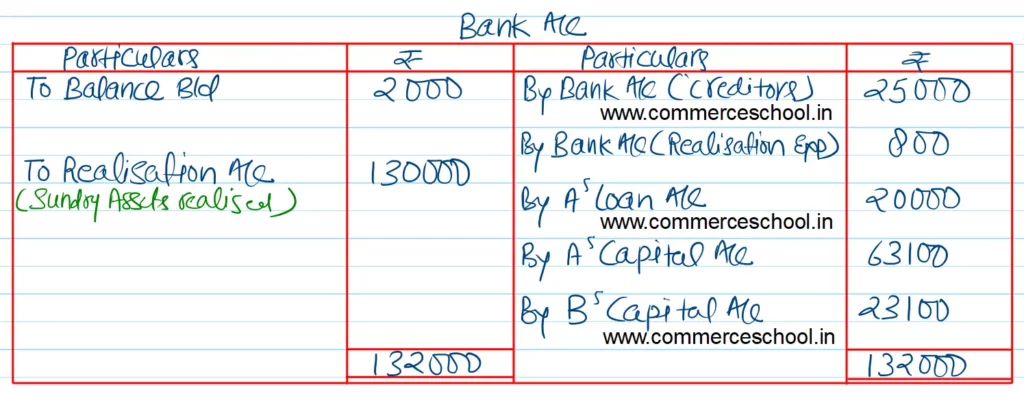

The balance of A’s Loan Account of the firm stood at ₹ 20,000. The realisation expenses amounted to ₹ 800. Stock realised ₹ 40,000 and Debtors ₹ 30,000. B took a machine at the agreed valuation of ₹ 20,000. Other fixed assets realised ₹ 60,000.

Prepare necessary accounts.

[Ans. Book value of Assets (other than cash) ₹ 1,43,000. Gain on Realisation ₹ 6,200. A is paid ₹ 63,100 (in addition to his loan) and B ₹ 23,100; Total of Bank A/c ₹ 1,32,000.]

Solution:-

Here are the solutions of Dissolution of a Partnership Firm chapter 5 of DK Goel Class 12 CBSE (2024-25)

| S.N | Questions | |

| 1 | Question – 1 | |

| 2 | Question – 2 | |

| 3 | Question – 3 | |

| 4 | Question – 4 | |

| 5 | Question – 5 | |

| 6 | Question – 6 | |

| 7 | Question – 7 | |

| 8 | Question – 8 | |

| 9 | Question – 9 | |

| 10 | Question – 10 |

| S.N | Questions | |

| 11 | Question – 11 | |

| 12 | Question – 12 | |

| 13 | Question – 13 | |

| 14 | Question – 14 | |

| 15 | Question – 15 | |

| 16 | Question – 16 | |

| 17 | Question – 17 | |

| 18 | Question – 18 | |

| 19 | Question – 19 | |

| 20 | Question – 20 |

| S.N | Questions | |

| 21 | Question – 21 | |

| 22 | Question – 22 | |

| 23 | Question – 23 | |

| 24 | Question – 24 | |

| 25 | Question – 25 | |

| 26 | Question – 26 | |

| 27 | Question – 27 | |

| 28 | Question – 28 | |

| 29 | Question – 29 | |

| 30 | Question – 30 |

| S.N | Questions | |

| 31 | Question – 31 | |

| 32 | Question – 32 | |

| 33 | Question – 33 | |

| 34 | Question – 34 | |

| 35 | Question – 35 | |

| 36 | Question – 36 | |

| 37 | Question – 37 | |

| 38 | Question – 38 | |

| 39 | Question – 39 | |

| 40 | Question – 40 |