[CBSE] Q 46 DK Goel Dissolution of a Partnership Firm Solutions Class 12 (2024-25)

Solution of Question number 46 of Dissolution of a Partnership Firm chapter 5 of DK Goel Class 12 CBSE (2024-25)

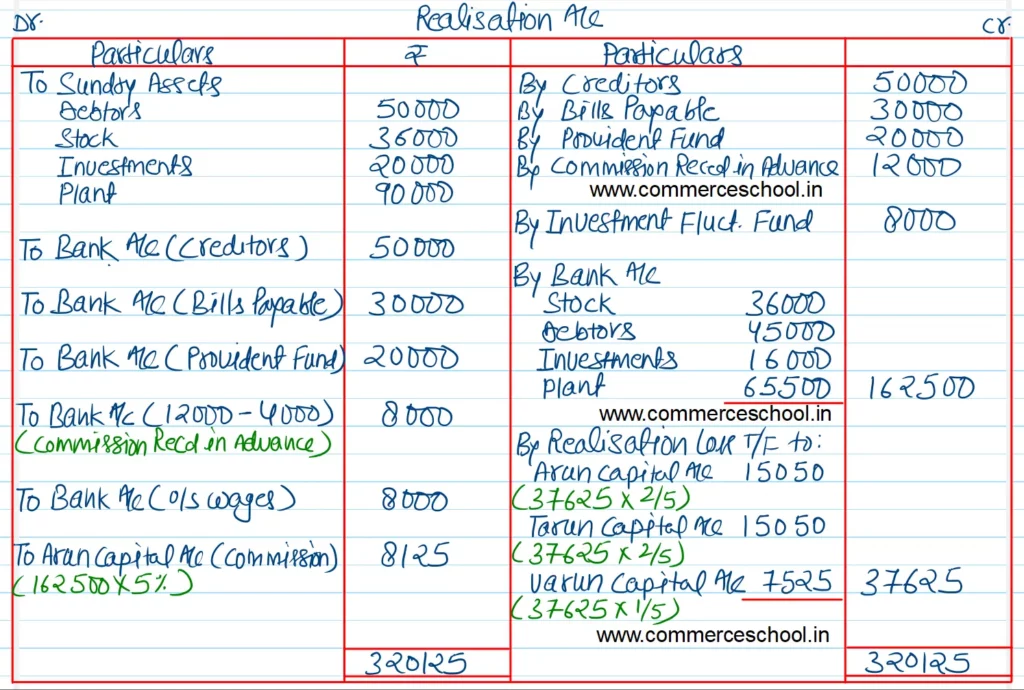

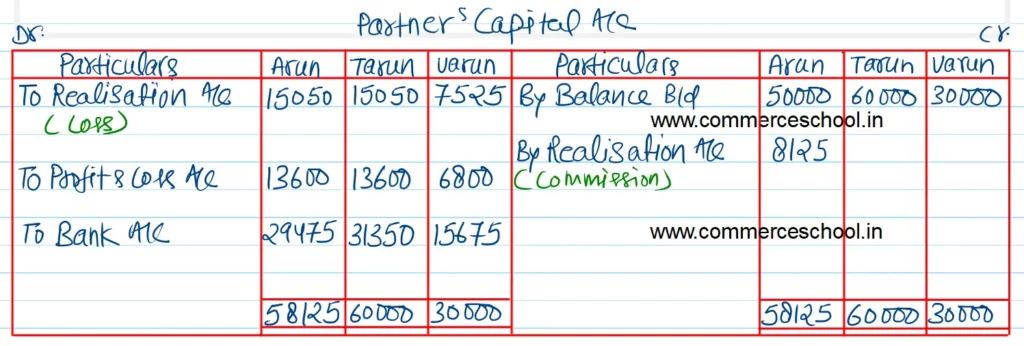

Q. 46. Arun, Tarun and Varun share profits in the ratio of 2 : 2 : 1. On 31.12.2022 their Balance Sheet was as follows:

| Liabilities | ₹ | Assets | ₹ |

| Creditors | 50,000 | Cash | 30,000 |

| Bills Payable | 30,000 | Debtors | 50,000 |

| Provident Fund | 20,000 | Stock | 36,000 |

| Investment Fluctuation Fund | 8,000 | Investments | 20,000 |

| Commission Received in Advance | 12,000 | Plant | 90,000 |

| Capitals: Arun Tarun Varun | 50,000 60,000 30,000 | Profit & Loss A/c | 34,000 |

| 2,60,000 | 2,60,000 |

On this date the firm was dissolved. Arun was appointed to realise the assets. Arun was to receive 5% commission on the sale of assets (except cash) and was to bear all expenses of realisation.

Arun realised the assets as follows:

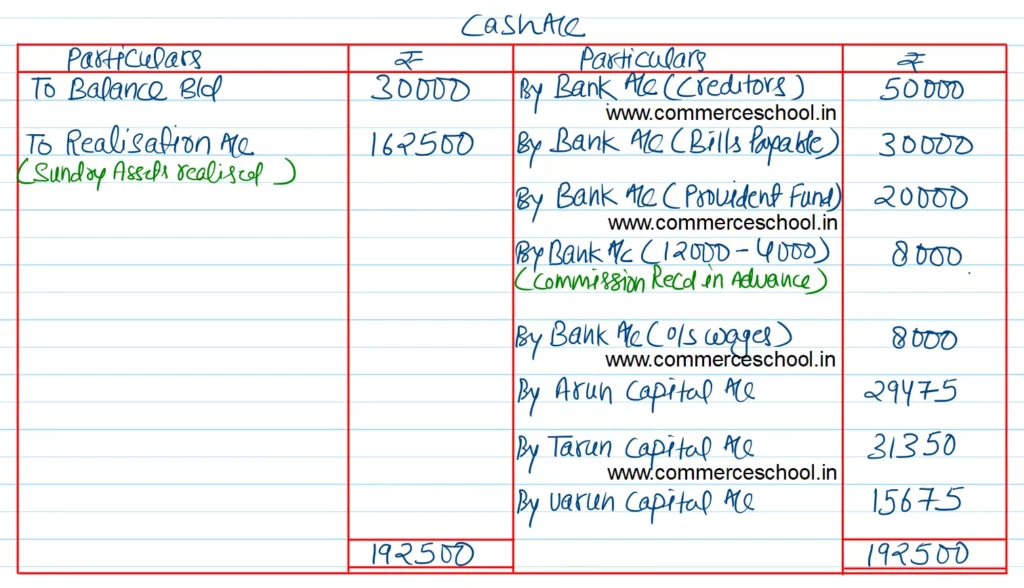

Stock ₹ 36,000, Debtors ₹ 45,000, Investments 80% of the book value, Plant ₹ 65,500. Expenses of realisation amounted to ₹ 5,500. Commission received in advance was returned to the customers after deducting ₹ 4,000. Firm had to pay ₹ 8,000 for outstanding wages. This liability was not provided for in the above Balance Sheet. ₹ 20,000 had to be paid for provident fund.

Prepare Realisation Account, Capital Accounts and Cash Account.

[Ans. Loss on Realisation ₹ 37,625; Final Payment Arun ₹ 29,475, Tarun ₹ 31,350 and Varun ₹ 15,675; Total of Cash A/c ₹ 1,92,500.]

Solution:-

Here are the solutions of Dissolution of a Partnership Firm chapter 5 of DK Goel Class 12 CBSE (2024-25)

| S.N | Questions | |

| 1 | Question – 1 | |

| 2 | Question – 2 | |

| 3 | Question – 3 | |

| 4 | Question – 4 | |

| 5 | Question – 5 | |

| 6 | Question – 6 | |

| 7 | Question – 7 | |

| 8 | Question – 8 | |

| 9 | Question – 9 | |

| 10 | Question – 10 |

| S.N | Questions | |

| 11 | Question – 11 | |

| 12 | Question – 12 | |

| 13 | Question – 13 | |

| 14 | Question – 14 | |

| 15 | Question – 15 | |

| 16 | Question – 16 | |

| 17 | Question – 17 | |

| 18 | Question – 18 | |

| 19 | Question – 19 | |

| 20 | Question – 20 |

| S.N | Questions | |

| 21 | Question – 21 | |

| 22 | Question – 22 | |

| 23 | Question – 23 | |

| 24 | Question – 24 | |

| 25 | Question – 25 | |

| 26 | Question – 26 | |

| 27 | Question – 27 | |

| 28 | Question – 28 | |

| 29 | Question – 29 | |

| 30 | Question – 30 |

| S.N | Questions | |

| 31 | Question – 31 | |

| 32 | Question – 32 | |

| 33 | Question – 33 | |

| 34 | Question – 34 | |

| 35 | Question – 35 | |

| 36 | Question – 36 | |

| 37 | Question – 37 | |

| 38 | Question – 38 | |

| 39 | Question – 39 | |

| 40 | Question – 40 |