[CBSE] Q. 49 Solution of Dissolution of Partnership Firm Chapter TS Grewal Class 12 (2023-24)

Solution to Question number 49 of the Dissolution of Partnership Firm TS Grewal Book 2023-24 Edition for the CBSE Board?

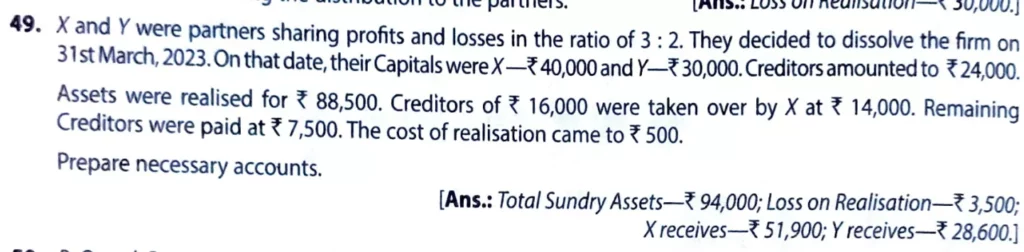

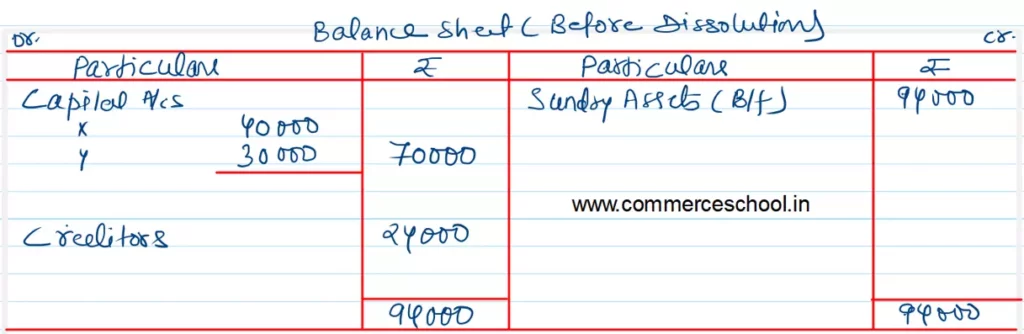

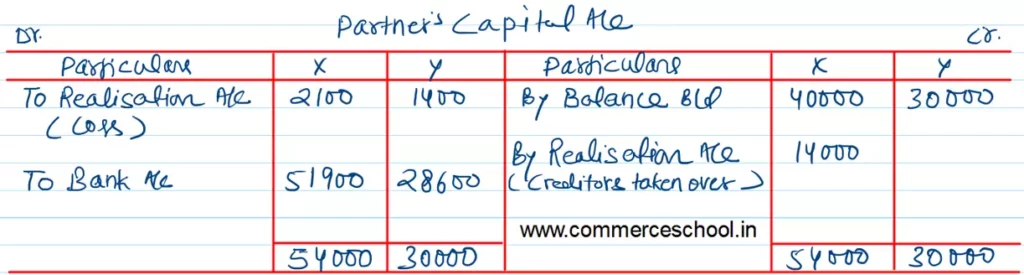

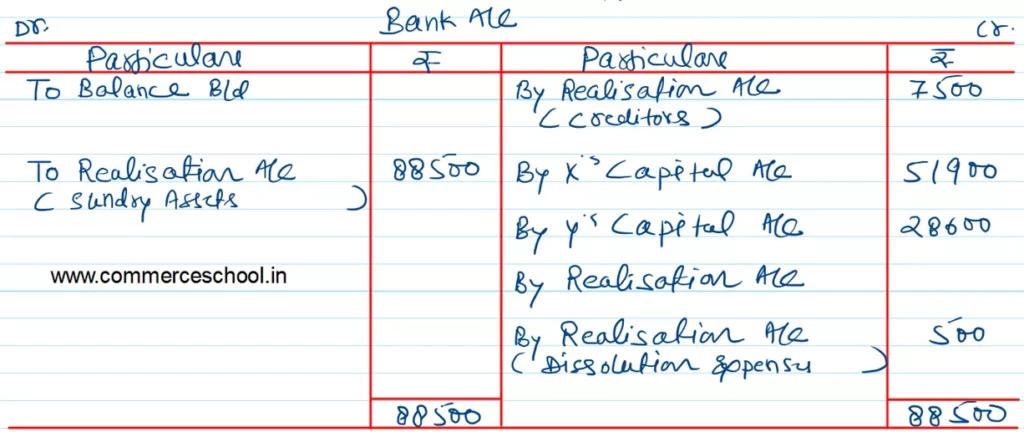

X and Y were partners sharing profits and losses in the ratio of 3 : 2. They decided to dissolve the firm on 31st March 2023. On that date, their Capitals were X – ₹ 40,000 and Y – ₹ 30,000. Creditors amounted to ₹ 24,000. Assets were realised for ₹ 88,500. Creditors of ₹ 16,000 were taken over by X at ₹ 14,000. Remaining Creditors were paid at ₹ 7,500. The cost of realisation came to ₹ 500. Prepare necessary accounts.

[Ans.: Total Sundry Assets – ₹ 94,000; Loss on Realisation – ₹ 3,500; X receives – ₹ 51,900; Y receives – ₹ 28,600.]

Solution:-

Here is the list of solutions

| S.N | Questions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Questions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Questions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |