[CBSE] Q 5, Q 6 Accounting for Goods and Services Tax (GST) TS Grewal class 11 (2025-26)

Solutions of Question number 5 and 6 of Accounting for Goods and Services Tax (GST) of TS Grewal class 11 CBSE Board 2025-26

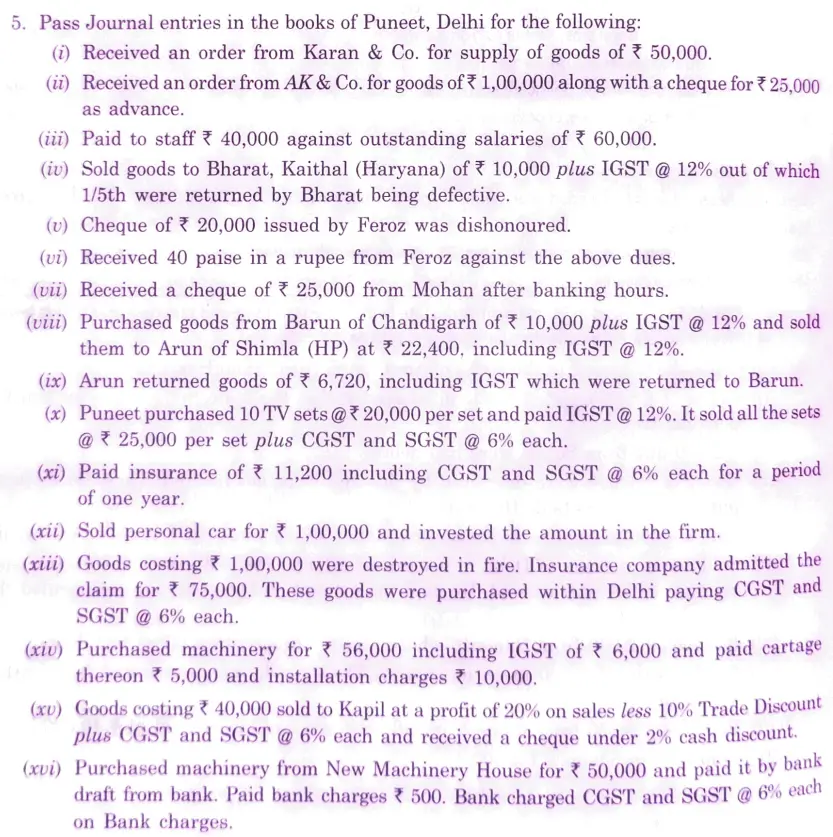

Q. 5. Pass Journal entries in the books of Puneet, Delhi for the following:

(i) Received an order from Karan & Co. for supply of goods of ₹ 50,000.

(ii) Received an order from AK & Co. for goods of ₹ 1,00,000 along with a cheque for ₹ 25,000 as advance.

(iii) Paid to staff ₹ 40,000 against outstading salaries of ₹ 60,00.

(iv) Sold goods to Bharat, Kaithal (Haryana) of ₹ 10,000 plus IGST @ 12% out of which 1/5th were returned by Bharat being defective.

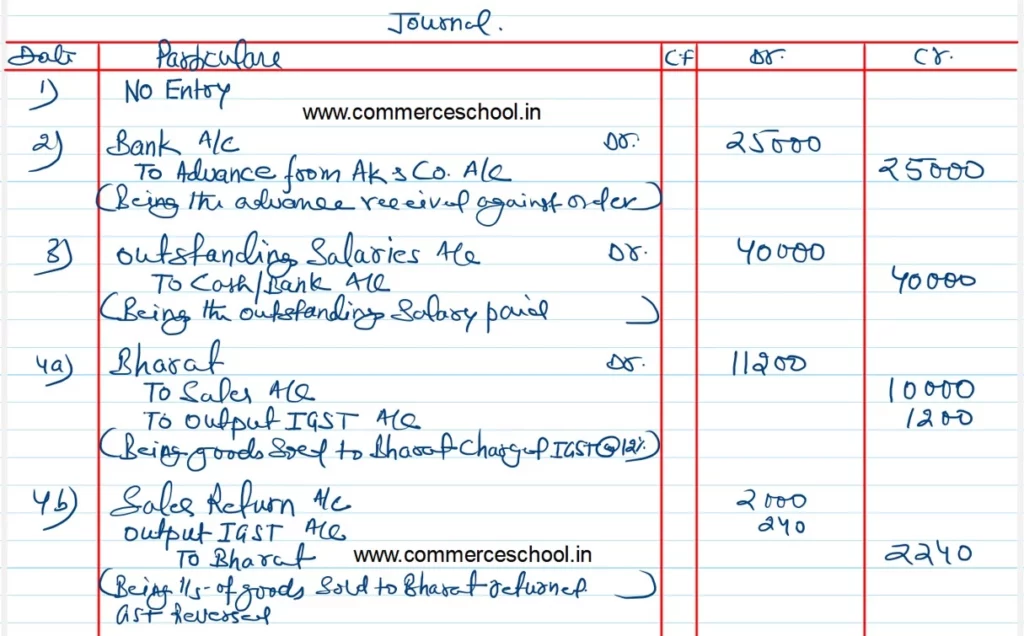

(v) Cheque of ₹ 20,000 issued by Feroz was dishonoured.

(vi) Received 40 paise in a rupee from Feroz against the above dues.

(vii) Received a cheque of ₹ 25,000 from Mohan after banking hours.

(viii) Purchased goods from Barun of Chandigarh of ₹ 10,000 plus IGST @ 12% and sold them to Arun of Shimla (HP) at ₹ 22,400, including IGST @ 12%.

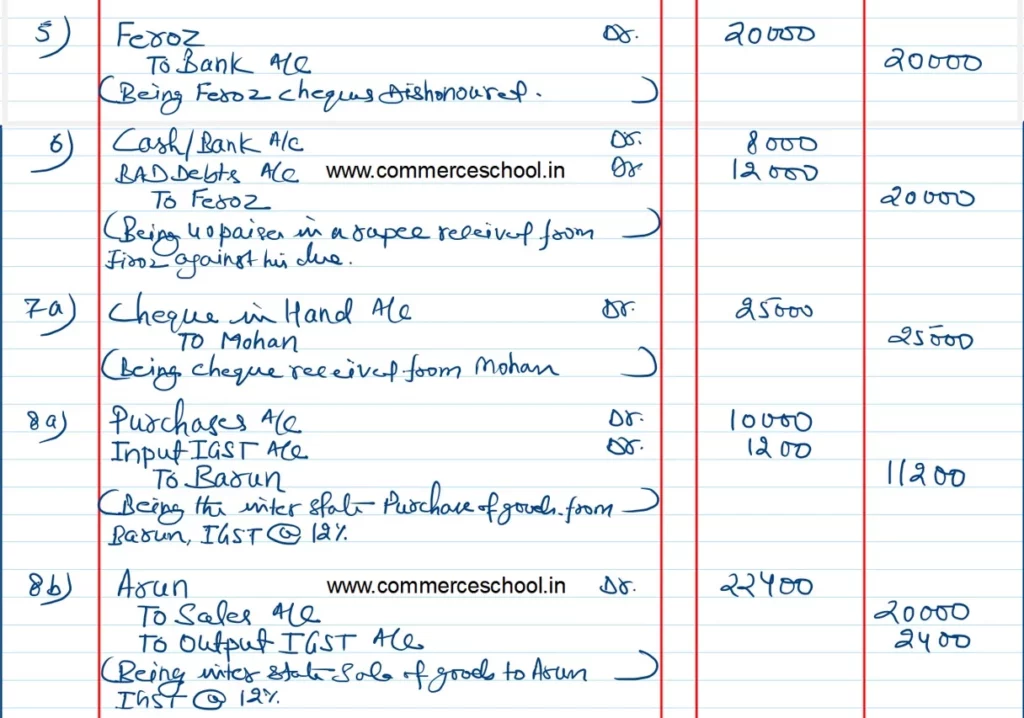

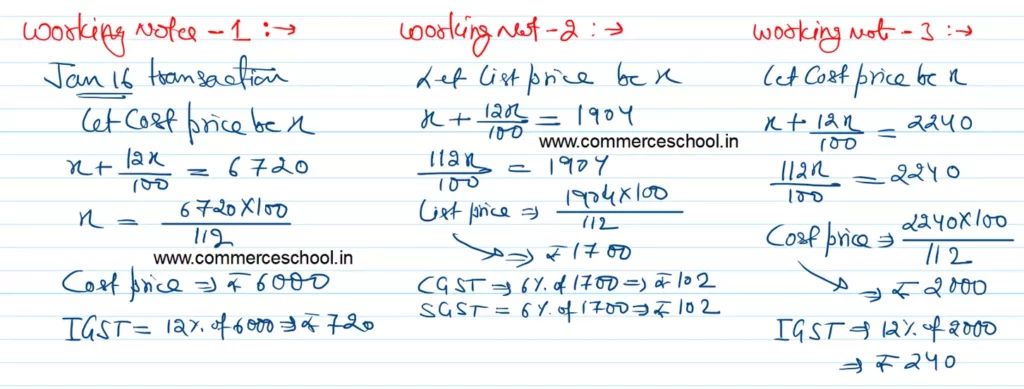

(ix) Arun returned goods of ₹ 6,720, including IGST which were returned to Barun.

(x) Puneet purchased 10 TV sets @ ₹ 20,000 per set and paid IGST @ 12%. It sold all the sets @ ₹ 25,000 per set plus CGST and SGST @ 6% each.

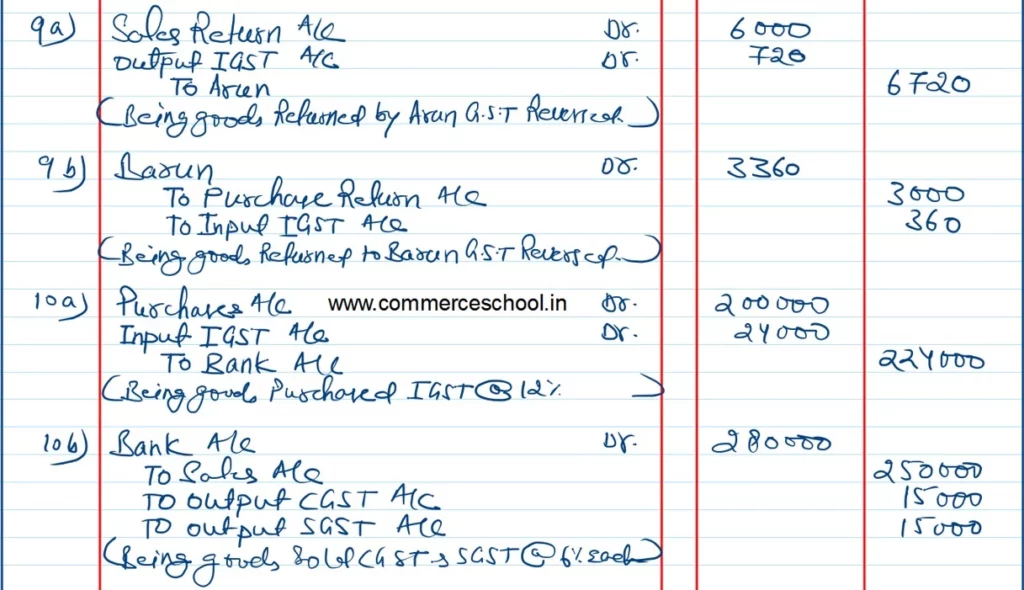

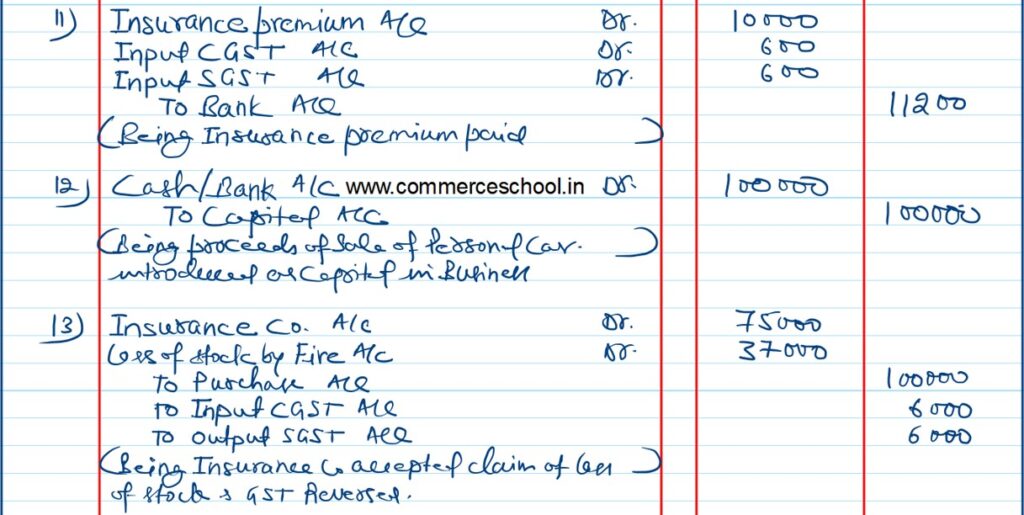

(xi) Paid insurance of ₹ 11,200 including CGST and SGST @ 6% each for a period of one year.

(xii) Sold personal car for ₹ 1,00,000 and invested the amount in the firm.

(xiii) Goods costing ₹ 1,00,000 were destroyed in fire. Insurance company admitted the claim for ₹ 75,000. These goods were purchased within Delhi paying CGST and SGST @ 6% each.

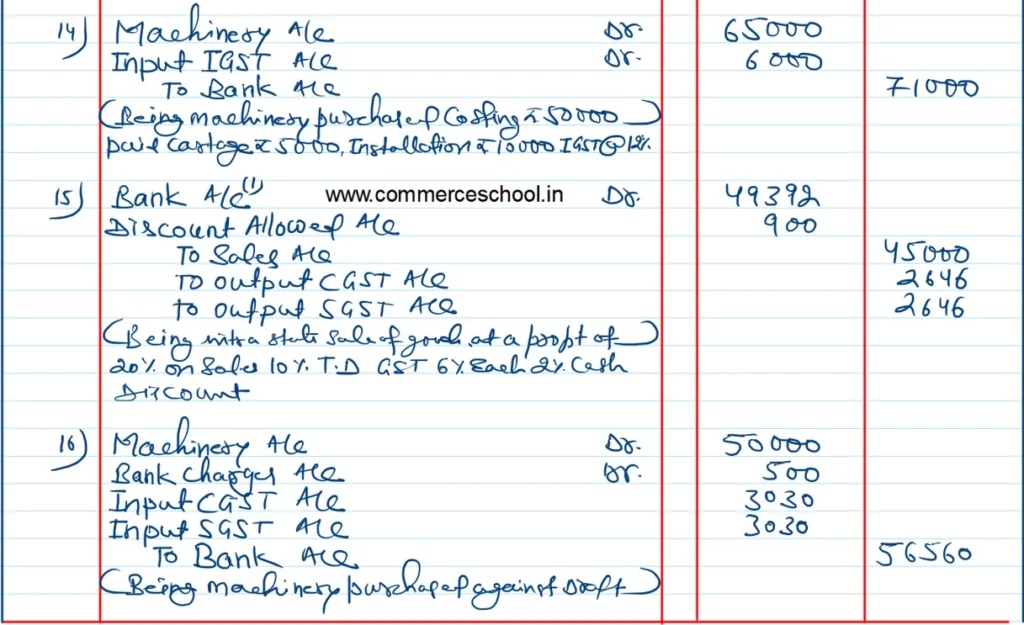

(xiv) Purchase machinery for ₹ 56,000 including IGST of ₹ 6,000 and paid cartage thereon ₹ 5,000 and installation charges ₹ 10,000.

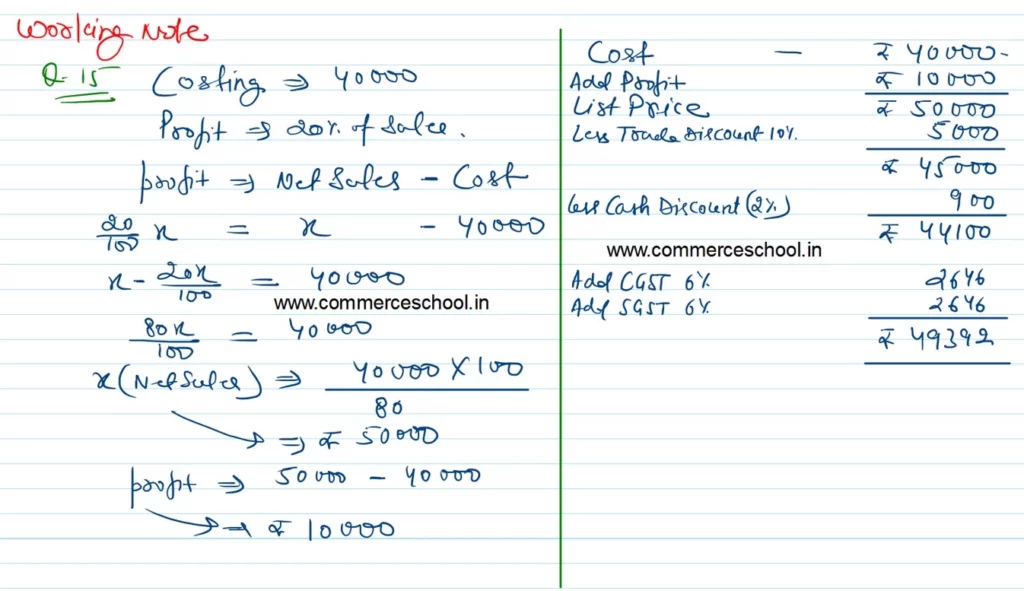

(xv) Goods costing ₹ 40,000 sold to Kapil at a profit of 20% on sales less 10% Trade Discount plus CGST and SGST @ 6% each and received a cheque under @5 cash discount.

(xvi) Purchased machinery from New Machinery House of ₹ 50,000 and paid it by bank draft from bank. Paid bank charges ₹ 500. Bank charged CGST and SGST @ 6% each on Bank charges.

Solution:-

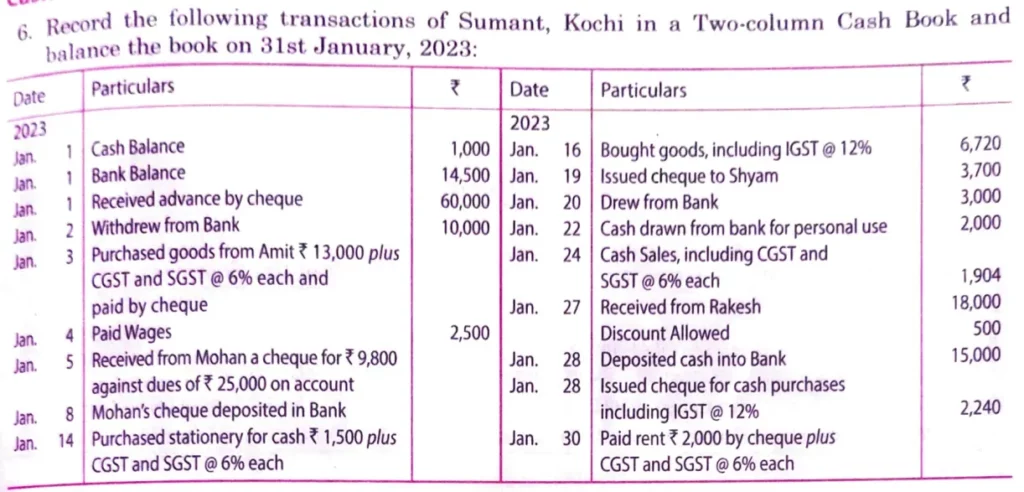

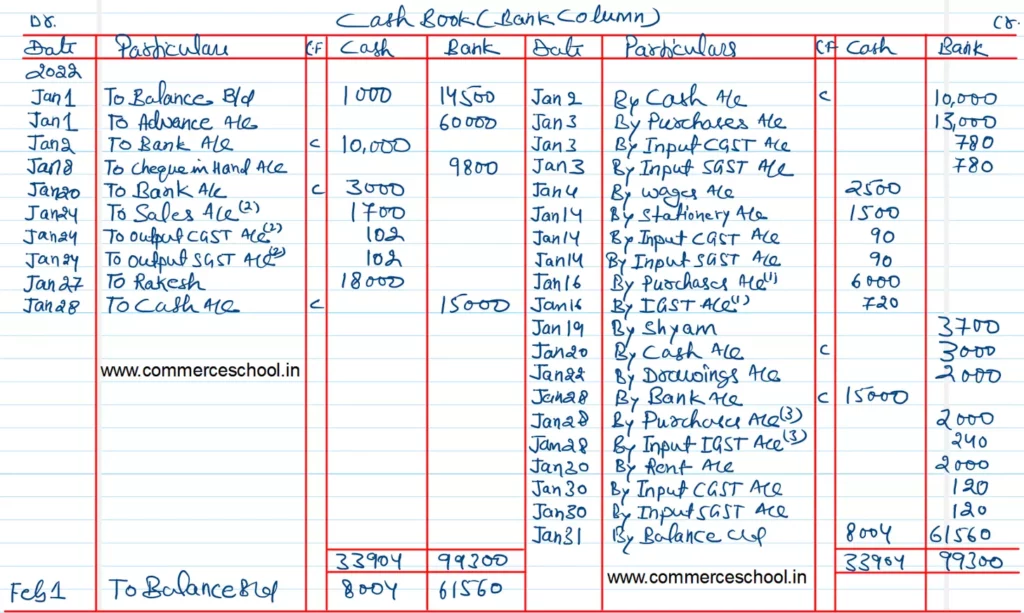

Q. 6. Record the following transactions of Sumant, Kochi in a Two-column Cash Book and balance the book on 31st January, 2024:

| Date | Particulars | ₹ | Date | ₹ | |

| 2023 Jan. 1 Jan. 1 Jan. 1 Jan. 2 Jan. 3 Jan. 4 Jan. 5 Jan. 8 Jan. 14 | Cash Balance Bank Balance Received advance by cheque withdrew from Bank Purchased goods from Amit ₹ 13,000 plus CGST and SGST @ 6% each and paid by cheque Paid wages Received from Mohan a cheque for ₹ 9,800 against dues of ₹ 25,000 on account Mohan’s cheque deposited in Bank Purchased stationery for cash ₹ 1,500 plus CGST and SGST @ 6% each | 1,000 14,500 60,000 10,000 2,500 | 2022 Jan. 16 Jan. 19 Jan. 20 Jan. 22 Jan. 24 Jan. 27 Jan. 28 Jan. 28 Jan. 30 | Bought goods, including IGST @ 12% Issued cheque to Shyam Drew from Bank Cash drawn from bank for personal use Cash sales, including CGST and SGST @ 6% each Received from Rakesh Discount Allowed Deposited cash into Bank Issued cheque for cash purchases including IGST @ 12% Paid rent ₹ 2,000 by cheque plus CGST and SGST @ 6% each | 6,720 3,700 3,000 2,000 1,904 18,000 500 15,000 2,240 |

Solution:-

Below is the list of all solutions of chapter 12 Goods and Services Tax (GST) TS Grewal class 11 CBSE