[CBSE] Q 5, Q 6 Depreciation Solutions TS Grewal Class 11 (2025-26)

Solution of Question number 5 and 6 of the Depreciation chapter TS Grewal Class 11 CBSE Board for 2025-26 Session.

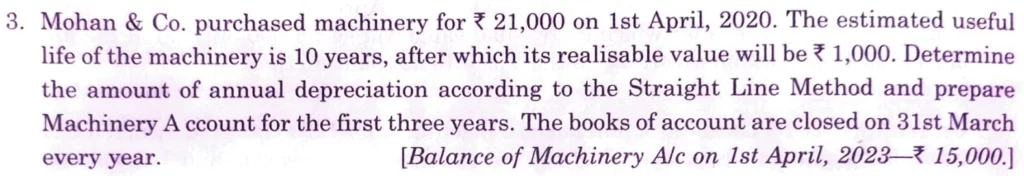

Q. 5. Mohan & Co. Purchased machinery for ₹ 21,000 on 1st April, 2020.

The estimated useful life of machinery is 10 years, after which its realisable value will be ₹ 1,000 Determine the amount of annual depreciation according to the Straight Line Method and prepare Machinery A ccount for first three years. The books of account are closed on 31st March every years.

[Balance of Machinery A/c on 1 st April, 2023-₹ 15,000.]

Solution:-

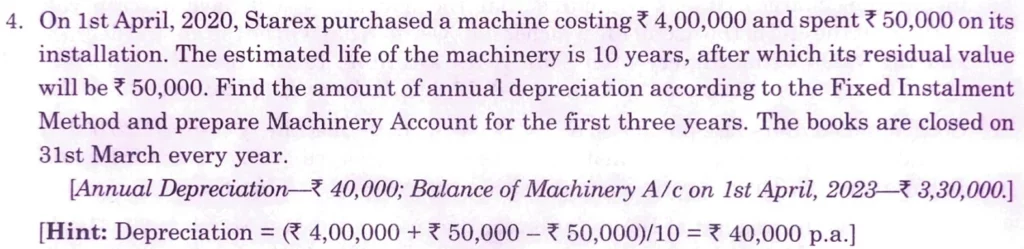

Q. 6. On Ist April, 2020, Starex purchased a machine costing ₹ 4,00,000 and spent ₹ 50,000 on its installation.

The estimated life the machinery is 10 years, after which its residual value will be ₹ 50,000. Find the amount of annual depreciation according to the Fixed Instalment Method and prepare Machinery Account for the first three years.The books are closed on 31st March every year.

[Annual Depreciation-₹ 40,000; Balance of Machinery A/c on 1st April,2023-₹ 3,30,000.]

Hint: Depreciation = (₹ 4,00,000+ ₹ 50,000 -₹ 50,000)/10= ₹ 40,000 p.a.]

Solution:-

Following is the list of all solutions of the depreciation chapter of ts Grewal CBSE for the (2025-26) session.