[CBSE] Q 50 DK Goel Dissolution of a Partnership Firm Solutions Class 12 (2024-25)

Solution of Question number 50 of Dissolution of a Partnership Firm chapter 5 of DK Goel Class 12 CBSE (2024-25)

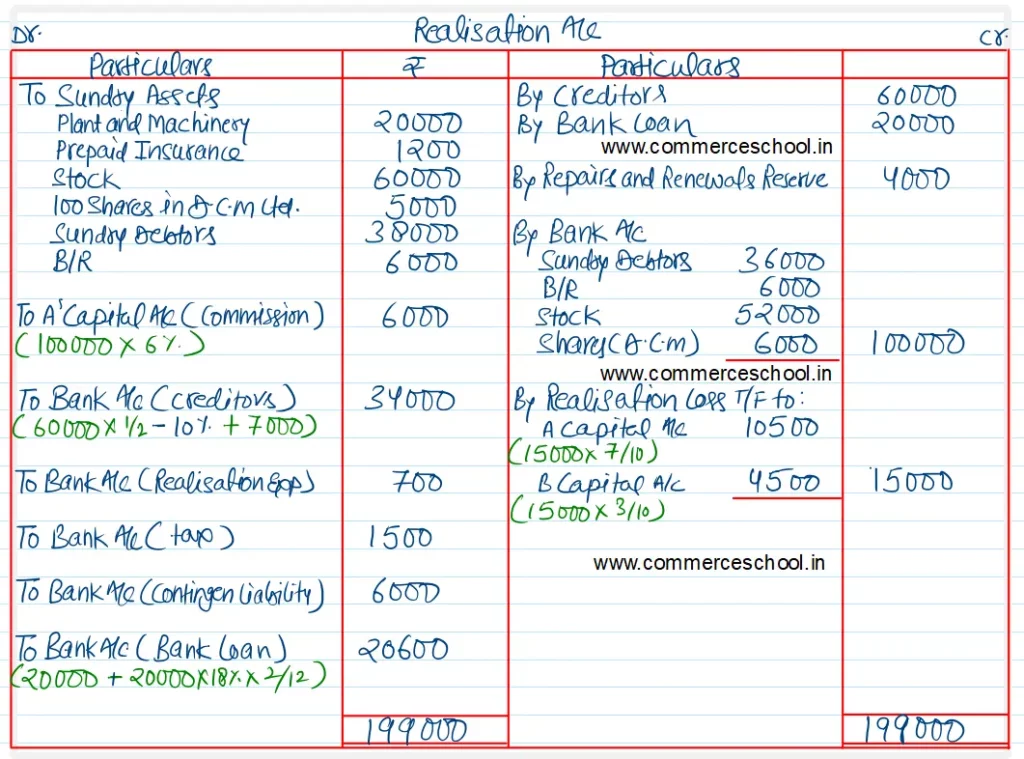

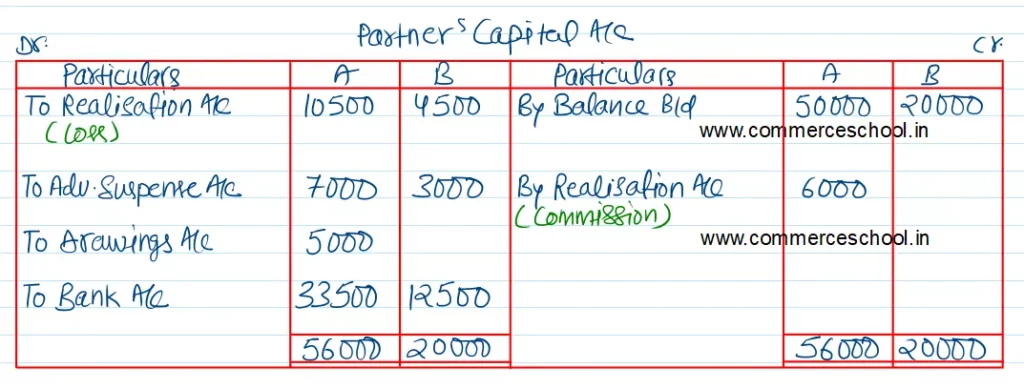

Q. 50. A and B shared profits in the ratio of 7 : 3. They dissolved the partnership and appointed A to realise the assets. A is to receive 6% commission on the amount realised from stock, Debtors, B/R and Shares.

The position of the firm was as follows:

| Liabilities | ₹ | Assets | ₹ |

| Creditors | 60,000 | Plant and Machinery | 20,000 |

| Repairs and Renewals Reserve | 4,000 | Prepaid Insurance | 1,200 |

| Bank Loan | 20,000 | Stock | 60,000 |

| A’s Capital A/c B’s Capital A/c | 50,000 20,000 | 100 Shares in D.C.M Ltd | 5,000 |

| Sundry Debtors | 38,000 | ||

| B/R | 6,000 | ||

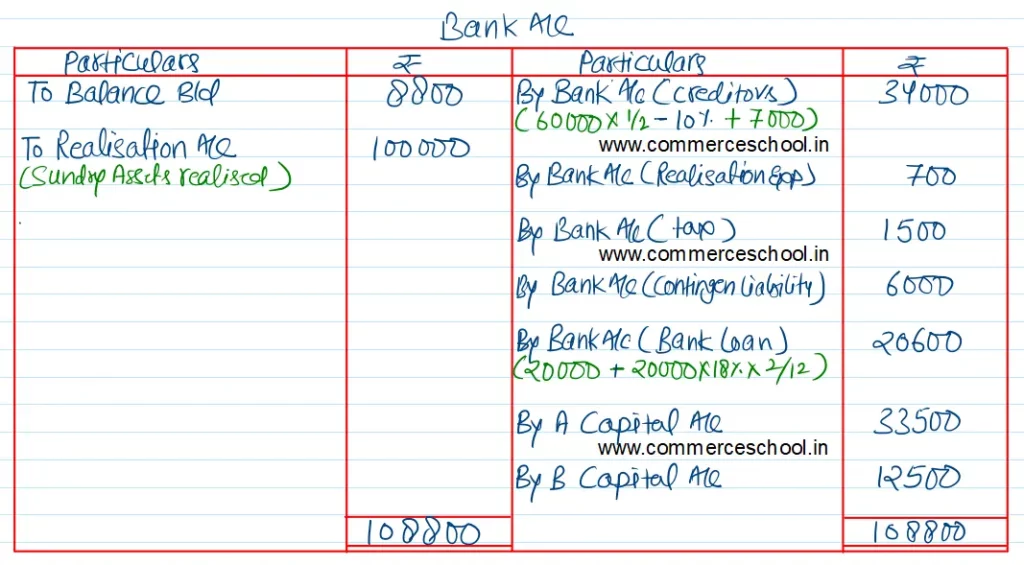

| Cash at Bank | 8,800 | ||

| A’s Drawings | 5,000 | ||

| Advertisement Suspense A/c | 10,000 | ||

| 1,54,000 | 1,54,000 |

Information:

- A realised the assets as follows:- Full amount from Sundry Debtors and B/R except from one for ₹ 2,000 being insolvent. Stock realised ₹ 52,000; Shares in D.C.M were sold for ₹ 60 each.

- Half the trade creditors accepted plant and machinery at an agreed valuation of 10% less than the book value and cash of ₹ 7,000 in full settlement of their claims.

- Remaining creditors were paid off at a discount of 10%. Expenses of realisation amounted to ₹ 700.

- On quarter’s tax amounting to ₹ 1,500 was due and had to be paid.

- There was a contingent liability amounting to ₹ 13,000. It was settled for ₹ 6,000.

- Bank Loan was discharged along with interest due for two months @ 18% p.a.

Prepare necessary accounts.

[Ans. Loss on Realisation ₹ 15,000; Amount paid to A ₹ 33,500 and B ₹ 12,500; Total of Bank A/c ₹ 1,08,800.]

Solution:-

Here are the solutions of Dissolution of a Partnership Firm chapter 5 of DK Goel Class 12 CBSE (2024-25)

| S.N | Questions | |

| 1 | Question – 1 | |

| 2 | Question – 2 | |

| 3 | Question – 3 | |

| 4 | Question – 4 | |

| 5 | Question – 5 | |

| 6 | Question – 6 | |

| 7 | Question – 7 | |

| 8 | Question – 8 | |

| 9 | Question – 9 | |

| 10 | Question – 10 |

| S.N | Questions | |

| 11 | Question – 11 | |

| 12 | Question – 12 | |

| 13 | Question – 13 | |

| 14 | Question – 14 | |

| 15 | Question – 15 | |

| 16 | Question – 16 | |

| 17 | Question – 17 | |

| 18 | Question – 18 | |

| 19 | Question – 19 | |

| 20 | Question – 20 |

| S.N | Questions | |

| 21 | Question – 21 | |

| 22 | Question – 22 | |

| 23 | Question – 23 | |

| 24 | Question – 24 | |

| 25 | Question – 25 | |

| 26 | Question – 26 | |

| 27 | Question – 27 | |

| 28 | Question – 28 | |

| 29 | Question – 29 | |

| 30 | Question – 30 |

| S.N | Questions | |

| 31 | Question – 31 | |

| 32 | Question – 32 | |

| 33 | Question – 33 | |

| 34 | Question – 34 | |

| 35 | Question – 35 | |

| 36 | Question – 36 | |

| 37 | Question – 37 | |

| 38 | Question – 38 | |

| 39 | Question – 39 | |

| 40 | Question – 40 |