[CBSE] Q 51 DK Goel Dissolution of a Partnership Firm Solutions Class 12 (2024-25)

Solution of Question number 51 of Dissolution of a Partnership Firm chapter 5 of DK Goel Class 12 CBSE (2024-25)

Q. 51. E, F and G were partners in a firm sharing profits in the ratio of 2 : 2 : 1. On March 31, 2017, their firm was dissolved. On the date of dissolution, the Balance Sheet of the firm was as follows:

| Liabilities | ₹ | Assets | ₹ |

| Capitals: E F | 1,30,000 1,00,000 | G’s Capital | 500 |

| Creditors | 45,000 | Profit & Loss Account | 10,000 |

| Outstanding Expenses | 17,000 | Land & Building | 1,00,000 |

| Furniture | 50,000 | ||

| Machinery | 90,000 | ||

| Debtors | 36,500 | ||

| Bank | 5,000 | ||

| 2,92,000 | 2,92,000 |

F was appointed to undertake the process of dissolution for which he was allowed a remuneration of ₹ 5,000. F agreed to bear the dissolution expenses. Assets realized as follows:

(i) The Land & Building was sold for ₹ 1,08,900.

(ii) Furniture was sold at 25% of book value.

(iii) Machinery was sold as scrap for ₹ 9,000.

(iv) All Debtors were realised at full value.

Creditors were payable on an average of 3 months from the date of dissolution. On discharging the Creditors on the date of dissolution, they allowed a discount of 5%.

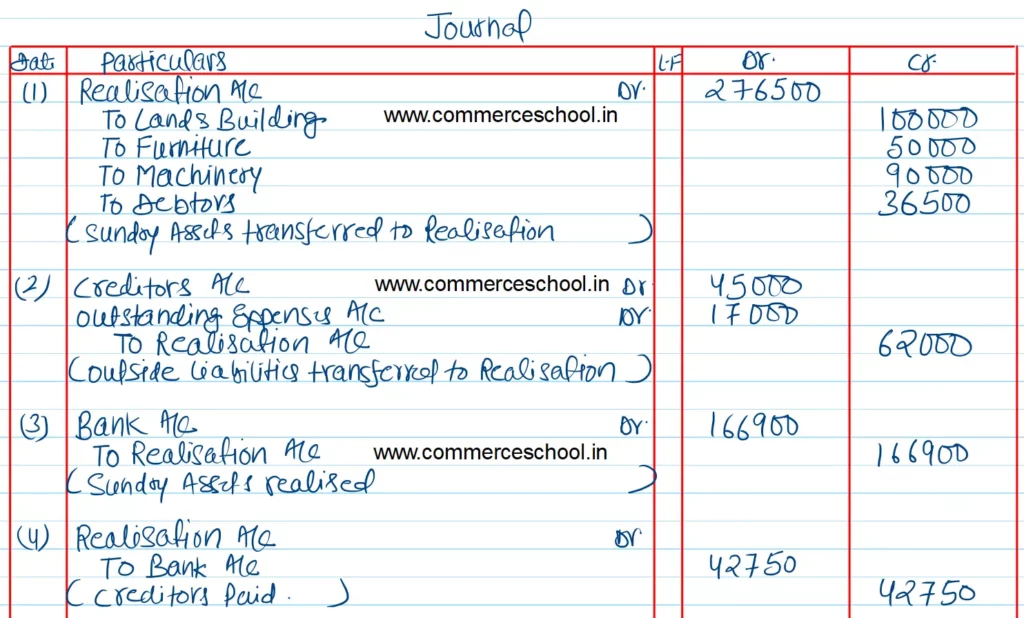

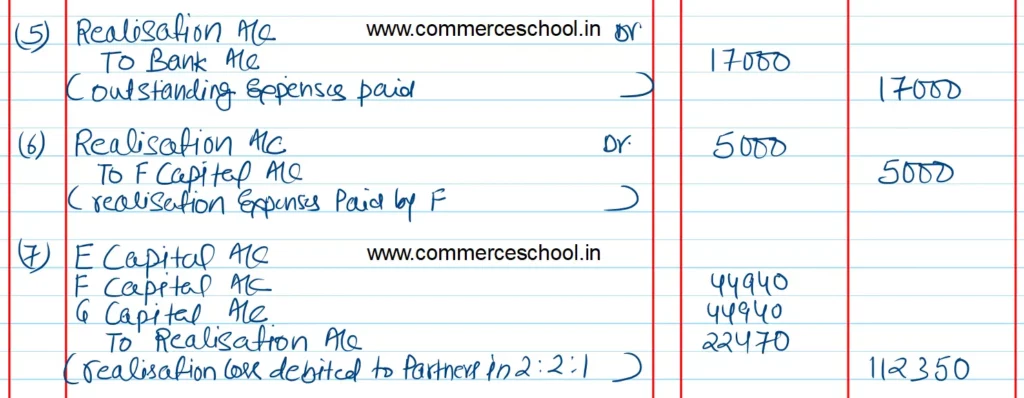

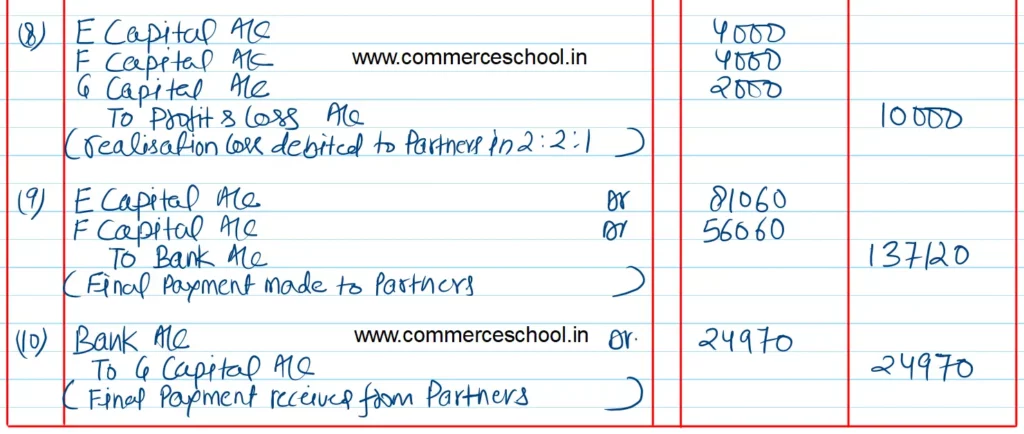

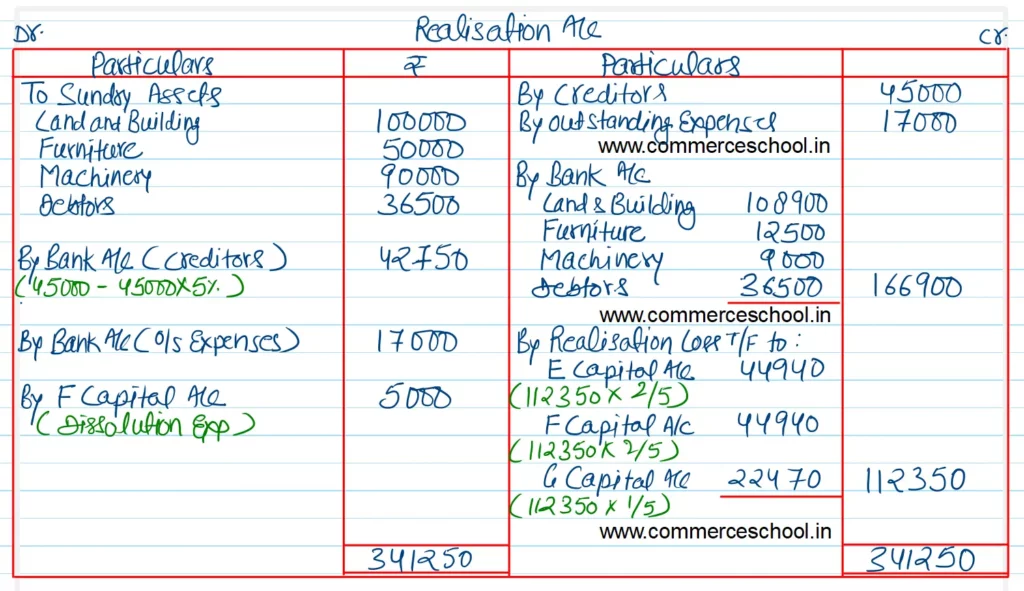

Pass necessary Journal entries for dissolution in the books of the firm.

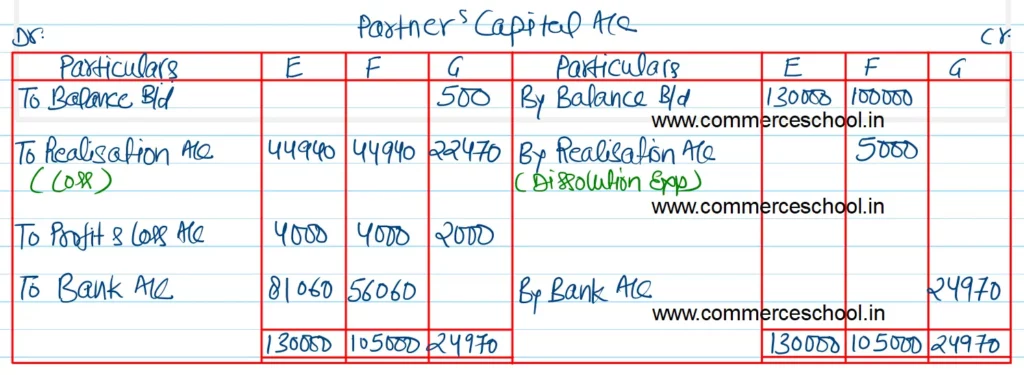

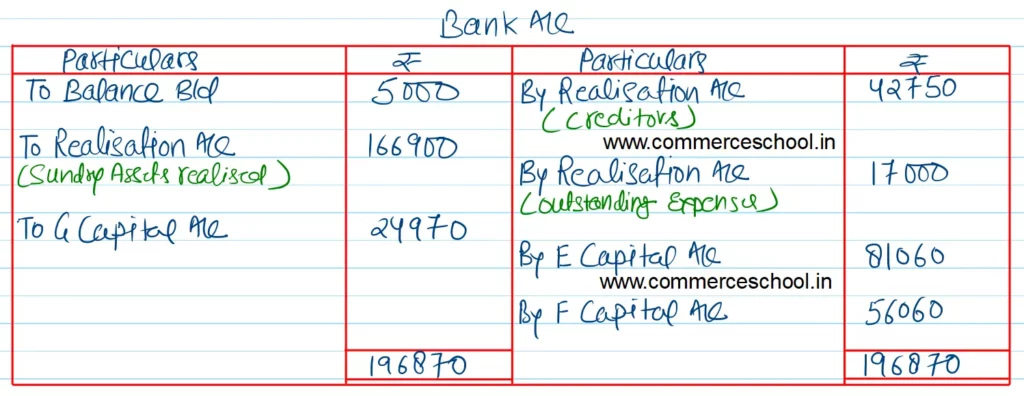

[Ans. Loss on Realisation ₹ 1,12,350; Net amount received from G ₹ 24,970 and Final Payment made to E ₹ 81,060 and F ₹ 56,060.]

Solution:-

Hint:-

(i) Payment made to creditors after deducting flat 5% as rate of interest is not given with 5% p.a., thus 3 months time period will not be considered.

Here are the solutions of Dissolution of a Partnership Firm chapter 5 of DK Goel Class 12 CBSE (2024-25)

| S.N | Questions | |

| 1 | Question – 1 | |

| 2 | Question – 2 | |

| 3 | Question – 3 | |

| 4 | Question – 4 | |

| 5 | Question – 5 | |

| 6 | Question – 6 | |

| 7 | Question – 7 | |

| 8 | Question – 8 | |

| 9 | Question – 9 | |

| 10 | Question – 10 |

| S.N | Questions | |

| 11 | Question – 11 | |

| 12 | Question – 12 | |

| 13 | Question – 13 | |

| 14 | Question – 14 | |

| 15 | Question – 15 | |

| 16 | Question – 16 | |

| 17 | Question – 17 | |

| 18 | Question – 18 | |

| 19 | Question – 19 | |

| 20 | Question – 20 |

| S.N | Questions | |

| 21 | Question – 21 | |

| 22 | Question – 22 | |

| 23 | Question – 23 | |

| 24 | Question – 24 | |

| 25 | Question – 25 | |

| 26 | Question – 26 | |

| 27 | Question – 27 | |

| 28 | Question – 28 | |

| 29 | Question – 29 | |

| 30 | Question – 30 |

| S.N | Questions | |

| 31 | Question – 31 | |

| 32 | Question – 32 | |

| 33 | Question – 33 | |

| 34 | Question – 34 | |

| 35 | Question – 35 | |

| 36 | Question – 36 | |

| 37 | Question – 37 | |

| 38 | Question – 38 | |

| 39 | Question – 39 | |

| 40 | Question – 40 |