[CBSE] Q 52 DK Goel Dissolution of a Partnership Firm Solutions Class 12 (2024-25)

Solution of Question number 52 of Dissolution of a Partnership Firm chapter 5 of DK Goel Class 12 CBSE (2024-25)

Q. 52. A, B and C shared profits in the ratio of 1 : 2 : 2. Following is their Balance Sheet on the date of dissolution:

| Liabilities | ₹ | Assets | ₹ |

| Sundry Creditors | 2,50,000 | Cash at Bank | 25,000 |

| Bills Payable | 25,000 | Debtors 4,00,000 Less: Provision for Doubtful Debts Stock 20,000 | 3,80,000 |

| Workmen Compensation Reserve | 30,000 | Stock | 20,000 |

| A’s Loan | 1,00,000 | Machinery | 3,00,000 |

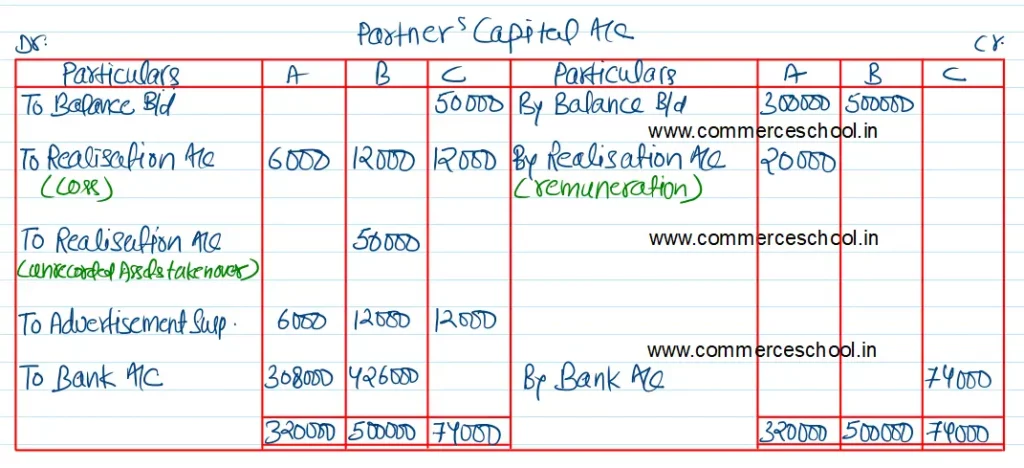

| Capital Accounts: A B | 3,00,000 5,00,000 | Land & Buildings | 4,00,000 |

| Advertisement Suspense Account | 30,000 | ||

| Capital Account: C | 50,000 | ||

| 12,05,000 | 12,05,000 |

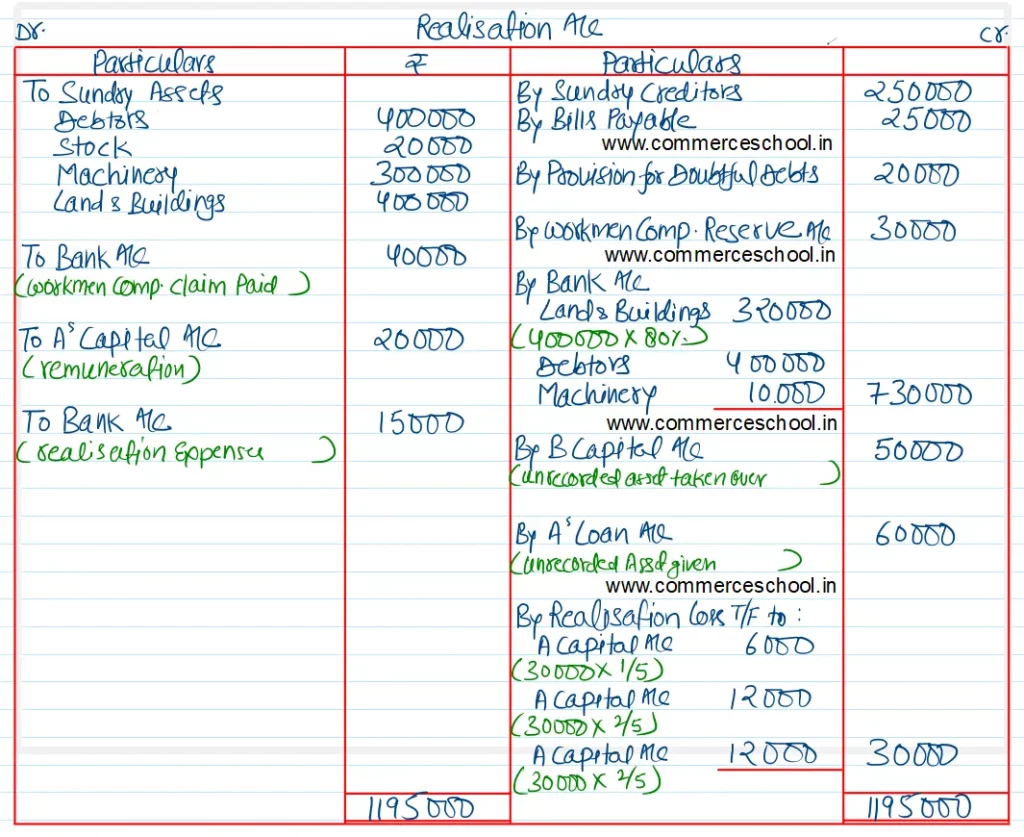

Information:-

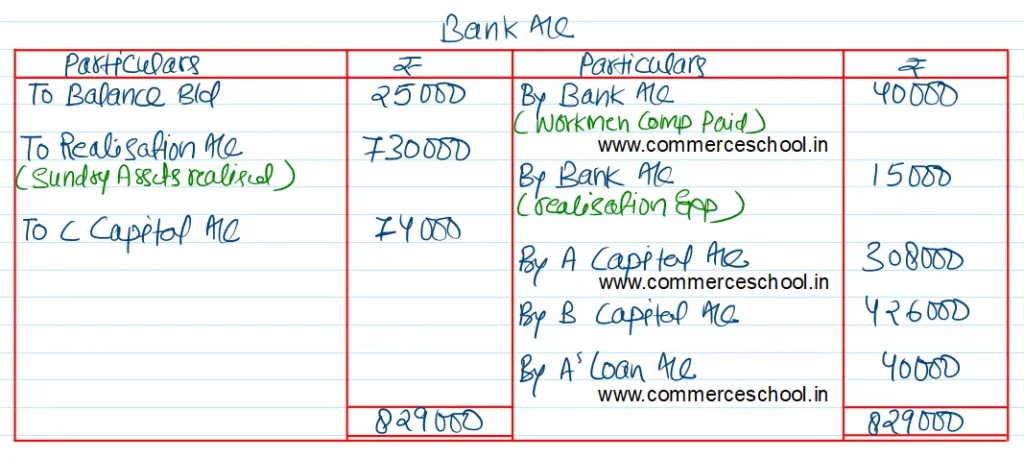

(i) Land & Buildings were sold at 80% of the book value.

(ii) Stock was given to bills payable in full settlement.

(iii) Sundry Creditors accepted machinery and paid ₹ 10,000 to the firm.

(iv) Debtors were all good.

(v) An unrecorded asset estimated at ₹ 60,000 was taken over by partner B at ₹ 50,000.

(vi) Firm had to pay ₹ 40,000 as Workmen Compensation.

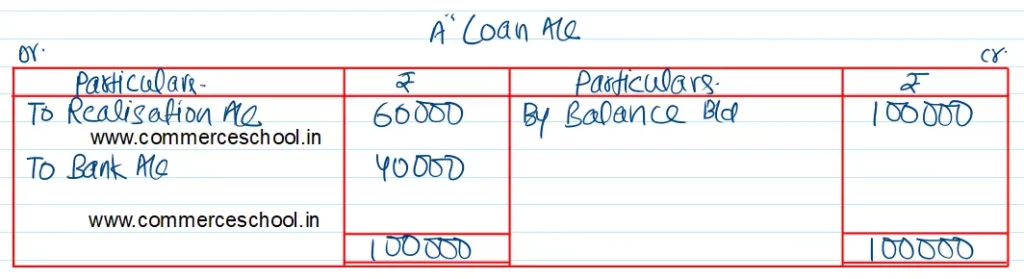

(vii) A’s Loan was settled by giving his an unrecorded asset of ₹ 75,000 at ₹ 60,000 and the balance in cash.

(viii) Partner A is to be paid remuneration of ₹ 20,000 for dissolution work. Realisation expenses of ₹ 15,000 were paid by the firm.

Prepare necessary accounts.

[Ans. Loss on Realisation ₹ 30,000; C brings in ₹ 74,000; Final Payments to A ₹ 3,08,000 and B ₹ 4,26,000; Total of Bank Account ₹ 8,29,000.]

Solution:-

Here are the solutions of Dissolution of a Partnership Firm chapter 5 of DK Goel Class 12 CBSE (2024-25)

| S.N | Questions | |

| 1 | Question – 1 | |

| 2 | Question – 2 | |

| 3 | Question – 3 | |

| 4 | Question – 4 | |

| 5 | Question – 5 | |

| 6 | Question – 6 | |

| 7 | Question – 7 | |

| 8 | Question – 8 | |

| 9 | Question – 9 | |

| 10 | Question – 10 |

| S.N | Questions | |

| 11 | Question – 11 | |

| 12 | Question – 12 | |

| 13 | Question – 13 | |

| 14 | Question – 14 | |

| 15 | Question – 15 | |

| 16 | Question – 16 | |

| 17 | Question – 17 | |

| 18 | Question – 18 | |

| 19 | Question – 19 | |

| 20 | Question – 20 |

| S.N | Questions | |

| 21 | Question – 21 | |

| 22 | Question – 22 | |

| 23 | Question – 23 | |

| 24 | Question – 24 | |

| 25 | Question – 25 | |

| 26 | Question – 26 | |

| 27 | Question – 27 | |

| 28 | Question – 28 | |

| 29 | Question – 29 | |

| 30 | Question – 30 |

| S.N | Questions | |

| 31 | Question – 31 | |

| 32 | Question – 32 | |

| 33 | Question – 33 | |

| 34 | Question – 34 | |

| 35 | Question – 35 | |

| 36 | Question – 36 | |

| 37 | Question – 37 | |

| 38 | Question – 38 | |

| 39 | Question – 39 | |

| 40 | Question – 40 |