[CBSE] Q. 53 Solution of Retirement of Partner TS Grewal Class 12 (2025-26)

Solution to Question number 53 of the Retirement of Partner chapter 5 of TS Grewal Book 2025-26 Edition CBSE Board.

Meghna, Mehak and Mandeep were partners in a firm whose Balance Sheet as on 31st March, 2023 was as under:

| Liabilities | ₹ | Assets | ₹ |

| Creditors | 28,000 | Cash | 27,000 |

| General Reserve | 7,500 | Debtors | 20,000 |

| Capitals: Meghna Mehak Mandeep | 20,000 14,500 10,000 | Stock | 28,000 |

| Furniture | 5,000 | ||

| 80,000 | 80,000 |

Mehak retired on this date under following terms:

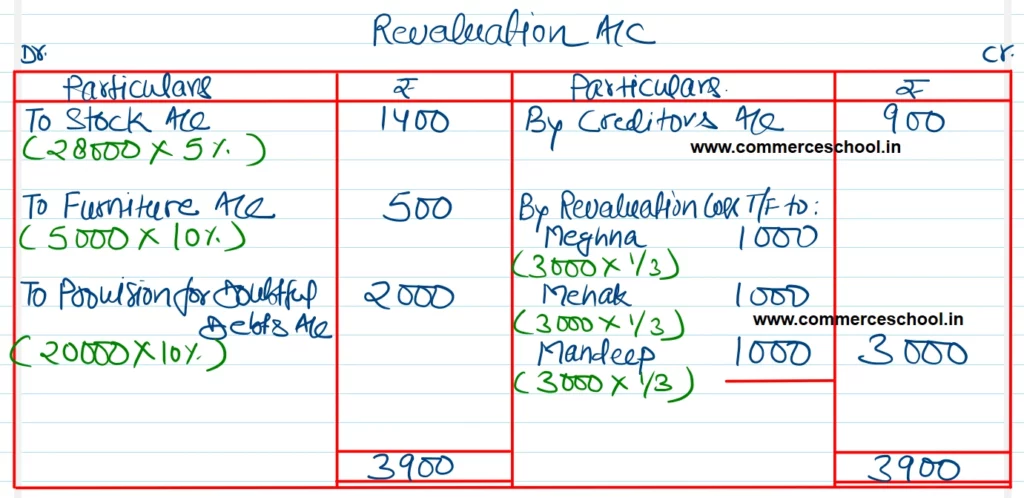

(i) To reduce stock and furniture by 5% and 1% respectively.

(ii) To provide for doubtful debts at 10% on debtors

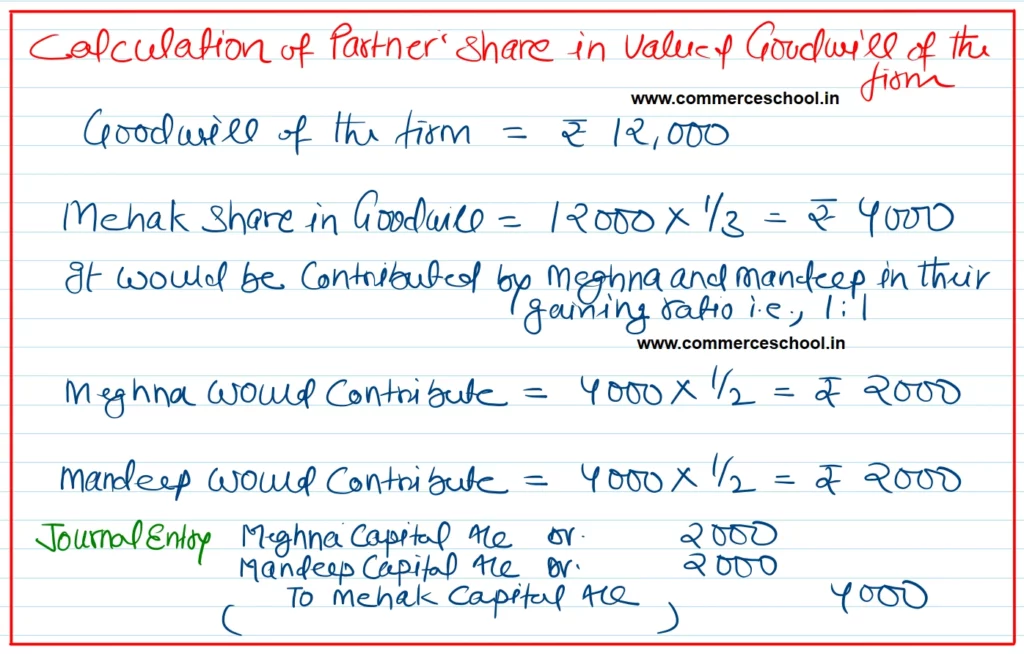

(iii) Goodwill was valued at ₹ 12,000.

(iv) Creditors of ₹ 8,000 were settled at ₹ 7,100.

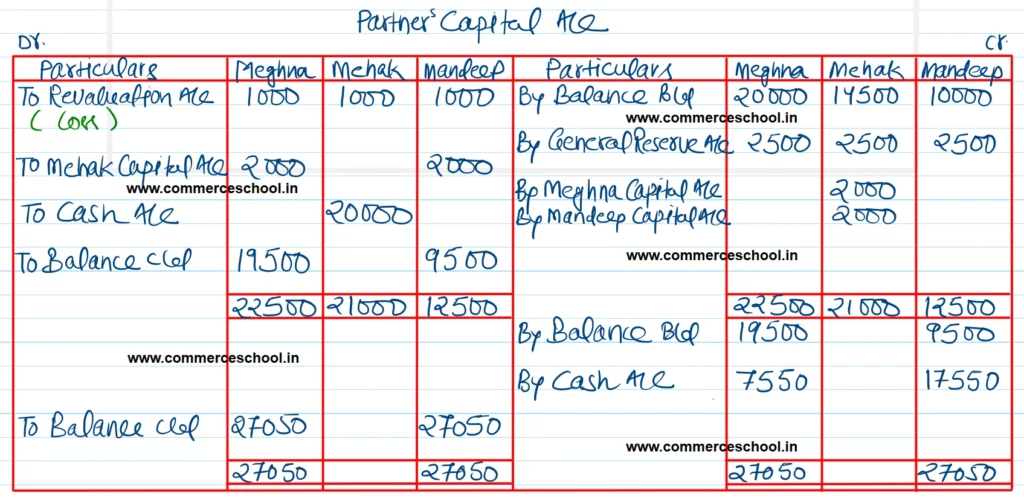

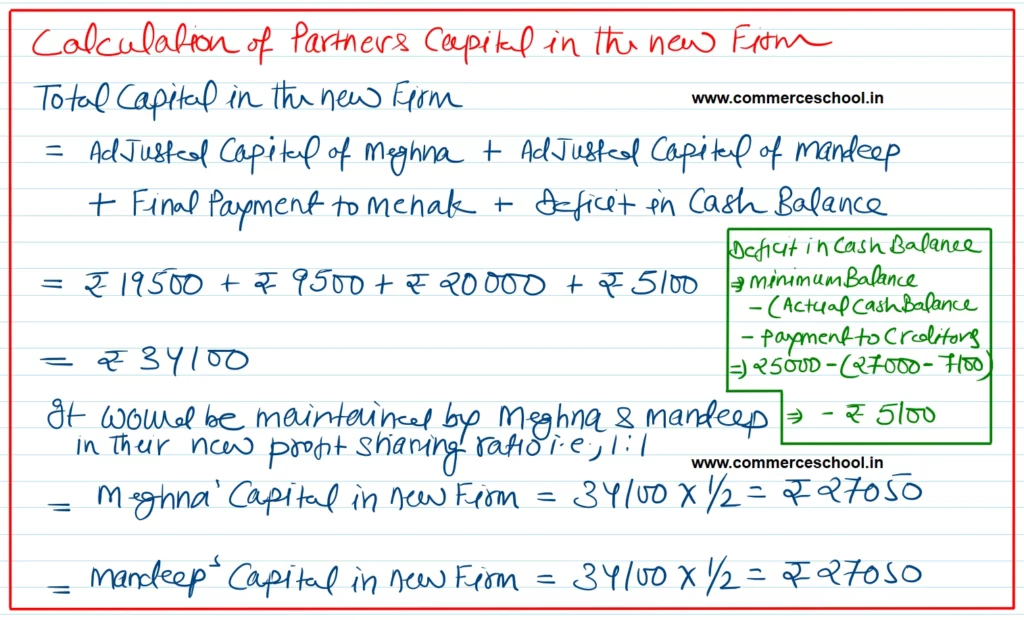

(v) Mehak should be paid off and the entire sum payable to Mehak shall be brought in by Meghna and Mandeep in such a way that their capitals should be in their new profit sharing ratio and a balance of ₹ 25,000 is maintained in the Cash Account.

Prepare Revaluation Account and Partner’s Capital Accounts of the new firm.

[Ans.: Loss on Revaluation – ₹ 3,000; Partner’s Capital Account: Meghna – ₹ 27,050; Mandeep – ₹ 27,050; Cash brought by Meghna – ₹ 7,550; Mandeep – ₹ 17,550; Cash paid to Mehak – ₹ 20,000; Gaining Ratio – 1 : 1.]

Solution:-

Here is the list of all Solutions of Retirement of Partners of TS Grewal class 12 CBSE 2025-26.

| S.N | Questions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Questions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Questions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Questions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |

| 40 | Question – 40 |

Sir,

There is an error in answer (34100×1/2=1750 not 27050. Sir I think it is done as 19500+9500+20000+25000-(27000-7100)=54100 and when it is divided into partners new profit sharing ratio (1:1) 54100×1/2=27050