[CBSE] Q 55 DK Goel Admission of a Partner Solutions Class 12 (2024-25)

The solution of Question number 55 of Admission of a Partner chapter 3 of DK Goel Class 12 CBSE (2024-25)

Q. 55. A, B and C were partners in a firm sharing profits and losses in the ratio of 2 : 2 : 1. Their Balance Sheet as at 31st March, 2024 was as follows:

| Liabilities | ₹ | Assets | ₹ |

| Creditors | 20,000 | Cash & Bank | 30,000 |

| Bills Payable | 5,000 | Debtors | 60,000 |

| General Reserve | 40,000 | Stock | 1,50,000 |

| Workmen Compensation Reserve | 35,000 | Investments (Market Value ₹ 32,000) | 40,000 |

| Investment Fluctuation Reserve | 10,000 | Plant & Machinery | 2,60,000 |

| Capital Accounts: A B C | 2,00,000 1,50,000 1,00,000 | Profit & Loss Account | 20,000 |

| 5,60,000 | 5,60,000 |

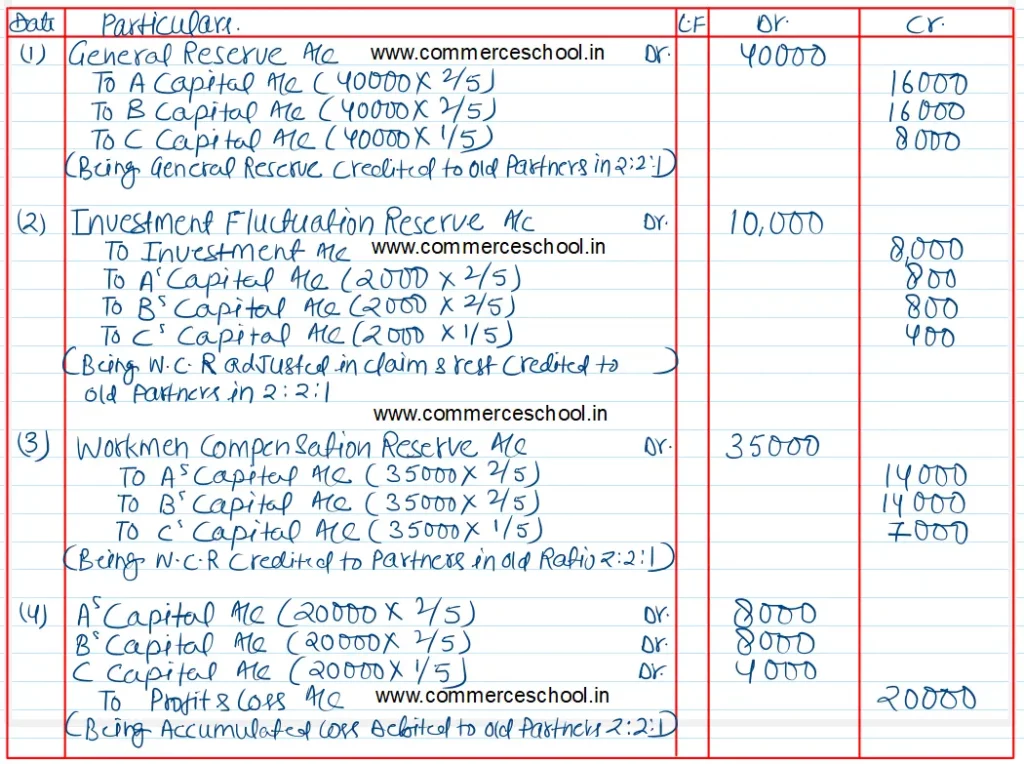

They admit D into partnership for 1/4th share on 1st April, 2024. Give necessary journal entries to adjust the accumulated profits and losses.

[Ans. Accumulated profits credited to A, B and C ₹ 30,800; ₹ 30,800 and ₹ 15,400 respectively. Accumulated loss debited to A, B and C ₹ 8,000, ₹ 8,000 and ₹ 4,000 respectively.]

Solution:-