[CBSE] Q 55 DK Goel Dissolution of a Partnership Firm Solutions Class 12 (2024-25)

Solution of Question number 55 of Dissolution of a Partnership Firm chapter 5 of DK Goel Class 12 CBSE (2024-25)

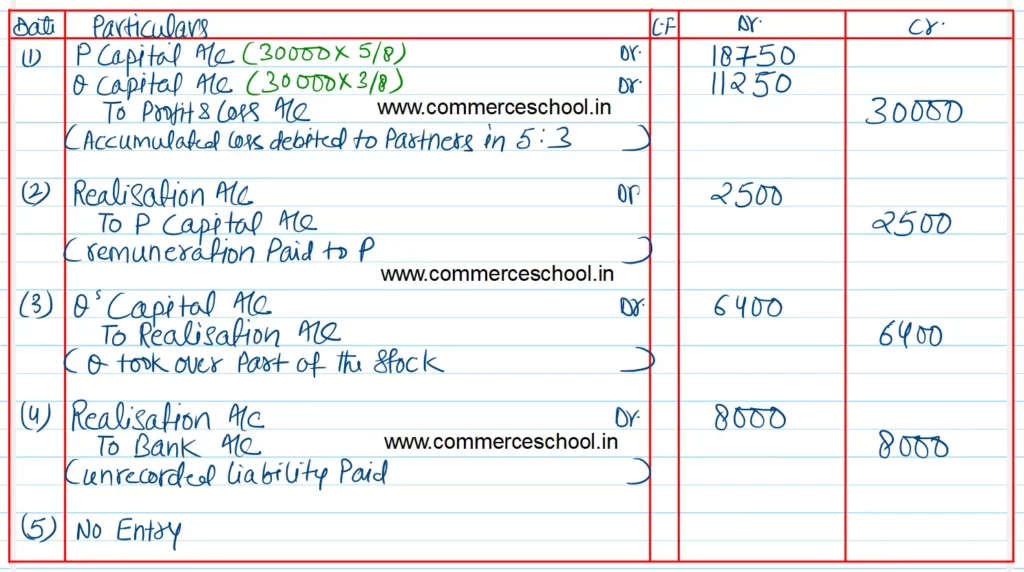

Q. 55. P and Q share profits and losses in 5 : 3. What Journal entries would be passed for the following transactions on the dissolution of their firm, after various assets (other than cash) and third party liabilities have been transferred to Realisation Account?

(i) Profit and Loss Account (Dr. Balance) appeared in the books at ₹ 30,000.

(ii) P was asked to look into the dissolution of the firm for which he was allowed a commission of ₹ 2,500.

(iii) Q took over part of the stock at ₹ 6,400 (being 20% less than the book value).

(iv) An unrecorded liability amounting to ₹ 10,000 was settled at ₹ 8,000.

(v) Motor Car of the book value of ₹ 80,000 taken over by Creditors of the book value of ₹ 60,000 in full settlement.

Solution:-

Here are the solutions of Dissolution of a Partnership Firm chapter 5 of DK Goel Class 12 CBSE (2024-25)

| S.N | Questions | |

| 1 | Question – 1 | |

| 2 | Question – 2 | |

| 3 | Question – 3 | |

| 4 | Question – 4 | |

| 5 | Question – 5 | |

| 6 | Question – 6 | |

| 7 | Question – 7 | |

| 8 | Question – 8 | |

| 9 | Question – 9 | |

| 10 | Question – 10 |

| S.N | Questions | |

| 11 | Question – 11 | |

| 12 | Question – 12 | |

| 13 | Question – 13 | |

| 14 | Question – 14 | |

| 15 | Question – 15 | |

| 16 | Question – 16 | |

| 17 | Question – 17 | |

| 18 | Question – 18 | |

| 19 | Question – 19 | |

| 20 | Question – 20 |

| S.N | Questions | |

| 21 | Question – 21 | |

| 22 | Question – 22 | |

| 23 | Question – 23 | |

| 24 | Question – 24 | |

| 25 | Question – 25 | |

| 26 | Question – 26 | |

| 27 | Question – 27 | |

| 28 | Question – 28 | |

| 29 | Question – 29 | |

| 30 | Question – 30 |

| S.N | Questions | |

| 31 | Question – 31 | |

| 32 | Question – 32 | |

| 33 | Question – 33 | |

| 34 | Question – 34 | |

| 35 | Question – 35 | |

| 36 | Question – 36 | |

| 37 | Question – 37 | |

| 38 | Question – 38 | |

| 39 | Question – 39 | |

| 40 | Question – 40 |

| S.N | Questions | |

| 41 | Question – 41 | |

| 42 | Question – 42 | |

| 43 | Question – 43 | |

| 44 | Question – 44 | |

| 45 | Question – 45 | |

| 46 | Question – 46 | |

| 47 | Question – 47 | |

| 48 | Question – 48 | |

| 49 | Question – 49 | |

| 50 | Question – 50 |