[CBSE] Q 56 DK Goel Admission of a Partner Solutions Class 12 (2024-25)

The solution of Question number 56 of Admission of a Partner chapter 3 of DK Goel Class 12 CBSE (2024-25)

Q. 56 (A). Vimal and Nirmal are partners sharing profits in the ratio of 3 : 2. Following was the position of their business as at 31st March, 2024:

| Liabilities | ₹ | Assets | ₹ |

| Sundry Creditors | 20,000 | Cash | 14,000 |

| Capital Accounts: Vimal Nirmal | 60,000 32,000 | Debtors | 18,000 |

| Profit & Loss A/c | 20,000 | Plant & Machinery | 50,000 |

| Stock | 40,000 | ||

| Goodwill | 10,000 | ||

| 1,32,000 | 1,32,000 |

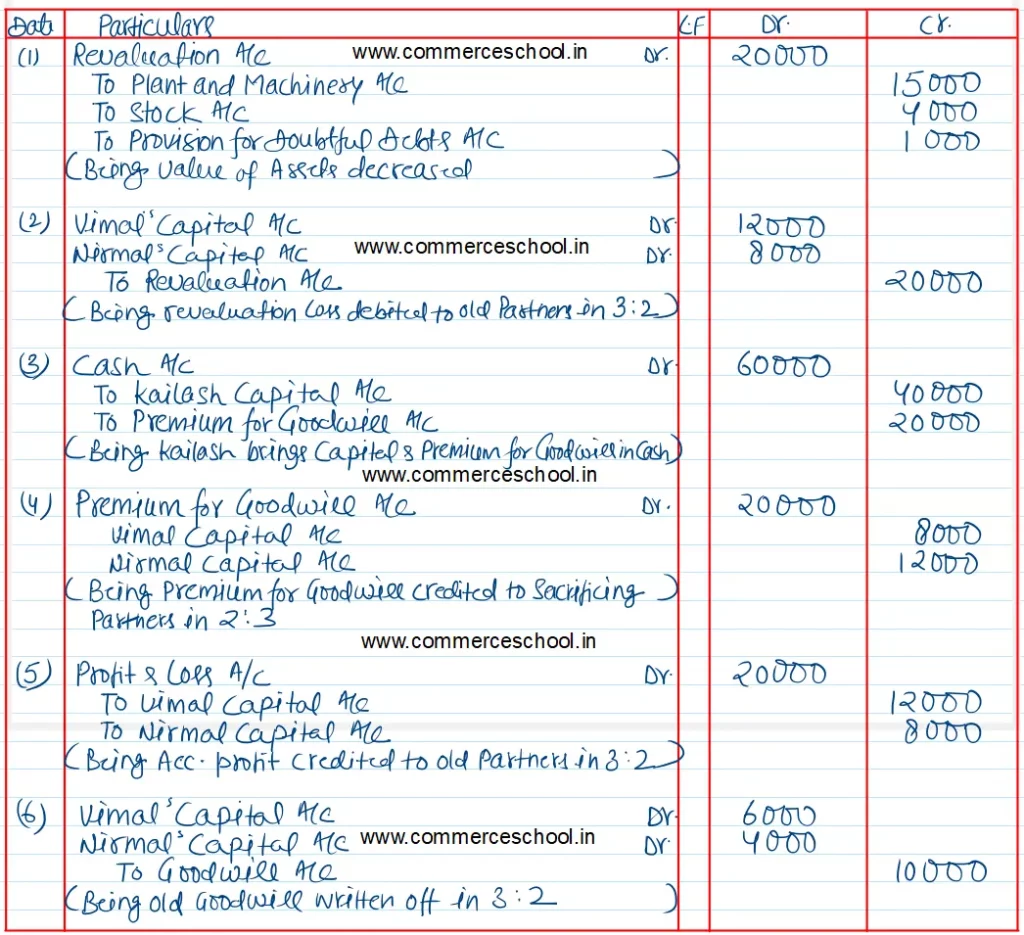

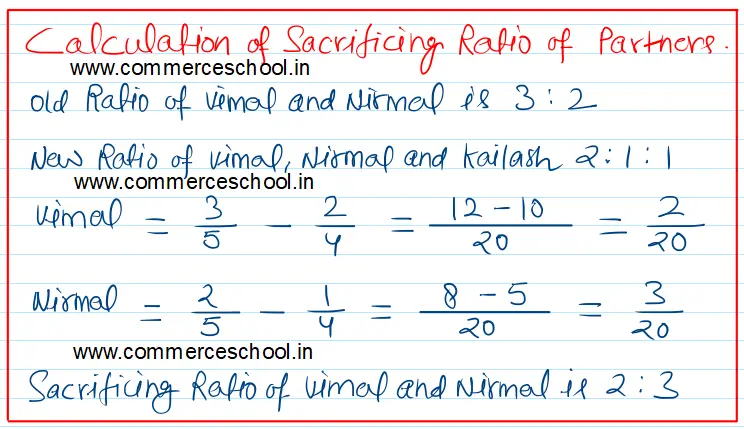

On 1st April, 2024, Kailash agrees to join the business on the following terms and conditions:

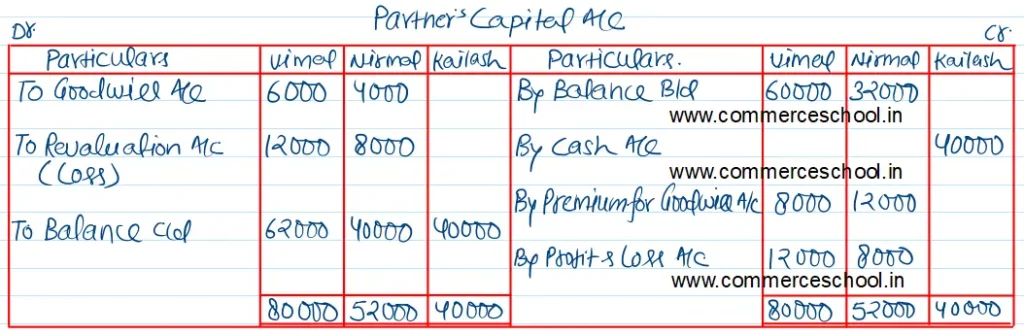

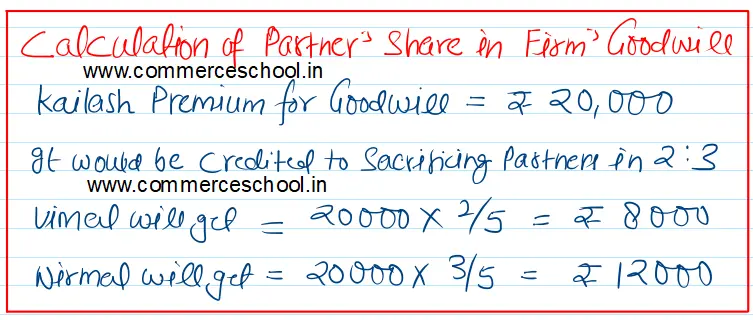

(I) He will introduce ₹ 40,000 as his capital and pay ₹ 20,000 to the existing partners for his share of goodwill.

(ii) The new profit sharing ratio will be 2 : 1 : 1 respectively for Vimal, Nirmal and Kailash.

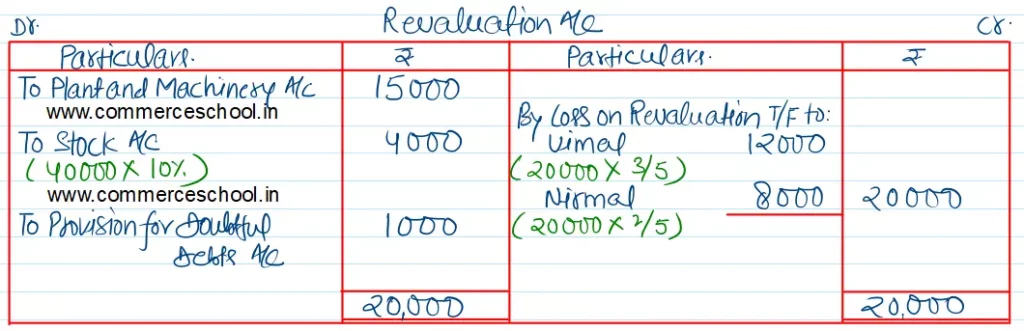

(iii) A revaluation of assets will be made by reducing plant and machinery to ₹ 35,000 and stock by 10%. Provision of ₹ 1,000 is to be created for bad and doubtful debts.

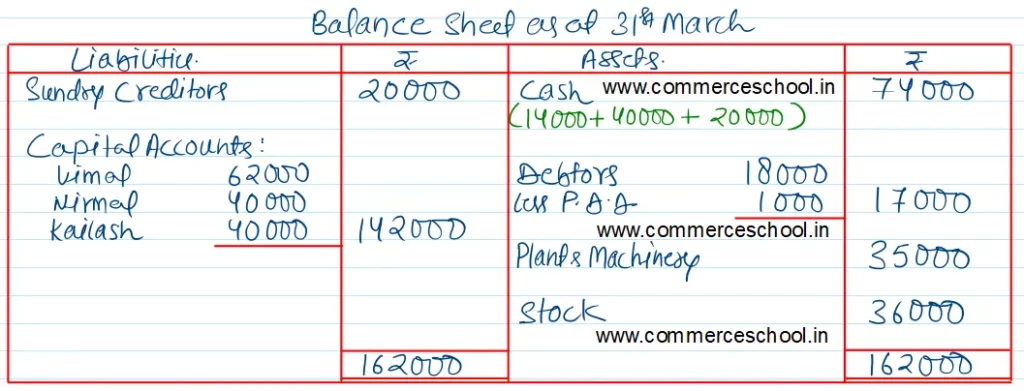

Pass journal entries for the above arrangements and give the balance sheet of the newly constituted firm. Also specify the sacrificing ratio.

[Ans. Sacrifice Ratio 2 : 3; Loss on revaluation ₹ 20,000; Capital Accounts Vimal ₹ 62,000; Nirmal and Kailash ₹ 40,000 each; Cash Balance ₹ 74,000; Balance Sheet total ₹ 1,62,000.]

Solution:-

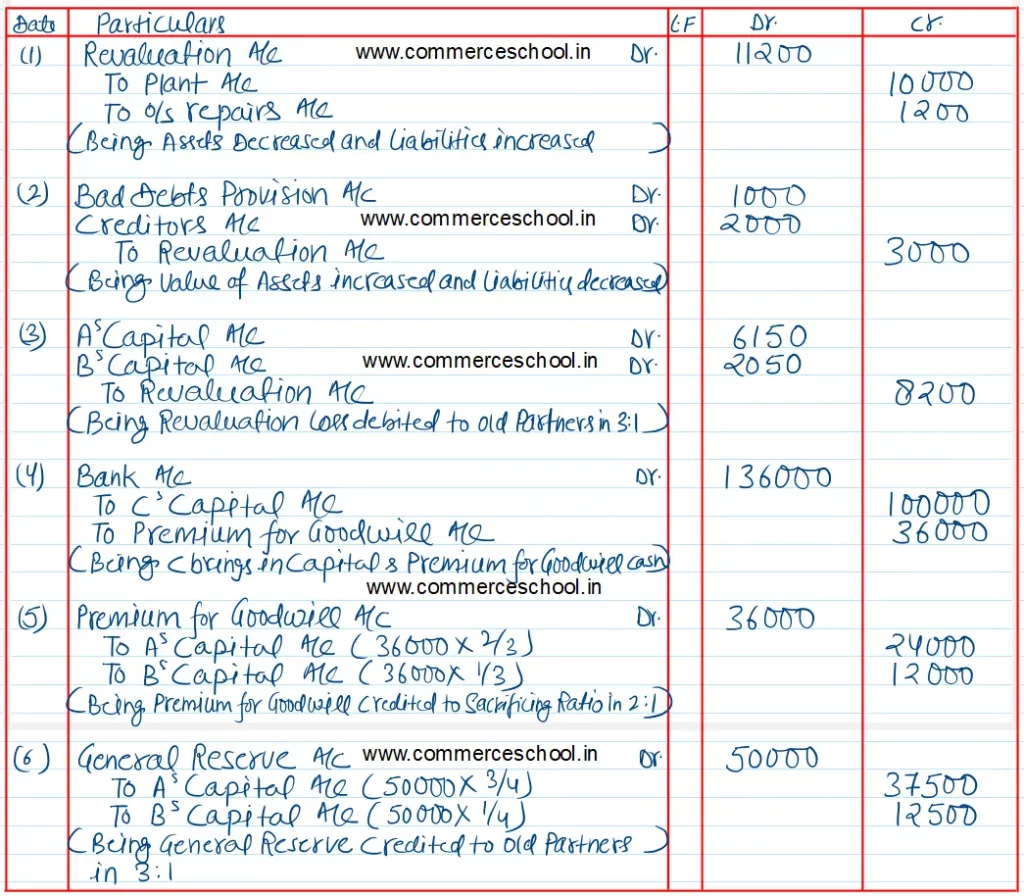

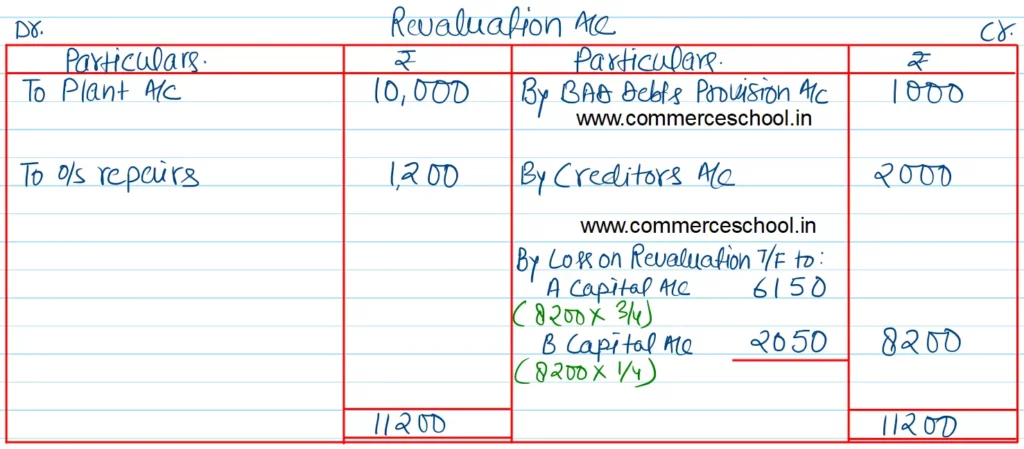

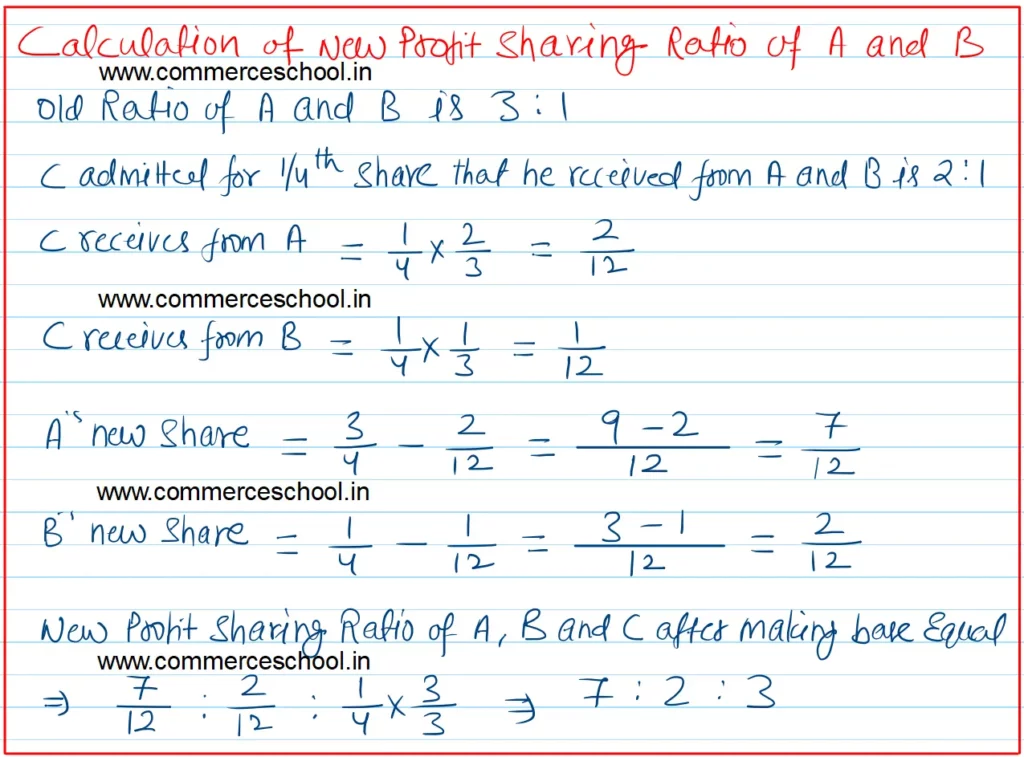

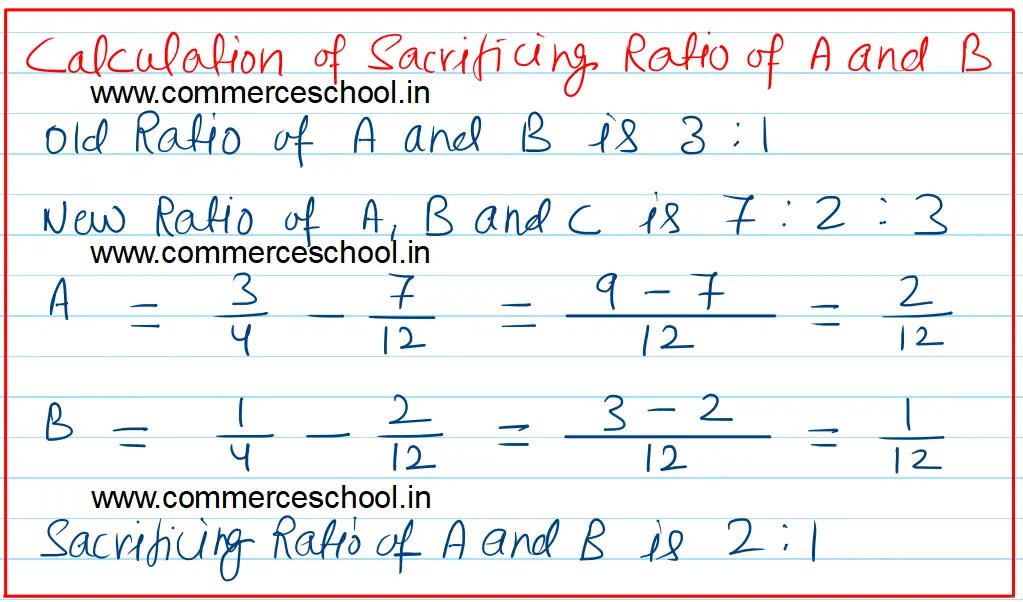

Q. 56 (B). A and B are partners sharing profits in the ratio of 3 : 1. They admitted C as a partner by giving him 1/4th share of profits which he acquired from A and B in the ratio of 2 : 1. C brings in ₹ 1,00,000 as Capital and ₹ 36,000 as goodwill in cash. At the time of admission of C, general reserve appeared in their balance sheet at ₹ 50,000.

Following revaluations are also made:

I. Value of Plant is to be reduced by ₹ 10,000.

II. Bad Debts Provision is to be reduced from ₹ 4,000 to ₹ 3,000.

III. ₹ 2,000 Out of total Creditors of ₹ 20,000 are not to be paid.

IV. There is an outstanding bill for repairs for ₹ 1,200.

Pass necessary journal entries and prepare a Revaluation Account. Also Calculate the new profit sharing ratios.

[Ans. Loss on Revaluation ₹ 8,200; New Ratio 7 : 2 : 3. Premium for goodwill will be distributed in sacrifice ratio, i.e., 2 : 1.]

Solution:-