[CBSE] Q 57 DK Goel Admission of a Partner Solutions Class 12 (2024-25)

The solution of Question number 57 of Admission of a Partner chapter 3 of DK Goel Class 12 CBSE (2024-25)

Q. 57. X and Y share profits in the ratio of 5 : 3. Their balance sheet as at 31st March, 2024 was as follows:

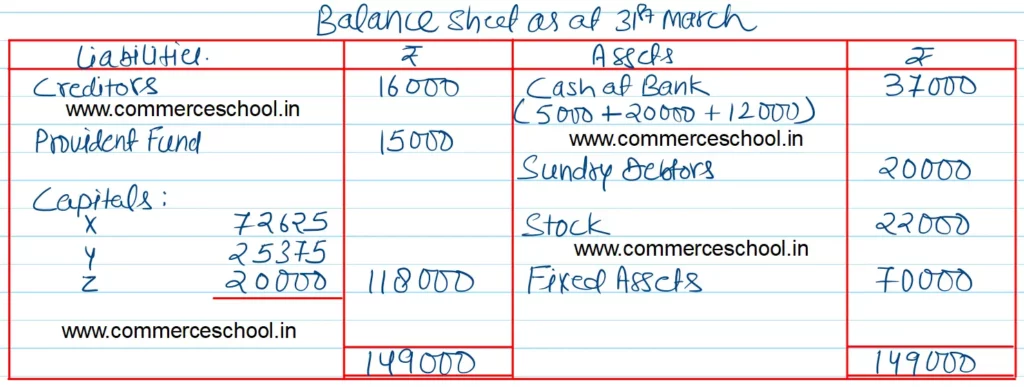

Balance Sheet as at 31st March

| Liabilities | ₹ | Assets | ₹ |

| Creditors | 15,000 | Cash at Bank | 5,000 |

| Provident Fund | 10,000 | Sundry Debtors 20,000 Less: Provision 600 | 19,400 |

| Workmen’s Compensation Reserve | 5,800 | Stock | 25,000 |

| Capitals: X Y | 70,000 31,000 | Fixed Assets | 80,000 |

| Profit & Loss A/c | 2,400 | ||

| 1,31,800 | 1,31,800 |

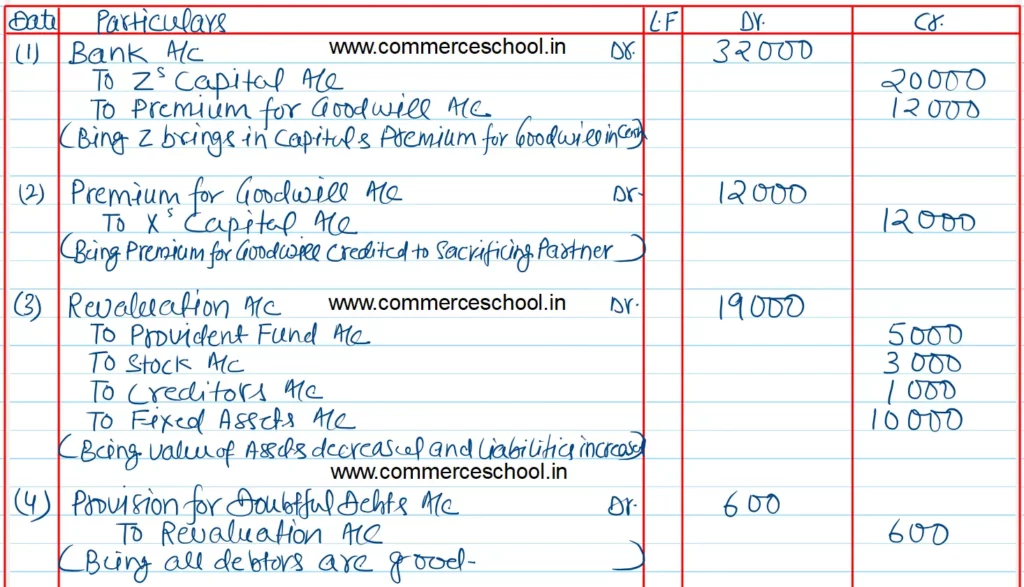

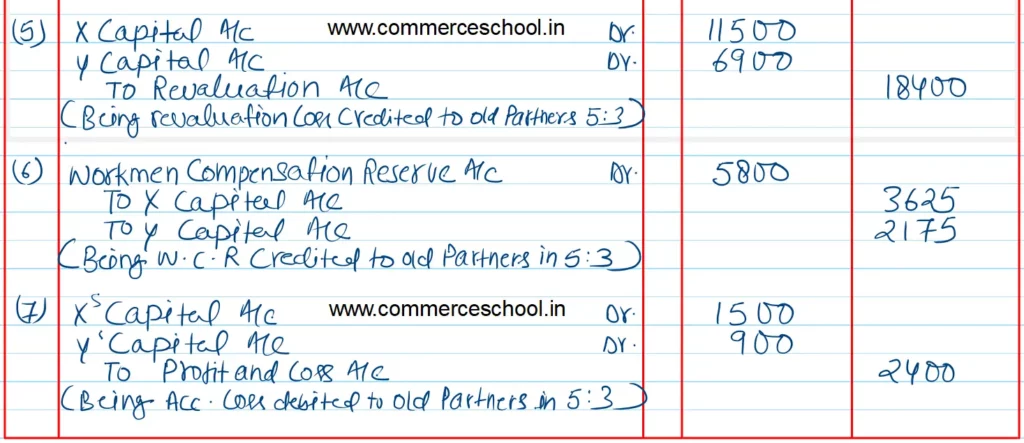

They admit Z into partnership on 1st April, 2024 with 1/8th share in profits. Z brings ₹ 20,000 as his capital and ₹ 12,000 for goodwill in cash. Z acquires his share entirely from X. Following revaluations are also made:

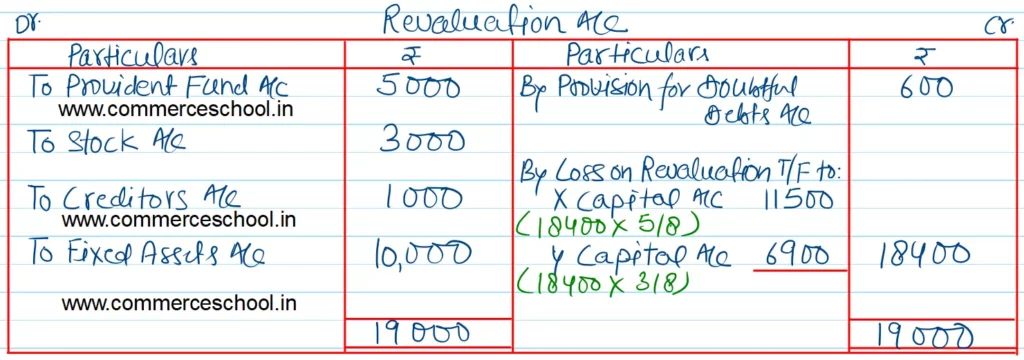

- Provident fund is to be increased by ₹ 5,000.

- Debtors are all good. Therefore, no provision is required on debtors.

- Stock includes ₹ 3,000 for obsolete items.

- Creditors are to be paid ₹ 1,000 more.

- Fixed Assets are to be revalued at ₹ 70,000.

Prepare Journal entries, necessary accounts and new balance sheet Also calculate the new profit sharing raio.

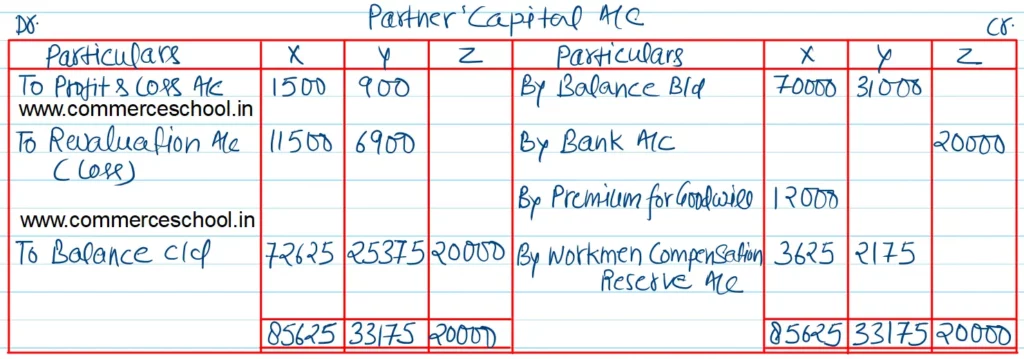

[Ans. Loss on Revaluation ₹ 18,400; Capitals X ₹ 72,625; Y ₹ 25,375; Z ₹ 20,000; B/s total ₹ 1,49,000. New Ratio 4 : 3 : 1.]

Solution:-

Note:-

As only X sacrifices to Z, the premium of goodwill is credited to the partner X.