[CBSE] Q 57 DK Goel Dissolution of a Partnership Firm Solutions Class 12 (2024-25)

Solution of Question number 57 of Dissolution of a Partnership Firm chapter 5 of DK Goel Class 12 CBSE (2024-25)

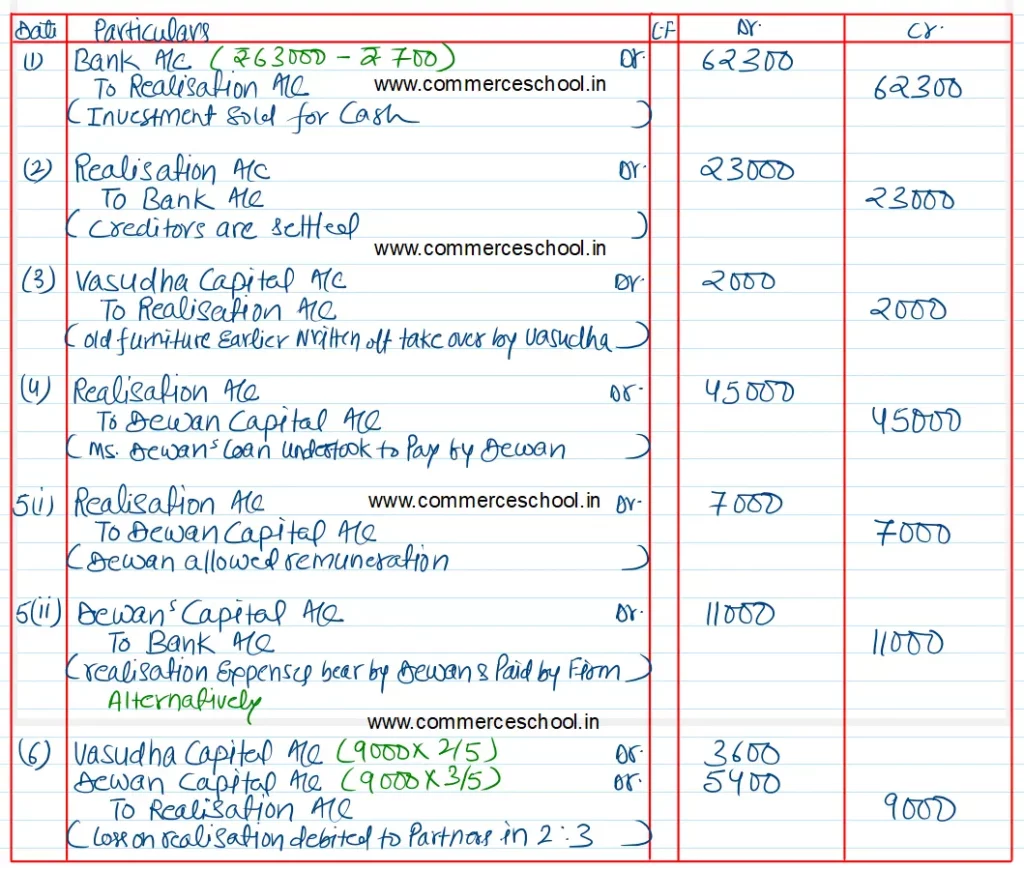

Q. 57. Vasudha and Dewan were partners in a firm sharing profits and losses in the ratio of 2 : 3. The firm was dissolved on 31st March, 2019. After transfer of assets (other than cash) and external liabilities to Realization Account, the following transactions took place:

(1) Investments of the face value of ₹ 60,000 were sold in the open market for ₹ 63,000 for which a commission of ₹ 700 was paid to the broker.

(2) Creditors worth ₹ 65,000 were settled by handing over the entire stock to them along with a payment of ₹ 23,000 by cheque.

(3) There was old furniture which had been completely written off from the books of the firm. It was taken over by Vasudha at ₹ 2,000.

(4) Dewan undertook to pay Ms. Dewan’s loan of ₹ 45,000.

(5) Dewan was appointed to look after the process of dissolution for which he was allowed a remuneration of ₹ 7,000. He agreed to bear the dissolution expenses. Actual expenses incurred by Dewan were ₹ 11,000, which were paid by the firm.

(6) Loss on realisation amounted to ₹ 9,000.

Pass the necessary journal entries to record the above transactions in the books of the firm.

Solution:-

Here are the solutions of Dissolution of a Partnership Firm chapter 5 of DK Goel Class 12 CBSE (2024-25)

| S.N | Questions | |

| 1 | Question – 1 | |

| 2 | Question – 2 | |

| 3 | Question – 3 | |

| 4 | Question – 4 | |

| 5 | Question – 5 | |

| 6 | Question – 6 | |

| 7 | Question – 7 | |

| 8 | Question – 8 | |

| 9 | Question – 9 | |

| 10 | Question – 10 |

| S.N | Questions | |

| 11 | Question – 11 | |

| 12 | Question – 12 | |

| 13 | Question – 13 | |

| 14 | Question – 14 | |

| 15 | Question – 15 | |

| 16 | Question – 16 | |

| 17 | Question – 17 | |

| 18 | Question – 18 | |

| 19 | Question – 19 | |

| 20 | Question – 20 |

| S.N | Questions | |

| 21 | Question – 21 | |

| 22 | Question – 22 | |

| 23 | Question – 23 | |

| 24 | Question – 24 | |

| 25 | Question – 25 | |

| 26 | Question – 26 | |

| 27 | Question – 27 | |

| 28 | Question – 28 | |

| 29 | Question – 29 | |

| 30 | Question – 30 |

| S.N | Questions | |

| 31 | Question – 31 | |

| 32 | Question – 32 | |

| 33 | Question – 33 | |

| 34 | Question – 34 | |

| 35 | Question – 35 | |

| 36 | Question – 36 | |

| 37 | Question – 37 | |

| 38 | Question – 38 | |

| 39 | Question – 39 | |

| 40 | Question – 40 |

| S.N | Questions | |

| 41 | Question – 41 | |

| 42 | Question – 42 | |

| 43 | Question – 43 | |

| 44 | Question – 44 | |

| 45 | Question – 45 | |

| 46 | Question – 46 | |

| 47 | Question – 47 | |

| 48 | Question – 48 | |

| 49 | Question – 49 | |

| 50 | Question – 50 |

very helpful