[CBSE] Q 58 DK Goel Dissolution of a Partnership Firm Solutions Class 12 (2024-25)

Solution of Question number 58 of Dissolution of a Partnership Firm chapter 5 of DK Goel Class 12 CBSE (2024-25)

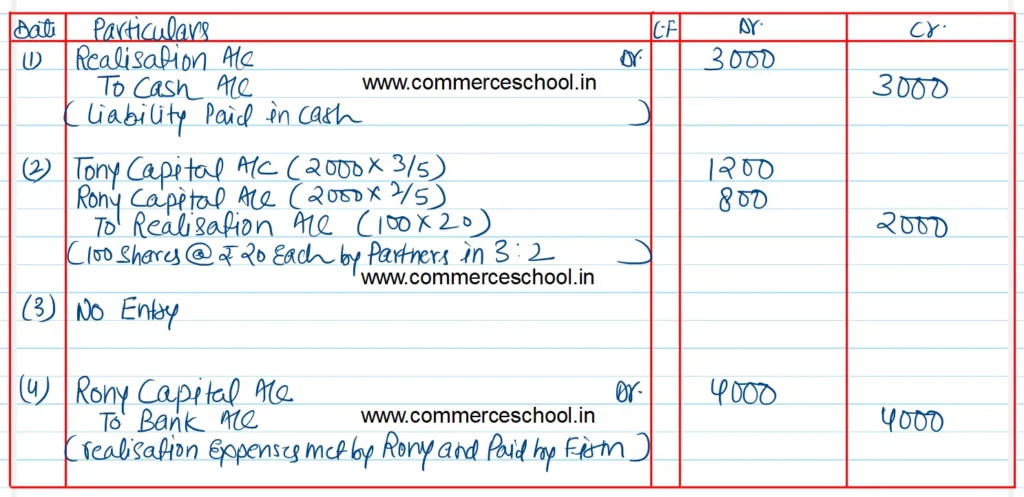

Q. 58. Pass the necessary journal entries for the following transactions on the dissolution of the partnership firm of Tony and Rony after the various assets (other than cash) and external liabilities have been transferred to Realization Account:

(i) An unrecorded asset of ₹ 2,000 and cash ₹ 3,000 was paid for liability of ₹ 6,000 in full settlement.

(ii) 100 shares of ₹ 10 each have been taken over by partners at market value of ₹ 20 per share in their profit sharing ratio, which is 3 : 2.

(iii) Stock of ₹ 30,000 was taken over by a creditor of ₹ 40,000 at a discount of 30% in full settlement.

(iv) Expenses of realisation ₹ 4,000 were to be borne by Rony. Rony used the firm’s cash for paying these expenses.

Solution:-

Here are the solutions of Dissolution of a Partnership Firm chapter 5 of DK Goel Class 12 CBSE (2024-25)

| S.N | Questions | |

| 1 | Question – 1 | |

| 2 | Question – 2 | |

| 3 | Question – 3 | |

| 4 | Question – 4 | |

| 5 | Question – 5 | |

| 6 | Question – 6 | |

| 7 | Question – 7 | |

| 8 | Question – 8 | |

| 9 | Question – 9 | |

| 10 | Question – 10 |

| S.N | Questions | |

| 11 | Question – 11 | |

| 12 | Question – 12 | |

| 13 | Question – 13 | |

| 14 | Question – 14 | |

| 15 | Question – 15 | |

| 16 | Question – 16 | |

| 17 | Question – 17 | |

| 18 | Question – 18 | |

| 19 | Question – 19 | |

| 20 | Question – 20 |

| S.N | Questions | |

| 21 | Question – 21 | |

| 22 | Question – 22 | |

| 23 | Question – 23 | |

| 24 | Question – 24 | |

| 25 | Question – 25 | |

| 26 | Question – 26 | |

| 27 | Question – 27 | |

| 28 | Question – 28 | |

| 29 | Question – 29 | |

| 30 | Question – 30 |

| S.N | Questions | |

| 31 | Question – 31 | |

| 32 | Question – 32 | |

| 33 | Question – 33 | |

| 34 | Question – 34 | |

| 35 | Question – 35 | |

| 36 | Question – 36 | |

| 37 | Question – 37 | |

| 38 | Question – 38 | |

| 39 | Question – 39 | |

| 40 | Question – 40 |

| S.N | Questions | |

| 41 | Question – 41 | |

| 42 | Question – 42 | |

| 43 | Question – 43 | |

| 44 | Question – 44 | |

| 45 | Question – 45 | |

| 46 | Question – 46 | |

| 47 | Question – 47 | |

| 48 | Question – 48 | |

| 49 | Question – 49 | |

| 50 | Question – 50 |