[CBSE] Q. 58 Solution of Admission of Partner TS Grewal Class 12 (2024-25)

Solution to Question number 58 of the Admission of Partner chapter 5 of TS Grewal Book 2024-25 Edition CBSE Board?

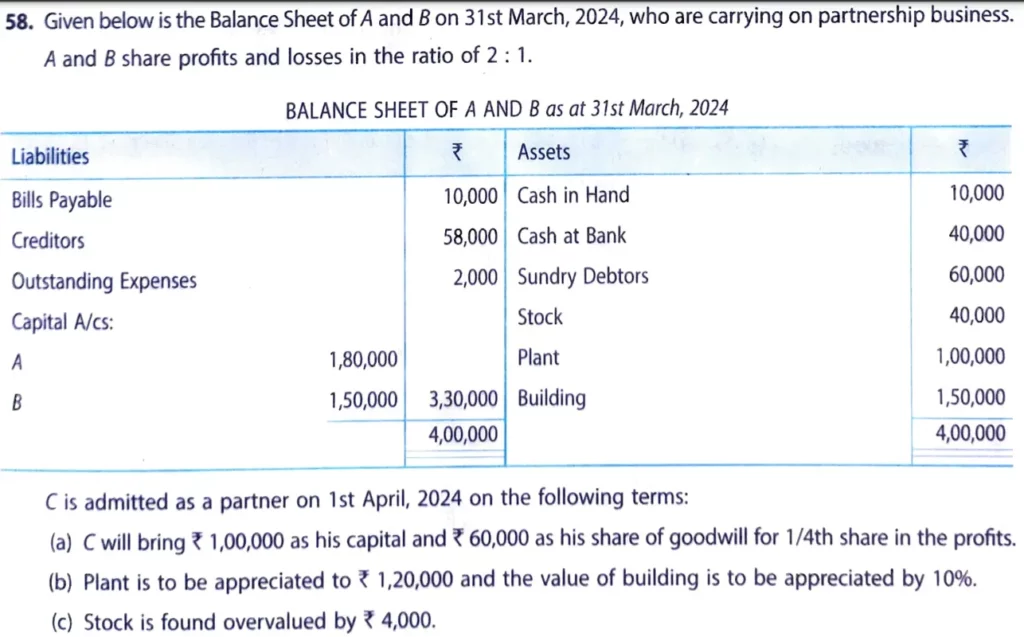

Given below is the Balance Sheet of A and B on 31st March, 2023, who are carrying on partnership business. A and B share profits and losses in the ratio of 2 : 1.

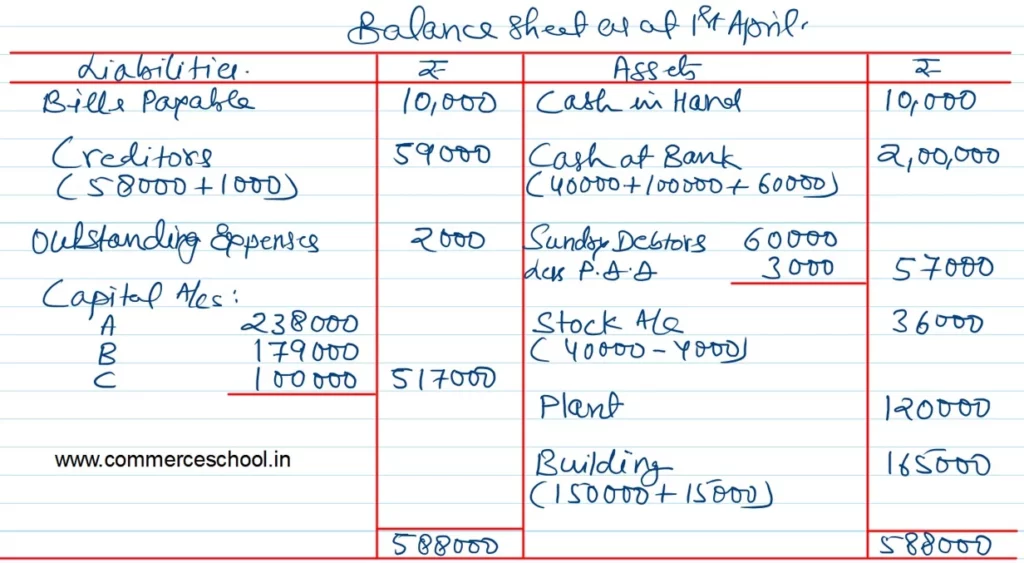

Balance sheet of A and B as at 31st March, 2023

| Liabilities | ₹ | Assets | ₹ |

| Bills Payable Creditors Outstanding Expenses Capital A/cs: A B | 10,000 58,000 2,000 1,80,000 1,50,000 | Cash in Hand Cash at Bank Sundry Debtors Stock Plant Building | 10,000 40,000 60,000 40,000 1,00,000 1,50,000 |

| 4,00,000 | 4,00,000 |

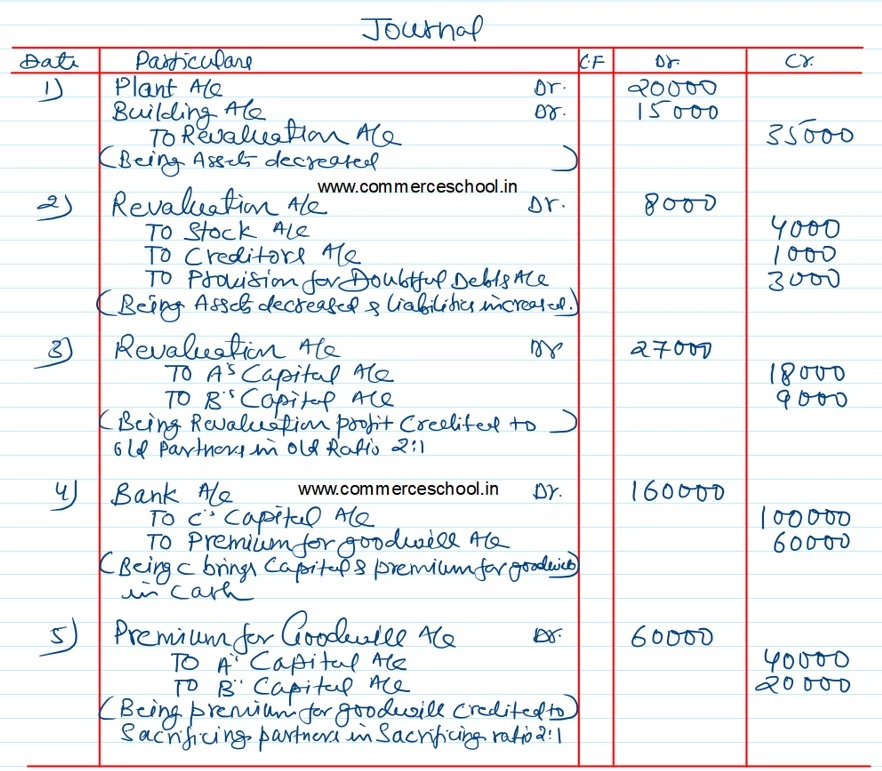

C is admitted as a partner on 1st April, 2023 on the following terms:

(a) C will bring ₹ 1,00,000 as his capital and ₹ 60,000 as his share of goodwill for 1/4th share in the profits.

(b) Plant is to be appreciated to ₹ 1,20,000 and the value of building is to be appreciated by 10%.

(c) Stock is found overvalued by ₹ 4,000.

(d) A provision for doubtful debts is to be created at 5% of sundry debtors.

(e) Creditors were unrecorded to the extent of ₹ 1,000.

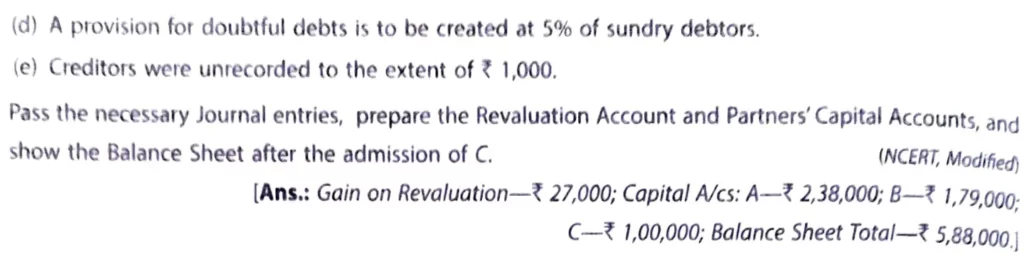

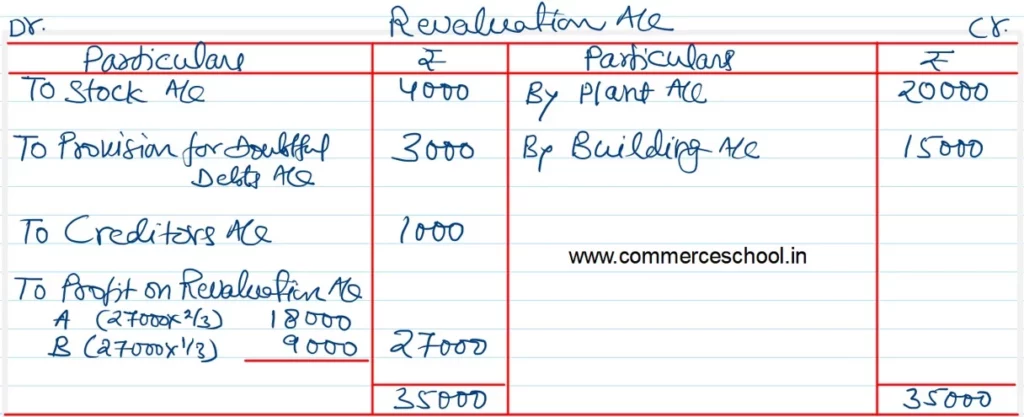

Pass the necessary Journal entries, prepare the Revaluation Account and Partner’s Capital Accounts and Show the Balance Sheet after the admission of C.

[Ans.: Gain on Revaluation – ₹ 27,000; Capital A/cs: A – ₹ 2,38,000; B – ₹ 1,79,000; C – ₹ 1,00,000; Balance Sheet Total – ₹ 5,88,000.]

Solution:-

Here is the list of all Solutions of Admission of Partners of TS Grewal class 12 CBSE 2024-25.

| S.N | Questions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Questions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Questions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Questions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |

| 40 | Question – 40 |

| S.N | Questions |

| 41 | Question – 41 |

| 42 | Question – 42 |

| 43 | Question – 43 |

| 44 | Question – 44 |

| 45 | Question – 45 |

| 46 | Question – 46 |

| 47 | Question – 47 |

| 48 | Question – 48 |

| 49 | Question – 49 |

| 50 | Question – 50 |

| S.N | Questions |

| 51 | Question – 51 |

| 52 | Question – 52 |

| 53 | Question – 53 |

| 54 | Question – 54 |

| 55 | Question – 55 |

| 56 | Question – 56 |

| 57 | Question – 57 |

| 58 | Question – 58 |

| 59 | Question – 59 |

| 60 | Question – 60 |

| S.N | Questions |

| 61 | Question – 61 |

| 62 | Question – 62 |

| 63 | Question – 63 |

| 64 | Question – 64 |

| 65 | Question – 65 |

| 66 | Question – 66 |

| 67 | Question – 67 |

| 68 | Question – 68 |

| 69 | Question – 69 |

| 70 | Question – 70 |

| S.N | Questions |

| 71 | Question – 71 |

| 72 | Question – 72 |

| 73 | Question – 73 |

| 74 | Question – 74 |

| 75 | Question – 75 |

| 76 | Question – 76 |

| 77 | Question – 77 |

| 78 | Question – 78 |