[CBSE] Q. 59 Solution of Fundamentals of Partnership Firms TS Grewal Book (2023-24)

Solution of Question number 59 of the Fundamentals of partnership firm chapter TS Grewal Book CBSE 2023-24 Edition.

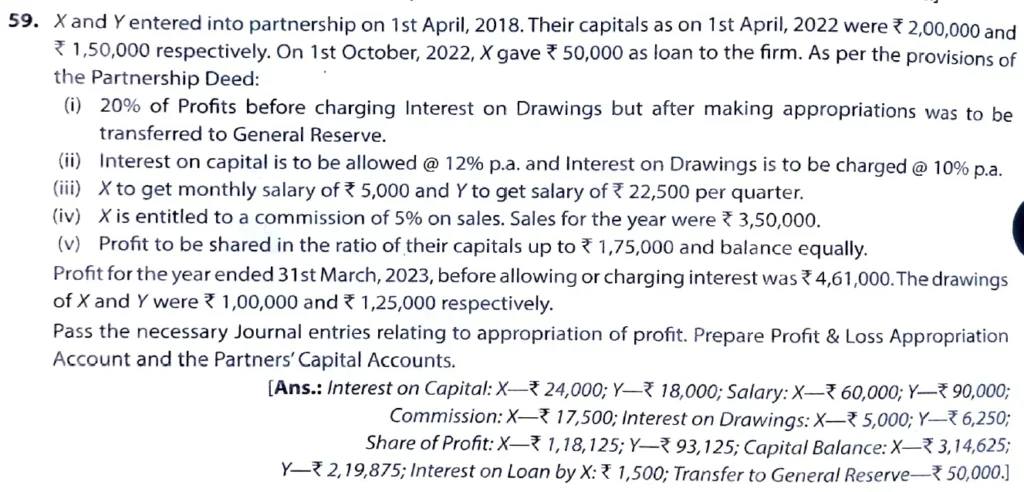

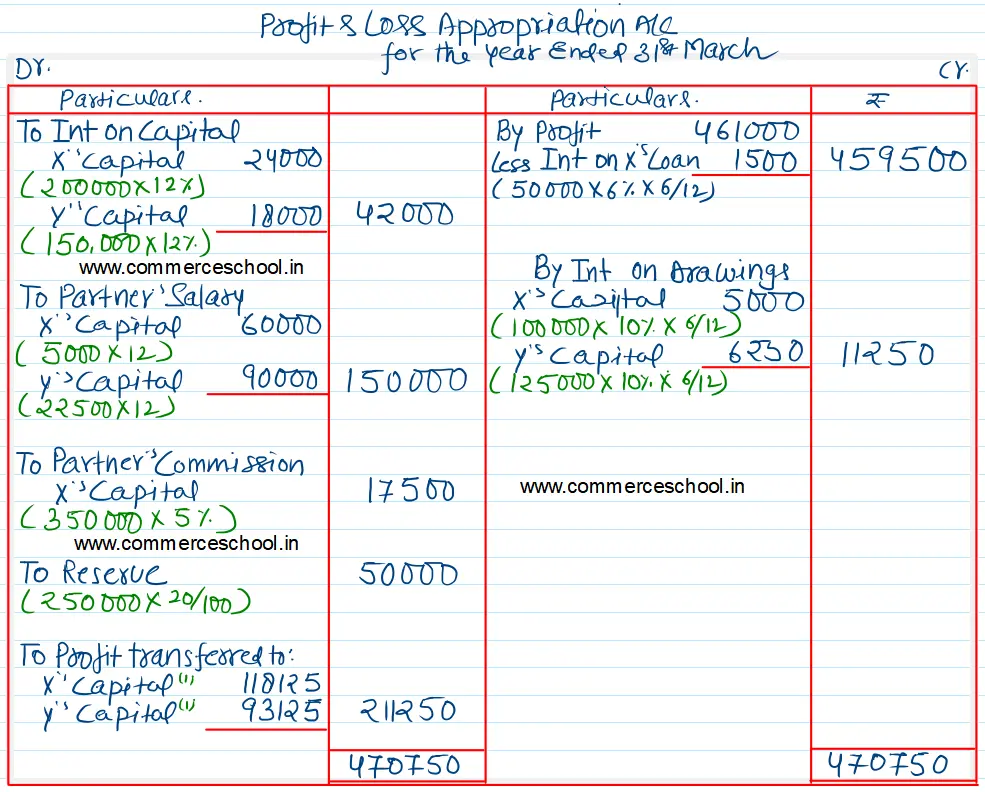

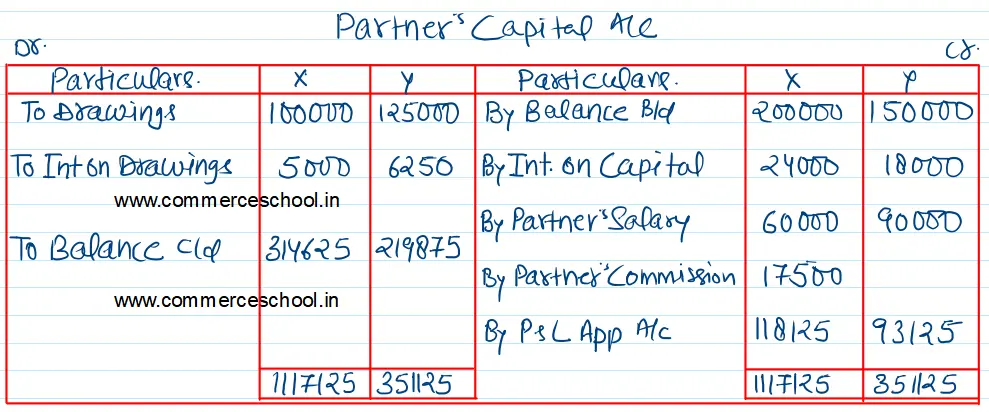

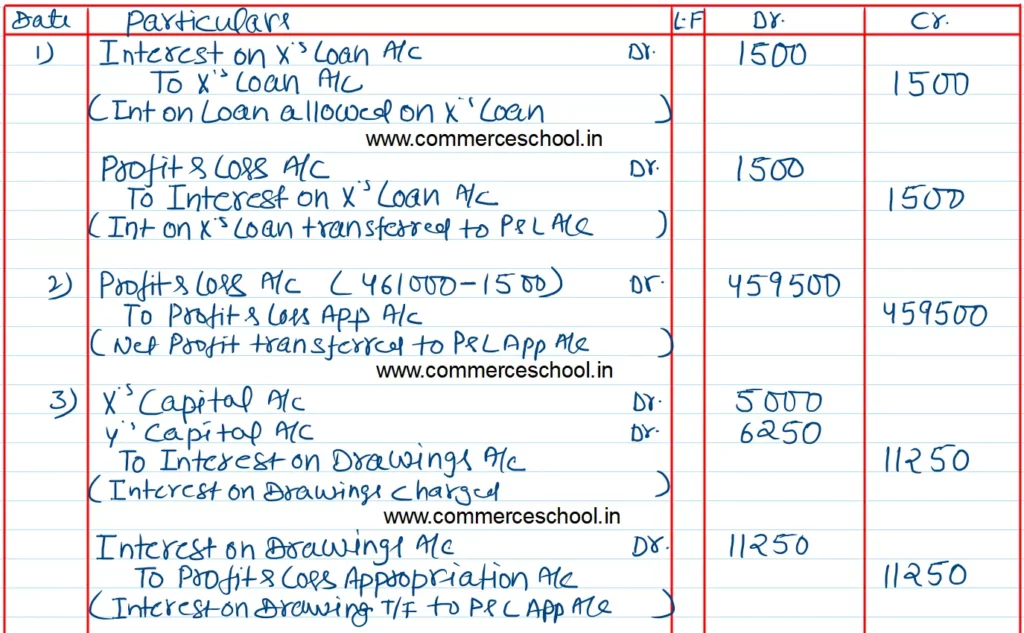

X and Y entered into a partnership on 1st April 2018. Their capitals as on 1st April 2022 were ₹ 2,00,000 and ₹ 1,50,000 respectively. On 1st October 2022, X gave ₹ 50,000 as a loan to the firm. As per the provisions of the Partnership Deed:

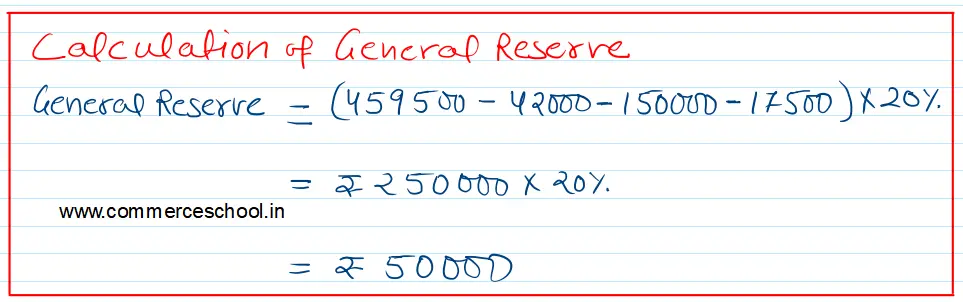

(i) 20% of Profits before charging Interest on Drawings but after making appropriations was to be transferred to General Reserve.

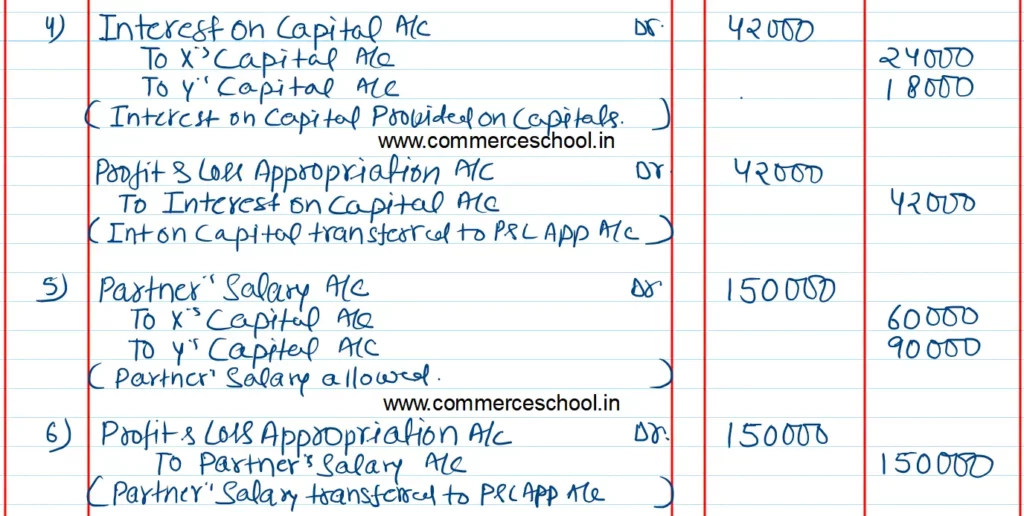

(ii) Interest on capital is to be allowed @ 12% p.a. and Interest on Drawings is to be charged @ 10% p.a.

(iii) X to get a monthly salary of ₹ 5,000 and Y to get a salary of ₹ 22,500 per quarter.

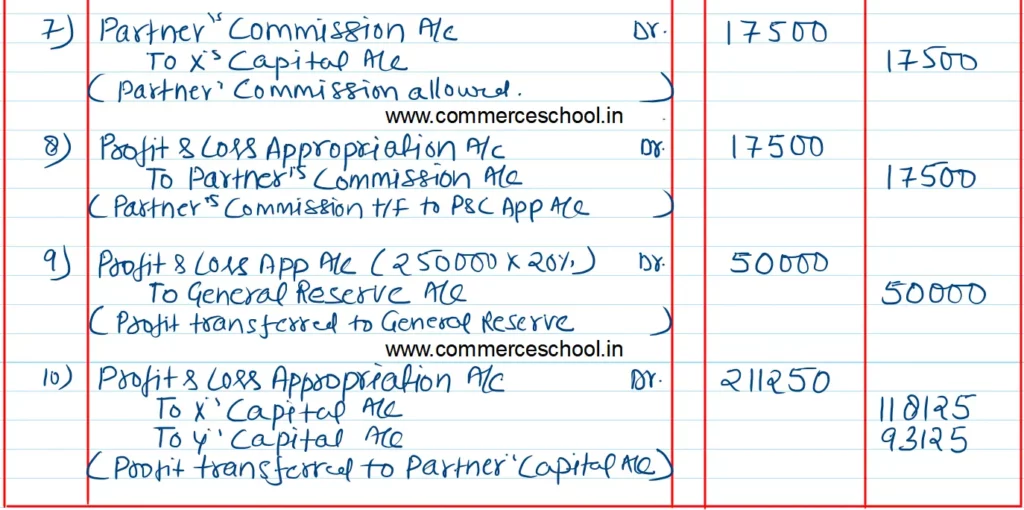

(iv) X is entitled to a commission of 5% on sales. Sales for the year were ₹ 3,50,000.

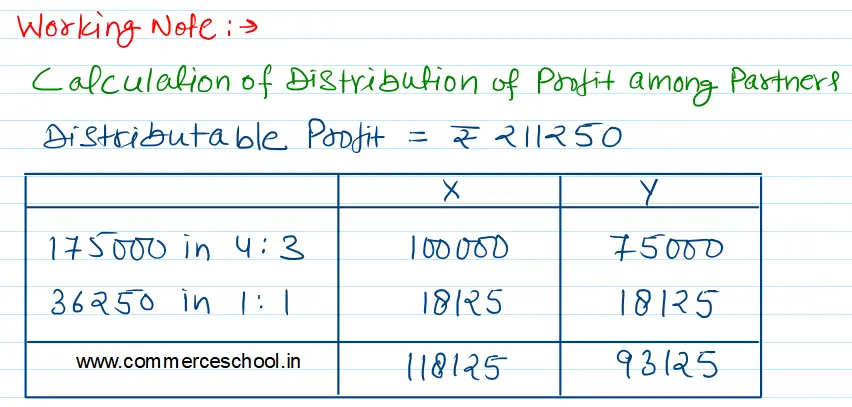

(v) Profit to be shared in the ratio of their capitals up to ₹ 1,75,000 and balance equally.

Profit for the year ended 31st March 2023, before allowing or charging interest was ₹ 4,61,000. The drawings of X and Y were ₹ 1,00,000 and ₹ 1,25,000 respectively.

Pass the necessary Journal entries relating to the appropriation of profit. Prepare the Profit and Loss Appropriation Account and the Partner’s Capital Accounts.

[Ans: Interest on Capital: X – ₹ 24,000; Y – ₹ 18,000; Salary: X – ₹ 60,000; Y – ₹ 90,000; Commission X – ₹ 17,500; Interest on Drawings: X – ₹ 5,000; Y – ₹ 6,250; Share of Profit: X – ₹ 1,18,125; Y – ₹ 93,125; Capital Balance: X – ₹ 3,14,625; Y – ₹ 2,19,875; Interest on Loan by X: ₹ 1,500; Transfer to General Reserve – ₹ 50,000]

Solution:-

Here is the list of all Solutions.

| S.N | Questions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Questions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Questions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Questions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |

| 40 | Question – 40 |

| S.N | Questions |

| 41 | Question – 41 |

| 42 | Question – 42 |

| 43 | Question – 43 |

| 44 | Question – 44 |

| 45 | Question – 45 |

| 46 | Question – 46 |

| 47 | Question – 47 |

| 48 | Question – 48 |

| 49 | Question – 49 |

| 50 | Question – 50 |

| S.N | Questions |

| 51 | Question – 51 |

| 52 | Question – 52 |

| 53 | Question – 53 |

| 54 | Question – 54 |

| 55 | Question – 55 |

| 56 | Question – 56 |

| 57 | Question – 57 |

| 58 | Question – 58 |

| 59 | Question – 59 |

| 60 | Question – 60 |

| S.N | Questions |

| 61 | Question – 61 |

| 62 | Question – 62 |

| 63 | Question – 63 |

| 64 | Question – 64 |

| 65 | Question – 65 |

| 66 | Question – 66 |

| 67 | Question – 67 |

| 68 | Question – 68 |

| 69 | Question – 69 |

| 70 | Question – 70 |

| S.N | Questions |

| 71 | Question – 71 |

| 72 | Question – 72 |

| 73 | Question – 73 |

| 74 | Question – 74 |

| 75 | Question – 75 |

| 76 | Question – 76 |

| 77 | Question – 77 |

| 78 | Question – 78 |

| 79 | Question – 79 |

| 80 | Question – 80 |

| S.N | Questions |

| 81 | Question – 81 |

| 82 | Question – 82 |

| 83 | Question – 83 |

| 84 | Question – 84 |

| 85 | Question – 85 |

| 86 | Question – 86 |

| 87 | Question – 87 |

| 88 | Question – 88 |

| 89 | Question – 89 |

| 90 | Question – 90 |

| S.N | Questions |

| 91 | Question – 91 |

| 92 | Question – 92 |

| 93 | Question – 93 |

| 94 | Question – 94 |

| 95 | Question – 95 |