[CBSE] Q. 6 Death of Partner Solution TS Grewal Class 12 (2023-24)

Solution of Question number 6 of the Death of Partner Chapter of TS Grewal Book 2023-24 Edition CBSE Board.

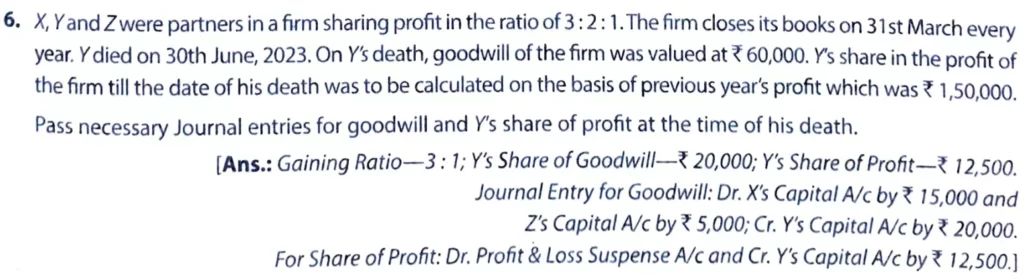

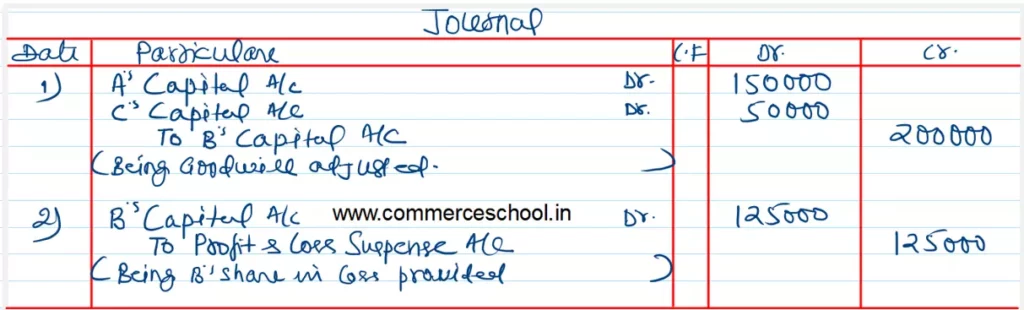

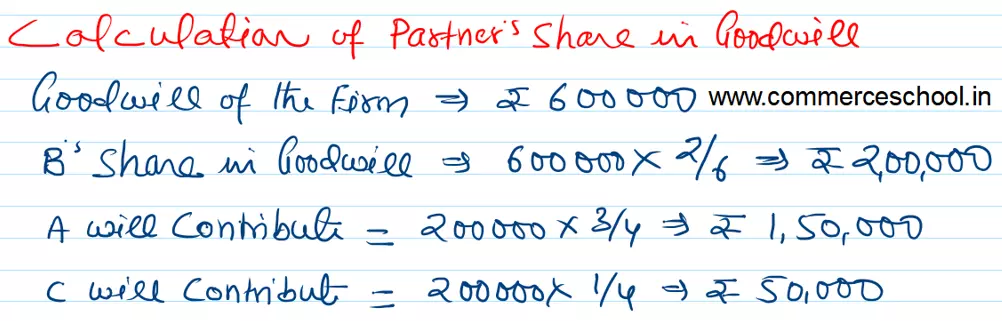

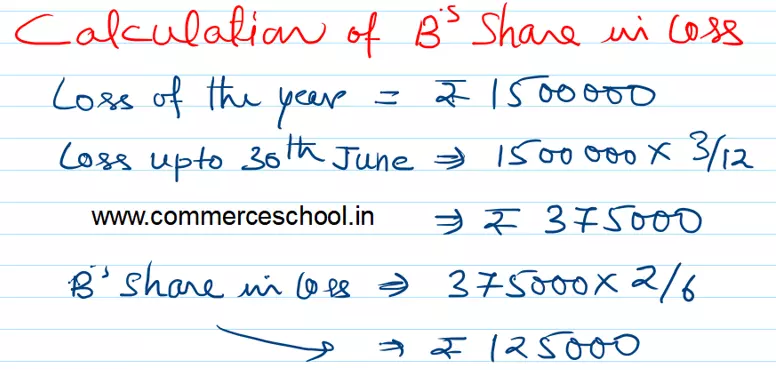

X, Y and Z were partners in a firm sharing profit in the ratio of 3 : 2 : 1. The firm closes its books on 31st March every year. Y died on 30th June, 2023. On Y’s death, goodwill of the firm was valued at ₹ 60,000. Y’s share in the profit of the firm till the date of his death was to be calculated on the basis of previous year’s profit which was ₹ 1,50,000. Pass necessary Journal entries for goodwill and Y’s share at the time of his death.

[Ans.: Gaining Ratio – 3 : 1; Y’s share of Goodwill – ₹ 20,000; Y’s share of Profit – ₹ 12,500. Journal Entry for Goodwill: Dr. X’s Capital A/c by ₹ 15,000 and Z’s Capital A/c by ₹ 5,000; Cr. Y’s Capital A/c by ₹ 20,000. For Share of Profit: Dr. Profit & Loss Suspense A/c and Cr. Y’s Capital A/c by ₹ 12,500.]

Solution:-

Solutions of Death of Partner chapter 7 of TS Grewal Book class 12 Accountancy 2023-24 CBSE Board

| S.N | Questions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Questions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Questions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Questions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |