[CBSE] Q 6 DK Goel Dissolution of a Partnership Firm Solutions Class 12 (2024-25)

Solution of Question number 6 of Dissolution of a Partnership Firm chapter 5 of DK Goel Class 12 CBSE (2024-25)

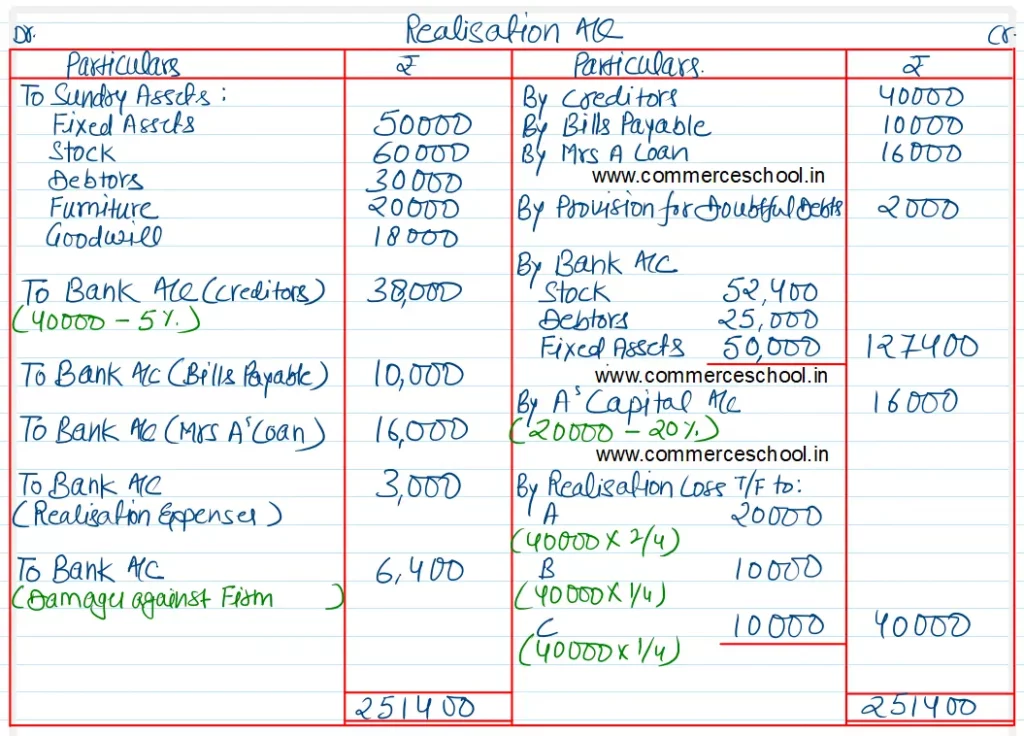

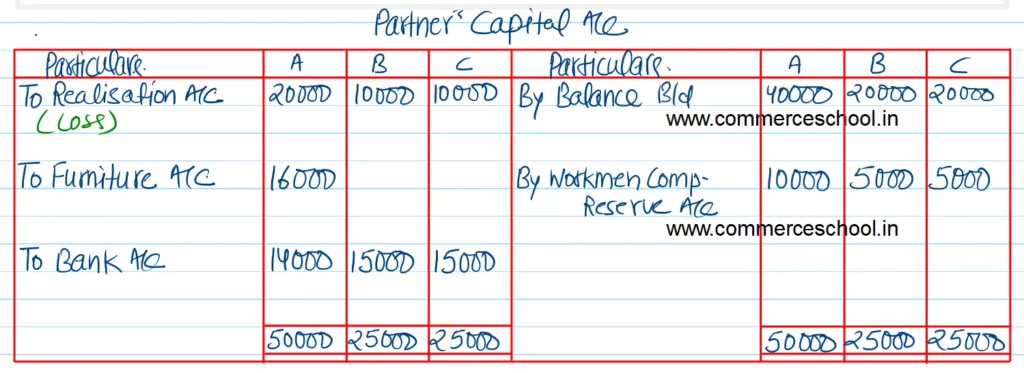

A, B and C were in partnership sharing profits in the ratio of 2 : 1 : 1. Their Balance Sheet showed the following position on the date of dissolution:

| Liabilities | ₹ | Assets | ₹ |

| Creditors | 40,000 | Fixed Assets | 50,000 |

| Bills Payable | 10,000 | Stock | 60,000 |

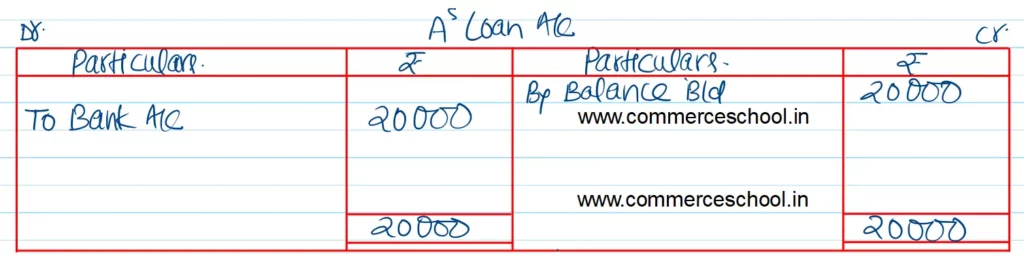

| A’s Loan | 20,000 | Debtors 30,000 Less: Provision 2,000 | 28,000 |

| Mrs. A’s Loan | 16,000 | Furniture | 20,000 |

| Workmen Compensation Reserve | 20,000 | Goodwill | 18,000 |

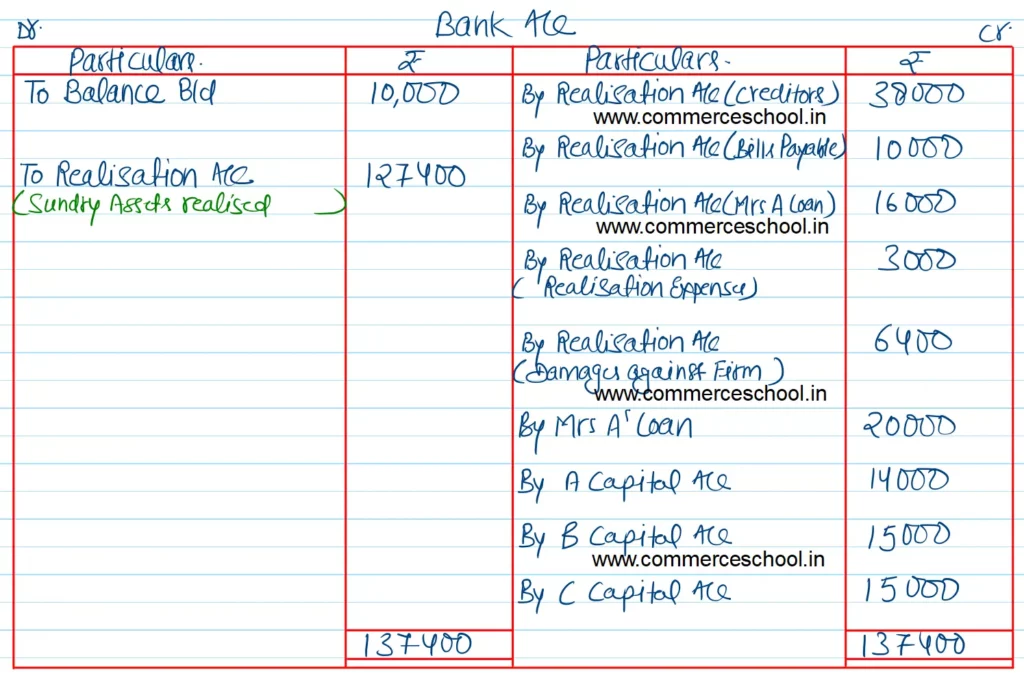

| Capitals: A B C | 40,000 20,000 20,000 | Cash at Bank | 10,000 |

| 1,86,000 | 1,86,000 |

I. A agreed to take over furniture at 20% less than the book value.

II. Stock was realised for ₹ 52,400.

III. Bad Debts amounted to ₹ 5,000.

IV. Expenses of realisation were ₹ 3,000. Creditors were paid at a discount of 5%.

V. There was a claim of ₹ 6,400 for damages against the firm. It had to be paid.

Prepare necessary accounts.

[Ans. Loss on Realisation ₹ 40,000; Final Payments: A ₹ 14,000; B ₹ 15,000; C ₹ 15,000; Total of Bank A/c ₹ 1,37,400.]

Hints:

(1) Nothing is mentioned in the question about the payment of B/P and Mrs. A’s Loan. It will be assumed that these will be paid in full.

(2) Nothing is mentioned in the question about the realisaiton of fixed assets. It will be assumed that it has realised at the book value given in the Balance Sheet i.e., at ₹ 50,000.

Solution:-

Here are the solutions of Dissolution of a Partnership Firm chapter 5 of DK Goel Class 12 CBSE (2024-25)

| S.N | Questions | |

| 1 | Question – 1 | |

| 2 | Question – 2 | |

| 3 | Question – 3 | |

| 4 | Question – 4 | |

| 5 | Question – 5 | |

| 6 | Question – 6 | |

| 7 | Question – 7 | |

| 8 | Question – 8 | |

| 9 | Question – 9 | |

| 10 | Question – 10 |

| S.N | Questions | |

| 11 | Question – 11 | |

| 12 | Question – 12 | |

| 13 | Question – 13 | |

| 14 | Question – 14 | |

| 15 | Question – 15 | |

| 16 | Question – 16 | |

| 17 | Question – 17 | |

| 18 | Question – 18 | |

| 19 | Question – 19 | |

| 20 | Question – 20 |

| S.N | Questions | |

| 21 | Question – 21 | |

| 22 | Question – 22 | |

| 23 | Question – 23 | |

| 24 | Question – 24 | |

| 25 | Question – 25 | |

| 26 | Question – 26 | |

| 27 | Question – 27 | |

| 28 | Question – 28 | |

| 29 | Question – 29 | |

| 30 | Question – 30 |

| S.N | Questions | |

| 31 | Question – 31 | |

| 32 | Question – 32 | |

| 33 | Question – 33 | |

| 34 | Question – 34 | |

| 35 | Question – 35 | |

| 36 | Question – 36 | |

| 37 | Question – 37 | |

| 38 | Question – 38 | |

| 39 | Question – 39 | |

| 40 | Question – 40 |