[CBSE] Q. 60 DK Goel Fundamentals of Partnership [2024-25]

Solution of Question Number 60 (A), 60 (B), 60 (C) of the Fundamentals of partnership firm DK Goel CBSE Board (2024-25).

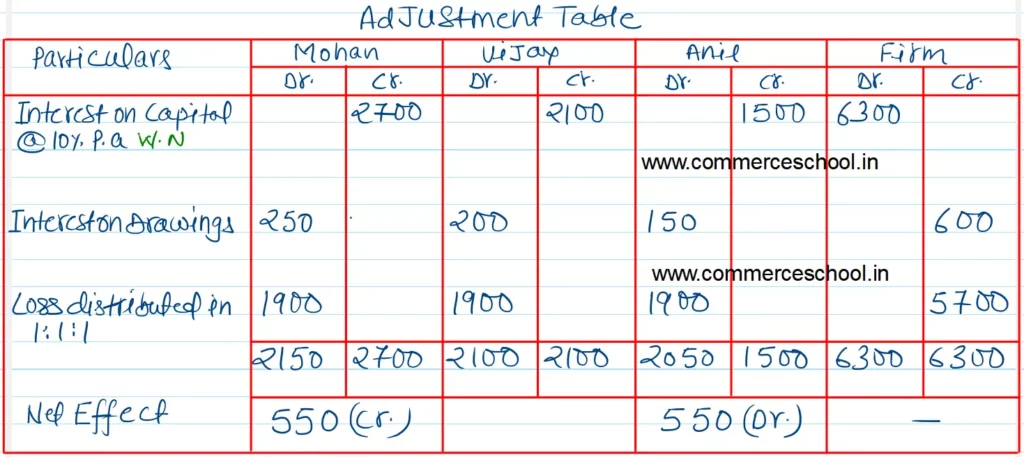

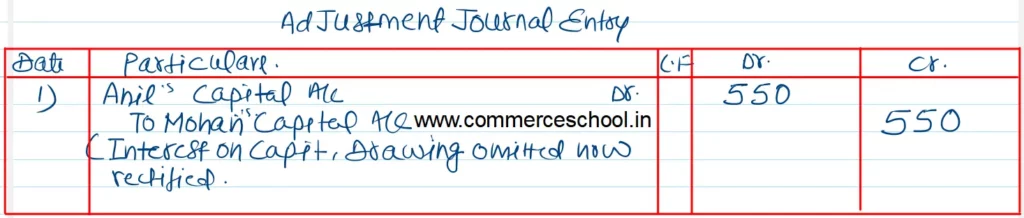

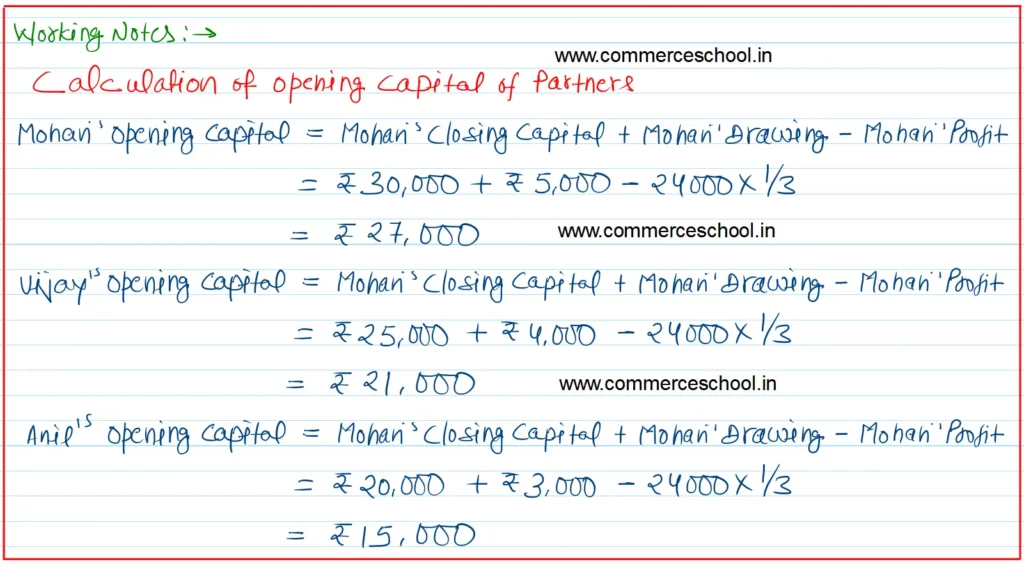

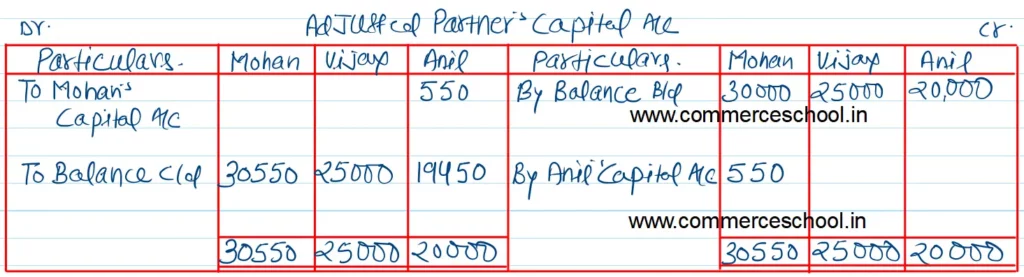

Mohan, Vijay and Anil are partners, their capitals on 31st March 2024 after adjustments of drawings and profits were ₹ 30,000, ₹ 25,000 and ₹ 20,000 respectively. Profits for the year ending 31st March 2024 were ₹ 24,000. Their drawings were ₹ 5,000 (Mohan); ₹ 4,000 (Vijay) and ₹ 3,000 (Anil) for the yer ending 31st Marchf, 2024. Subsequently the following omissions were noticed and it was decided to bring them into account.

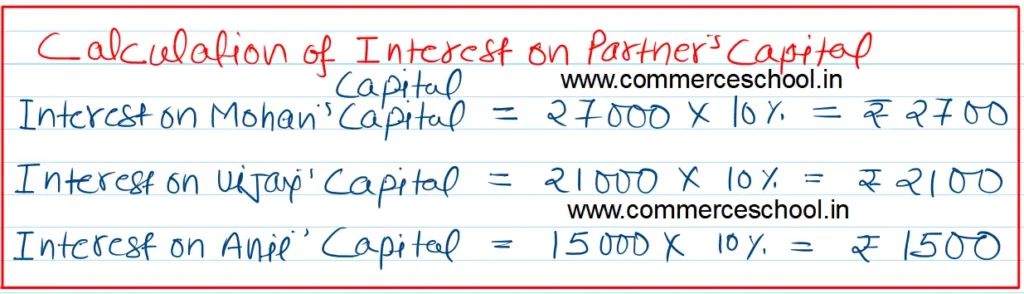

(i) Interest on Capital at 10% p.a.

(ii) Interest on Drawings Mohan ₹ 250, Vijay ₹ 200 and Anil ₹ 150.

Make the necessary Journal entry and prepare Capital Accounts of Partner’s

[Ans. Opening Capitals – Mohan ₹ 27,000, Vijay ₹ 21,000, Anil ₹ 15,000; Dr. Anil’s Capital by ₹ 550 and Cr. Mohan’s Capital by ₹ 550. Adjusted Capital Accounts balances Mohan ₹ 30,550; Vijay ₹ 25,000; Anil ₹ 19,450.]

Solution:-

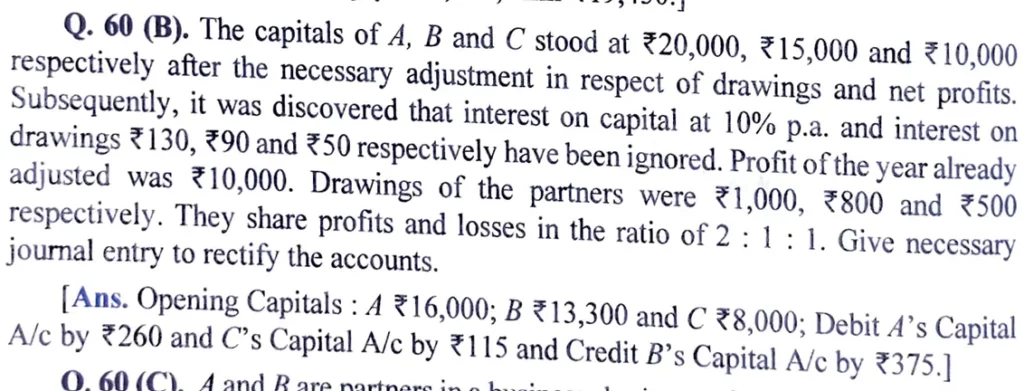

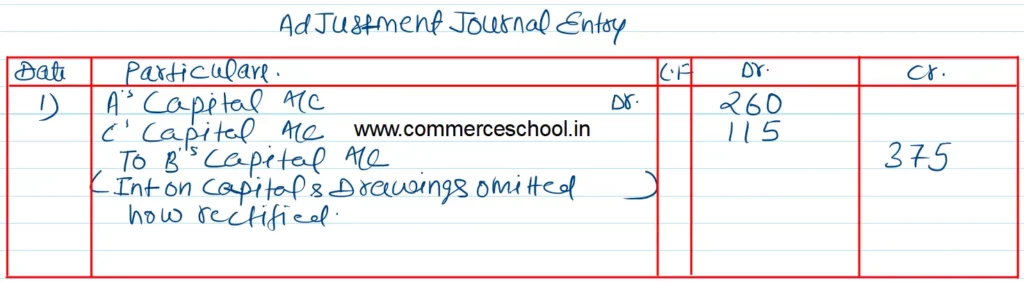

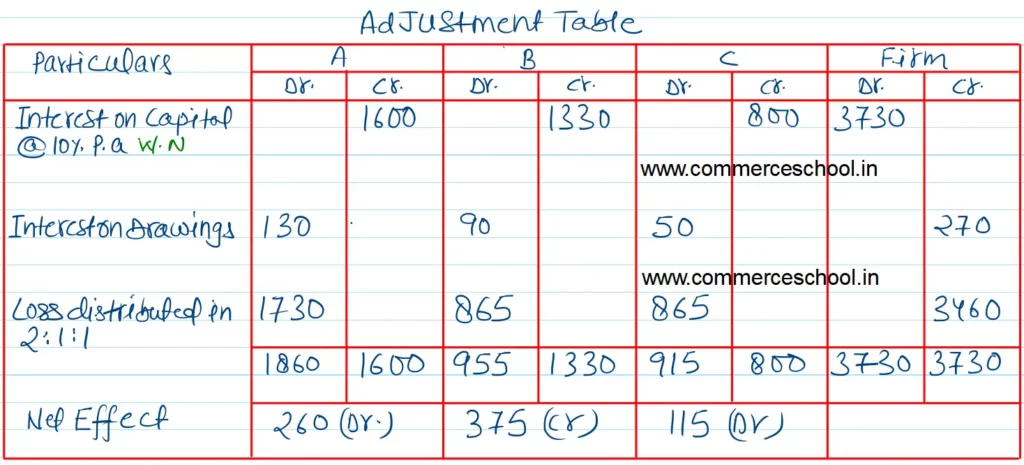

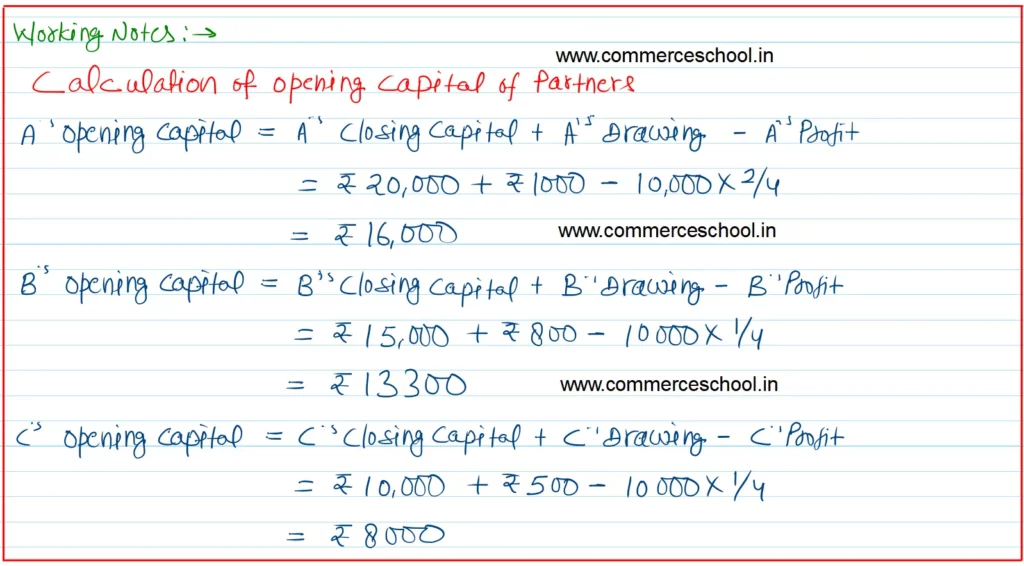

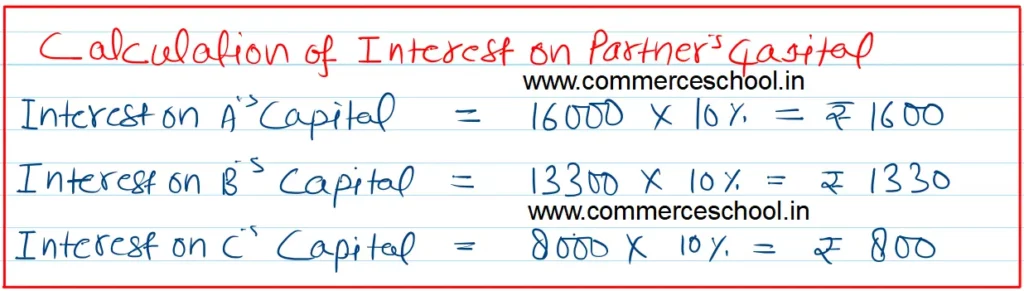

The capitals of A, B and C stood at ₹ 20,000, ₹ 15,000 and ₹ 10,000 respectively after the necessary adjustment in respect of drawings and net profits. Subsequently, it was discovered that interest on capital at 10% p.a. and interest on drawings ₹ 130, ₹ 90 and ₹ 50 respectively have been ignored. Profit of the year already adjusted was ₹ 10,000. Drawings of the partners were ₹ 1,000, ₹ 800 and ₹ 550 respectively. They share profits and losses in the ratio of 2 : 1 : 1. Give necessary journal entry to rectify the accounts.

[Ans. Opening Capitals : A ₹ 16,000; B ₹ 13,300 and C ₹ 8,000; Debit A’s Capital A/c by ₹ 260 and C’s Capital A/c by ₹ 115 and Credit B’s Capital A/c by ₹ 375.]

Solution:-

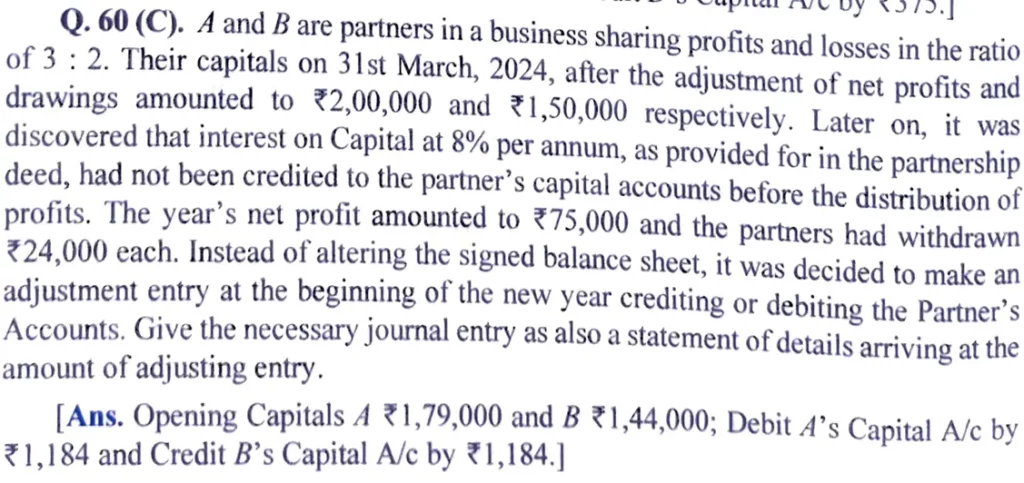

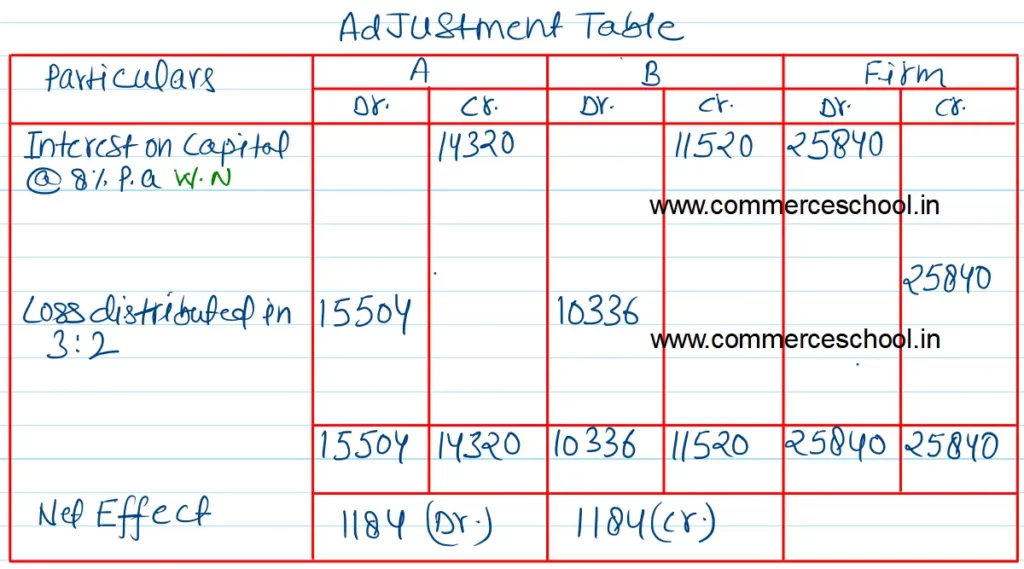

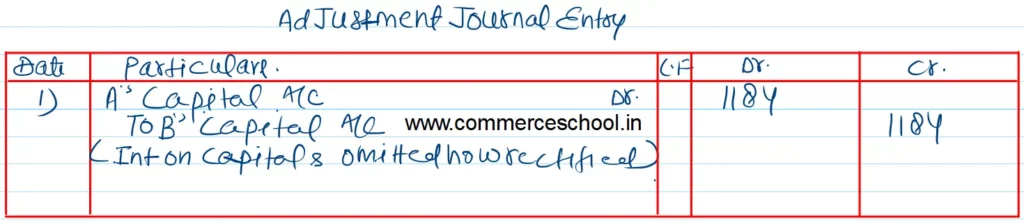

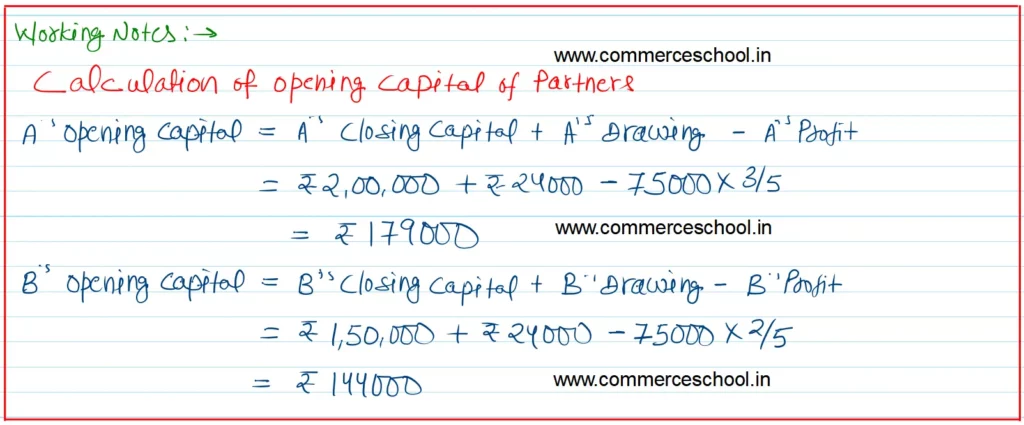

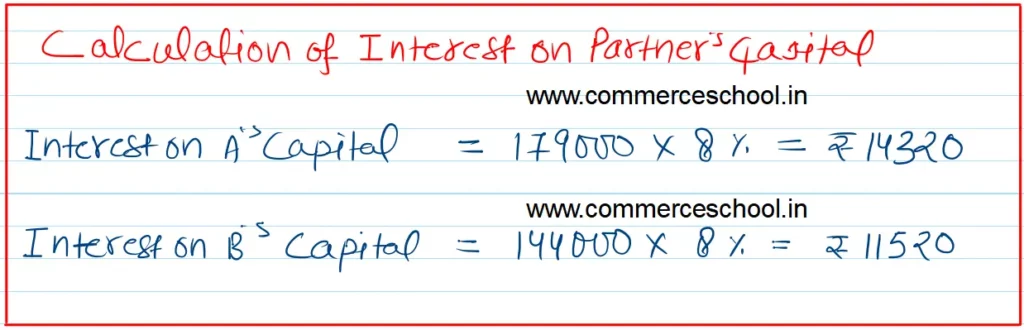

A and B are partners in a business sharing profits and losses in the ratio of 3 : 2. Their capitals on 31st March, 2024, after the adjustment of net profits and drawingsw amounted to ₹ 2,00,000 and ₹ 1,50,000 respectively. Later on, it was discovered that interest on Capital at 8% per annum, as provided for in the partnership deed, had not been credited to the partner’s capital accounts before the distribution of profits. The year’s net profit amounted to ₹ 75,000 and the partners had withdrawn ₹ 24,000 each. Instead of altering the signed balance sheet, it was decided to make an adjustment entry at the beginning of the new year crediting or debiting the Partner’s Accounts. Give the necessary journal entry as also a statement of details arriving at the amount of adjusting entry.

[Ans. Opening Capitals A ₹ 1,79,000 and B ₹ 1,44,000; Debit A’s Capital A/c by ₹ 1,184 and Credit B’s Capital A/c by ₹ 1,184.]

Solution:-

Here is the complete index of solutions

| S.N | Questions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Questions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Questions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Questions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |

| 40 | Question – 40 |

| S.N | Questions |

| 41 | Question – 41 |

| 42 | Question – 42 |

| 43 | Question – 43 |

| 44 | Question – 44 |

| 45 | Question – 45 |

| 46 | Question – 46 |

| 47 | Question – 47 |

| 48 | Question – 48 |

| 49 | Question – 49 |

| 50 | Question – 50 |

| S.N | Questions |

| 51 | Question – 51 |

| 52 | Question – 52 |

| 53 | Question – 53 |

| 54 | Question – 54 |

| 55 | Question – 55 |

| 56 | Question – 56 |

| 57 | Question – 57 |

| 58 | Question – 58 |

| 59 | Question – 59 |

| 60 | Question – 60(A), 60(B), 60 (C) |

| S.N | Questions |

| 61 | Question – 61 |

| 62 | Question – 62 |

| 63 | Question – 63 |

| 64 | Question – 64 |

| 65 | Question – 65 |

| 66 | Question – 66 |

| 67 | Question – 67 |

| 68 | Question – 68 |

| 69 | Question – 69 |

| 70 | Question – 70 |

| S.N | Questions |

| 71 | Question – 71 |

| 72 | Question – 72 |

| 73 | Question – 73 |

| 74 | Question – 74 |

| 75 | Question – 75 |

| 76 | Question – 76 |

| 77 | Question – 77 |

| 78 | Question – 78 |

| 79 | Question – 79 |

| 80 | Question – 80 |

| S.N | Questions |

| 81 | Question – 81 |

| 82 | Question – 82 |

| 83 | Question – 83 |

| 84 | Question – 84 |

| 85 | Question – 85 |

| 86 | Question – 86 |

| 87 | Question – 87 |

| 88 | Question – 88 |

| 89 | Question – 89 |

| 90 | Question – 90 |

| S.N | Questions |

| 91 | Question – 91 |

| 92 | Question – 92 |

| 93 | Question – 93 |

| 94 | Question – 94 |

| 95 | Question – 95 |

| 96 | Question – 96 |

| 97 | Question – 97 |

| 98 | Question – 98 |

| 99 | Question – 99 |

| 100 | Question – 100 |

| S.N | Questions |

| 101 | Question – 101 |

| 102 | Question – 102 |

| 103 | Question – 103 |

| 104 | Question – 104 |

| 105 | Question – 105 |

| 106 | Question – 106 |

| 107 | Question – 107 |

| 108 | Question – 108 |

| 109 | Question – 109 |

| 110 | Question – 110 |