[CBSE] Q 62 DK Goel Admission of a Partner Solutions Class 12 (2024-25)

The solution of Question number 62 of Admission of a Partner chapter 3 of DK Goel Class 12 CBSE (2024-25)

Q. 62. A and B are partners sharing profits in 3 : 1. Their Balance Sheet as at 31st March, 2024 stood as follows:

| Liabilities | ₹ | Assets | ₹ |

| Creditors | 2,60,000 | Land and Buildings | 19,80,000 |

| Workmen Compensation Reserve | 40,000 | Stock | 8,00,000 |

| Capital Accounts: A B | 20,00,000 10,00,000 | Sundry Debtors 4,00,000 Less: Provision 12,000 | 3,88,000 |

| Cash at Bank | 1,32,000 | ||

| 33,00,000 | 33,00,000 |

On 1st April, 2024 they admit C as a new partner on the following terms:

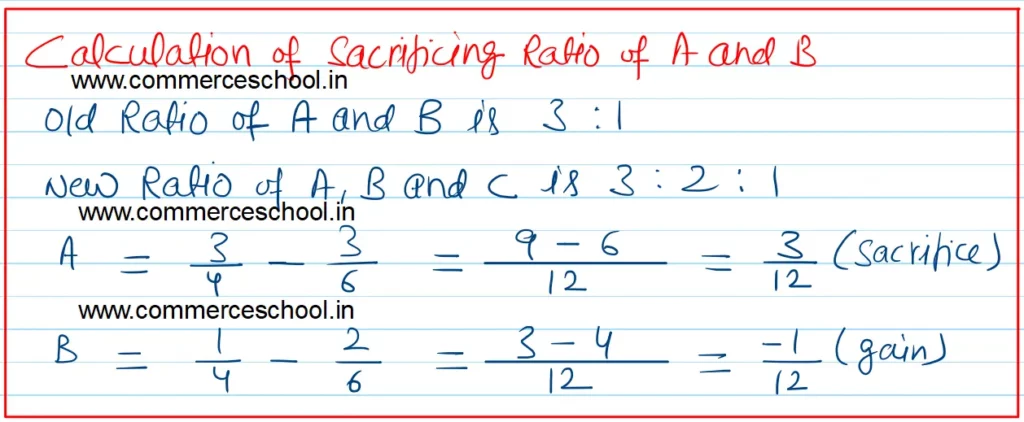

(I) The new profit sharing ratio of A, B and C will be 3 : 2 : 1.

(ii) All debtors are good.

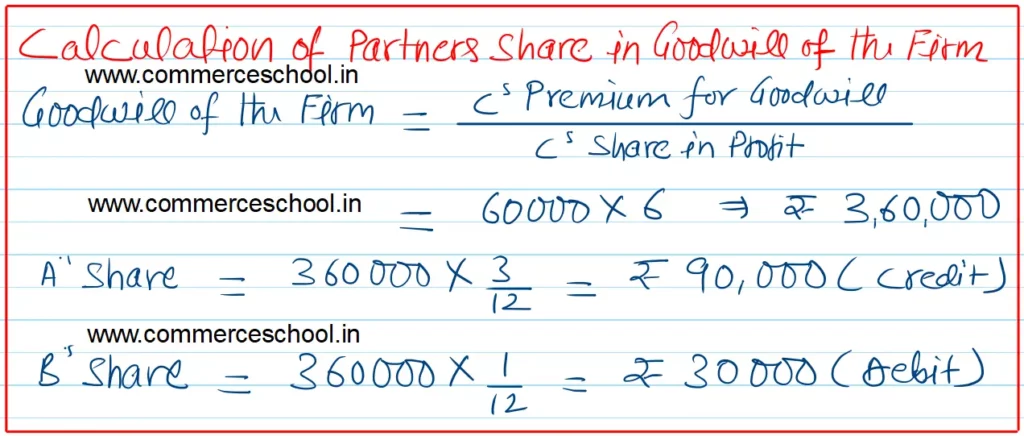

(iii) C to bring in ₹ 5,00,000 as Capital and his share of goodwill amounting to ₹ 60,000 in cash.

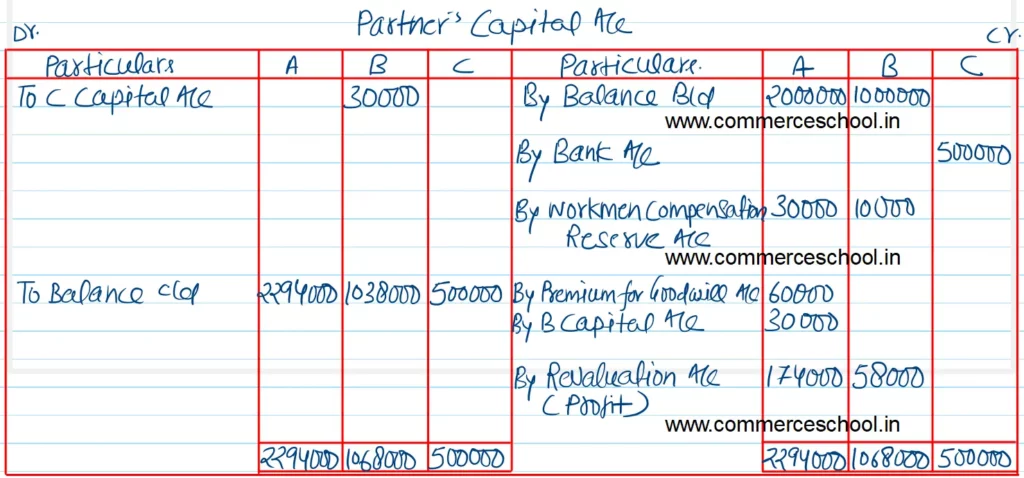

(iv) You are required to prepare Partner’s Capital Accounts.

[Ans. Gain on Revaluation ₹ 2,32,000; Balance of Capital Accounts: A ₹ 22,94,000; B ₹ 10,38,000 and C ₹ 5,00,000. A sacrifices 3/12; and B Gains 1/12.]

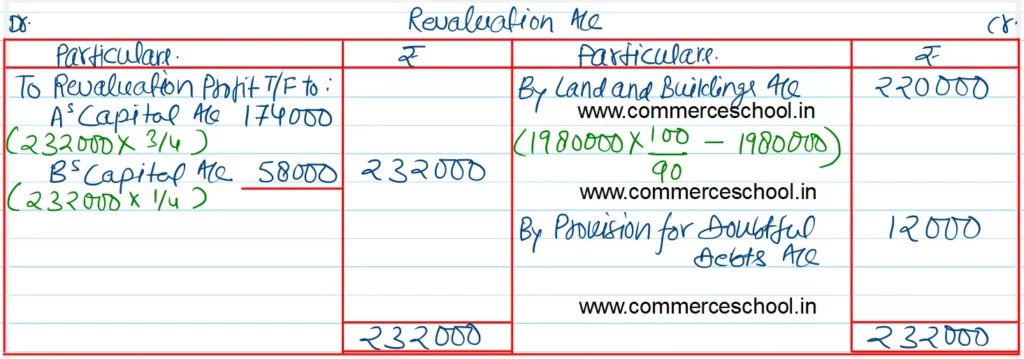

Solution:-

Working Notes:-