[CBSE] Q. 63 Solution of Accounting Ratios TS Grewal Class 12 (2025-26)

Solution of Question 63 Accounting Ratios of TS Grewal Book 2025-26 session CBSE Board?

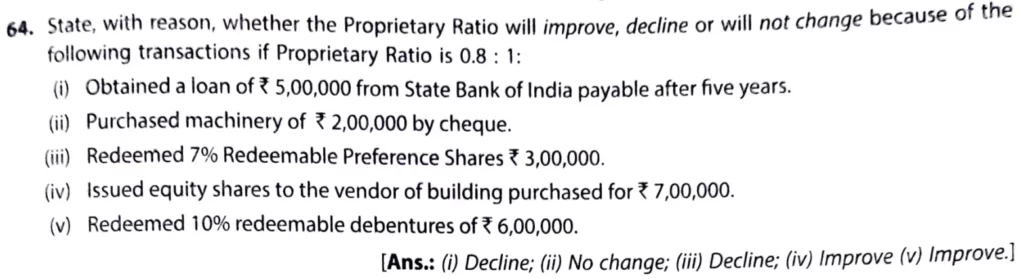

State, with reason, whether the Proprietary Ratio will improve, decline or will not change because of the following transactions if Proprietary Ratio is 0.8 : 1.

(i) Obtained a loan of ₹ 5,00,000 from State Bank of India payable after five years.

(ii) Purchased machinery of ₹ 2,00,000 by cheque.

(iii) Redeemed 7% Redeemable Preference Shares ₹ 3,00,000.

(iv) Issued equity shares to the vendor of building purchased for ₹ 7,00,000.

(v) Redeemed 10% redeemable debentures of ₹ 6,00,000.

[Ans.: (i) Decline; (ii) No Change, (iii) Decline; (iv) Improve, (v) Improve.]

Solution:-

(i) Obtained a loan of ₹ 5,00,000 from State Bank of India payable after five years.

The proprietary ratio will be affected by obtaining a loan of ₹ 5,00,000 payable after five years, and here’s how:

Proprietary Ratio Formula:

= Shareholder’s Funds/Total Assets

- Shareholders’ Funds: Includes share capital, reserves, and retained earnings.

- Total Assets: Includes both fixed and current assets.

- Effect of Loan:

- By obtaining a loan, total assets increase because the cash received from the loan is added to the company’s assets.

- However, shareholders’ funds remain unchanged, as the loan is a liability and does not affect equity.

- Impact on Proprietary Ratio:

- The numerator (shareholders’ funds) remains constant.

- The denominator (total assets) increases due to the addition of ₹ 5,00,000 from the loan.

- Since the denominator increases while the numerator stays constant, the proprietary ratio will decrease from its original value of 0.8 : 1, reflecting lower reliance on shareholders’ funds compared to total assets.

(ii) Purchased machinery of ₹ 2,00,000 by cheque.

The purchase of machinery worth ₹ 2,00,000 by cheque will affect the proprietary ratio, and here’s how:

Proprietary Ratio Formula:

= Shareholder’s Funda/Total Assets

- Shareholders’ Funds: Includes share capital, reserves, and retained earnings.

- Total Assets: Includes both fixed and current assets.

- Impact of Transaction:

- Purchasing machinery increases fixed assets (part of total assets) by ₹ 2,00,000.

- Simultaneously, paying via cheque reduces cash/bank balance, so the total assets remain unchanged.

- Shareholders’ funds are also unaffected because this transaction does not involve equity adjustments.

- Final Effect:

- Since neither the numerator (shareholders’ funds) nor the denominator (total assets) changes, the proprietary ratio remains the same at 0.8 : 1.

(iii) Redeemed 7% Redeemable Preference Shares ₹ 3,00,000.

Given the assumed values:

- Shareholders’ Funds (before redemption): ₹ 8,00,000

- Total Assets (before redemption): ₹ 10,00,000

Let’s calculate the proprietary ratio before redemption:

Proprietary Ratio

= Shareholder’s Funds/Total Assets =

= 8,00,000/10,00,000 = 0.8 : 1

Now, consider the redemption of ₹ 3,00,000 preference shares:

- Shareholders’ Funds (after redemption): [ 8,00,000 – 3,00,000 = ₹ 5,00,000 ]

- Total Assets (after redemption): [ 10,00,000 – 3,00,000 = ₹ 7,00,000 ]

Recalculate the proprietary ratio after redemption:

Proprietary Ratio = Shareholders’ Funds\Total Assets

= 5,00,000/7,00,000 = 0.714 : 1 (approx)

Impact: The proprietary ratio decreases from 0.8 : 1 to 0.714 : 1, reflecting reduced reliance on shareholders’ funds relative to total assets.

Reason:-

Shareholders’ Funds:– Includes equity share capital, reserves, and retained earnings. Preference shares (redeemable) are part of shareholders’ funds until redeemed.

Total Assets:- Includes all fixed and current assets.

Impact of Redemption:– Redeeming preference shares decreases shareholders’ funds by ₹ 3,00,000, as this amount is paid out to the preference shareholders.

If the redemption is made from cash or bank balances, total assets also decrease by ₹ 3,00,000.

(iv) Issued equity shares to the vendor of building purchased for ₹ 7,00,000.

Let’s analyze the effect of issuing equity shares to the vendor for a building worth ₹ 7,00,000, given:

- Shareholders’ Funds (before transaction): ₹ 8,00,000

- Total Assets (before transaction): ₹ 10,00,000

Proprietary Ratio (before transaction):

= Shareholders’ Funds\Total Assets

= 8,00,000/10,00,000 = 0.8 : 1

Effects of the Transaction:

- Increase in Shareholders’ Funds:

- Equity shares worth ₹ 7,00,000 are issued, increasing shareholders’ funds to: [ 8,00,000 + 7,00,000 = ₹ 15,00,000 ]

- Increase in Total Assets:

- The building is added as an asset worth ₹ 7,00,000, increasing total assets to: [ 10,00,000 + 7,00,000 = ₹ 17,00,000 ]

Proprietary Ratio After the Transaction:

Proprietary Ratio} = Shareholders’ Funds\Total Assets

= 15,00,000/17,00,000

= 0.882 : 1 (approx)

Impact:

The proprietary ratio increases from 0.8 : 1 to approximately 0.882 : 1. This reflects a stronger reliance on shareholders’ funds compared to total assets, indicating improved financial stability.

(v) Redeemed 10% redeemable debentures of ₹ 6,00,000.

Let’s analyze the effect of redeeming ₹ 6,00,000 worth of 10% redeemable debentures, given:

- Shareholders’ Funds (before redemption): ₹ 8,00,000

- Total Assets (before redemption): ₹ 10,00,000

Proprietary Ratio (before redemption):-

Proprietary Ratio = Shareholders’ Funds\Total Assets

= 8,00,000/10,00,000

= 0.8 : 1

Effects of the Redemption:

- No Change to Shareholders’ Funds:

- Redeeming debentures does not affect shareholders’ funds, as these are liabilities and not part of equity.

- Decrease in Total Assets:

- If ₹ 6,00,000 is paid for the redemption from cash or bank balances, total assets will decrease by ₹ 6,00,000.

Revised Values:

- Shareholders’ Funds (after redemption): ₹ 8,00,000 (unchanged)

- Total Assets (after redemption): [ 10,00,000 – 6,00,000 = ₹ 4,00,000 ]

Proprietary Ratio After Redemption:

Proprietary Ratio = Shareholders’ Funds\Total Assets

= 8,00,000/4,00,000

= 2 : 1

Impact:

- The proprietary ratio increases significantly, from 0.8 : 1 to 2 : 1, indicating a stronger reliance on shareholders’ funds relative to total assets.

Here is the list of all Solutions.

| S.N | Questions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Questions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Questions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Questions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |

| 40 | Question – 40 |

| S.N | Questions |

| 41 | Question – 41 |

| 42 | Question – 42 |

| 43 | Question – 43 |

| 44 | Question – 44 |

| 45 | Question – 45 |

| 46 | Question – 46 |

| 47 | Question – 47 |

| 48 | Question – 48 |

| 49 | Question – 49 |

| 50 | Question – 50 |

| S.N | Questions |

| 51 | Question – 51 |

| 52 | Question – 52 |

| 53 | Question – 53 |

| 54 | Question – 54 |

| 55 | Question – 55 |

| 56 | Question – 56 |

| 57 | Question – 57 |

| 58 | Question – 58 |

| 59 | Question – 59 |

| 60 | Question – 60 |

| S.N | Questions |

| 61 | Question – 61 |

| 62 | Question – 62 |

| 63 | Question – 63 |

| 64 | Question – 64 |

| 65 | Question – 65 |

| 66 | Question – 66 |

| 67 | Question – 67 |

| 68 | Question – 68 |

| 69 | Question – 69 |

| 70 | Question – 70 |

| S.N | Questions |

| 71 | Question – 71 |

| 72 | Question – 72 |

| 73 | Question – 73 |

| 74 | Question – 74 |

| 75 | Question – 75 |

| 76 | Question – 76 |

| 77 | Question – 77 |

| 78 | Question – 78 |

| 79 | Question – 79 |

| 80 | Question – 80 |

| S.N | Questions |

| 81 | Question – 81 |

| 82 | Question – 82 |

| 83 | Question – 83 |

| 84 | Question – 84 |

| 85 | Question – 85 |

| 86 | Question – 86 |

| 87 | Question – 87 |

| 88 | Question – 88 |

| 89 | Question – 89 |

| 90 | Question – 90 |

| S.N | Questions |

| 91 | Question – 91 |

| 92 | Question – 92 |

| 93 | Question – 93 |

| 94 | Question – 94 |

| 95 | Question – 95 |

| 96 | Question – 96 |

| 97 | Question – 97 |

| 98 | Question – 98 |

| 99 | Question – 99 |

| 100 | Question – 100 |

| S.N | Questions |

| 101 | Question – 101 |

| 102 | Question – 102 |

| 103 | Question – 103 |

| 104 | Question – 104 |

| 105 | Question – 105 |

| 106 | Question – 106 |

| 107 | Question – 107 |

| 108 | Question – 108 |

| 109 | Question – 109 |

| 110 | Question – 110 |

| S.N | Questions |

| 111 | Question – 111 |

| 112 | Question – 112 |

| 113 | Question – 113 |

| 114 | Question – 114 |

| 115 | Question – 115 |

| 116 | Question – 116 |

| 117 | Question – 117 |

| 118 | Question – 118 |

| 119 | Question – 119 |

| 120 | Question – 120 |

| S.N | Questions |

| 121 | Question – 121 |

| 122 | Question – 122 |

| 123 | Question – 123 |

| 124 | Question – 124 |

| 125 | Question – 125 |

| 126 | Question – 126 |

| 127 | Question – 127 |

| 128 | Question – 128 |

| 129 | Question – 129 |

| 130 | Question – 130 |

| S.N | Questions |

| 131 | Question – 131 |

| 132 | Question – 132 |

| 133 | Question – 133 |

| 134 | Question – 134 |

| 135 | Question – 135 |

| 136 | Question – 136 |

| 137 | Question – 137 |

| 138 | Question – 138 |

| 139 | Question – 139 |

| 140 | Question – 140 |

| S.N | Questions |

| 141 | Question – 141 |

| 142 | Question – 142 |

| 143 | Question – 143 |

| 144 | Question – 144 |

| 145 | Question – 145 |

| 146 | Question – 146 |

| 147 | Question – 147 |

| 148 | Question – 148 |

| 149 | Question – 149 |

| 150 | Question – 150 |

| S.N | Questions |

| 151 | Question – 151 |

| 152 | Question – 152 |

| 153 | Question – 153 |

| 154 | Question – 154 |

| 155 | Question – 155 |

| 156 | Question – 156 |

| 157 | Question – 157 |

| 158 | Question – 158 |

| 159 | Question – 159 |

| 160 | Question – 160 |

| S.N | Questions |

| 161 | Question – 161 |

| 162 | Question – 162 |

| 163 | Question – 163 |

| 164 | Question – 164 |

| 165 | Question – 165 |

| 166 | Question – 166 |

| 167 | Question – 167 |

| 168 | Question – 168 |

| 169 | Question – 169 |

| 170 | Question – 170 |

| S.N | Questions |

| 171 | Question – 171 |

| 172 | Question – 172 |

| 173 | Question – 173 |

| 174 | Question – 174 |

| 175 | Question – 175 |

| 176 | Question – 176 |

| 177 | Question – 177 |

| 178 | Question – 178 |

| 179 | Question – 179 |

| 180 | Question – 180 |

| 181 | Question – 181 |

| 182 | Question – 182 |

| 183 | Question – 183 |

| 184 | Question – 184 |