[CBSE] Q 64 DK Goel Admission of a Partner Solutions Class 12 (2024-25)

The solution of Question number 64 of Admission of a Partner chapter 3 of DK Goel Class 12 CBSE (2024-25)

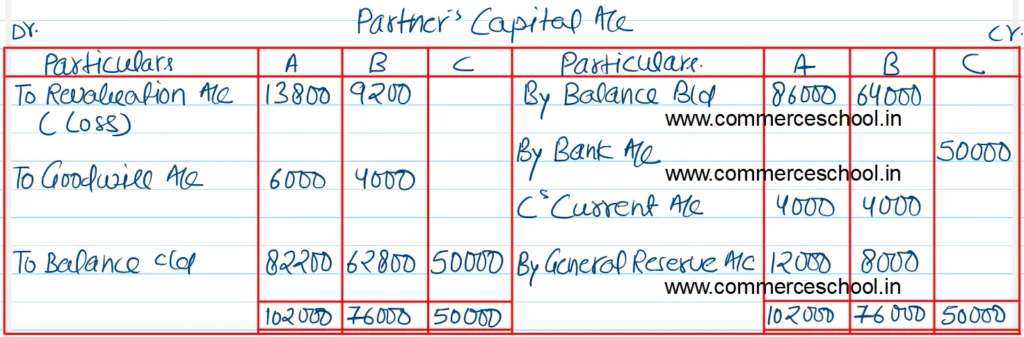

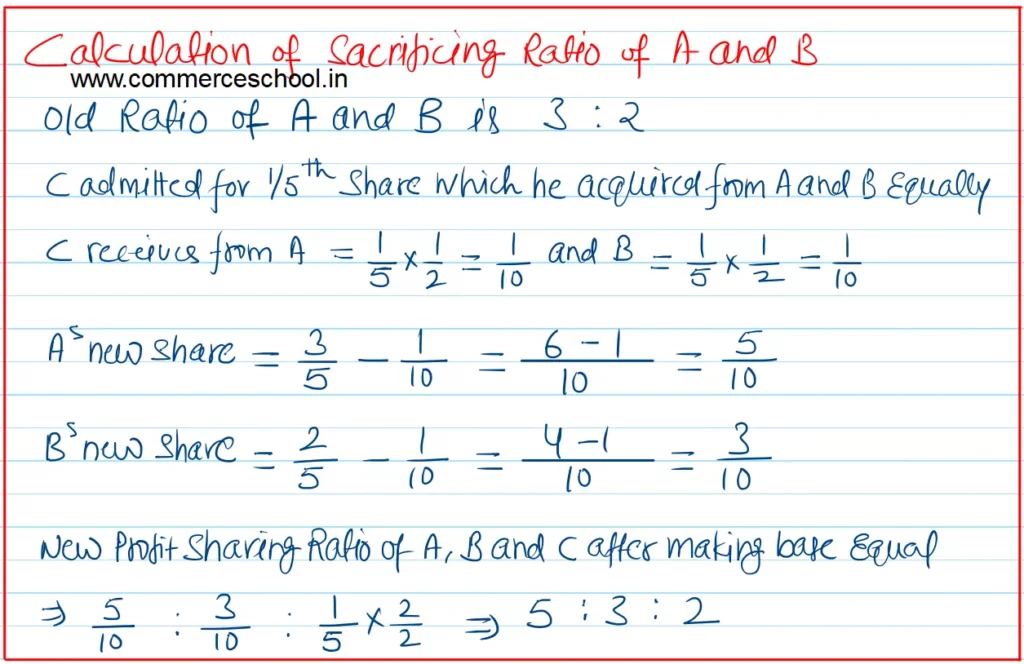

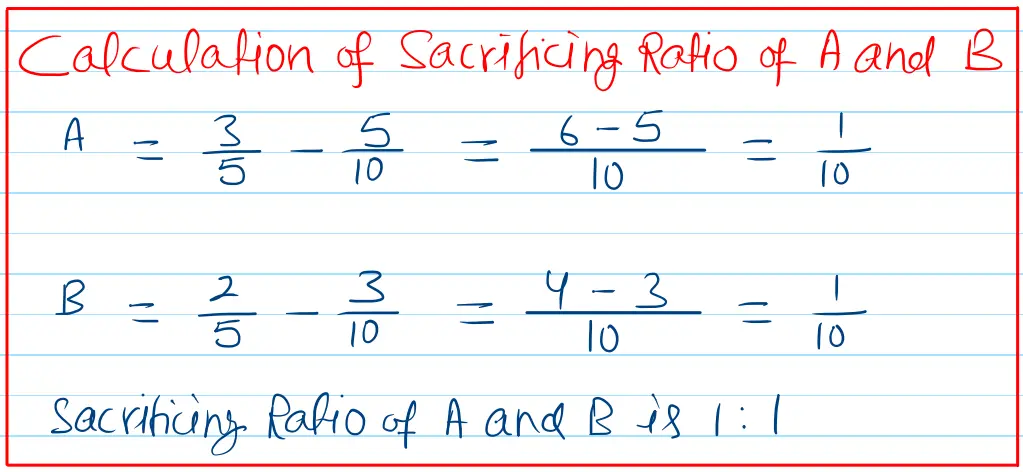

Q. 64. A and B are in partnership sharing profits and losses in the ratio of 3 : 2. On 1st April 2024, they admitted C into partnership. He paid ₹ 50,000 as his capital but nothing for Goodwill which was valued at ₹ 40,000 for the time. He acquired 1/5th share in profits, equally from both partners. It was also decided that:

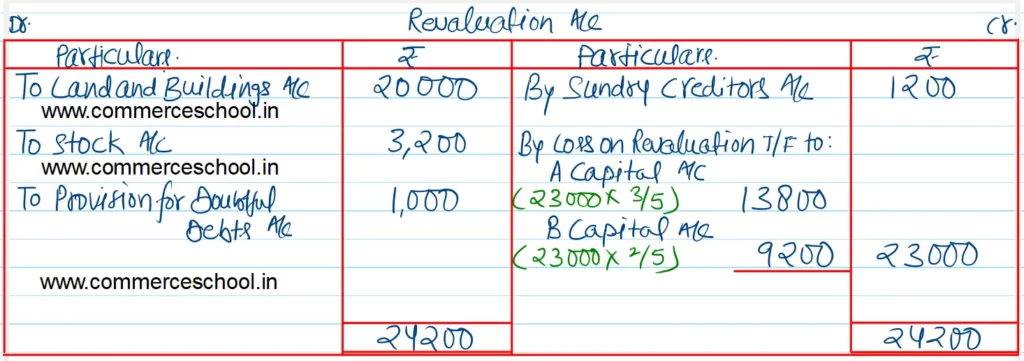

(i) Land and Building be written off by ₹ 20,000.

(ii) Stock be written down by ₹ 3,200.

(iii) A provision of ₹ 1,000 be created for doubtful debts; and

(iv) An amount of ₹ 1,200, included in Sundry Creditors, be written off as it is no longer payable.

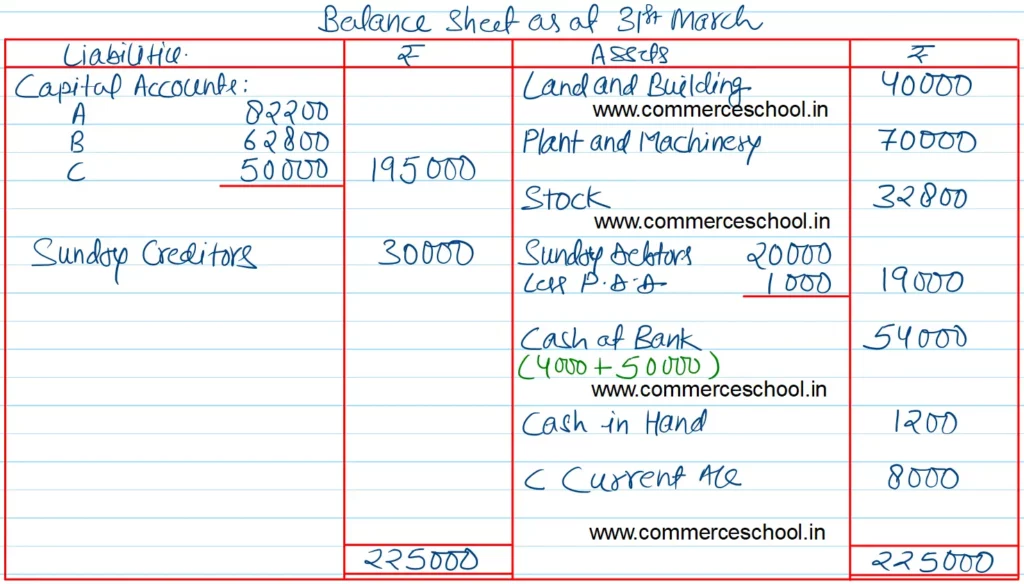

The Balance Sheet of A and B as at 31st March, 2024 was as under:

Balance Sheet as at 31st March, 2024

| Liabilities | ₹ | Assets | ₹ |

| Capital Accounts A B | 86,000 64,000 | Goodwill | 10,000 |

| General Reserve | 20,000 | Land and Building | 60,000 |

| Sundry Creditors | 31,200 | Plant and Machinery | 70,000 |

| Stock | 36,000 | ||

| Sundryy Debtors | 20,000 | ||

| Cash at Bank | 4,000 | ||

| Cash in Hand | 1,200 | ||

| 2,01,200 | 2,01,200 |

Prepare Revaluation Account, Partner’s Capital Accounts and new Balance Sheet of the firm.

[Ans. Loss on Revaluation ₹ 23,000; C’s Current A/c (Dr. ₹ 8,000; Capital A/cs: A ₹ 82,200; B ₹ 62,800; C ₹ 50,000; B/S total ₹ 2,25,000.]

Solution:-