[CBSE] Q 65 DK Goel Admission of a Partner Solutions Class 12 (2024-25)

The solution of Question number 65 of Admission of a Partner chapter 3 of DK Goel Class 12 CBSE (2024-25)

Q. 65. X and Y are partners in a firm sharing profits and losses in the ratio of 5 : 3. On 31st March, 2024, their Balance Sheet was as under:

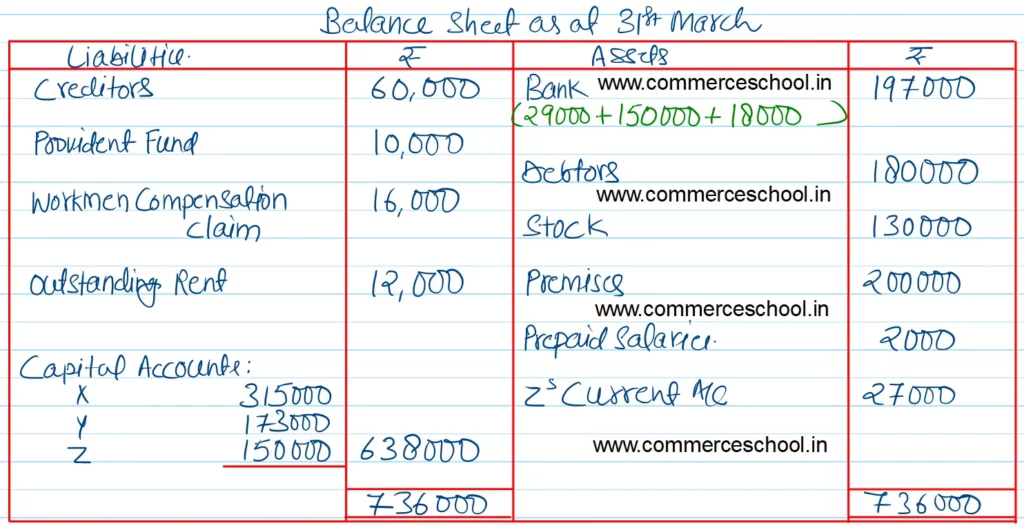

Balance Sheet as at 31st March

| Liabilities | ₹ | Assets | ₹ |

| Creditors | 50,000 | Bank | 29,000 |

| Workmen’s Compensation Reserve | 40,000 | Debtors | 1,80,000 |

| Capitals A/cs: X Y | 2,60,000 1,35,000 | Stock | 1,25,000 |

| Premises | 1,50,000 | ||

| Advertisement Expenses | 16,000 | ||

| 5,00,000 | 5,00,000 |

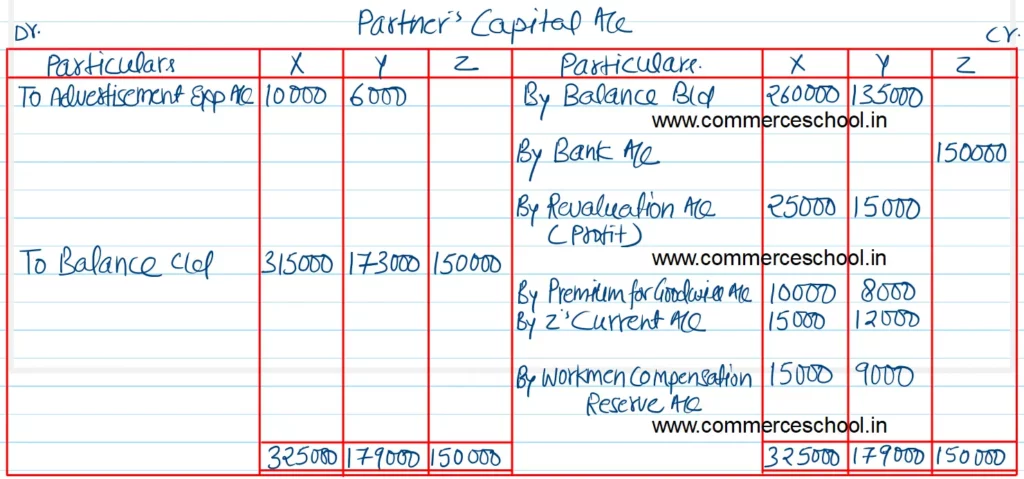

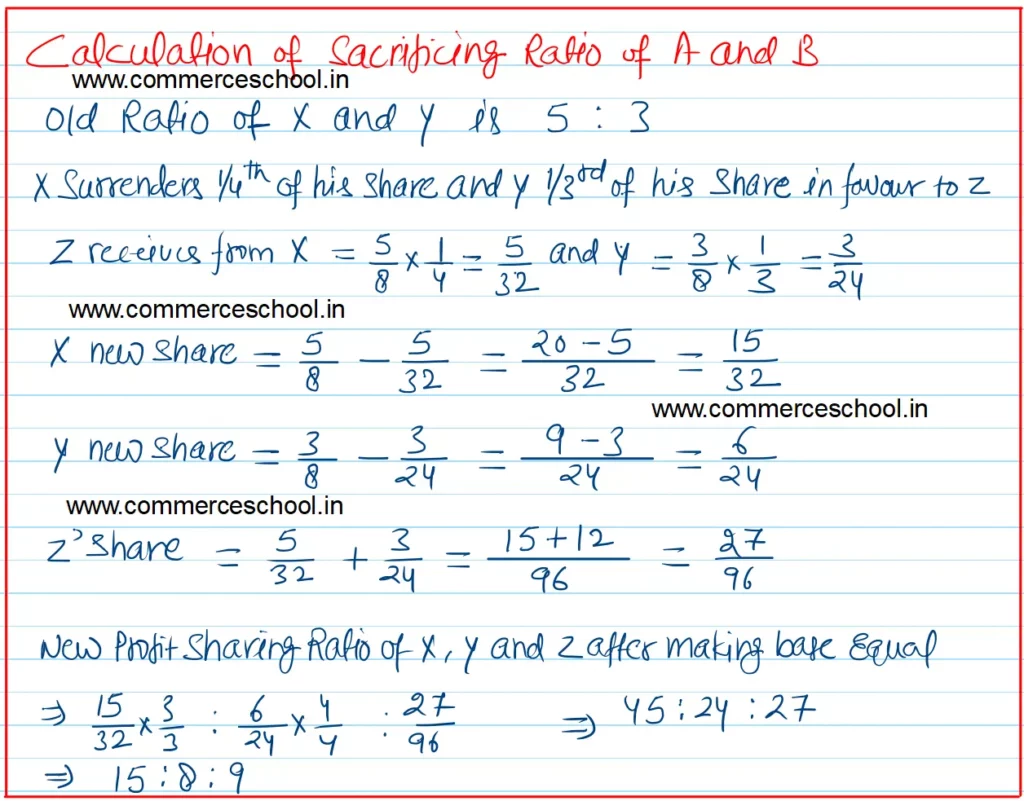

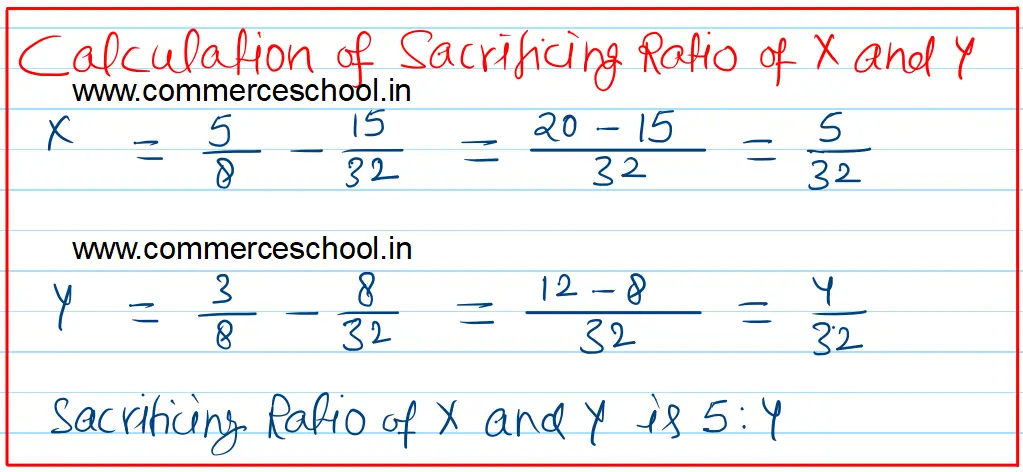

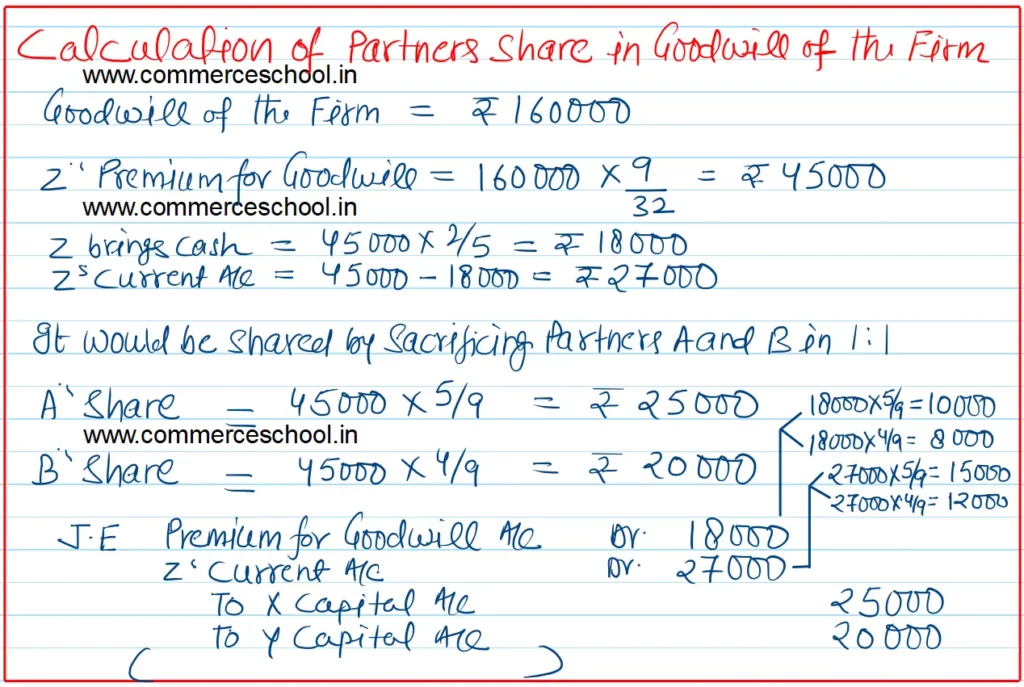

On 1st April, 2024, Z is admitted as a partner. X surrenders 1/4th of his share and Y 1/3rd of his share in favour of Z. Goodwill is valued at ₹ 1,60,000. Z brings in only 2/5th of his share of goodwill in cash and ₹ 1,50,000 as his capital. Following terms are agreed upon:

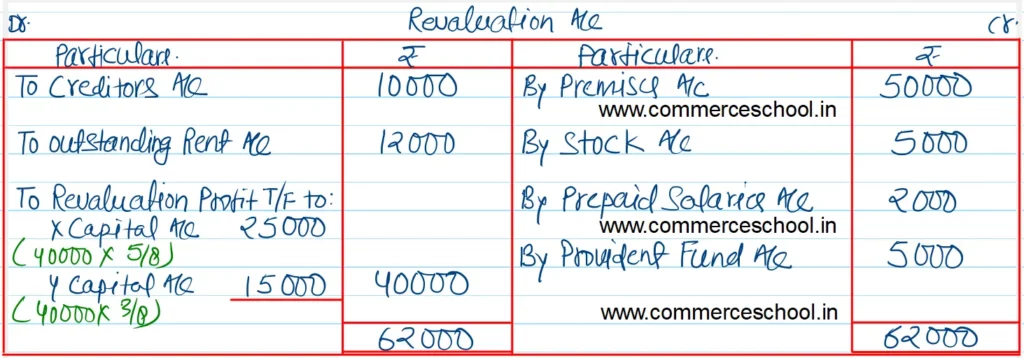

(I) Premises is to be increased to ₹ 2,00,000 and stock by ₹ 5,000.

(ii) Creditors proved at ₹ 60,000, one bill for goods purchased having been omitted from the books.

(iii) Outstanding rent amounted to ₹ 12,000 and prepaid salaries ₹ 2,000.

(iv) Liability on account of provident fund was only ₹ 10,000.

(v) Liability for Workmen’s Compensation Claim was ₹ 16,000.

Prepare Revaluation A/c, Capital A/cs and the opening Balance Sheet. Also Calculate the new profit sharing ratios.

[Ans. Gain on Revaluation ₹ 40,000; Z’s Current A/c (Dr.) ₹ 27,000; Capital A/cs X ₹ 3,15,000; Y ₹ 1,73,000 and Z ₹ 1,50,000; B/S Total ₹ 7,36,000; Sacrificing Ratio 5 : 4; New Ratios 15 : 8 : 9.]

Solution:-