[CBSE] Q 66 DK Goel Admission of a Partner Solutions Class 12 (2024-25)

The solution of Question number 66 of Admission of a Partner chapter 3 of DK Goel Class 12 CBSE (2024-25)

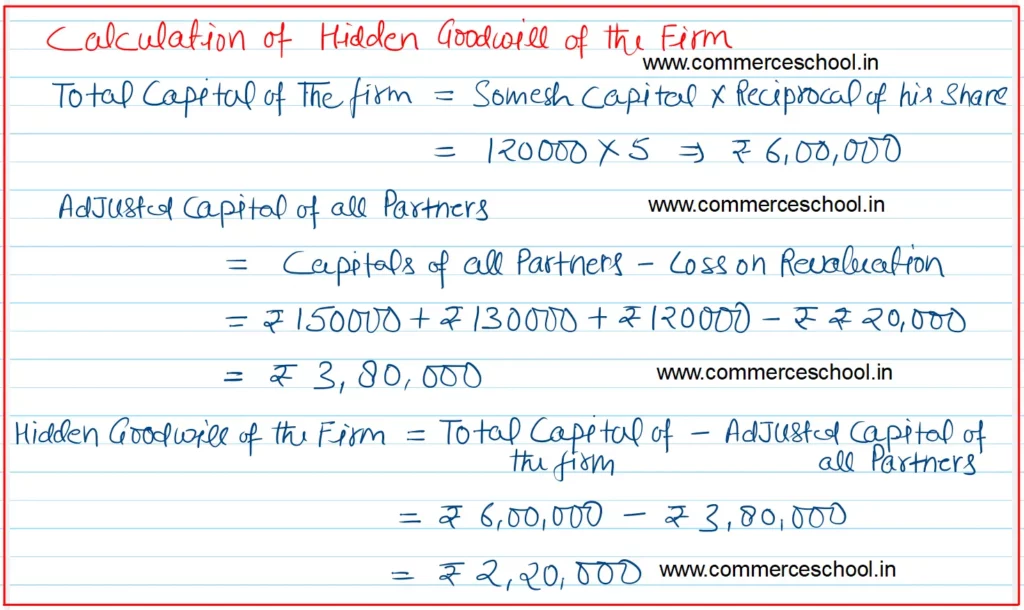

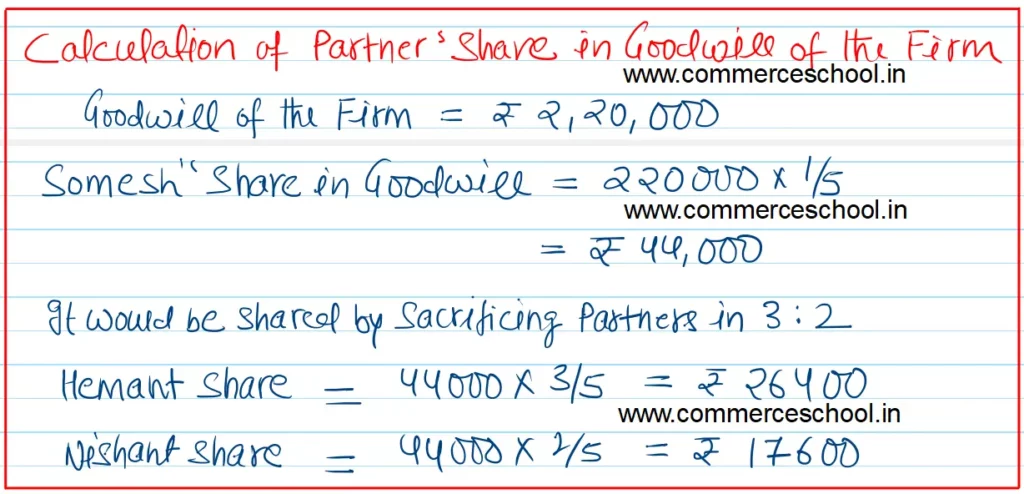

Q. 66 (A). Hemant and Nishant were partners in a firm sharing profits in the ratio of 3 : 2. Their Capitals were ₹ 1,50,000 and ₹ 1,30,000 respectively. They admitted Somesh on 1st April, 2024 as a new partner for 1/5th share in the future profits. Loss on Revaluation amounted to ₹ 20,000. Somesh brought ₹ 1,20,000 as his capital. Calculate the value of goodwill of the firm and record necessary journal entries for the above transactions on Somesh’s admission.

[Ans. Hidden Goodwill ₹ 2,20,000; Somesh’s Current A/c will be debited by ₹ 44,000 and Capital Accounts of Hemant and Nishant will be credited by ₹ 26,400 and ₹ 17,600 respectively.]

Solution:-

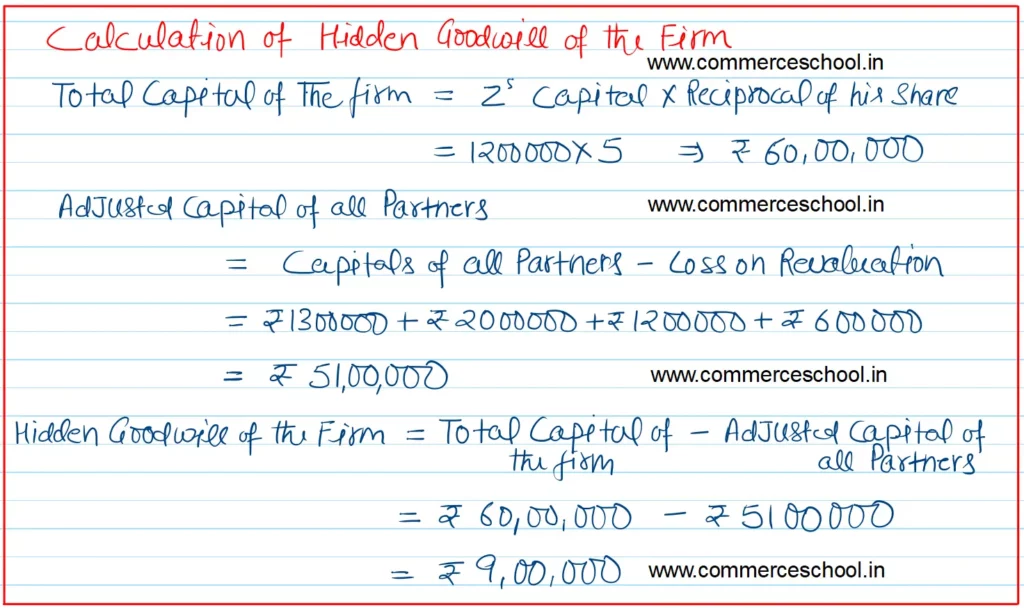

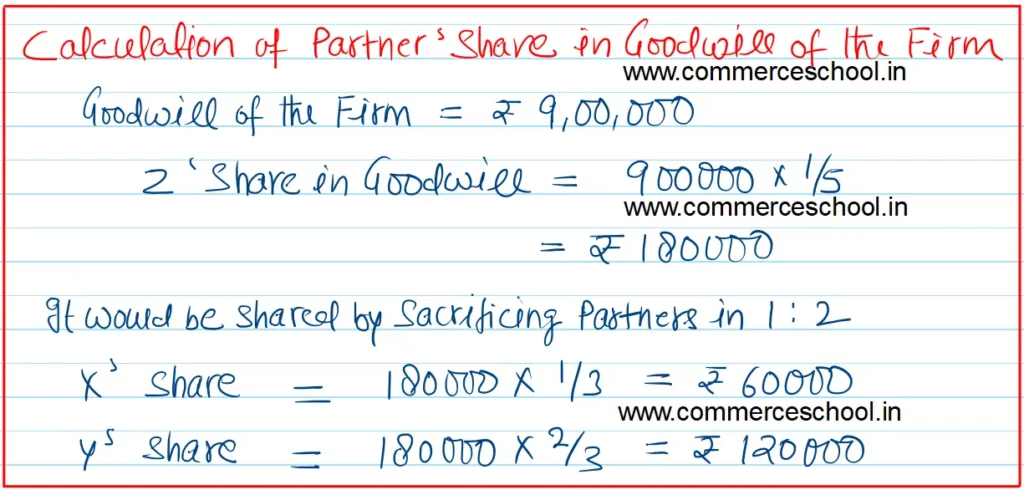

Q. 66 (B). X and Y are partners with capital of ₹ 13,00,000 and ₹ 20,00,000. They share profits in the ratio of 1 : 2. They admit Z as a partner with 1/5th share in the profits of the firm. Z brings in ₹ 12,00,000 as his share of capital. The Profit and Loss account showed a credit balance of ₹ 6,00,000 as on the date of admission of Z. Give the necessary Journal entries to record the goodwill.

[Ans. Hidden Goodwill ₹ 9,00,000.]

Hint: Balance of P& L will be credited to the Capital Accounts of X and Y and hidden goodwill will be calculated thereafter.

Solution:-