[CBSE] Q. 69 Solution of Admission of Partner TS Grewal Accounts Class 12 (2023-24)

Solution to Question number 69 of the Admission of Partner chapter 5 of TS Grewal Book 2023-24 Edition CBSE Board?

Divya, Yasmin and Fatima are partners in a firm, sharing profits and losses in 11 : 7 : 2 respectively. The Balance Sheet of the firm on 31st March, 2018 as follows:

| Liabiliites | ₹ | Assets | ₹ | |

| Sundry Creditors Public Deposits Reserve Fund Outstanding Expenses Capital A/cs: Divya Yasmin Fatima | 70,000 1,10,000 90,000 10,000 5,10,000 3,00,000 5,00,000 | Factory Building Plant and Machinery Furniture Stock Debtors Less: provision Cash at Bank | 1,50,000 (30,000) | 7,35,000 1,80,000 2,60,000 1,45,000 1,20,000 1,59,000 |

| 15,99,000 | 15,99,000 |

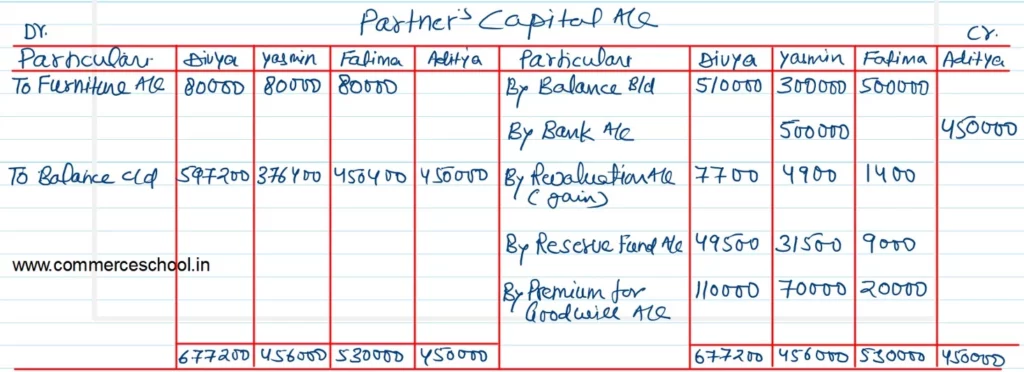

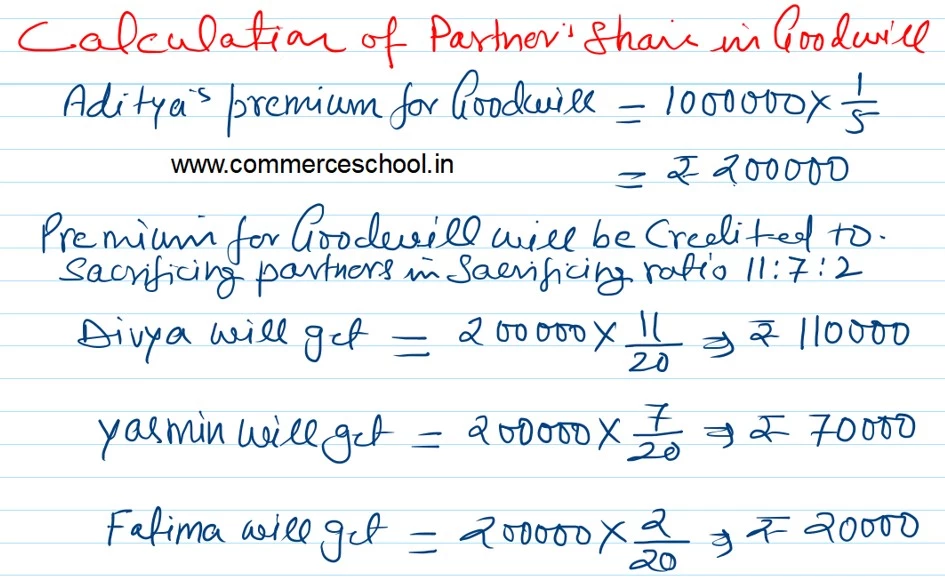

On 1st April, 2018, Aditya is admitted as a partner for one-fifth share in the profits with a capital of ₹ 4,50,000 and necessary amount for his share of goodwill on the following terms:

(a) Furniture of ₹ 2,40,000 were to be taken over Divya, Yasmin and Fatima equally.

(b) A creditor of ₹ 7,000 not recorded in books to be taken into account.

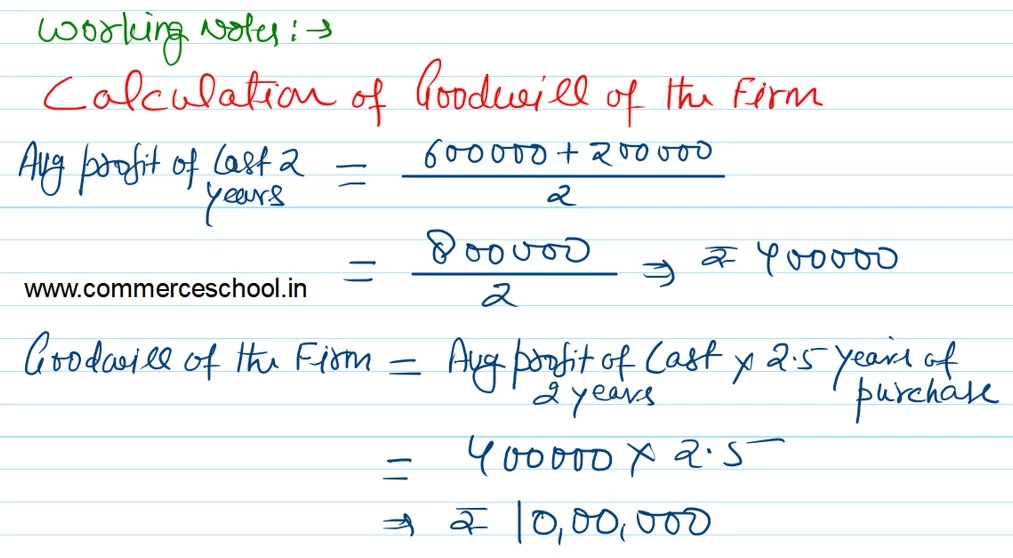

(c) Goodwill of the firm is to be valued at 2.5 year’s purchase of average profits of last two years. The profits of the last three years were:

2015-16 – ₹ 6,00,000; 2016-17 – ₹ 2,00,000; 2017 – 18 – ₹ 6,00,000.

(d) At time of Aditya’s admission. Yasmin also brought in ₹ 50,000 as fresh capital.

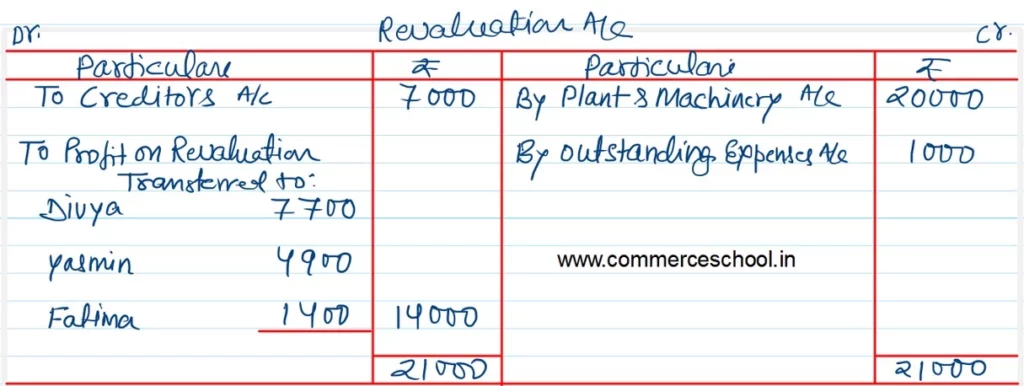

(e) Plant and Machinery is revalued to ₹ 2,00,000 and expenses outstanding were brought down to ₹ 9,000.

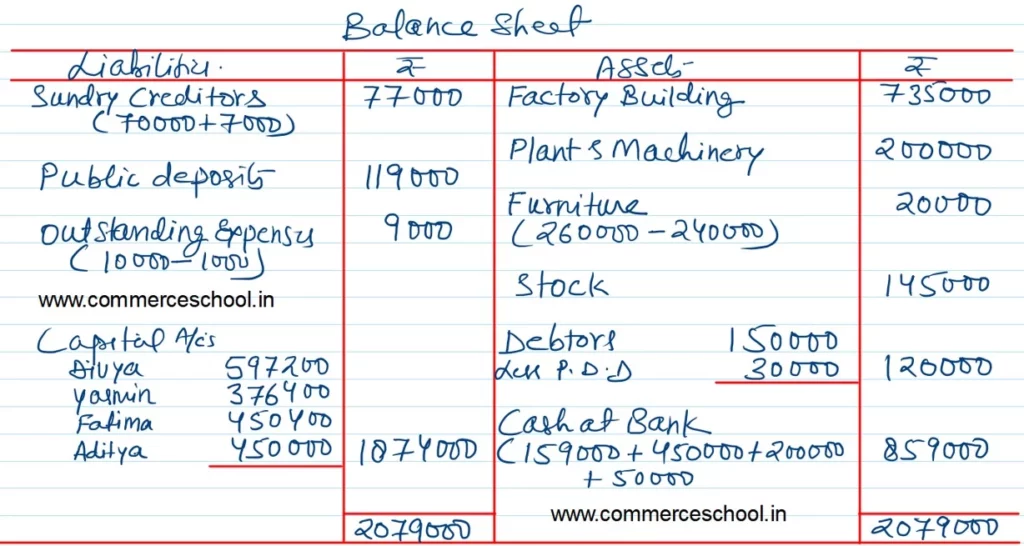

Prepare Revaluation Account, Partner’s Capital Accounts and the Balance Sheet of the reconstituted firm.

[Ans.: Gain on Revaluation – ₹ 14,000; Partner’s Capital A/cs: Divya – ₹ 5,97,200; Yasmin – ₹ 3,76,000; Fatima – ₹ 4,50,400; and Aditya – ₹ 4,50,000; Balance Sheet Total – ₹ 20,79,000; Value of Firm’s Goodwill – ₹ 10,00,000; Cash at Bank – ₹ 8,59,000.]

Solution:-

| S.N | Questions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Questions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Questions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |

| 40 | Question – 40 |

| S.N | Questions |

| 41 | Question – 41 |

| 42 | Question – 42 |

| 43 | Question – 43 |

| 44 | Question – 44 |

| 45 | Question – 45 |

| 46 | Question – 46 |

| 47 | Question – 47 |

| 48 | Question – 48 |

| 49 | Question – 49 |

| 50 | Question – 50 |

| S.N | Questions |

| 51 | Question – 51 |

| 52 | Question – 52 |

| 53 | Question – 53 |

| 54 | Question – 54 |

| 55 | Question – 55 |

| 56 | Question – 56 |

| 57 | Question – 57 |

| 58 | Question – 58 |

| 59 | Question – 59 |

| 60 | Question – 60 |

| S.N | Questions |

| 61 | Question – 61 |

| 62 | Question – 62 |

| 63 | Question – 63 |

| 64 | Question – 64 |

| 65 | Question – 65 |

| 66 | Question – 66 |

| 67 | Question – 67 |

| 68 | Question – 68 |

| 69 | Question – 69 |

| 70 | Question – 70 |

| S.N | Questions |

| 71 | Question – 71 |

| 72 | Question – 72 |

| 73 | Question – 73 |

| 74 | Question – 74 |

| 75 | Question – 75 |

| 76 | Question – 76 |

| 77 | Question – 77 |

| 78 | Question – 78 |

| 79 | Question – 79 |

| 80 | Question – 80 |

| S.N | Questions |

| 81 | Question – 81 |

| 82 | Question – 82 |

| 83 | Question – 83 |

| 84 | Question – 84 |

| 85 | Question – 85 |

| 86 | Question – 86 |