[CBSE] Q 7, Q 8 Accounting for Goods and Services Tax (GST) TS Grewal class 11 (2025-26)

Solutions of Question number 7 and 8 of Accounting for Goods and Services Tax (GST) of TS Grewal class 11 CBSE Board 2025-26

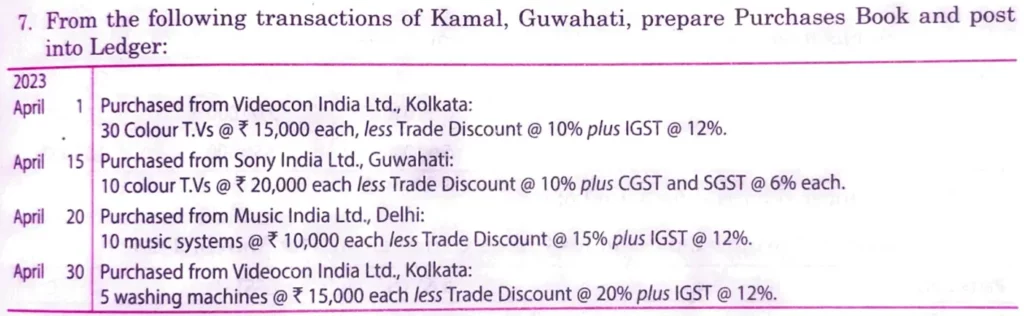

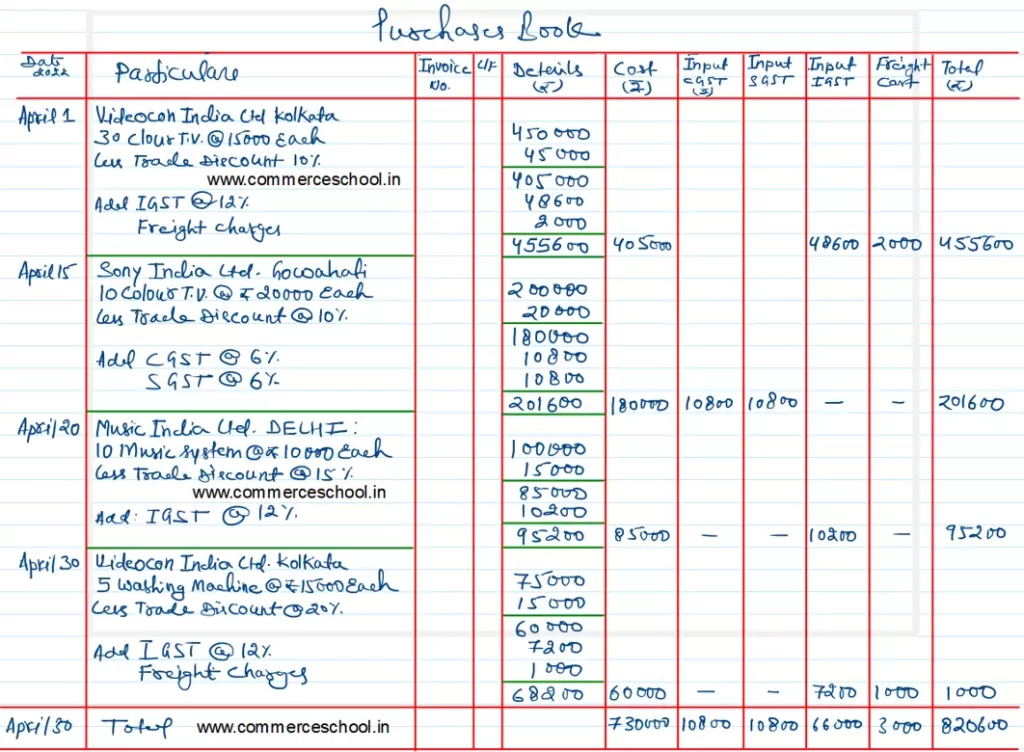

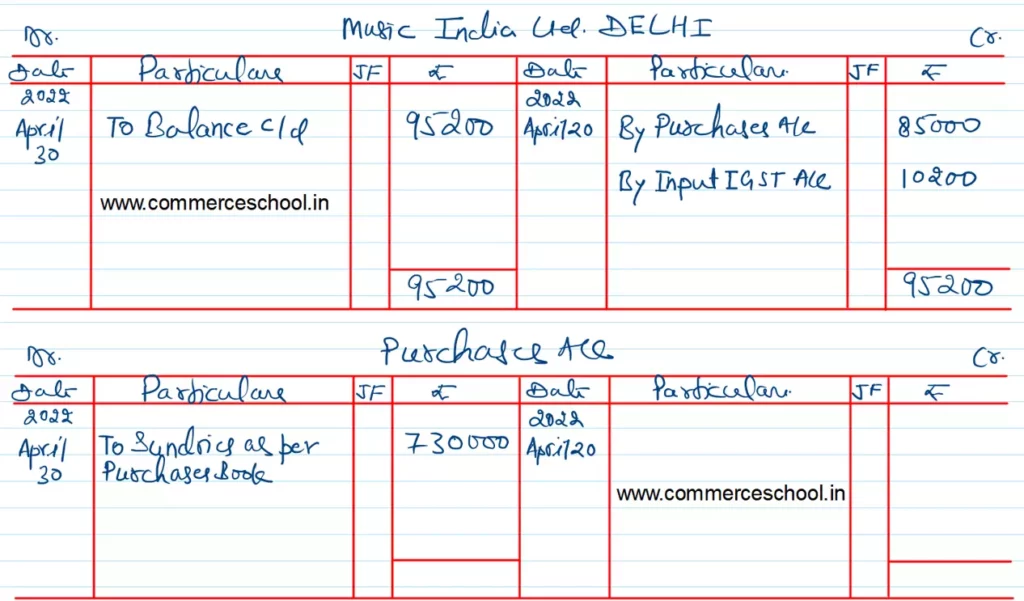

Q. 7. From the following transactions of Kamal, Guwahati, prepare Purchases Book and post into Ledger:

| 2023 April 1 | Purchased from Videocon India Ltd., Kolkata: 20 Colur T.Vs @ ₹ 15,000 each, less Trade Discount @ 10% plus IGST @ 12%. |

| April 15 | Purchased from Sony India Ltd., Guwahat: 10 colour T.Vs @ ₹ 20,000 each less Trade Discount @ 10% plus CGST and SGST @ 6% each. |

| April 20 | Purchased from Music India Ltd., Delhi: 10 Music systems @ ₹ 10,000 each less Trade Discount @ 15% plus IGST @ 12%. |

| April 30 | Purchased from Videocon India Ltd., Kolkata: 5 Washing Machines @ ₹ 15,000 each less Trade Discount @ 20% IGST @ 12% |

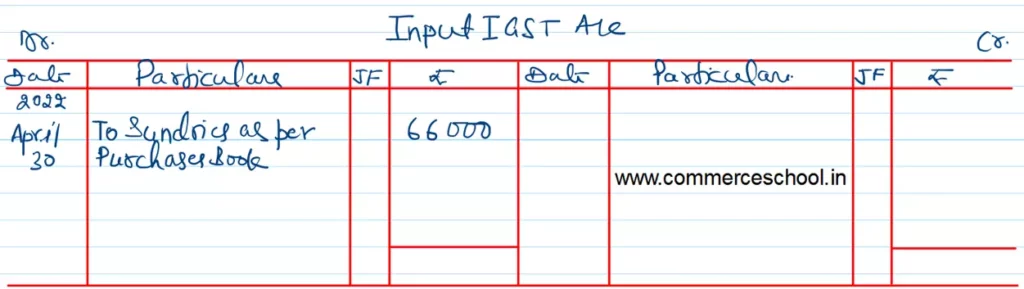

Solution:-

Solution:-

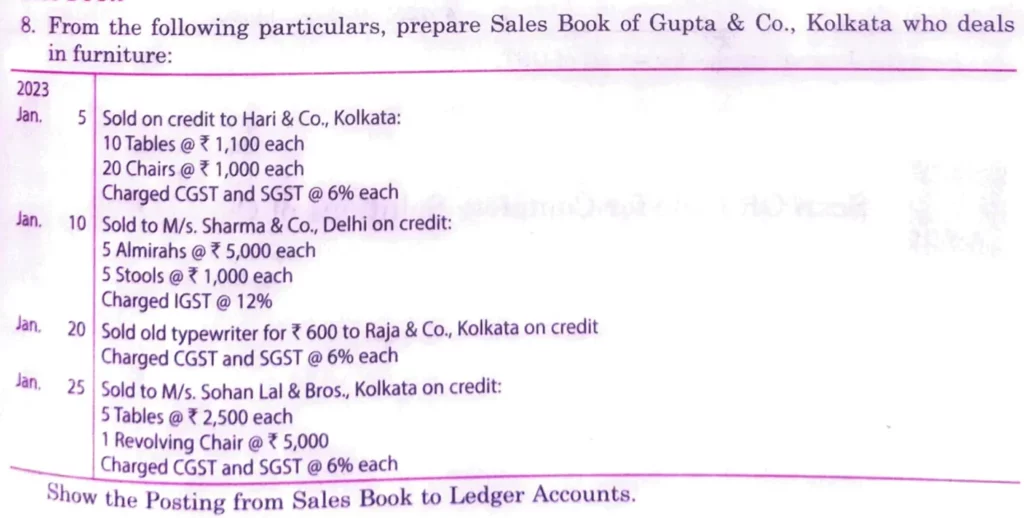

Q. 8. From the following particulars, prepare Sales Book of Ganesh & Co., Kolkata who deals in furniture:

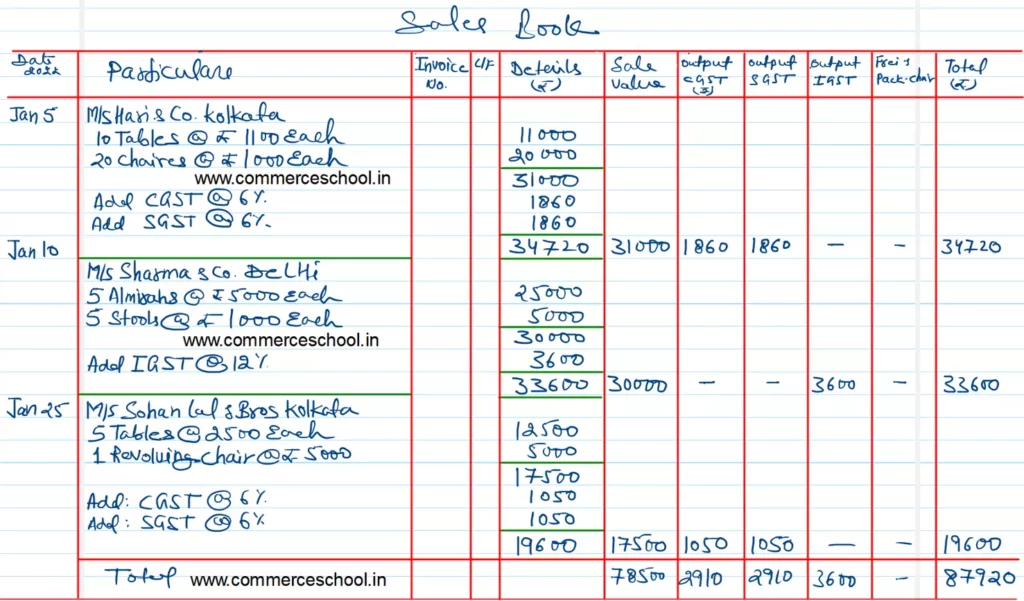

| 2022 Jan 5 | Sold on credit to Hari & Co., Kolkata: 10 Tables @ ₹ 1,100 each 20 Chairs @ ₹ 1,000 each Charged CGST and SGST @ 6% each |

| Jan 10 | Sold to M/s. Sharma & Co., Delhi on credit: 5 Almirahs @ ₹ 5,000 each 5 Stools @ ₹ 1,000 each Charged IGST @ 12% |

| Jan 20 | Sold old typewriter for ₹ 600 to Raja & Co., Kolkata on credit Charged CGST and SGST @ 6% each |

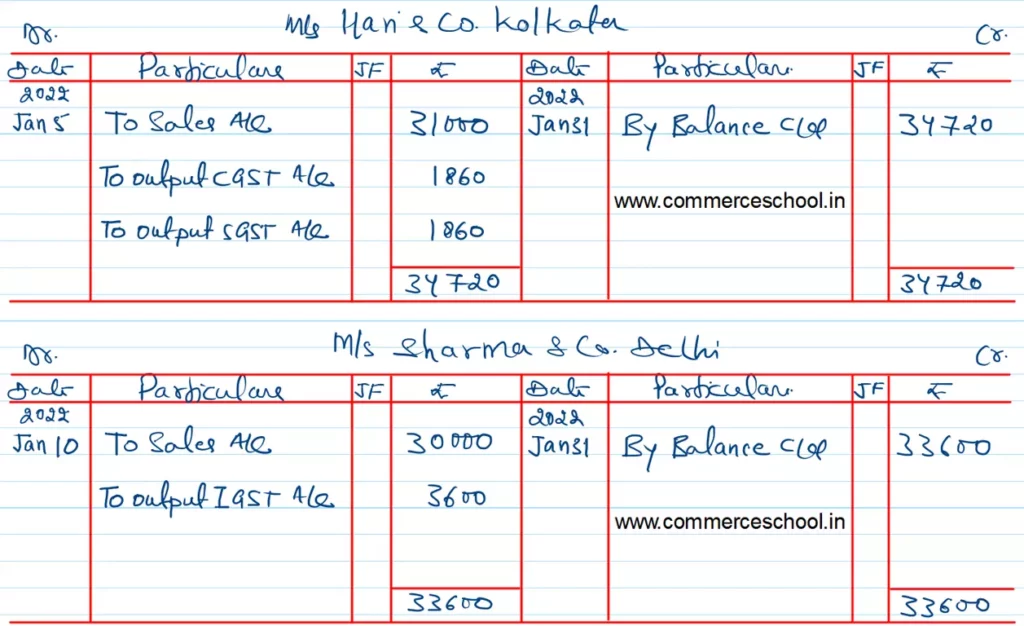

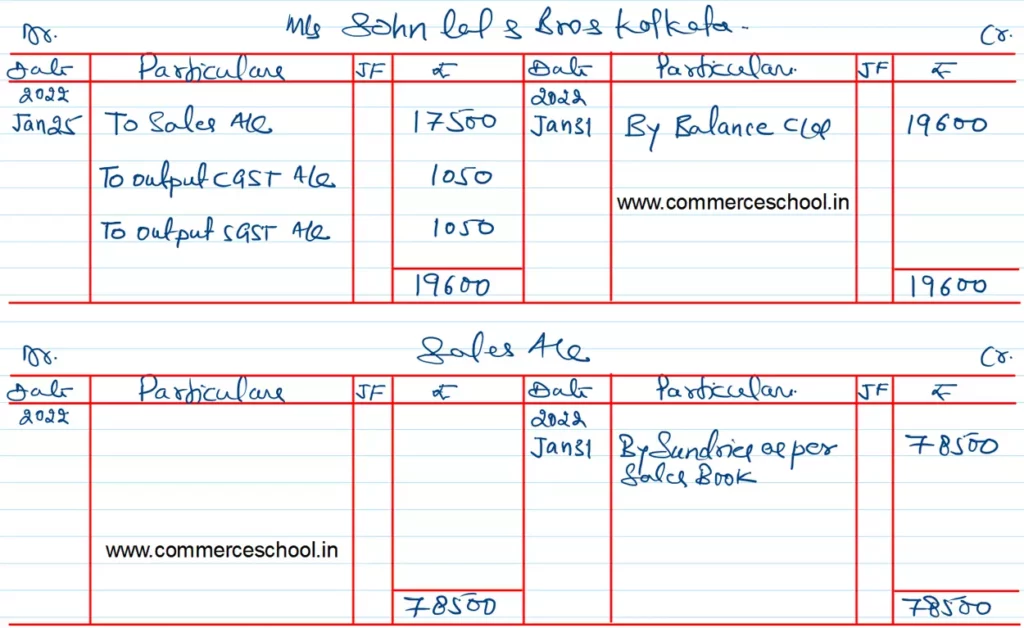

| Jan 25 | Sold to M/s. Sohan Lal & Bros., Kolkata on credit: 5 Tables @ ₹ 2,500 each 1 Revolving Chair @ ₹ 5,000 Charged CGST and SGST @ 6% each |

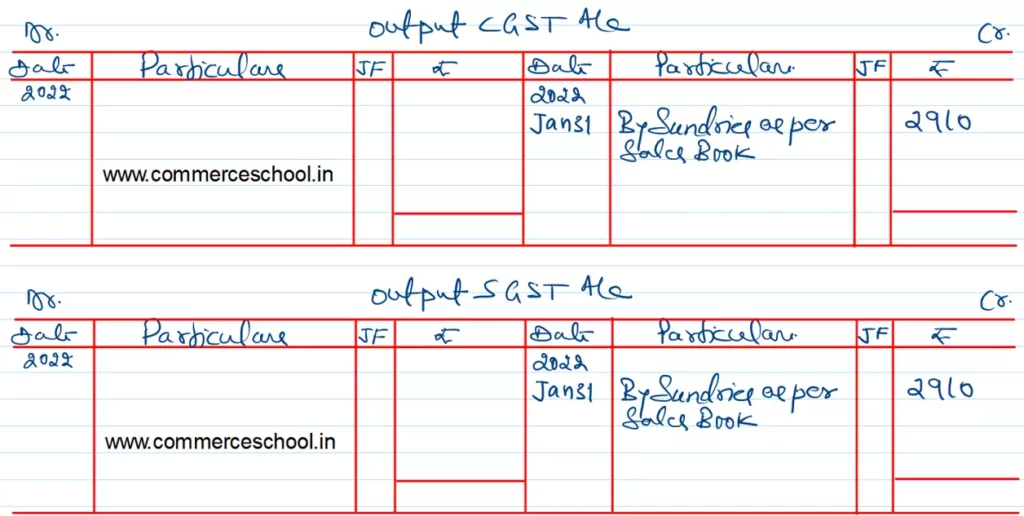

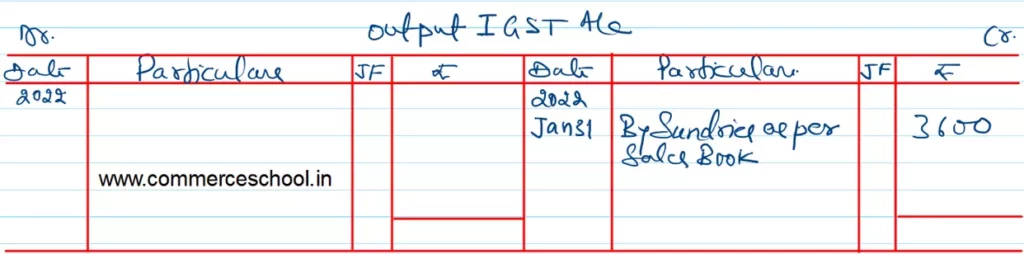

Show the Posting from Sales Book to Ledger Accounts:

Solution:-

Below is the list of all solutions of chapter 12 Goods and Services Tax (GST) TS Grewal class 11 CBSE