[CBSE] Q 7 Trial Balance Solution TS Grewal class 11 (2023-24)

Are you looking for the solution of question number 7 Trial Balance TS Grewal class 11 CBSE Board for the 2023-24 session?

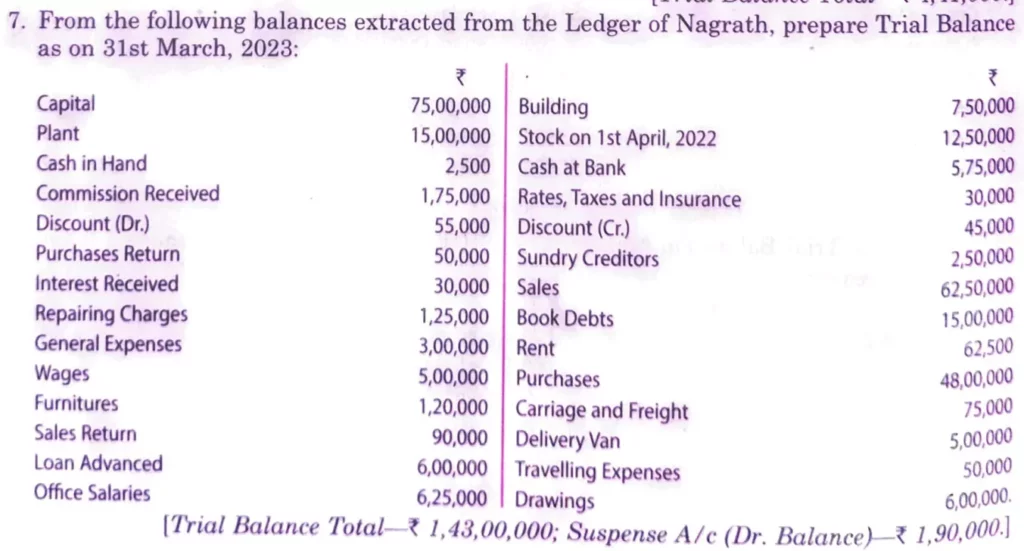

From the following balances extracted from the Ledger of Nagrath, prepare Trial Balance as on 31st March, 2023:

| Particulars | ₹ | Particulars | ₹ |

| Capital Plant Cash in Hand Commission Received Discount (Dr.) Purchases Return Interest Received Repairing Charges General Expenses Wages Furnitures Sales Return Loan Advanced Office Salaries | 75,00,000 15,00,000 2,500 1,75,00 55,000 50,000 30,000 1,25,000 3,00,000 5,00,000 1,20,000 90,000 6,00,000 6,25,000 | Building Stock on 1st April, 2021 Cash at Bank Rates, Taxes and Insurance Discount (Cr.) Sundry Creditors Sales Book Debts Rent Purchases Carriage and Freight Delivery Van Travelling Expenses Drawings | 7,50,000 12,50,000 5,75,000 30,000 45,000 2,50,000 62,50,000 15,00,000 62,500 48,00,000 75,000 5,00,000 50,000 6,00,000 |

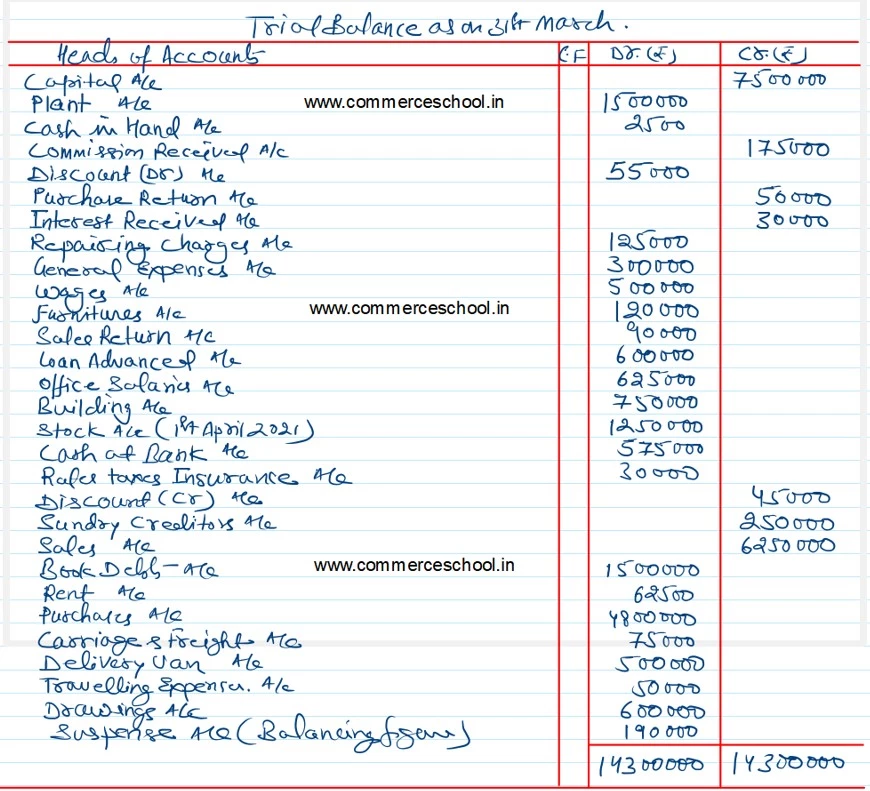

[Trial Balance Total – ₹ 1,43,00,000; Suspense A/c (Dr. Balance) – ₹ 1,90,000.]

Solution:-

Below is the list of all solutions of Trial Balance chapter TS Grewal CBSE board for the 2023-24 Session.